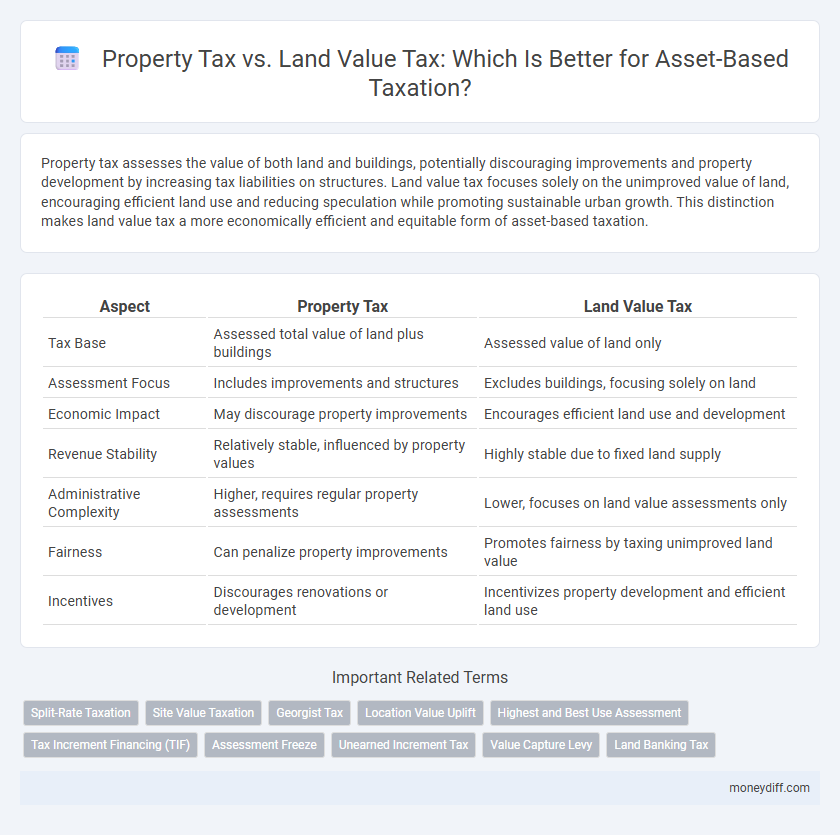

Property tax assesses the value of both land and buildings, potentially discouraging improvements and property development by increasing tax liabilities on structures. Land value tax focuses solely on the unimproved value of land, encouraging efficient land use and reducing speculation while promoting sustainable urban growth. This distinction makes land value tax a more economically efficient and equitable form of asset-based taxation.

Table of Comparison

| Aspect | Property Tax | Land Value Tax |

|---|---|---|

| Tax Base | Assessed total value of land plus buildings | Assessed value of land only |

| Assessment Focus | Includes improvements and structures | Excludes buildings, focusing solely on land |

| Economic Impact | May discourage property improvements | Encourages efficient land use and development |

| Revenue Stability | Relatively stable, influenced by property values | Highly stable due to fixed land supply |

| Administrative Complexity | Higher, requires regular property assessments | Lower, focuses on land value assessments only |

| Fairness | Can penalize property improvements | Promotes fairness by taxing unimproved land value |

| Incentives | Discourages renovations or development | Incentivizes property development and efficient land use |

Understanding Asset-Based Taxation: Property Tax vs Land Value Tax

Property tax levies charges on both land and buildings, often leading to higher taxes on improvements and potentially discouraging property development. Land value tax focuses solely on the unimproved land value, promoting efficient land use and reducing speculative holding. Understanding these distinctions clarifies how each tax impacts urban growth, investment incentives, and equitable asset taxation.

Key Differences Between Property Tax and Land Value Tax

Property tax is levied on the combined value of land and any improvements, such as buildings, while land value tax targets only the unimproved value of the land itself. Property tax rates can discourage property development and improvements due to increased tax burdens, whereas land value tax incentivizes better land use by taxing solely the land's intrinsic value. Land value tax often results in a more efficient allocation of land resources by encouraging development and reducing speculative holding.

How Property Tax and Land Value Tax Are Calculated

Property tax is calculated based on the combined value of land and any permanent structures on it, assessed periodically by local tax authorities using market value estimates or cost approaches. Land value tax, in contrast, is determined solely by the unimproved value of the land itself, disregarding buildings or improvements, often assessed through land market sales or location-based factors. This distinction affects tax liabilities and incentives, as property tax increases with developments, while land value tax encourages optimal land use without penalizing property improvements.

Economic Impacts of Property Tax and Land Value Tax

Property tax, levied on the combined value of land and buildings, can discourage real estate improvements and reduce housing supply by increasing holding costs, potentially slowing economic growth. Land value tax targets only the unimproved land value, encouraging efficient land use and reducing speculation, which can stimulate development and increase urban density. Studies indicate that shifting taxation from property to land value tends to enhance economic efficiency and foster sustainable urban growth by promoting better land utilization.

Equity and Fairness: Comparing Tax Burdens

Property tax often results in unequal tax burdens because it taxes both land and improvements, disproportionately affecting owners of high-value structures regardless of land value. Land value tax focuses solely on the unimproved land value, promoting fairness by taxing based on location and inherent land scarcity, which tends to distribute tax burdens more equitably. Empirical studies show land value tax reduces distortions, encourages efficient land use, and mitigates wealth inequality by preventing speculation-driven land price inflation.

Influence on Land Use and Housing Supply

Property tax often discourages property improvements due to higher taxes on built structures, leading to inefficient land use and limited housing supply. Land value tax, by taxing only the unimproved value of land, incentivizes owners to develop or sell underutilized parcels, promoting optimal land use and increasing housing availability. Empirical studies show land value tax can reduce urban sprawl and encourage higher density developments, benefiting overall housing supply.

Administrative Considerations for Each Tax Model

Property tax requires comprehensive assessments of both land and structures, demanding more frequent evaluations and higher administrative costs due to fluctuating building values. Land value tax simplifies administration by focusing solely on land, reducing the need for regular reassessments and enabling more stable revenue streams. However, implementing land value tax may face initial challenges in accurate land valuation and legal frameworks, impacting administrative efficiency during the transition phase.

Incentives and Disincentives: Investment Effects

Property tax tends to discourage investment in property improvements by taxing both land and building values, reducing the incentive to enhance asset quality. Land value tax, by taxing only the unimproved value of land, encourages property development and efficient land use, as improvements are not penalized. This tax structure promotes optimal investment behavior, boosting economic growth and urban revitalization.

Global Practices: Property and Land Value Tax in Different Countries

Countries like Denmark and Australia have implemented land value taxes (LVT) to promote efficient land use and reduce speculation, with Denmark using LVT to fund local governments. In contrast, property taxes that include both land and building values remain prevalent in the United States and Canada, providing stable revenue based on combined asset valuations. Several nations integrate hybrid models, balancing land value taxation to encourage development while using property taxes to finance public services, reflecting diverse approaches in asset-based taxation globally.

Choosing the Right Asset-Based Tax: Policy Implications

Property tax levies charges on both land and immovable structures, impacting homeowners and businesses, while land value tax exclusively targets the unimproved value of land, encouraging efficient land use. Policymakers must consider the economic incentives; land value tax promotes development and reduces speculation, potentially boosting urban growth and housing affordability. Selecting the appropriate tax influences revenue stability, equity, and economic behavior, making it critical for sustainable asset-based taxation strategies.

Related Important Terms

Split-Rate Taxation

Split-rate taxation combines a low tax on land value with a higher tax on property improvements, incentivizing efficient land use while discouraging overdevelopment. Empirical studies show that this dual-rate system promotes economic growth by encouraging investment in buildings without penalizing land ownership.

Site Value Taxation

Site Value Taxation targets the unimproved value of land, promoting efficient land use by taxing the intrinsic worth of the property separate from structures or improvements. Unlike traditional property tax, which taxes both land and buildings, Land Value Tax encourages development and reduces speculative holding by incentivizing optimal asset-based taxation on the land itself.

Georgist Tax

Georgist Tax principles advocate for Land Value Tax (LVT) as a more efficient and equitable form of asset-based taxation compared to traditional Property Tax, which taxes both land and improvements. LVT targets only the unimproved value of land, encouraging productive use while reducing speculation and economic distortions commonly associated with property taxes.

Location Value Uplift

Property tax often includes improvements on land, which can discourage development, while land value tax targets only the unimproved value, capturing Location Value Uplift more efficiently. This approach incentivizes optimal land use and reflects increased public investments or neighborhood growth without penalizing property improvements.

Highest and Best Use Assessment

Property tax assesses the total value of land and improvements, often leading to inefficiencies by taxing buildings and structures regardless of their optimal use. Land value tax concentrates solely on the unimproved land value, promoting highest and best use by encouraging development that maximizes economic productivity without penalizing property enhancements.

Tax Increment Financing (TIF)

Property tax bases revenue on the combined value of land and improvements, while land value tax targets only the unimproved land value, promoting efficient land use and reducing speculation. Tax Increment Financing (TIF) leverages increases in property tax revenues from land improvements but may disregard the potential for land value tax to more directly capture value shifts driven by public investments.

Assessment Freeze

Assessment freeze policies in property tax systems prevent increases in assessed property values despite market appreciation, often reducing tax burdens for long-term owners but potentially distorting revenue and equity. Land value tax, by taxing only the unimproved land value, avoids assessment freezes and ensures taxation reflects current economic land value, promoting efficient land use and stable revenue collection.

Unearned Increment Tax

Property tax levies a rate on the combined value of land and improvements, often discouraging development, while land value tax targets only the unimproved value of land, capturing the unearned increment generated by community growth and public investments. Unearned increment tax, as embedded in land value taxation, efficiently redistributes wealth by taxing the appreciation in land value that arises without the landowner's effort, promoting equitable and growth-friendly asset-based taxation.

Value Capture Levy

Value Capture Levy targets the increase in land value generated by public infrastructure investments, distinguishing it from traditional Property Tax which taxes both land and improvements. By focusing solely on land value, Value Capture Levy promotes efficient land use and incentivizes development without penalizing property improvements, making it a more equitable and economically effective form of asset-based taxation.

Land Banking Tax

Land value tax targets the unimproved value of land, encouraging efficient land use and reducing speculative land banking by taxing idle land holdings at a higher rate. Property tax combines land and improvements, potentially disincentivizing development, whereas land banking tax specifically deters hoarding of underused land, promoting urban growth and fiscal sustainability.

Property tax vs Land value tax for asset-based taxation. Infographic

moneydiff.com

moneydiff.com