Income tax applies to all earnings including wages, salaries, and business income, while crypto tax specifically targets gains from cryptocurrency transactions such as trading, mining, or staking. Understanding both tax obligations is crucial for accurate financial planning and compliance, as crypto assets are often subject to capital gains tax rules. Proper record-keeping of crypto activities can minimize tax liabilities and avoid penalties in personal finance management.

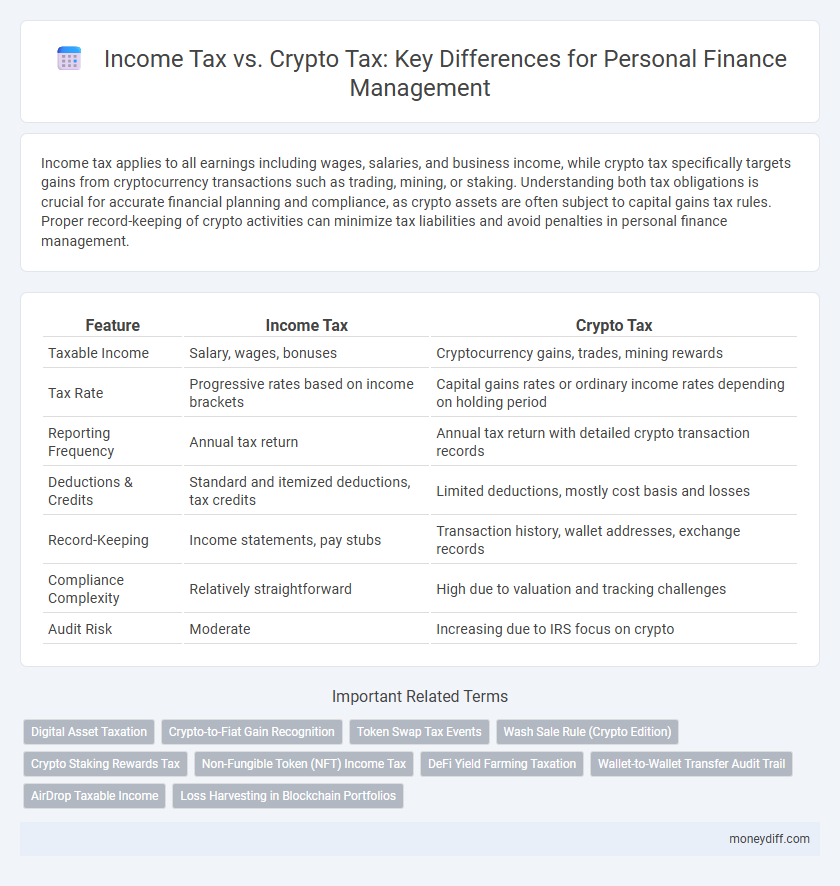

Table of Comparison

| Feature | Income Tax | Crypto Tax |

|---|---|---|

| Taxable Income | Salary, wages, bonuses | Cryptocurrency gains, trades, mining rewards |

| Tax Rate | Progressive rates based on income brackets | Capital gains rates or ordinary income rates depending on holding period |

| Reporting Frequency | Annual tax return | Annual tax return with detailed crypto transaction records |

| Deductions & Credits | Standard and itemized deductions, tax credits | Limited deductions, mostly cost basis and losses |

| Record-Keeping | Income statements, pay stubs | Transaction history, wallet addresses, exchange records |

| Compliance Complexity | Relatively straightforward | High due to valuation and tracking challenges |

| Audit Risk | Moderate | Increasing due to IRS focus on crypto |

Understanding Income Tax: The Basics

Income tax applies to an individual's earnings from salaries, investments, and business activities, calculated based on progressive tax rates set by federal and state governments. Crypto tax involves reporting gains or losses from cryptocurrency transactions, including trading, mining, and staking, often treated as capital gains for tax purposes. Understanding these distinctions is essential for accurate tax filing, maintaining compliance, and optimizing personal finance strategies.

What is Crypto Tax? Key Differences Explained

Crypto tax is a specific category of taxation that applies to digital assets such as cryptocurrencies, requiring individuals to report gains or losses from trading, mining, or selling crypto holdings. Unlike traditional income tax, which is levied on wages, salaries, and other earned income, crypto tax often involves capital gains tax rules and complex valuation methods due to the volatile nature of cryptocurrencies. Understanding the key differences between income tax and crypto tax is crucial for accurate personal finance management and compliance with tax authorities.

Taxable Events: Income vs Cryptocurrency Transactions

Income tax applies to wages, salaries, and other earned income reported on annual tax returns, with taxable events occurring upon receipt of payment. Cryptocurrency transactions trigger taxable events when assets are sold, exchanged, or used for purchases, requiring capital gains calculations based on acquisition cost and market value at the time of the transaction. Understanding the distinction between ordinary income tax rules and crypto tax regulations is essential for accurate reporting and compliance in personal finance.

Reporting Requirements for Income Tax vs Crypto Tax

Income tax reporting requires detailed documentation of all income sources, including wages, dividends, and self-employment earnings, with forms such as W-2s and 1099s submitted to the IRS. Crypto tax reporting mandates accurate records of every transaction, including buys, sells, trades, and income from mining or staking, often using IRS Form 8949 and Schedule D for capital gains. Failure to comply with these reporting requirements for either income tax or crypto tax can result in penalties, interest, and audits.

Capital Gains: Stocks, Salary, and Crypto Assets

Capital gains from stocks are typically taxed based on holding period, with long-term gains benefiting from lower rates, while salary income is taxed as ordinary income at progressive rates. Crypto assets are subject to capital gains tax upon disposal, with tax treatment depending on the duration of holding and nature of transactions. Accurate record-keeping of acquisition costs and transaction dates is essential for correct tax reporting and optimizing personal finance strategies.

Deductions and Exemptions: Traditional vs Digital Income

Income tax allows for various deductions such as mortgage interest, student loan interest, and retirement contributions, reducing taxable income significantly for traditional earnings. Crypto tax regulations, however, often treat cryptocurrency as property, limiting deductions to transaction fees and losses within specific rules under capital gains tax. Understanding these differences enables better personal finance management by optimizing allowable deductions and exemptions based on the nature of income received.

Tax Rates Comparison: Income Tax vs Crypto Tax Rates

Income tax rates typically range from 10% to 37% based on income brackets, while crypto tax rates vary depending on whether gains are classified as short-term or long-term capital gains, with rates between 0% to 20% for long-term holdings. Short-term crypto gains are taxed as ordinary income, aligning with individual income tax rates, whereas long-term crypto gains benefit from reduced capital gains tax rates. Understanding these differences is crucial for optimizing tax liability in personal finance, especially given the volatile nature of cryptocurrency transactions.

Compliance and Record-Keeping for Each Tax Type

Income tax compliance requires meticulous documentation of all income sources, including wages, dividends, and interest, along with maintaining proof such as pay stubs and receipts for deductions. Crypto tax compliance demands detailed records of each transaction, including dates, amounts, wallet addresses, and the fair market value of cryptocurrencies at the time of exchange. Both tax types necessitate accurate and organized record-keeping to ensure precise reporting and to withstand potential audits by tax authorities.

Common Mistakes to Avoid with Income and Crypto Tax

Common mistakes to avoid in income tax and crypto tax include failing to report all sources of income, such as cryptocurrency transactions and capital gains, which can lead to penalties and audits. Many taxpayers incorrectly classify crypto activities, neglecting to account for mining, staking rewards, and token swaps, resulting in inaccurate tax calculations. Maintaining detailed records and seeking professional advice can prevent costly errors and ensure compliance with IRS regulations.

Strategic Tax Planning: Maximizing Benefits Legally

Strategic tax planning for personal finance involves understanding the differences between income tax and crypto tax regulations to legally minimize liabilities. Income tax applies to wages, salaries, and traditional investments, while crypto tax encompasses capital gains from digital asset transactions and mining activities. Leveraging tax-advantaged accounts, tracking accurate basis for crypto holdings, and timing asset sales can maximize benefits under current tax laws.

Related Important Terms

Digital Asset Taxation

Digital asset taxation requires distinct reporting and compliance compared to traditional income tax, as gains from cryptocurrency transactions are often treated as capital gains rather than regular income. Understanding the IRS guidelines on cryptocurrency is essential for accurate tax filing and minimizing liabilities in personal finance.

Crypto-to-Fiat Gain Recognition

Crypto-to-fiat gain recognition triggers taxable events under income tax laws, requiring individuals to report realized gains when converting cryptocurrency into fiat currency. Unlike traditional income tax on wages, crypto tax obligations hinge on the precise timing and amount of each conversion, impacting personal finance through capital gains calculations and potential tax liabilities.

Token Swap Tax Events

Token swap tax events trigger taxable income recognition when exchanging one cryptocurrency for another, unlike traditional income tax that focuses on salary or capital gains. Navigating IRS guidelines on token swaps requires precise record-keeping to accurately report gains or losses and avoid penalties in personal finance management.

Wash Sale Rule (Crypto Edition)

The Wash Sale Rule, traditionally applied to stocks, currently does not extend to cryptocurrencies under IRS regulations, allowing taxpayers to sell crypto at a loss and immediately repurchase without waiting 30 days to claim the deduction. This discrepancy creates a unique tax planning opportunity in personal finance, where income tax strategies differ significantly from crypto tax considerations, emphasizing the need for tailored approaches to optimize tax liabilities.

Crypto Staking Rewards Tax

Income tax on crypto staking rewards requires reporting such earnings as ordinary income at fair market value upon receipt, impacting personal finance through increased taxable income and potential higher tax brackets. Proper documentation of staking rewards and understanding IRS guidelines on virtual currency transactions are essential to accurately calculate crypto tax liabilities and avoid penalties.

Non-Fungible Token (NFT) Income Tax

Income tax on Non-Fungible Token (NFT) transactions requires individuals to report earnings as ordinary income or capital gains depending on the nature of the sale or trade, with the IRS treating NFT sales similarly to property transactions. Accurate record-keeping of acquisition costs, sale dates, and transaction values is essential to calculate taxable income and comply with federal crypto tax regulations.

DeFi Yield Farming Taxation

DeFi yield farming generates taxable income classified as ordinary income under income tax laws, requiring detailed reporting of each transaction's fair market value at the time of receipt. Unlike traditional income tax, crypto tax obligations demand meticulous tracking of token swaps, liquidity pool contributions, and rewards, with taxable events triggered by staking rewards, token sales, and liquidity withdrawals.

Wallet-to-Wallet Transfer Audit Trail

Income tax regulations require detailed audit trails for wallet-to-wallet crypto transfers to verify the provenance of funds and avoid double taxation, while traditional income tax mainly concerns documented sources such as salaries and interest. Maintaining comprehensive transaction records within blockchain wallets is crucial for accurate capital gains reporting and compliance during tax audits.

AirDrop Taxable Income

Income tax regulations classify crypto airdrops as taxable income the moment they are received, requiring individuals to report their fair market value at that time. Failure to include airdrop earnings can lead to penalties, as these distributions are treated similarly to ordinary income under IRS guidelines.

Loss Harvesting in Blockchain Portfolios

Loss harvesting in blockchain portfolios allows investors to offset capital gains from cryptocurrency trading against realized losses, optimizing income tax obligations by reducing taxable income. Understanding specific regulations for crypto tax, such as IRS guidelines on digital asset transactions, is essential to effectively apply loss harvesting strategies within personal finance.

Income Tax vs Crypto Tax for personal finance. Infographic

moneydiff.com

moneydiff.com