Tax deductions reduce taxable income by lowering the amount of income subject to tax, while tax credits directly reduce the tax owed dollar for dollar. Choosing between tax deductions and tax credits depends on which offers a greater reduction in overall tax liability, with credits generally providing a more significant benefit. Understanding the difference helps taxpayers maximize savings and optimize their tax return outcomes.

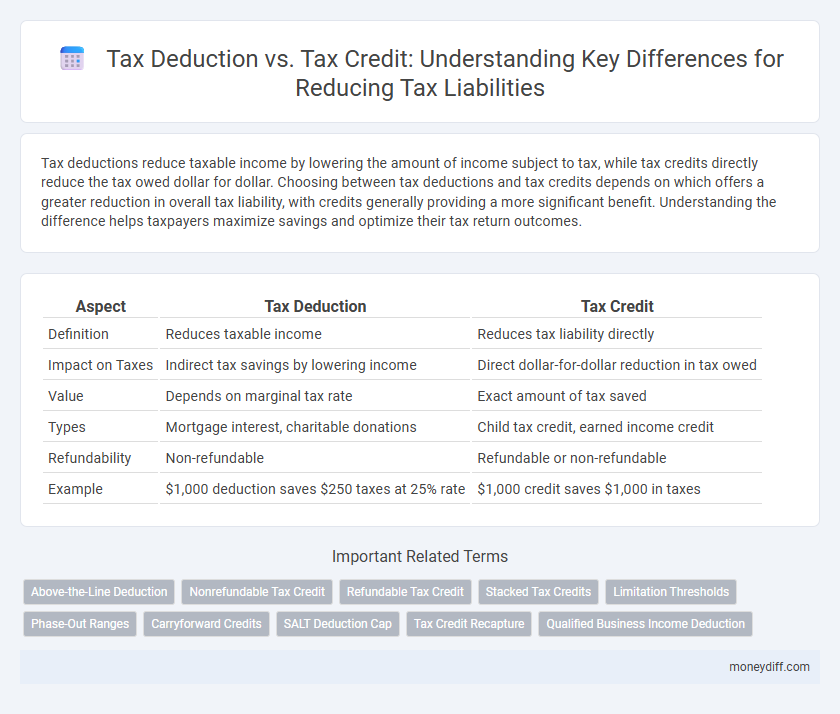

Table of Comparison

| Aspect | Tax Deduction | Tax Credit |

|---|---|---|

| Definition | Reduces taxable income | Reduces tax liability directly |

| Impact on Taxes | Indirect tax savings by lowering income | Direct dollar-for-dollar reduction in tax owed |

| Value | Depends on marginal tax rate | Exact amount of tax saved |

| Types | Mortgage interest, charitable donations | Child tax credit, earned income credit |

| Refundability | Non-refundable | Refundable or non-refundable |

| Example | $1,000 deduction saves $250 taxes at 25% rate | $1,000 credit saves $1,000 in taxes |

Understanding Tax Deductions vs Tax Credits

Tax deductions reduce taxable income by lowering the amount subject to tax, effectively decreasing overall tax liability based on the taxpayer's marginal tax rate. Tax credits provide a dollar-for-dollar reduction in tax owed, offering a more direct and often greater benefit compared to deductions. Understanding the difference between tax deductions and tax credits is essential for optimizing tax strategies and maximizing savings on tax liabilities.

How Tax Deductions Reduce Taxable Income

Tax deductions reduce taxable income by lowering the amount of income subject to tax, directly impacting the calculation of tax liability. Instead of subtracting from the tax owed, deductions decrease the base income, resulting in a smaller tax bill based on the taxpayer's marginal tax rate. Common deductions include mortgage interest, student loan interest, and charitable contributions, which effectively reduce the overall taxable income used to determine federal or state taxes.

The Impact of Tax Credits on Tax Owed

Tax credits directly reduce the amount of tax owed, offering a dollar-for-dollar decrease in tax liabilities, making them more advantageous than tax deductions, which only lower taxable income. For example, a $1,000 tax credit cuts tax owed by $1,000, whereas a $1,000 tax deduction reduces income subject to tax, saving only a portion depending on the taxpayer's marginal tax rate. Tax credits like the Earned Income Tax Credit (EITC) or Child Tax Credit significantly enhance tax savings, especially for low- and middle-income taxpayers.

Types of Common Tax Deductions

Common tax deductions include mortgage interest, state and local taxes, and charitable contributions, which reduce taxable income and consequently lower tax liabilities. Medical expenses exceeding a specified percentage of adjusted gross income and student loan interest are also deductible for eligible taxpayers, offering significant relief. Business expenses like travel, equipment, and home office costs provide further opportunities to decrease taxable income within IRS guidelines.

Popular Tax Credits for Individuals and Businesses

Popular tax credits for individuals, such as the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), directly reduce tax liabilities dollar-for-dollar, providing substantial financial relief. Businesses benefit from credits like the Research & Development (R&D) Tax Credit and the Work Opportunity Tax Credit (WOTC), which incentivize innovation and employment by lowering owed taxes. Unlike tax deductions that reduce taxable income, these credits offer more significant savings by decreasing the total tax owed.

Eligibility Criteria: Who Qualifies for Deductions and Credits?

Tax deductions reduce taxable income based on eligible expenses such as mortgage interest, student loan interest, or charitable donations, primarily benefiting taxpayers who itemize deductions or meet specific income criteria. Tax credits, including the Child Tax Credit or Earned Income Tax Credit, directly reduce tax liability and often have eligibility requirements tied to income limits, filing status, and dependent qualifications. Understanding the distinct eligibility criteria for deductions versus credits is crucial for maximizing tax savings and ensuring compliance with IRS regulations.

Dollar-for-Dollar Savings: The Power of Tax Credits

Tax credits provide dollar-for-dollar savings by directly reducing the amount of tax owed, making them more effective than tax deductions, which only reduce taxable income. A $1,000 tax credit lowers your tax bill by $1,000, while a $1,000 tax deduction reduces taxable income, resulting in a smaller tax savings depending on your tax bracket. Maximizing tax credits, such as the Earned Income Tax Credit (EITC) or Child Tax Credit, can substantially decrease tax liabilities and increase refund amounts.

Strategic Tax Planning: Maximizing Deductions and Credits

Tax deduction reduces taxable income by allowing specific expenses to be subtracted, effectively lowering the amount of income subject to tax. Tax credits directly reduce tax liability dollar-for-dollar, offering a more impactful way to decrease the total tax owed. Strategic tax planning combines both deductions and credits to optimize tax savings, ensuring maximum reduction of tax liabilities through careful identification and utilization of all eligible benefits.

Tax Deduction or Tax Credit: Which Offers Greater Savings?

Tax credits directly reduce the amount of tax owed dollar-for-dollar, often providing greater savings compared to tax deductions, which only lower taxable income. For example, a $1,000 tax credit saves the full $1,000 in taxes, whereas a $1,000 tax deduction reduces taxable income and results in savings based on the taxpayer's marginal tax rate, such as $220 for a 22% rate. Understanding the difference is crucial for maximizing tax benefits and minimizing overall tax liabilities.

Common Mistakes When Claiming Deductions and Credits

Taxpayers often confuse tax deductions with tax credits, leading to errors such as overstating deductions or failing to claim eligible credits, which directly reduce tax liabilities. Common mistakes include neglecting to keep proper documentation for deductions and incorrectly calculating income limits that affect credit eligibility. Understanding the difference--deductions lower taxable income, while credits reduce the tax owed--helps avoid costly filing errors and ensures maximum tax benefits.

Related Important Terms

Above-the-Line Deduction

Above-the-line deductions directly reduce gross income, lowering taxable income and ultimately decreasing tax liabilities before calculating adjusted gross income (AGI). Unlike tax credits, which reduce tax owed dollar-for-dollar, above-the-line deductions provide significant benefits by encompassing expenses such as educator costs, student loan interest, and contributions to retirement accounts, maximizing overall tax savings.

Nonrefundable Tax Credit

Nonrefundable tax credits directly reduce tax liabilities dollar-for-dollar but cannot lower the tax owed below zero, meaning any excess credit is forfeited. In contrast to tax deductions that lower taxable income, nonrefundable tax credits offer a more immediate and precise reduction in the amount of tax owed without providing a refund if the credit exceeds the liability.

Refundable Tax Credit

Refundable tax credits directly reduce tax liabilities and can result in a tax refund if the credit exceeds the amount owed, unlike tax deductions which only lower taxable income. These credits provide a more significant financial benefit, offering taxpayers the potential to receive money back even when no taxes are owed.

Stacked Tax Credits

Stacked tax credits multiply the overall tax reduction by allowing multiple non-refundable and refundable credits to be applied consecutively, significantly lowering the taxpayer's liability beyond standard deductions. Unlike tax deductions that reduce taxable income, tax credits provide a dollar-for-dollar reduction in tax owed, making stacked credits a powerful strategy for maximizing tax savings.

Limitation Thresholds

Tax deductions reduce taxable income based on expenses incurred but are subject to limitation thresholds such as income brackets and specific expense caps, which can limit their overall impact. Tax credits directly lower tax liabilities dollar-for-dollar, often with set maximum limits and phase-out thresholds, making them potentially more valuable within regulatory constraints.

Phase-Out Ranges

Tax credits directly reduce tax liabilities dollar-for-dollar and often have phase-out ranges that limit eligibility based on income levels, gradually decreasing the credit amount as income rises. In contrast, tax deductions lower taxable income, which indirectly reduces tax owed, and their phase-out thresholds determine when the deduction amount begins to decrease or becomes unavailable due to higher income.

Carryforward Credits

Tax credits directly reduce tax liabilities dollar-for-dollar, making them more valuable than tax deductions, which only lower taxable income. Carryforward credits allow taxpayers to apply unused tax credits to future tax years, optimizing long-term tax savings and efficiently managing tax liabilities over time.

SALT Deduction Cap

The SALT deduction cap limits state and local tax deductions to $10,000, reducing the effectiveness of tax deductions for many taxpayers. Unlike tax credits that directly reduce tax liability dollar-for-dollar, the capped SALT deduction only lowers taxable income, resulting in a smaller overall tax savings.

Tax Credit Recapture

Tax credit recapture occurs when taxpayers are required to repay previously claimed tax credits due to changes in eligibility or failure to meet specific requirements, effectively increasing their tax liabilities. Unlike tax deductions that reduce taxable income, tax credit recapture directly increases the amount of tax owed by reversing the original benefit of the tax credit.

Qualified Business Income Deduction

The Qualified Business Income Deduction (QBI) allows eligible taxpayers to deduct up to 20% of their qualified business income, directly reducing taxable income and providing significant tax savings compared to tax credits, which reduce tax liability dollar-for-dollar after taxable income is calculated. Understanding the QBI deduction's phase-in ranges and limitations on specified service trades is crucial for maximizing tax benefits and minimizing overall tax liabilities effectively.

Tax deduction vs Tax credit for reducing tax liabilities. Infographic

moneydiff.com

moneydiff.com