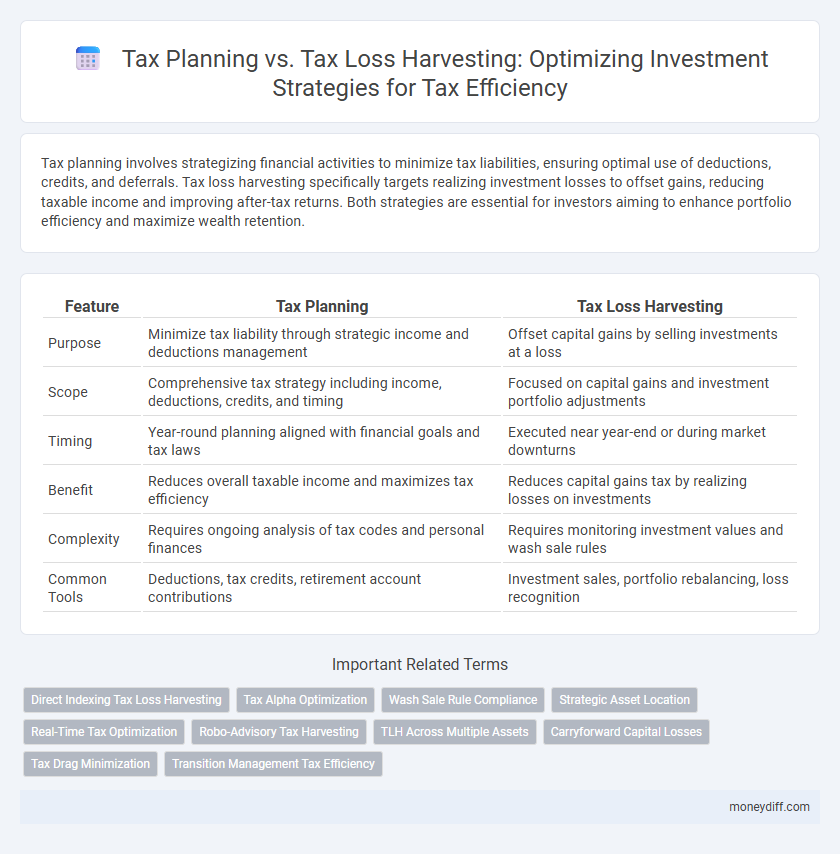

Tax planning involves strategizing financial activities to minimize tax liabilities, ensuring optimal use of deductions, credits, and deferrals. Tax loss harvesting specifically targets realizing investment losses to offset gains, reducing taxable income and improving after-tax returns. Both strategies are essential for investors aiming to enhance portfolio efficiency and maximize wealth retention.

Table of Comparison

| Feature | Tax Planning | Tax Loss Harvesting |

|---|---|---|

| Purpose | Minimize tax liability through strategic income and deductions management | Offset capital gains by selling investments at a loss |

| Scope | Comprehensive tax strategy including income, deductions, credits, and timing | Focused on capital gains and investment portfolio adjustments |

| Timing | Year-round planning aligned with financial goals and tax laws | Executed near year-end or during market downturns |

| Benefit | Reduces overall taxable income and maximizes tax efficiency | Reduces capital gains tax by realizing losses on investments |

| Complexity | Requires ongoing analysis of tax codes and personal finances | Requires monitoring investment values and wash sale rules |

| Common Tools | Deductions, tax credits, retirement account contributions | Investment sales, portfolio rebalancing, loss recognition |

Introduction: Understanding Tax Planning and Tax Loss Harvesting

Tax planning involves strategically organizing investments and financial activities to minimize tax liabilities within legal frameworks, enhancing after-tax returns. Tax loss harvesting is a specific tax planning technique where investors sell securities at a loss to offset capital gains, thereby reducing taxable income. Understanding these concepts helps investors optimize portfolios by balancing tax efficiency with investment goals.

Key Differences Between Tax Planning and Tax Loss Harvesting

Tax planning involves strategically organizing financial activities to minimize tax liabilities over time, including choosing tax-efficient investments and utilizing credits and deductions. Tax loss harvesting specifically focuses on selling securities at a loss to offset capital gains, thereby reducing tax obligations in a given tax year. While tax planning is a comprehensive approach to managing overall tax impact, tax loss harvesting is a tactical tool used within that broader strategy to optimize investment-related taxes.

The Role of Tax Planning in Investment Strategies

Tax planning plays a crucial role in investment strategies by optimizing the timing and selection of asset purchases and sales to minimize tax liabilities and enhance after-tax returns. Strategically balancing tax-deferred accounts with taxable investments allows investors to maximize tax efficiency through techniques like tax loss harvesting, which involves realizing losses to offset gains and reduce taxable income. Effective tax planning integrates these approaches to align investment decisions with long-term financial goals while adhering to current tax regulations.

What is Tax Loss Harvesting?

Tax loss harvesting is an investment strategy that involves selling securities at a loss to offset capital gains taxes on other investments. This approach helps investors reduce their taxable income by realizing losses that can be used to balance gains, potentially lowering their overall tax liability. Effective tax loss harvesting requires careful timing and adherence to IRS wash sale rules, which prevent repurchasing the same or substantially identical security within 30 days.

How Tax Planning Can Maximize Investment Returns

Tax planning strategically aligns investment decisions with tax laws to minimize tax liabilities and maximize after-tax returns. By timing income, deductions, and asset sales, investors can defer taxes, take advantage of lower tax brackets, and optimize asset allocation to reduce taxable gains. Effective tax planning ensures that portfolio growth is preserved by minimizing tax drag, ultimately enhancing long-term investment performance.

Step-by-Step Guide to Tax Loss Harvesting

Tax loss harvesting involves systematically selling investments at a loss to offset capital gains and reduce taxable income. Begin by identifying underperforming assets in your portfolio, carefully record the loss amounts, and reinvest in similar but not "substantially identical" securities to maintain market exposure while complying with IRS wash-sale rules. Consistently tracking realized losses and gains throughout the tax year maximizes the benefits of tax loss harvesting as part of a comprehensive tax planning strategy.

When to Use Tax Planning vs Tax Loss Harvesting

Tax planning is best utilized before the end of the fiscal year to strategically align investment decisions with long-term financial goals and minimize overall tax liability. Tax loss harvesting is most effective toward the end of the tax year when investors can sell underperforming assets to offset capital gains and reduce taxable income. Investors should evaluate their current portfolio performance, tax bracket, and investment horizon to determine the optimal timing for these tax strategies.

Common Pitfalls in Tax Planning and Tax Loss Harvesting

Common pitfalls in tax planning include underestimating the impact of changing tax laws and failing to align strategies with long-term investment goals, which can lead to unexpected liabilities. In tax loss harvesting, frequent mistakes involve overlooking wash sale rules and neglecting to account for transaction costs, reducing the anticipated tax benefits. Effective tax management requires careful attention to these details to optimize investment returns and minimize tax burdens.

Regulatory Considerations: Wash Sale Rule and IRS Guidelines

Tax planning must carefully navigate regulatory considerations such as the IRS's Wash Sale Rule, which prohibits claiming a tax loss on securities sold if the same or substantially identical stock is purchased within 30 days before or after the sale. Tax loss harvesting strategies require detailed compliance with these guidelines to avoid disallowed losses and potential penalties. Investors should monitor transaction timing and maintain accurate records to ensure alignment with IRS regulations and optimize tax benefits.

Best Practices for Effective Tax Management in Investments

Tax planning involves strategically timing income, deductions, and investments to minimize tax liabilities throughout the year, while tax loss harvesting specifically targets selling securities at a loss to offset capital gains and reduce taxable income. Best practices for effective tax management in investments include regularly reviewing your portfolio to identify potential loss harvesting opportunities, understanding the wash-sale rule to avoid disallowed losses, and coordinating tax strategies with your overall financial goals. Leveraging both approaches ensures optimized tax efficiency and improved after-tax returns.

Related Important Terms

Direct Indexing Tax Loss Harvesting

Direct indexing tax loss harvesting enables investors to strategically offset capital gains by selling individual securities at a loss within a customized index portfolio, maximizing tax efficiency compared to traditional tax planning methods. This approach leverages personalized stock selection and real-time loss realization, optimizing after-tax returns while maintaining market exposure.

Tax Alpha Optimization

Tax planning optimizes investment strategies by proactively managing income, deductions, and credits to minimize overall tax liabilities and enhance after-tax returns. Tax loss harvesting complements this by strategically realizing losses to offset gains, generating tax alpha that boosts portfolio efficiency and maximizes long-term wealth accumulation.

Wash Sale Rule Compliance

Tax planning involves strategically timing investments to maximize deductions and credits over multiple years, while tax loss harvesting focuses on selling securities at a loss to offset capital gains within the same tax year. Strict compliance with the IRS Wash Sale Rule, which prohibits repurchasing substantially identical securities within 30 days before or after the sale, is essential to ensure harvested losses are recognized and not disallowed.

Strategic Asset Location

Strategic asset location optimizes tax efficiency by placing tax-inefficient investments, such as bonds or REITs, in tax-advantaged accounts while positioning tax-efficient assets like index funds or ETFs in taxable accounts to minimize tax liabilities. Tax planning involves a comprehensive approach to this placement, whereas tax loss harvesting specifically targets realizing losses to offset gains within taxable portfolios without altering asset location strategy.

Real-Time Tax Optimization

Real-time tax optimization strategically integrates tax planning and tax loss harvesting to maximize after-tax investment returns, capitalizing on market fluctuations to offset gains with losses promptly. This dynamic approach leverages live portfolio data and tax code nuances to continuously adjust transactions, enhancing tax efficiency throughout the fiscal year.

Robo-Advisory Tax Harvesting

Robo-advisory tax harvesting automates the strategic sale of investments at a loss to offset capital gains, enhancing after-tax returns more efficiently than traditional tax planning methods. This technology leverages real-time data and algorithms to optimize tax loss harvesting while maintaining portfolio alignment and minimizing tax liabilities.

TLH Across Multiple Assets

Tax loss harvesting (TLH) across multiple assets enables investors to strategically offset capital gains by realizing losses in diversified holdings, optimizing overall tax efficiency. Implementing TLH beyond a single security allows for enhanced portfolio rebalancing while maximizing tax benefits through the aggregation of losses across asset classes.

Carryforward Capital Losses

Carryforward capital losses enable investors to offset future capital gains tax liabilities by applying prior year losses to upcoming gains, enhancing long-term tax planning strategies. Effective tax planning integrates the strategic use of tax loss harvesting to maximize carryforward capital losses, thereby reducing taxable income and optimizing investment returns over multiple tax periods.

Tax Drag Minimization

Tax planning strategically reduces tax liability through asset allocation and timing of income, maximizing after-tax returns and minimizing tax drag on investments. Tax loss harvesting offsets capital gains by realizing losses, directly lowering taxable income and enhancing portfolio efficiency against tax drag.

Transition Management Tax Efficiency

Tax planning optimizes investment portfolios by strategically timing asset sales to minimize tax liabilities, enhancing transition management tax efficiency through proactive analysis of capital gains and losses. Tax loss harvesting complements this by systematically offsetting realized gains with accrued losses during portfolio transitions, reducing taxable income and preserving after-tax returns.

Tax Planning vs Tax Loss Harvesting for Investments Infographic

moneydiff.com

moneydiff.com