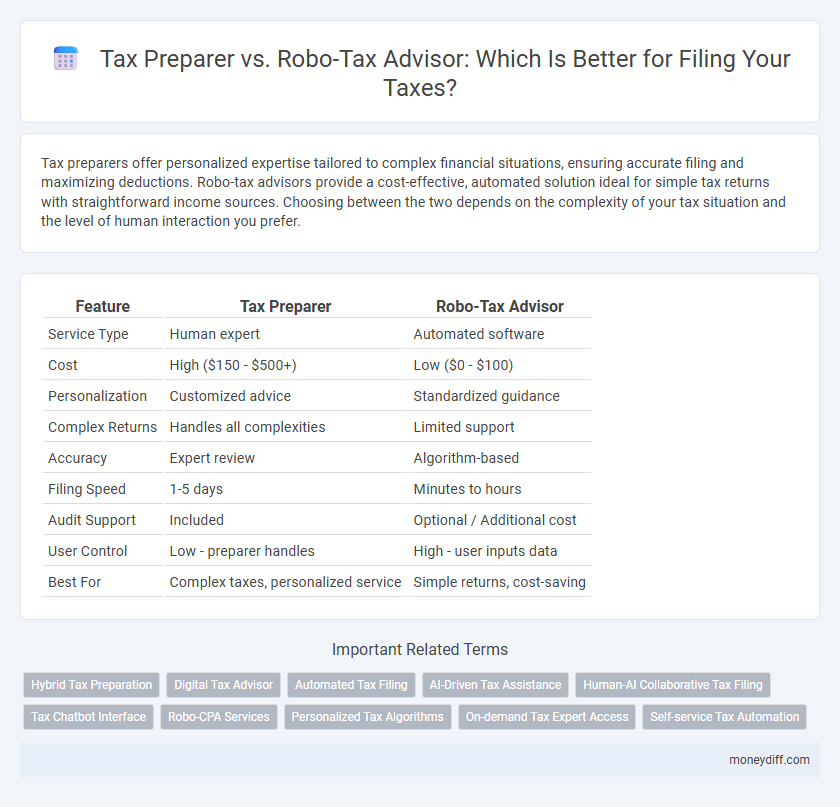

Tax preparers offer personalized expertise tailored to complex financial situations, ensuring accurate filing and maximizing deductions. Robo-tax advisors provide a cost-effective, automated solution ideal for simple tax returns with straightforward income sources. Choosing between the two depends on the complexity of your tax situation and the level of human interaction you prefer.

Table of Comparison

| Feature | Tax Preparer | Robo-Tax Advisor |

|---|---|---|

| Service Type | Human expert | Automated software |

| Cost | High ($150 - $500+) | Low ($0 - $100) |

| Personalization | Customized advice | Standardized guidance |

| Complex Returns | Handles all complexities | Limited support |

| Accuracy | Expert review | Algorithm-based |

| Filing Speed | 1-5 days | Minutes to hours |

| Audit Support | Included | Optional / Additional cost |

| User Control | Low - preparer handles | High - user inputs data |

| Best For | Complex taxes, personalized service | Simple returns, cost-saving |

Understanding Tax Preparers vs Robo-Tax Advisors

Tax preparers offer personalized services by analyzing individual financial situations and providing tailored advice, which can be crucial for complex tax returns. Robo-tax advisors utilize algorithms and automation to guide users through standard filing processes quickly and cost-effectively, ideal for straightforward tax scenarios. Understanding the differences between human expertise and automated tools helps taxpayers choose the most suitable option based on their filing complexity and budget.

Key Differences in Service and Approach

Tax preparers provide personalized, hands-on assistance, ensuring tailored advice and representation during IRS audits, ideal for complex tax situations. Robo-tax advisors offer automated, cost-effective solutions with algorithm-driven accuracy, suitable for straightforward returns and quick filing. The human element in tax preparers delivers customized insights, whereas robo-advisors emphasize convenience through technology.

Cost Comparison: Human vs Digital Tax Filing

Human tax preparers typically charge between $150 to $450 per return, depending on complexity and location, while robo-tax advisors offer services for as low as $0 to $100. Digital tax filing platforms use algorithms to minimize errors and optimize deductions, often reducing overall costs compared to in-person consultations. Despite higher fees, human preparers provide personalized advice and handle complex tax situations that robo-advisors may not fully address.

Accuracy and Error Rates: Who Performs Better?

Tax preparers demonstrate higher accuracy and lower error rates compared to robo-tax advisors due to their expertise in handling complex tax situations and interpreting nuanced tax laws. Robo-tax advisors rely on algorithms that may misinterpret unique financial scenarios, leading to increased mistakes, especially with incomplete or unusual data inputs. Studies indicate that human preparers catch up to 40% more errors that automated systems might overlook, ensuring more precise tax filings.

Security and Privacy Considerations

Tax preparers offer personalized security measures by handling sensitive documents directly, reducing the risk of data breaches inherent in online platforms. Robo-tax advisors rely on encrypted cloud storage and automated processes, but may be vulnerable to cyberattacks targeting software algorithms and large data repositories. Choosing between a human tax preparer and a robo-advisor involves evaluating the balance between human oversight and potential exposure to digital security threats.

Handling Complex Tax Situations

Tax preparers offer personalized expertise crucial for handling complex tax situations such as investment income, self-employment, and multiple state filings, ensuring accurate deductions and credits. Robo-tax advisors use algorithms that efficiently process straightforward tax returns but may struggle with nuanced scenarios requiring professional judgment. Choosing a tax preparer can minimize errors and optimize tax outcomes when dealing with complicated financial situations.

Personalization and Customer Support

Tax preparers offer tailored tax strategies by analyzing individual financial situations, while robo-tax advisors utilize algorithms that may lack nuanced understanding of complex personal circumstances. Personalized support from human preparers ensures immediate answers to specific queries and adaptive guidance during the filing process, which automated services cannot fully replicate. Customer satisfaction often hinges on the availability of empathetic assistance and customized tax optimization, areas where traditional preparers generally excel over robo-tax platforms.

Turnaround Time and Efficiency

Tax preparers typically offer personalized service with turnaround times ranging from a few days to a week, depending on the complexity of the return and client availability, while robo-tax advisors provide much faster processing, often completing filings within minutes to hours through automated algorithms. Efficiency in robo-tax platforms is enhanced by AI-driven accuracy checks and instant data validation, reducing errors and manual input compared to traditional tax preparers. However, tax preparers may better handle complex tax situations that robo-advisors might overlook, balancing speed with tailored expertise.

Who Should Choose a Tax Preparer?

Individuals with complex tax situations, such as multiple income streams, investments, or self-employment income, should choose a tax preparer for personalized guidance. Tax preparers offer expertise in maximizing deductions, navigating tax laws, and handling audits, which robo-tax advisors may not fully address. Clients seeking tailored advice, in-depth tax planning, or support with IRS interactions benefit most from human tax professionals over automated services.

Who Benefits Most from Robo-Tax Advisors?

Robo-tax advisors offer significant advantages for individuals with straightforward tax situations, such as employees with standard deductions and minimal investment income, by providing cost-effective and efficient filing services. Tax preparers deliver more value to those with complex returns involving multiple income sources, itemized deductions, or business activities, ensuring personalized guidance and error minimization. Users seeking quick, affordable, and user-friendly solutions benefit most from robo-tax advisors, while higher-net-worth individuals or freelancers typically prefer professional preparers.

Related Important Terms

Hybrid Tax Preparation

Hybrid tax preparation combines the expertise of a professional tax preparer with the efficiency of automated robo-tax advisory tools, ensuring accurate and personalized filing services. This approach leverages AI-driven software for data input and error checking while allowing human advisors to handle complex tax situations and provide tailored financial advice.

Digital Tax Advisor

Digital tax advisors utilize advanced algorithms and AI to analyze financial data, offering personalized tax filing recommendations that often surpass traditional tax preparers in speed and accuracy. These robo-tax services reduce human error and provide real-time updates on tax code changes, enhancing compliance for individual and business taxpayers.

Automated Tax Filing

Automated tax filing through robo-tax advisors offers streamlined, real-time calculations and error detection using AI algorithms, reducing the risk of human mistakes common in manual tax preparer services. These digital platforms provide cost-effective, 24/7 accessibility while automatically updating tax codes and regulations to ensure compliance and maximize deductions.

AI-Driven Tax Assistance

AI-driven tax assistance leverages advanced algorithms to provide real-time error detection, personalized deductions, and optimized filing strategies, surpassing traditional tax preparers in speed and cost efficiency. Machine learning models continuously update with the latest tax codes and regulations, ensuring accurate compliance and tailored advice for individual financial situations.

Human-AI Collaborative Tax Filing

Human-AI collaborative tax filing combines the accuracy and efficiency of robo-tax advisors with the personalized expertise of tax preparers, ensuring optimized deductions and compliance. This hybrid approach leverages advanced algorithms alongside professional judgment to navigate complex tax regulations and enhance overall filing accuracy.

Tax Chatbot Interface

Tax chatbot interfaces streamline the tax preparation process by providing real-time answers and personalized guidance, reducing reliance on traditional tax preparers. These AI-driven tools enhance accuracy, improve user experience, and offer cost-effective alternatives to robo-tax advisors by combining automation with interactive support.

Robo-CPA Services

Robo-CPA services leverage advanced algorithms and artificial intelligence to provide accurate, efficient tax filing solutions, minimizing human error and reducing costs compared to traditional tax preparers. These platforms offer real-time data analysis, personalized tax recommendations, and seamless integration with financial tools, making them an ideal choice for individuals seeking automated, reliable tax preparation services.

Personalized Tax Algorithms

Tax preparers utilize personalized tax algorithms to analyze individual financial situations and optimize deductions and credits, providing tailored filing strategies that adapt to complex tax scenarios. Robo-tax advisors offer algorithm-driven automation but often lack the nuanced customization and expert insight necessary for personalized tax optimization in unique or complicated cases.

On-demand Tax Expert Access

Tax preparers provide on-demand access to certified experts who can address complex tax situations and personalized queries in real-time, ensuring accuracy and tailored advice. Robo-tax advisors offer automated, algorithm-driven services that lack immediate personalized support, making them less suitable for taxpayers needing expert guidance during filing.

Self-service Tax Automation

Self-service tax automation leverages robo-tax advisors to streamline filing processes through algorithm-driven platforms offering personalized guidance with reduced costs compared to traditional tax preparers. These digital solutions enhance accuracy and efficiency by integrating real-time tax code updates and automated document recognition, empowering taxpayers to independently navigate complex tax regulations.

Tax preparer vs Robo-tax advisor for filing services. Infographic

moneydiff.com

moneydiff.com