Sales tax applies a single-stage charge on the final consumer at the point of purchase, making it straightforward but potentially encouraging tax evasion at earlier production stages. Value-added tax (VAT) imposes a multi-stage tax on the value added at each production and distribution phase, reducing cascading tax effects and enhancing revenue transparency. Both consumption tax approaches aim to tax consumer spending, but VAT generally provides more efficiency and broader tax compliance.

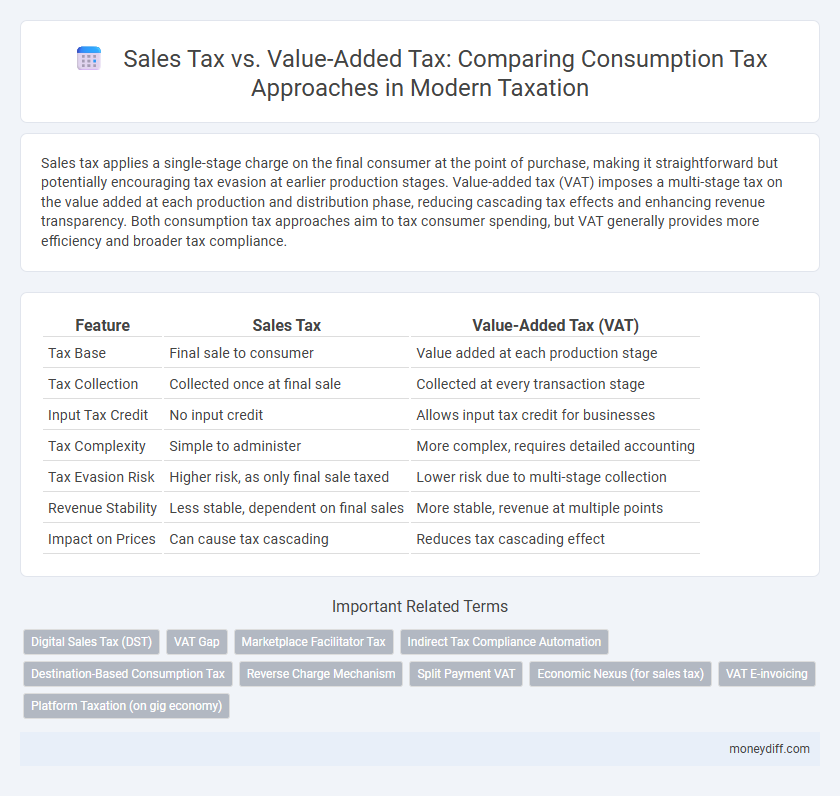

Table of Comparison

| Feature | Sales Tax | Value-Added Tax (VAT) |

|---|---|---|

| Tax Base | Final sale to consumer | Value added at each production stage |

| Tax Collection | Collected once at final sale | Collected at every transaction stage |

| Input Tax Credit | No input credit | Allows input tax credit for businesses |

| Tax Complexity | Simple to administer | More complex, requires detailed accounting |

| Tax Evasion Risk | Higher risk, as only final sale taxed | Lower risk due to multi-stage collection |

| Revenue Stability | Less stable, dependent on final sales | More stable, revenue at multiple points |

| Impact on Prices | Can cause tax cascading | Reduces tax cascading effect |

Introduction to Consumption Tax Systems

Sales tax applies a single-stage levy on the final sale to consumers, making it simpler to administer but prone to cascading effects when intermediate goods are taxed. Value-added tax (VAT) is a multi-stage consumption tax imposed on the value added at each stage of production and distribution, ensuring tax neutrality by allowing businesses to claim credits for taxes paid on inputs. Both systems aim to tax consumer expenditure but differ in complexity, revenue stability, and economic impact.

Defining Sales Tax: Key Features

Sales tax is a consumption tax imposed directly on the sale of goods and services, collected at the point of purchase by the retailer and passed on to the government. It is typically calculated as a percentage of the final sale price, applied only on the end consumer, making it simpler but potentially less comprehensive than value-added tax (VAT). Unlike VAT, sales tax does not tax the value added at each production stage, leading to differences in tax incidence and administrative complexity between the two systems.

Understanding Value-Added Tax (VAT) Essentials

Value-Added Tax (VAT) is a consumption tax applied at each stage of the supply chain where value is added, from production to final sale, ensuring tax is paid on the net value created. Unlike a single-point sales tax that targets only the final sale to consumers, VAT reduces tax evasion by require businesses to remit the difference between their input and output taxes. Effective implementation of VAT relies on accurate invoicing and input tax credit mechanisms, making it a more transparent and efficient tax system for governments seeking consistent revenue.

Historical Evolution of Sales Tax and VAT

Sales tax originated in the early 20th century as a straightforward levy on the final sale of goods to consumers, primarily adopted in the United States and several other countries. Value-added tax (VAT) emerged in Europe in the mid-20th century as a more efficient multistage consumption tax, capturing value added at each production stage to minimize tax evasion and cascading effects. The historical evolution reflects a global shift from single-stage sales tax systems toward comprehensive VAT frameworks, enhancing revenue collection and economic transparency.

Mechanisms of Collection: Sales Tax vs VAT

Sales tax is collected at the point of sale, with the retailer responsible for charging and remitting tax on the final transaction to the government, whereas value-added tax (VAT) is imposed at each stage of production and distribution, with businesses charging VAT on sales and claiming credits for VAT paid on inputs. The VAT mechanism ensures tax is collected incrementally and reduces the risk of tax evasion through input tax credits, while sales tax is simpler but can lead to cascading effects if intermediate sales are not exempt. Both systems aim to tax consumption but differ fundamentally in their collection methods and impact on business cash flow.

Impact on Consumers and Businesses

Sales tax is applied only at the point of purchase, directly affecting consumers by increasing the final price of goods and services, which can discourage spending. Value-added tax (VAT) is levied at each production stage, spreading the tax burden across businesses, but its embedded nature can lead to higher overall prices passed onto consumers. Businesses face more administrative complexity with VAT due to invoicing and compliance requirements, while sales tax requires less record-keeping but may create disparities in tax collection efficiency.

Administration and Compliance Challenges

Sales tax systems typically require tracking and collecting tax only at the point of final sale to the consumer, simplifying administration but increasing the burden on retailers. Value-added tax (VAT) involves taxing the incremental value added at each stage of production and distribution, requiring detailed documentation and compliance from businesses throughout the supply chain. VAT's multi-stage collection process often results in higher administrative costs and complexity but improves tax transparency and reduces evasion compared to sales tax.

Revenue Generation Efficiency

Sales tax relies on taxing the final retail transaction, often resulting in tax cascading and potential evasion in multi-stage production processes. Value-added tax (VAT) imposes levies on each production stage based on the value added, enhancing revenue generation efficiency by reducing tax evasion and economic distortions. Empirical studies show VAT systems typically yield higher compliance rates and broader tax bases, improving overall fiscal capacity for governments.

Global Adoption Trends: Sales Tax vs VAT

Sales tax and value-added tax (VAT) dominate global consumption tax systems, with VAT adopted by over 160 countries due to its multi-stage collection and reduced tax evasion. Sales tax remains prevalent primarily in the United States and parts of Canada, where a single-stage tax is levied at the point of retail sale. Recent trends show emerging economies increasingly favor VAT implementation for its efficiency in revenue generation and broader tax base coverage.

Determining the Optimal Approach for Effective Tax Policy

Sales tax applies only at the final point of sale, simplifying collection but risking tax cascading when intermediate goods are untaxed, whereas Value-added tax (VAT) charges tax on each stage of production, reducing distortion by allowing input tax credits and encouraging transparency. Effective tax policy requires balancing administrative efficiency, compliance costs, and economic impact, where VAT often outperforms due to its broader tax base and ability to minimize tax evasion. Selecting the optimal approach depends on the country's economic structure, tax administration capacity, and the goal of ensuring stable revenue without discouraging investment or consumption.

Related Important Terms

Digital Sales Tax (DST)

Digital Sales Tax (DST) targets revenue from digital services by imposing levies on gross revenues of multinational tech companies, differing from traditional Sales Tax which is applied at point of retail sale, and from Value-added Tax (VAT) which is collected incrementally at each production stage. DST aims to address the tax challenges posed by the digital economy by ensuring fair contribution from digital business models that often escape conventional Sales Tax or VAT frameworks.

VAT Gap

The VAT Gap, representing the difference between expected and actual Value-added tax revenues, highlights inefficiencies and non-compliance in VAT systems compared to sales taxes, which typically apply only at the final sale point and often result in lower tax revenue leakage. Addressing the VAT Gap involves improving compliance mechanisms, enhancing audit practices, and employing technology to track transactions, ultimately strengthening the consumption tax framework and increasing government revenue.

Marketplace Facilitator Tax

Marketplace facilitator tax laws require platforms to collect and remit sales tax on behalf of third-party sellers, streamlining compliance compared to traditional sales tax systems. Unlike value-added tax (VAT) which applies at each production stage, sales tax under marketplace facilitator rules targets the final consumer transaction, reducing administrative burdens for sellers.

Indirect Tax Compliance Automation

Sales tax and value-added tax (VAT) differ fundamentally in their collection mechanisms, with sales tax levied only at the point of retail sale and VAT applied at each stage of the supply chain, enhancing traceability and reducing tax evasion risks. Indirect tax compliance automation streamlines processes by integrating real-time transaction data, ensuring accurate tax calculation, timely reporting, and seamless cross-jurisdictional adherence for both sales tax and VAT systems.

Destination-Based Consumption Tax

Destination-based consumption taxes, such as sales tax and value-added tax (VAT), are levied at the point of consumption rather than production, ensuring tax revenue is allocated to the jurisdiction where goods or services are ultimately used. Sales tax applies only to final consumers, while VAT is collected at each production stage with credit for prior taxes, enhancing transparency and reducing tax cascading.

Reverse Charge Mechanism

The Reverse Charge Mechanism shifts the liability to pay sales tax or VAT from the supplier to the buyer, enhancing compliance and reducing tax evasion in cross-border transactions. This approach is integral in VAT systems, where it simplifies the collection process by making the consumer responsible for reporting and remitting the tax directly to the authorities.

Split Payment VAT

Split Payment VAT enhances tax compliance by mandating buyers to pay VAT directly into the government account instead of the seller, reducing tax evasion risks common in traditional sales tax systems; this mechanism ensures transparent VAT collection and improves cash flow for tax authorities while maintaining the fundamental consumption tax principle inherent in VAT. Unlike sales tax, which is collected only at the final sale to consumers, VAT applies at each production stage with input tax credits, and Split Payment VAT uniquely strengthens this system by securing government's share promptly without relying solely on seller compliance.

Economic Nexus (for sales tax)

Economic nexus for sales tax establishes a threshold based on sales revenue or transaction volume within a state, requiring remote sellers to collect and remit sales tax even without a physical presence, contrasting with value-added tax (VAT) which is imposed at each production stage regardless of seller location. Sales tax economic nexus laws are particularly critical for e-commerce businesses, ensuring state tax compliance and influencing cross-border trade dynamics.

VAT E-invoicing

Value-added tax (VAT) systems leverage VAT e-invoicing to enhance transparency, reduce tax evasion, and streamline compliance by electronically capturing transaction data at each production stage. Unlike sales tax, which is applied only at the final sale, VAT e-invoicing enables real-time verification and automated tax reporting, significantly improving accuracy in consumption tax administration.

Platform Taxation (on gig economy)

Sales tax applies a single-stage levy on the final sale of goods or services, often complicating platform taxation in the gig economy due to the fragmented nature of digital transactions. Value-added tax (VAT) imposes a multi-stage tax on the value added at each production and distribution stage, enabling more efficient collection from gig platforms by targeting the cumulative value generated across services and intermediaries.

Sales tax vs Value-added tax for consumption tax approaches. Infographic

moneydiff.com

moneydiff.com