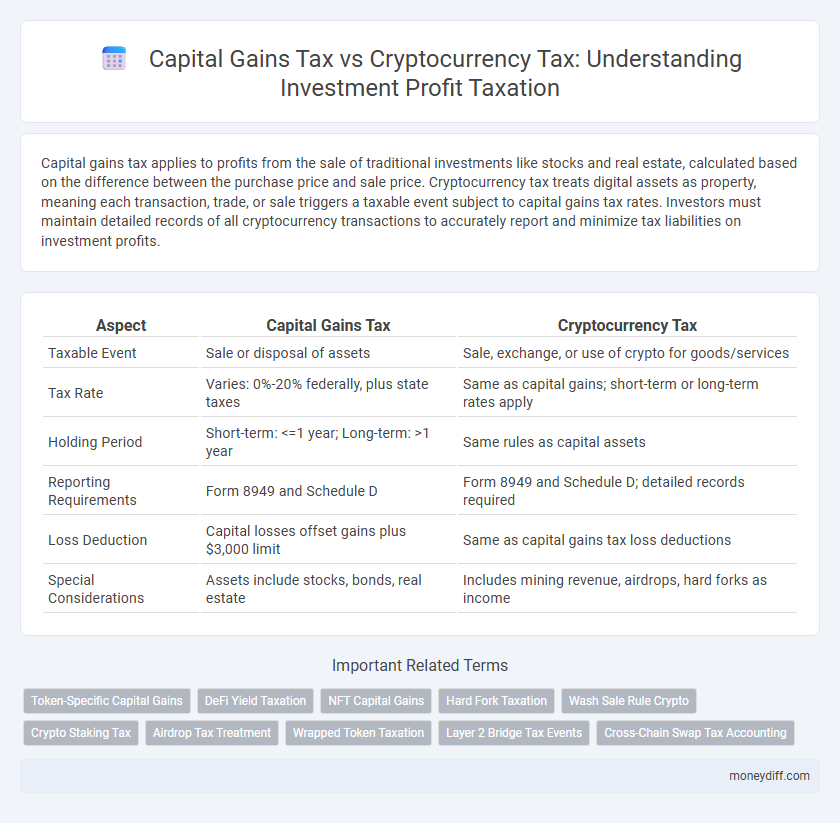

Capital gains tax applies to profits from the sale of traditional investments like stocks and real estate, calculated based on the difference between the purchase price and sale price. Cryptocurrency tax treats digital assets as property, meaning each transaction, trade, or sale triggers a taxable event subject to capital gains tax rates. Investors must maintain detailed records of all cryptocurrency transactions to accurately report and minimize tax liabilities on investment profits.

Table of Comparison

| Aspect | Capital Gains Tax | Cryptocurrency Tax |

|---|---|---|

| Taxable Event | Sale or disposal of assets | Sale, exchange, or use of crypto for goods/services |

| Tax Rate | Varies: 0%-20% federally, plus state taxes | Same as capital gains; short-term or long-term rates apply |

| Holding Period | Short-term: <=1 year; Long-term: >1 year | Same rules as capital assets |

| Reporting Requirements | Form 8949 and Schedule D | Form 8949 and Schedule D; detailed records required |

| Loss Deduction | Capital losses offset gains plus $3,000 limit | Same as capital gains tax loss deductions |

| Special Considerations | Assets include stocks, bonds, real estate | Includes mining revenue, airdrops, hard forks as income |

Understanding Capital Gains Tax: Basics for Investors

Capital Gains Tax (CGT) applies to the profit made from the sale of assets such as stocks, real estate, or cryptocurrency, calculated as the difference between the selling price and the purchase price. Investors must report capital gains on their tax returns, with rates varying based on holding period and income bracket, often categorized into short-term and long-term gains. Understanding CGT is crucial for cryptocurrency investors since the IRS treats digital assets as property, meaning each transaction, sale, or exchange triggers a taxable event subject to capital gains tax rules.

Cryptocurrency Taxation: Key Regulations and Definitions

Cryptocurrency taxation involves specific regulations that classify digital assets as property, subjecting them to capital gains tax on investment profits. Key definitions include taxable events such as selling, trading, or using cryptocurrency for purchases, which trigger gains or losses calculation based on acquisition cost and sale price. Compliance requires detailed record-keeping of transactions to accurately report capital gains or losses to tax authorities.

Differences Between Capital Gains Tax and Cryptocurrency Tax

Capital Gains Tax (CGT) applies to the profit from selling traditional investments like stocks and real estate, calculated based on the difference between purchase and sale price. Cryptocurrency Tax specifically targets gains or losses from trading or converting digital assets, often treated as property by tax authorities but requiring unique tracking due to high volatility and frequent transactions. Reporting standards for cryptocurrencies may involve different record-keeping requirements and tax treatment timelines compared to traditional capital assets.

How Investment Profits Are Taxed: Traditional vs Digital Assets

Investment profits from traditional assets like stocks are subject to capital gains tax, typically taxed at long-term or short-term rates depending on the holding period. Cryptocurrency investment profits are also taxable, but they fall under property tax rules, requiring detailed record-keeping of each transaction's cost basis and fair market value. Unlike conventional investments, cryptocurrency taxation demands tracking every trade to accurately calculate gains or losses for IRS compliance.

Short-Term vs Long-Term Gains: Tax Implications

Short-term capital gains from cryptocurrency investments held less than a year are typically taxed at higher ordinary income tax rates, often ranging from 22% to 37% depending on income brackets. Long-term gains on assets held over one year benefit from reduced tax rates between 0% and 20%, providing significant tax savings for cryptocurrency investors. Understanding the holding period and corresponding tax implications is essential for optimizing investment profit strategies under IRS regulations.

Reporting Requirements for Capital Gains and Crypto Profits

Investors must report capital gains from traditional assets on IRS Form 8949 and Schedule D, detailing each transaction's cost basis and sale price. Cryptocurrency profits require the same thorough reporting, as the IRS treats virtual currencies as property, mandating disclosure of acquisition price, sale proceeds, and dates on Form 8949. Failure to accurately report either capital gains or crypto profits can result in penalties, emphasizing the importance of meticulous record-keeping for all investment transactions.

Tax Deductions and Offsets: Capital Gains vs Crypto Losses

Capital gains tax allows investors to reduce taxable profits through specific tax deductions and offsets such as the capital gains discount and carry-forward losses, optimizing overall tax liability. In contrast, cryptocurrency tax treatment varies by jurisdiction but generally permits losses from crypto investments to offset gains, although eligibility for broader tax deductions may be more limited. Understanding the nuances between capital gains tax rules and cryptocurrency tax regulations is essential for maximizing tax efficiency and compliance in investment portfolios.

International Perspectives: Cryptocurrency and Capital Gains Tax Laws

Capital gains tax on cryptocurrency investments varies significantly across countries, reflecting diverse regulatory frameworks and tax treatments. Some jurisdictions classify cryptocurrencies as property or assets, subjecting gains to capital gains tax at rates ranging from 10% to 37%, while others apply specific cryptocurrency tax rules or exempt certain transactions. International investors must navigate complex tax treaties and reporting requirements to comply with local laws and optimize tax liabilities on cryptocurrency profits.

Common Pitfalls in Tax Filing for Investors

Investors often face common pitfalls when filing taxes on capital gains versus cryptocurrency gains, such as misclassifying transactions or failing to report all trades accurately. The complexity of tracking cost basis and holding periods for various cryptocurrency transactions frequently leads to underreporting or overpaying taxes. Understanding IRS guidelines and leveraging specialized tax software can help mitigate errors and ensure proper compliance with both capital gains tax rules and cryptocurrency tax regulations.

Strategies to Minimize Taxes on Investment Profits

Implementing tax-efficient strategies such as holding investments for over a year to qualify for lower long-term capital gains rates significantly reduces tax liabilities on profits. Utilizing tax-loss harvesting by offsetting gains with investment losses further decreases taxable income, while contributing to tax-advantaged accounts like IRAs or 401(k)s defers or eliminates taxes on cryptocurrency and other investment earnings. Careful record-keeping of cryptocurrency transactions ensures accurate reporting, preventing overpayment and maximizing deductions under evolving tax regulations.

Related Important Terms

Token-Specific Capital Gains

Token-specific capital gains tax applies to profits realized from the sale or exchange of individual cryptocurrency tokens, with each token treated as a distinct asset for tax reporting purposes. Investors must calculate gains or losses based on the acquisition cost and sale price of each token, ensuring accurate tax compliance under capital gains regulations.

DeFi Yield Taxation

Capital Gains Tax on investment profits typically applies to the sale or exchange of assets, including cryptocurrencies, but DeFi yield taxation specifically targets income generated through decentralized finance activities such as staking, liquidity mining, and yield farming. Tax authorities often classify DeFi earnings as ordinary income subject to income tax rates, contrasting with capital gains rates applied to asset disposals, requiring detailed record-keeping of transaction dates, amounts, and types of income for accurate reporting.

NFT Capital Gains

Capital Gains Tax applies to profits from the sale of investments, including NFTs, with rates varying based on holding period and income bracket, while Cryptocurrency Tax specifically addresses gains from digital asset transactions, which include NFTs classified as taxable property by the IRS. Accurate reporting of NFT capital gains requires calculating the difference between the purchase price and sale price, with short-term holdings taxed as ordinary income and long-term holdings eligible for reduced rates.

Hard Fork Taxation

Capital Gains Tax applies to profits from selling or exchanging cryptocurrency, whereas Hard Fork Taxation treats new coins received in a hard fork as taxable income based on their fair market value at receipt. Investors must report these new assets as ordinary income before calculating capital gains on subsequent sales to ensure compliance with IRS guidelines.

Wash Sale Rule Crypto

Capital Gains Tax applies to profits from selling traditional investments, while Cryptocurrency Tax governs gains from digital asset transactions, with the Wash Sale Rule generally not applying to cryptocurrencies, allowing investors to repurchase crypto immediately without disallowed losses. This distinction enables crypto traders to realize tax losses without the 30-day waiting period mandatory for stocks, optimizing tax strategies for digital asset investments.

Crypto Staking Tax

Capital gains tax applies to profits from selling investments like stocks, while cryptocurrency tax includes specific rules for digital assets, with crypto staking income often treated as ordinary income rather than capital gains. Taxpayers must report staking rewards at their fair market value upon receipt, making accurate tracking essential to comply with IRS guidelines and minimize tax liabilities.

Airdrop Tax Treatment

Capital gains tax applies to profits from selling assets like stocks, while cryptocurrency tax regulations often treat airdrops as taxable income upon receipt, based on the fair market value of the tokens at that time. Investors must report airdrop distributions as ordinary income, which differs from capital gains taxation triggered only upon disposal of the asset.

Wrapped Token Taxation

Capital Gains Tax on investment profits typically applies to the sale of assets, while Cryptocurrency Tax regulations specifically address the unique nature of digital assets such as wrapped tokens, which represent one cryptocurrency wrapped into another blockchain's token standard. Wrapped token taxation requires careful tracking of acquisition costs and disposition events, as the IRS treats these transactions as taxable sales or exchanges, impacting accurate reporting and tax liability calculation.

Layer 2 Bridge Tax Events

Capital gains tax applies to profits realized from the sale or exchange of cryptocurrencies, including transactions on Layer 2 bridges, which are often treated as taxable events due to asset transfers between Layer 1 and Layer 2 networks. Understanding the tax implications of Layer 2 bridge activities is crucial for accurate reporting, as these cross-chain movements can trigger taxable events that impact overall investment profit calculations.

Cross-Chain Swap Tax Accounting

Capital gains tax on investment profits typically applies to the realized gains from selling or exchanging assets, including cryptocurrencies, where cross-chain swap tax accounting requires tracking the cost basis and fair market value across different blockchain networks. Properly accounting for cross-chain swaps ensures accurate reporting and compliance by treating each swap as a taxable event, reflecting the distinct tax implications compared to traditional capital gains methods.

Capital Gains Tax vs Cryptocurrency Tax for investment profits. Infographic

moneydiff.com

moneydiff.com