Excise tax applies broadly to specific goods such as alcohol, tobacco, and fuel, targeting consumption and generating revenue for governments. Sugar tax specifically targets sugary beverages and products to reduce sugar intake and combat obesity-related health issues. Both taxes influence consumer behavior but differ in scope and intended health impact.

Table of Comparison

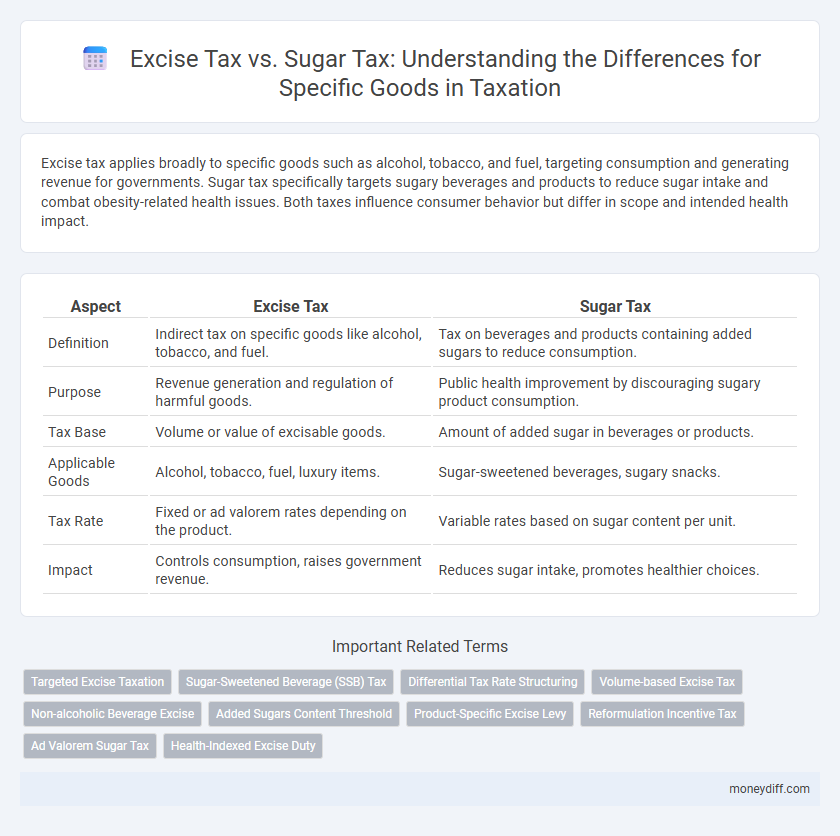

| Aspect | Excise Tax | Sugar Tax |

|---|---|---|

| Definition | Indirect tax on specific goods like alcohol, tobacco, and fuel. | Tax on beverages and products containing added sugars to reduce consumption. |

| Purpose | Revenue generation and regulation of harmful goods. | Public health improvement by discouraging sugary product consumption. |

| Tax Base | Volume or value of excisable goods. | Amount of added sugar in beverages or products. |

| Applicable Goods | Alcohol, tobacco, fuel, luxury items. | Sugar-sweetened beverages, sugary snacks. |

| Tax Rate | Fixed or ad valorem rates depending on the product. | Variable rates based on sugar content per unit. |

| Impact | Controls consumption, raises government revenue. | Reduces sugar intake, promotes healthier choices. |

Understanding Excise Tax: Definition and Scope

Excise tax is a specific form of indirect tax imposed on certain goods such as alcohol, tobacco, and fuel, designed to generate revenue and influence consumer behavior. Unlike sugar tax, which targets sugary beverages and foods to reduce sugar consumption and improve public health, excise tax covers a broader range of products and often aims at regulating consumption of goods with negative externalities. Understanding the definition and scope of excise tax helps clarify its role in fiscal policy and its impact on market prices and consumer choices.

What Is Sugar Tax? Target and Implications

Sugar tax is a specific excise tax imposed on sugary beverages and products to reduce sugar consumption and combat public health issues like obesity and diabetes. It targets manufacturers and distributors of sugary drinks by increasing product prices, encouraging healthier alternatives. The implications include shifts in consumer behavior, potential revenue for healthcare initiatives, and industry reformulation of products to lower sugar content.

Key Differences Between Excise Tax and Sugar Tax

Excise tax applies broadly to specific goods such as alcohol, tobacco, and fuel, imposed to generate revenue and discourage consumption, while sugar tax specifically targets sugary beverages to reduce sugar intake and combat obesity. Excise tax rates vary based on product type and quantity, whereas sugar tax is typically calculated per volume or sugar content in drinks. The enforcement of excise tax involves multiple industries, but sugar tax primarily impacts beverage manufacturers and retailers.

Historical Overview of Excise and Sugar Taxes

Excise tax has a long history dating back to ancient civilizations where governments imposed levies on goods like alcohol, tobacco, and fuel to generate revenue and regulate consumption. Sugar tax, a more recent development, emerged in the late 20th and early 21st centuries as public health concerns about sugar consumption and obesity grew, leading many countries to introduce specific taxes targeting sugary beverages and products. Both taxes serve fiscal and regulatory purposes but differ in scope, with excise tax applying broadly to various goods and sugar tax focusing narrowly on products with high sugar content.

Purposes and Policy Objectives: Excise vs Sugar Tax

Excise tax targets products like tobacco, alcohol, and gasoline primarily to generate government revenue and regulate consumption through price increases. Sugar tax specifically aims to reduce sugar intake by discouraging the purchase of sugary beverages and foods, addressing public health concerns such as obesity and diabetes. Both taxes serve policy objectives that balance fiscal goals with behavioral change, but sugar tax emphasizes health outcomes more directly than broad excise taxes.

Impact on Consumer Behavior and Public Health

Excise tax on sugary beverages increases retail prices, leading to reduced consumption and promoting healthier dietary choices among consumers. Sugar tax specifically targets products high in added sugars, effectively decreasing sugar intake and mitigating risks associated with obesity, diabetes, and cardiovascular diseases. Both taxes incentivize manufacturers to reformulate products with lower sugar content, further benefiting public health outcomes.

Industry Response: How Producers Adapt

Producers in the beverage and food industry adjust formulations and marketing strategies to comply with excise and sugar tax regulations, often reducing sugar content to avoid higher levies. Many manufacturers invest in alternative sweeteners and smaller portion sizes to maintain consumer appeal while minimizing tax impact. These adaptations influence product innovation and drive shifts towards healthier options within the industry.

Revenue Generation: Comparing Financial Outcomes

Excise tax on specific goods generates steady revenue streams by imposing fixed rates on production or sales volumes, ensuring predictable financial outcomes for governments. Sugar tax targets sugary beverages and products, driving both health benefits and potential revenue increases through reduced consumption and higher prices. While excise taxes offer consistent income regardless of demand shifts, sugar taxes may fluctuate but contribute to long-term healthcare savings along with fiscal gains.

Global Case Studies: Excise and Sugar Tax in Practice

Excise taxes on goods such as alcohol and tobacco have been implemented worldwide to curb consumption and generate revenue, with countries like the United States and Mexico demonstrating significant reductions in use following these levies. Sugar taxes targeting sugary drinks and products have shown positive health impacts in countries like the United Kingdom and South Africa by decreasing sugar consumption and obesity rates. Combining excise and sugar taxes in global case studies reveals a pattern where targeted fiscal policies effectively influence consumer behavior and public health outcomes.

Future Trends in Taxation on Specific Goods

Excise tax on goods like tobacco and alcohol remains a primary tool for governments to control consumption and generate revenue, while sugar tax specifically targets sugary beverages to combat rising obesity rates. Future trends indicate an expansion of sugar tax to include a broader range of high-sugar foods as public health concerns intensify, with increasing alignment across countries to standardize these levies. Digital tracking and advanced data analytics will enhance tax enforcement and compliance in excise and sugar taxes, promoting transparency and efficiency in collection.

Related Important Terms

Targeted Excise Taxation

Targeted excise taxation on specific goods like sugary beverages allows governments to directly address public health concerns by imposing higher taxes on sugar content, thereby discouraging excessive consumption. Excise tax differs from sugar tax by encompassing broader product categories, while sugar tax specifically targets sugary products to reduce sugar intake and associated health risks.

Sugar-Sweetened Beverage (SSB) Tax

Excise tax on Sugar-Sweetened Beverages (SSBs) targets the sugar content to reduce consumption and generate public health revenue, differing from general excise taxes that apply broadly to goods regardless of sugar levels. The SSB tax specifically imposes higher rates on beverages with added sugars to combat obesity and diabetes by incentivizing reformulation and healthier choices.

Differential Tax Rate Structuring

Excise tax typically applies uniformly to categories of goods based on volume or price, while sugar tax employs differential tax rate structuring focused on sugar content levels to incentivize healthier consumption. This targeted approach in sugar tax allows for varying rates on beverages and foods according to added sugar thresholds, promoting public health goals through economic disincentives.

Volume-based Excise Tax

Volume-based excise tax is applied uniformly to specific goods, such as alcohol and tobacco, based on the quantity sold, ensuring consistent revenue regardless of product price variations. In contrast, sugar tax targets sugary beverages and snacks by imposing charges linked to sugar content, aiming to reduce consumption for health reasons rather than generating excise revenue.

Non-alcoholic Beverage Excise

Non-alcoholic beverage excise tax targets production and distribution of soft drinks and energy drinks, whereas sugar tax specifically levies charges based on sugar content to reduce consumption of sugary beverages. The excise tax applies broadly to manufacturing and importation processes, while sugar tax is a health-driven measure designed to discourage excessive sugar intake in beverages.

Added Sugars Content Threshold

Excise tax on sugary beverages typically applies when the added sugars content exceeds a defined threshold, such as 5 grams per 100 milliliters, targeting products with high sugar levels to reduce consumption. Sugar tax policies differ by jurisdiction but commonly set specific added sugars content limits to determine taxable goods, incentivizing manufacturers to reformulate products below the threshold to avoid excise duties.

Product-Specific Excise Levy

Product-specific excise levies target particular goods such as tobacco, alcohol, and sugary beverages, imposing taxes based on quantity or volume to discourage consumption and generate revenue. Sugar tax specifically applies to sweetened products, aiming to reduce sugar intake by increasing prices through excise duties focused on sugar content levels.

Reformulation Incentive Tax

Excise Tax typically targets broad categories of goods such as tobacco, alcohol, and fuel, whereas Sugar Tax specifically aims at sugary beverages to reduce sugar consumption and combat obesity. The Reformulation Incentive Tax encourages manufacturers to modify product recipes by reducing sugar content to benefit from lower tax rates, promoting healthier alternatives in the market.

Ad Valorem Sugar Tax

Ad Valorem Sugar Tax is calculated as a percentage of the product's value, targeting sugary beverages and confectioneries to reduce sugar consumption and generate revenue. Unlike Excise Tax, which imposes a fixed amount per unit, Ad Valorem Sugar Tax adjusts with product price fluctuations, incentivizing manufacturers to offer lower-sugar options.

Health-Indexed Excise Duty

Health-Indexed Excise Duty targets specific goods based on sugar content, incentivizing manufacturers to reduce added sugars to lower the tax burden. Unlike general Excise Tax, this tailored approach directly links fiscal policy with public health goals, promoting healthier consumption patterns.

Excise Tax vs Sugar Tax for specific goods. Infographic

moneydiff.com

moneydiff.com