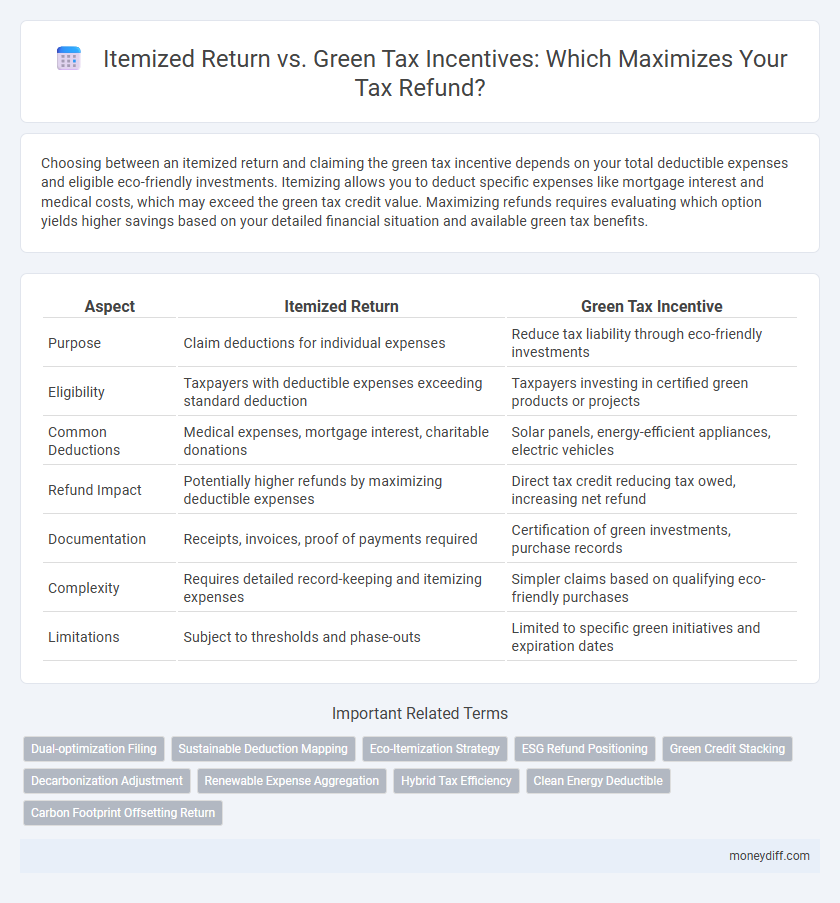

Choosing between an itemized return and claiming the green tax incentive depends on your total deductible expenses and eligible eco-friendly investments. Itemizing allows you to deduct specific expenses like mortgage interest and medical costs, which may exceed the green tax credit value. Maximizing refunds requires evaluating which option yields higher savings based on your detailed financial situation and available green tax benefits.

Table of Comparison

| Aspect | Itemized Return | Green Tax Incentive |

|---|---|---|

| Purpose | Claim deductions for individual expenses | Reduce tax liability through eco-friendly investments |

| Eligibility | Taxpayers with deductible expenses exceeding standard deduction | Taxpayers investing in certified green products or projects |

| Common Deductions | Medical expenses, mortgage interest, charitable donations | Solar panels, energy-efficient appliances, electric vehicles |

| Refund Impact | Potentially higher refunds by maximizing deductible expenses | Direct tax credit reducing tax owed, increasing net refund |

| Documentation | Receipts, invoices, proof of payments required | Certification of green investments, purchase records |

| Complexity | Requires detailed record-keeping and itemizing expenses | Simpler claims based on qualifying eco-friendly purchases |

| Limitations | Subject to thresholds and phase-outs | Limited to specific green initiatives and expiration dates |

Understanding Itemized Return: An Overview

An itemized return allows taxpayers to list eligible expenses such as mortgage interest, medical expenses, and charitable contributions to potentially increase their tax refund by reducing taxable income. Utilizing itemized deductions strategically requires precise documentation and understanding which expenses qualify under IRS guidelines. Comparing benefits between itemized returns and green tax incentives involves analyzing individual financial situations to maximize refunds effectively.

What Are Green Tax Incentives?

Green tax incentives are government-offered benefits designed to encourage environmentally friendly practices, such as installing solar panels or purchasing electric vehicles. These incentives can include tax credits, deductions, or rebates that directly reduce tax liability, often resulting in higher refunds compared to standard itemized deductions. Utilizing green tax incentives strategically can maximize refunds by lowering taxable income and offsetting costs associated with sustainable investments.

Comparing Standard and Itemized Deductions

Itemized deductions allow taxpayers to list eligible expenses such as medical costs, mortgage interest, and charitable contributions to potentially increase refund amounts beyond the standard deduction. The Green Tax Incentive can enhance these benefits by providing additional credits or deductions for energy-efficient home improvements or electric vehicle purchases. Comparing standard and itemized deductions helps determine the optimal tax strategy by evaluating total eligible expenses against the fixed standard deduction amount.

Eligibility Criteria for Itemized Deductions

Itemized deductions require taxpayers to meet specific eligibility criteria, including expenses such as mortgage interest, medical costs exceeding 7.5% of adjusted gross income, and charitable contributions. Only taxpayers whose total itemized deductions exceed the standard deduction benefit maximally by filing an itemized return. Green tax incentives, while valuable, often have separate eligibility requirements tied to energy-efficient home improvements or electric vehicle purchases, which may not always surpass itemized deduction thresholds.

Types of Green Tax Incentives Available

Green tax incentives include credits for energy-efficient home improvements, electric vehicle purchases, and renewable energy installations such as solar panels. Itemizing deductions allows taxpayers to claim specific expenses like mortgage interest and charitable contributions, but may miss out on targeted green incentives designed to directly reduce tax liability. Leveraging available federal and state green tax credits can significantly increase refunds beyond standard itemized deductions by focusing on environmentally sustainable investments.

Tax Savings: Itemized Deductions vs Green Credits

Tax savings from itemized deductions often depend on eligible expenses such as mortgage interest, medical expenses, and charitable contributions, which can significantly reduce taxable income. Green tax incentives, including credits for solar panel installations, electric vehicle purchases, and energy-efficient home improvements, directly decrease the amount of tax owed dollar-for-dollar. Maximizing refunds requires comparing the total value of itemized deductions against available green credits, as green tax credits generally offer higher refund potential by directly reducing tax liability rather than just lowering taxable income.

Common Expenses to Itemize for Higher Refunds

Common expenses to itemize for higher refunds include mortgage interest, state and local taxes paid, medical expenses exceeding 7.5% of adjusted gross income, charitable donations, and unreimbursed business expenses. Taxpayers opting for itemized deductions can often increase their refund compared to claiming the standard deduction, especially when these expenses are substantial. Understanding eligibility for the green tax incentive, such as energy-efficient home improvements and electric vehicle credits, can further maximize total tax savings.

Leveraging Green Tax Credits for Maximum Refund

Leveraging green tax credits on an itemized return can significantly increase your tax refund by directly reducing your taxable income with deductions for energy-efficient home improvements, electric vehicle purchases, and renewable energy installations. Homeowners who meticulously document eligible expenses such as solar panel installations, energy-efficient windows, or HVAC upgrades maximize their refundable benefits by combining them with traditional itemized deductions like mortgage interest and charitable contributions. Strategic use of green tax incentives alongside itemized deductions not only lowers tax liability but also promotes sustainable investments, resulting in higher overall refunds.

Combining Itemized Deductions and Green Incentives

Combining itemized deductions with green tax incentives can maximize overall tax refunds by leveraging a broader range of deductible expenses, including mortgage interest, medical costs, and energy-efficient home improvements. Taxpayers who file itemized returns can claim credits for solar panels, electric vehicle purchases, and energy-saving appliances alongside traditional deductions, enhancing refund potential. Careful documentation and adherence to IRS guidelines ensure optimal benefit from both deduction types on federal tax returns.

Which Strategy Maximizes Your Tax Refund?

Choosing between an itemized return and utilizing green tax incentives depends on individual expenses and eligibility criteria. Itemizing deductions, including mortgage interest, medical expenses, and charitable contributions, can yield higher refunds if these surpass the standard deduction. Green tax incentives, such as credits for solar energy systems or electric vehicle purchases, offer direct dollar-for-dollar reductions, often maximizing refunds for environmentally conscious taxpayers.

Related Important Terms

Dual-optimization Filing

Maximizing tax refunds involves a dual-optimization strategy that compares the benefits of itemized returns against green tax incentives, ensuring taxpayers claim every eligible deduction and credit. Leveraging specific data points such as medical expenses, mortgage interest, and qualified energy-efficient home improvements enhances refund potential by precisely targeting deductions aligned with IRS criteria.

Sustainable Deduction Mapping

Itemized returns allow taxpayers to list deductible expenses such as mortgage interest, medical costs, and charitable donations, maximizing refunds through detailed reporting. Green tax incentives leverage Sustainable Deduction Mapping to identify and apply specific eco-friendly investments, enhancing refunds by promoting energy-efficient home improvements and renewable energy installations.

Eco-Itemization Strategy

Maximizing tax refunds through the Eco-Itemization Strategy involves carefully comparing traditional itemized deductions against green tax incentives, such as the Residential Energy Efficient Property Credit and Electric Vehicle Tax Credit. Taxpayers should evaluate eligible eco-friendly expenses, like solar panel installations and energy-efficient home improvements, to strategically leverage both deductions and credits for optimal refund outcomes.

ESG Refund Positioning

Maximizing tax refunds through an itemized return allows taxpayers to deduct specific expenses such as mortgage interest, medical costs, and charitable contributions, directly enhancing their refund potential. In contrast, leveraging Green tax incentives aligns with ESG principles by providing credits or deductions for environmentally sustainable investments, optimizing refund positions while promoting corporate social responsibility.

Green Credit Stacking

Maximizing tax refunds involves strategic use of green credit stacking, which allows taxpayers to combine multiple green tax incentives such as solar energy credits, electric vehicle deductions, and energy-efficient home improvements on their itemized returns. This approach leverages overlapping federal and state green tax credits to enhance overall deductions, surpassing the potential benefits of standard itemized returns.

Decarbonization Adjustment

Maximizing tax refunds through an itemized return can be enhanced by leveraging the Decarbonization Adjustment under green tax incentives, which rewards investments in energy-efficient technologies and renewable energy systems. This adjustment allows taxpayers to reduce their taxable income by factoring in costs associated with decarbonization efforts, often resulting in greater refunds compared to standard deductions.

Renewable Expense Aggregation

Itemized returns allow taxpayers to consolidate renewable energy expenses such as solar panel installations and energy-efficient home improvements, maximizing deductions and increasing refund potential. Combining these with green tax incentives like the Residential Energy Efficient Property Credit further amplifies savings by offsetting costs through direct credits rather than standard deductions.

Hybrid Tax Efficiency

Itemized returns allow taxpayers to deduct specific expenses such as mortgage interest and medical expenses, often resulting in higher refunds for those with significant deductible costs. Green tax incentives for hybrid vehicles offer tax credits up to $7,500, enhancing overall tax efficiency by directly reducing tax liability and maximizing combined refund potential.

Clean Energy Deductible

Claiming the Clean Energy Deductible on an itemized tax return can significantly increase your refund by lowering taxable income through expenses related to solar panels, energy-efficient windows, and electric vehicle charging stations. Utilizing green tax incentives alongside traditional itemized deductions maximizes tax savings by combining eligible renewable energy investments with standard deductible expenses.

Carbon Footprint Offsetting Return

Itemized returns allow taxpayers to deduct specific expenses such as mortgage interest and medical costs, but leveraging green tax incentives specifically targeting carbon footprint offsetting can maximize refunds by directly reducing taxable income through credits for eco-friendly actions. Utilizing carbon offsetting credits on a tax return not only supports environmental sustainability but also often provides a more substantial financial benefit compared to traditional itemized deductions.

Itemized return vs Green tax incentive for maximizing refunds. Infographic

moneydiff.com

moneydiff.com