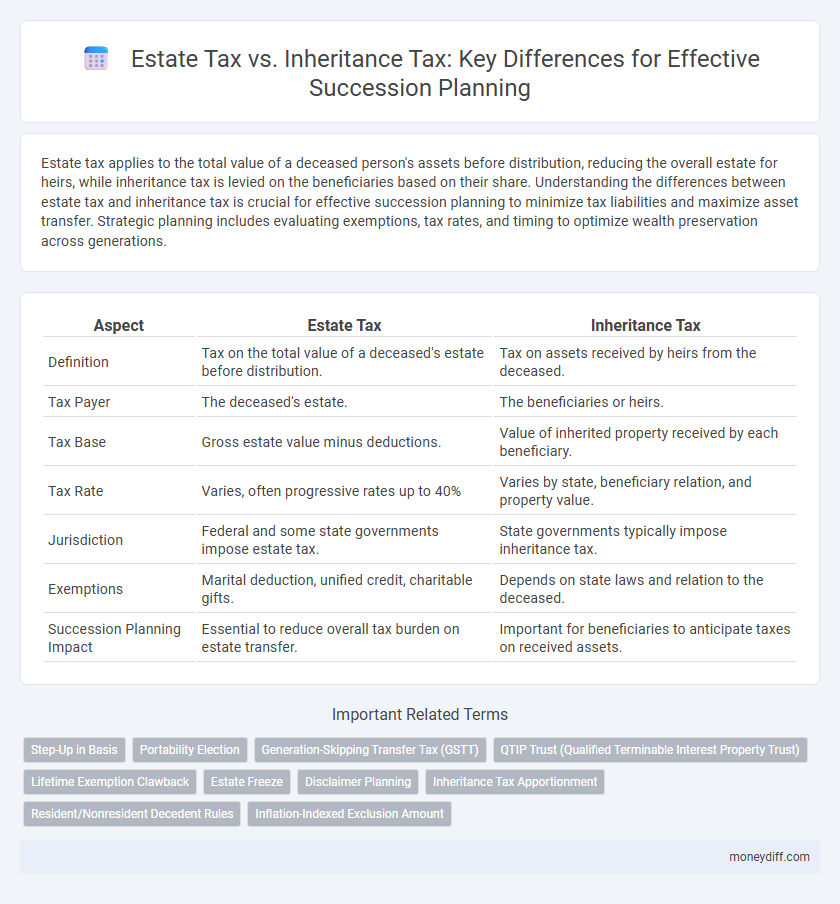

Estate tax applies to the total value of a deceased person's assets before distribution, reducing the overall estate for heirs, while inheritance tax is levied on the beneficiaries based on their share. Understanding the differences between estate tax and inheritance tax is crucial for effective succession planning to minimize tax liabilities and maximize asset transfer. Strategic planning includes evaluating exemptions, tax rates, and timing to optimize wealth preservation across generations.

Table of Comparison

| Aspect | Estate Tax | Inheritance Tax |

|---|---|---|

| Definition | Tax on the total value of a deceased's estate before distribution. | Tax on assets received by heirs from the deceased. |

| Tax Payer | The deceased's estate. | The beneficiaries or heirs. |

| Tax Base | Gross estate value minus deductions. | Value of inherited property received by each beneficiary. |

| Tax Rate | Varies, often progressive rates up to 40% | Varies by state, beneficiary relation, and property value. |

| Jurisdiction | Federal and some state governments impose estate tax. | State governments typically impose inheritance tax. |

| Exemptions | Marital deduction, unified credit, charitable gifts. | Depends on state laws and relation to the deceased. |

| Succession Planning Impact | Essential to reduce overall tax burden on estate transfer. | Important for beneficiaries to anticipate taxes on received assets. |

Understanding Estate Tax: Key Concepts and Definitions

Estate tax is a government levy on the total value of a deceased person's assets before they are distributed to heirs, calculated based on the gross estate value including real estate, investments, and personal property. The tax threshold varies by jurisdiction, often with exemptions for estates below a certain value to minimize impact on smaller inheritances. Understanding the distinction between estate tax and inheritance tax is crucial for effective succession planning, as estate tax is paid from the deceased's estate, whereas inheritance tax is paid by the beneficiaries receiving the assets.

What Is Inheritance Tax? An Overview

Inheritance tax is a levy imposed on individuals who receive assets from a deceased person's estate, varying significantly by jurisdiction. Unlike estate tax, which is paid from the estate before distribution, inheritance tax is paid by the beneficiaries based on the value they receive and their relationship to the deceased. Proper understanding of inheritance tax rates, exemptions, and thresholds is crucial for effective succession planning to minimize tax liabilities and preserve wealth.

Estate Tax vs Inheritance Tax: Core Differences

Estate tax is levied on the total value of a deceased person's assets before distribution to heirs, whereas inheritance tax is imposed on the beneficiaries based on the assets they receive. Estate tax rates and exemption limits vary by jurisdiction, often impacting estate planning strategies to minimize taxable estate value. In contrast, inheritance tax depends on the beneficiary's relationship to the decedent, with close relatives frequently subject to lower rates or exemptions.

How Estate Tax Impacts Succession Planning

Estate tax directly reduces the overall value of the estate passed to heirs, influencing critical succession planning decisions such as asset distribution and trust formation. High estate tax rates can incentivize the use of strategies like lifetime gifting, irrevocable trusts, and insurance policies to minimize taxable estate value. Proper understanding of estate tax thresholds and exemptions is essential to preserve wealth and ensure efficient transfer of assets within estate plans.

Inheritance Tax Considerations in Succession Strategies

Inheritance tax considerations play a crucial role in succession planning, as they directly affect the net value transferred to heirs and beneficiaries. Effective strategies involve understanding state-specific inheritance tax rates, exemptions, and potential deductions to minimize tax liabilities. Proper planning tools such as trusts, lifetime gifts, and beneficiary designations help mitigate inheritance tax burdens and ensure efficient wealth transfer across generations.

Jurisdictional Variations: Which States Impose Estate or Inheritance Taxes?

Estate tax is imposed by states such as Washington, Oregon, and Massachusetts, targeting the total value of a decedent's estate before distribution, whereas inheritance tax, levied by states like Pennsylvania and Kentucky, is charged on beneficiaries receiving assets. Jurisdictional variations significantly affect succession planning strategies, as estate tax rates and exemptions differ widely, with some states imposing no estate or inheritance taxes at all. Understanding specific state laws is crucial to minimize tax liability and ensure efficient asset transfer to heirs.

Minimizing Estate Tax Liability through Trusts

Minimizing estate tax liability through trusts involves strategically transferring assets to reduce the taxable estate and protect wealth for heirs. Irrevocable trusts, such as bypass or credit shelter trusts, effectively remove assets from the estate, lowering estate tax exposure while maintaining control over asset distribution. Properly structured trusts complement inheritance tax considerations by potentially reducing the overall tax burden during succession planning.

Exemptions and Deductions: Reducing Your Tax Burden

Estate tax offers a unified exemption amount, currently set at $12.92 million per individual in 2023, allowing substantial assets to transfer tax-free, while inheritance tax exemptions vary significantly by state and beneficiary relationship. Deductions such as charitable contributions and debts owed by the deceased reduce the taxable estate, directly lowering the estate tax liability. In contrast, inheritance tax deductions depend on the heir's state laws, with some states providing exemptions or reduced rates for close relatives, making it crucial to understand specific state provisions for optimal succession planning.

Succession Planning Pitfalls: Common Tax Mistakes to Avoid

Failing to differentiate between estate tax and inheritance tax during succession planning can lead to unexpected tax liabilities, as estate tax is levied on the deceased's total estate before distribution, while inheritance tax is imposed on beneficiaries. Overlooking state-specific variations in estate and inheritance tax laws often results in underestimating tax burdens, jeopardizing the intended asset transfer. Properly structuring asset transfers and consulting tax professionals helps minimize tax exposure and avoid costly succession planning mistakes.

Professional Guidance: Choosing the Right Tax Advisor for Estate Planning

Selecting a tax advisor with expertise in both estate tax and inheritance tax is crucial for effective succession planning. Professionals adept in these areas provide tailored strategies that minimize tax liabilities and ensure compliance with federal and state regulations. Evaluating credentials, experience in complex estate matters, and familiarity with jurisdiction-specific tax laws enhances decision-making for optimal wealth transfer.

Related Important Terms

Step-Up in Basis

Estate tax applies to the total value of a deceased person's assets before distribution, impacting the estate's overall tax liability, while inheritance tax is levied on recipients based on their share received. The step-up in basis resets the asset's value to its market price at the time of death, minimizing capital gains tax for heirs when they sell inherited property, making estate tax considerations crucial for succession planning.

Portability Election

Estate tax applies to the total value of the decedent's assets and can be reduced by the portability election, which allows the surviving spouse to use the deceased spouse's unused exemption. Inheritance tax, imposed by some states on beneficiaries, is separate from the federal estate tax system and does not benefit from portability provisions.

Generation-Skipping Transfer Tax (GSTT)

Generation-Skipping Transfer Tax (GSTT) applies to transfers of assets that skip a generation, such as from grandparents directly to grandchildren, and is designed to prevent the avoidance of estate and gift taxes. Effective succession planning must consider GSTT alongside estate tax and inheritance tax to minimize tax liability and ensure the smooth transfer of wealth across multiple generations.

QTIP Trust (Qualified Terminable Interest Property Trust)

A QTIP Trust allows the grantor to provide income to a surviving spouse while controlling the ultimate distribution of the estate, effectively minimizing estate tax liability by deferring estate taxes until the death of the surviving spouse instead of facing inheritance tax immediately upon the first death. Utilizing a QTIP Trust in succession planning strategically balances estate tax and inheritance tax considerations, ensuring assets pass efficiently to heirs while maximizing tax deferral benefits.

Lifetime Exemption Clawback

Lifetime exemption clawback provisions in estate tax laws can significantly reduce the benefits of succession planning by recapturing previously sheltered assets upon death, unlike inheritance tax which is levied directly on beneficiaries without such clawbacks. Understanding the implications of these clawback rules is crucial for optimizing estate transfer strategies and minimizing tax liabilities during generational wealth transfers.

Estate Freeze

Estate tax applies to the total value of assets transferred upon death, while inheritance tax is levied on the recipients of those assets; implementing an estate freeze can limit the taxable estate's growth, locking in current asset values to minimize estate tax liability. This strategy allows wealth transfer to heirs at a fixed value, reducing future estate tax exposure and facilitating more efficient succession planning.

Disclaimer Planning

Estate tax applies to the total value of a deceased person's estate before distribution, while inheritance tax is levied on beneficiaries receiving assets, making disclaimer planning a strategic tool to redirect assets and minimize tax liabilities by legally refusing an inheritance. Utilizing disclaimer planning allows heirs to optimize succession outcomes by transferring inherited assets without triggering immediate estate or inheritance tax consequences.

Inheritance Tax Apportionment

Inheritance tax apportionment determines how the tax liability is divided among the beneficiaries, often proportionate to the value of their inherited assets, ensuring fairness in succession planning. Proper apportionment planning can mitigate estate tax burdens by allocating tax responsibilities efficiently, preserving more wealth for heirs.

Resident/Nonresident Decedent Rules

Estate tax applies to the worldwide assets of resident decedents and to U.S.-situated assets of nonresident decedents, while inheritance tax depends on the beneficiary's state of residence and varies in applicability. Understanding distinctions in resident versus nonresident decedent rules is crucial for optimizing estate planning strategies and minimizing tax liabilities.

Inflation-Indexed Exclusion Amount

The inflation-indexed exclusion amount significantly impacts estate tax liability by increasing the threshold exempt from taxation annually, reducing the overall tax burden on large estates during succession planning. Inheritance tax, however, usually varies by state without a standardized inflation adjustment, making estate tax planning strategies with inflation-indexed exclusions crucial for minimizing intergenerational wealth transfer taxes.

Estate Tax vs Inheritance Tax for succession planning Infographic

moneydiff.com

moneydiff.com