Tax filing requires manual data entry and careful review to ensure accuracy and adherence to regulations, which can be time-consuming and prone to human error. Tax automation streamlines compliance by integrating software solutions that automatically gather, verify, and submit tax information, reducing risks of mistakes and accelerating processing times. Leveraging tax automation enhances precision, ensures timely filings, and eases compliance burdens for businesses and individuals alike.

Table of Comparison

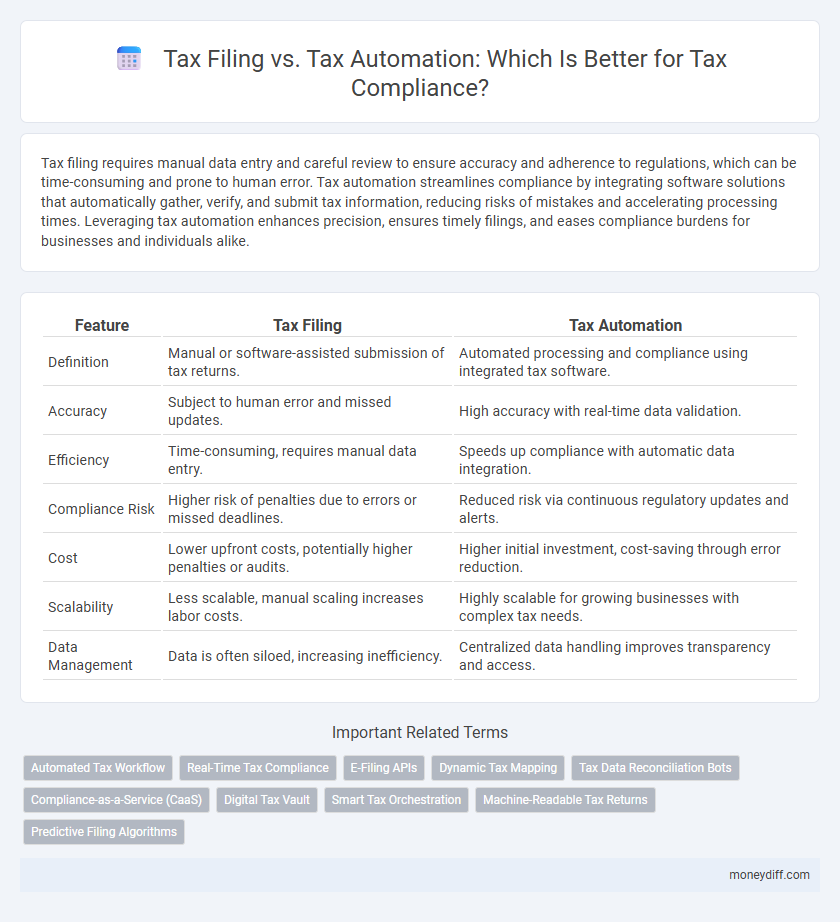

| Feature | Tax Filing | Tax Automation |

|---|---|---|

| Definition | Manual or software-assisted submission of tax returns. | Automated processing and compliance using integrated tax software. |

| Accuracy | Subject to human error and missed updates. | High accuracy with real-time data validation. |

| Efficiency | Time-consuming, requires manual data entry. | Speeds up compliance with automatic data integration. |

| Compliance Risk | Higher risk of penalties due to errors or missed deadlines. | Reduced risk via continuous regulatory updates and alerts. |

| Cost | Lower upfront costs, potentially higher penalties or audits. | Higher initial investment, cost-saving through error reduction. |

| Scalability | Less scalable, manual scaling increases labor costs. | Highly scalable for growing businesses with complex tax needs. |

| Data Management | Data is often siloed, increasing inefficiency. | Centralized data handling improves transparency and access. |

Introduction: Understanding Tax Filing and Tax Automation

Tax filing involves manually submitting financial information and documentation to tax authorities to ensure compliance with legal requirements. Tax automation uses software tools to streamline data collection, calculation, and submission processes, minimizing errors and saving time. Embracing tax automation enhances accuracy, reduces compliance risks, and allows businesses to focus on strategic financial planning.

Key Differences Between Manual Tax Filing and Automation

Manual tax filing requires extensive data entry, increasing the risk of human error and consuming significant time, whereas tax automation streamlines data collection and improves accuracy through software integration. Automated systems offer real-time updates on tax regulations, ensuring compliance with the latest laws, while manual methods depend on individual knowledge and frequent review. Tax automation enhances efficiency by reducing processing time, enabling faster submission and better audit readiness compared to manual filing.

Benefits of Automated Tax Compliance

Automated tax compliance significantly reduces errors by leveraging advanced software to accurately process complex tax regulations and deadlines. It enhances efficiency through seamless integration with financial systems, ensuring timely submissions and minimizing the risk of penalties. Automated solutions also provide real-time updates on tax law changes, enabling businesses to maintain full compliance with evolving government requirements.

Common Challenges in Traditional Tax Filing

Traditional tax filing often faces challenges such as manual data entry errors, time-consuming document management, and difficulties in tracking regulatory changes. Compliance risks increase due to inconsistent application of tax codes and missed deadlines caused by human oversight. These issues highlight the need for efficient systems to ensure accurate and timely tax reporting.

Accuracy and Error Reduction: Manual vs Automated Tax Processes

Manual tax filing often leads to higher error rates due to human oversight and complex data handling, increasing the risk of non-compliance penalties. Automated tax processes leverage advanced algorithms and real-time data integration to enhance accuracy and significantly reduce errors in tax calculations and submissions. Implementing tax automation improves compliance by ensuring precise data entry, timely updates to tax codes, and streamlined verification processes.

Time Efficiency: Comparing Filing Methods

Tax automation significantly reduces time spent on tax compliance by streamlining data entry and minimizing manual errors, compared to traditional tax filing methods which often involve labor-intensive paperwork and prolonged processing times. Automated systems enable real-time data integration and faster submission deadlines, leading to quicker refunds and improved accuracy in tax reporting. Companies employing tax automation report up to 50% faster tax cycle completion and enhanced compliance consistency.

Cost Implications: Filing Taxes Manually vs Automation Solutions

Manual tax filing incurs higher costs due to increased labor hours and the potential for human errors leading to penalties or audits. Automation solutions reduce expenses by streamlining data entry, enhancing accuracy, and accelerating processing times, which lowers the risk of costly mistakes. Businesses experience significant savings on compliance costs and resource allocation when adopting tax automation tools over traditional manual filing methods.

Data Security and Privacy in Tax Automation

Tax automation enhances data security and privacy by utilizing encryption and secure access controls, minimizing risks associated with manual tax filing processes. Automated systems comply with regulatory standards such as GDPR and HIPAA, ensuring sensitive taxpayer information remains protected throughout the filing process. Leveraging artificial intelligence and machine learning, tax automation detects anomalies and prevents unauthorized access, significantly improving overall compliance and confidentiality.

Regulatory Compliance: How Automation Helps Stay Updated

Tax automation streamlines regulatory compliance by continuously updating tax rules and rates based on the latest government mandates, reducing the risk of errors in filing. Automated systems integrate real-time data feeds and compliance updates from tax authorities, ensuring businesses adhere to evolving regulations without manual intervention. This proactive approach minimizes penalties and audit risks while enhancing accuracy and efficiency in tax reporting.

Which Solution is Best for Your Business?

Tax filing requires meticulous manual input and adherence to deadlines, often increasing the risk of errors and penalties for businesses. Tax automation leverages advanced software to streamline compliance by accurately calculating liabilities, generating reports, and submitting filings electronically, reducing time and operational costs. Choosing the best solution depends on your business size, volume of transactions, and need for scalable error reduction and efficiency in tax compliance processes.

Related Important Terms

Automated Tax Workflow

Automated tax workflow streamlines tax filing by integrating real-time data processing, reducing errors, and accelerating compliance deadlines. This technology enhances accuracy and consistency in tax returns, minimizing the risk of audits and penalties while ensuring adherence to evolving tax regulations.

Real-Time Tax Compliance

Real-time tax compliance leverages tax automation to streamline tax filing processes, reducing errors and ensuring up-to-date adherence to changing regulations. Automated systems integrate continuously updated tax codes, enabling accurate, immediate reporting that surpasses traditional periodic filing methods in efficiency and reliability.

E-Filing APIs

Tax filing requires manual data entry and document submission, increasing the risk of errors and delays, whereas tax automation leverages E-Filing APIs to streamline compliance by enabling instant, secure electronic submission of tax returns directly to government portals. E-Filing APIs enhance accuracy, reduce processing time, and ensure real-time validation and updates, making tax compliance more efficient and reliable.

Dynamic Tax Mapping

Dynamic Tax Mapping streamlines tax filing by automatically aligning transactions with the correct tax codes, reducing errors and ensuring compliance with evolving regulations. Automation accelerates data processing and enhances accuracy compared to manual tax filing, minimizing audit risks and optimizing tax liabilities.

Tax Data Reconciliation Bots

Tax Data Reconciliation Bots enhance tax filing accuracy by automatically verifying and matching financial records against tax regulations, reducing human errors and ensuring compliance. These bots streamline the tax automation process by integrating with accounting systems to provide real-time data validation and seamless reporting for audit readiness.

Compliance-as-a-Service (CaaS)

Tax Filing requires manual input and is prone to errors, while Tax Automation streamlines data integration and ensures real-time compliance updates. Compliance-as-a-Service (CaaS) leverages automated workflows and AI-driven analytics to provide continuous regulatory adherence, reducing risk and improving accuracy in tax reporting.

Digital Tax Vault

Tax filing requires meticulous document management and adherence to regulatory deadlines, often leading to manual errors and compliance risks. Leveraging a Digital Tax Vault automates data storage and retrieval, enhances audit readiness, and ensures secure, real-time access to tax records for seamless regulatory compliance.

Smart Tax Orchestration

Smart Tax Orchestration streamlines tax filing and compliance by integrating advanced automation technologies with real-time data analysis, reducing errors and accelerating submission processes. This innovative approach ensures precise tax calculations and seamless regulatory adherence, transforming traditional tax filing into an efficient, automated compliance system.

Machine-Readable Tax Returns

Machine-readable tax returns enhance tax filing accuracy and efficiency by enabling seamless data extraction and validation, reducing manual errors and compliance risks. Implementing tax automation systems that support these formats accelerates processing times and improves regulatory adherence for businesses and tax authorities.

Predictive Filing Algorithms

Predictive filing algorithms enhance tax compliance by automating data analysis and forecasting accurate filing requirements, reducing errors and penalties. These advanced algorithms streamline the tax filing process, enabling timely submissions and improved regulatory adherence through real-time decision-making.

Tax Filing vs Tax Automation for compliance. Infographic

moneydiff.com

moneydiff.com