Tax deferral allows investors to postpone paying taxes on investment gains until a later date, thereby enabling compound growth over time without immediate tax impact. NFT-based tax shelters offer innovative ways to legally reduce tax liabilities by leveraging digital asset ownership and blockchain technology to create new opportunities for tax efficiency and asset protection. Choosing between traditional tax deferral methods and NFT-based shelters depends on individual investment goals, risk tolerance, and regulatory considerations.

Table of Comparison

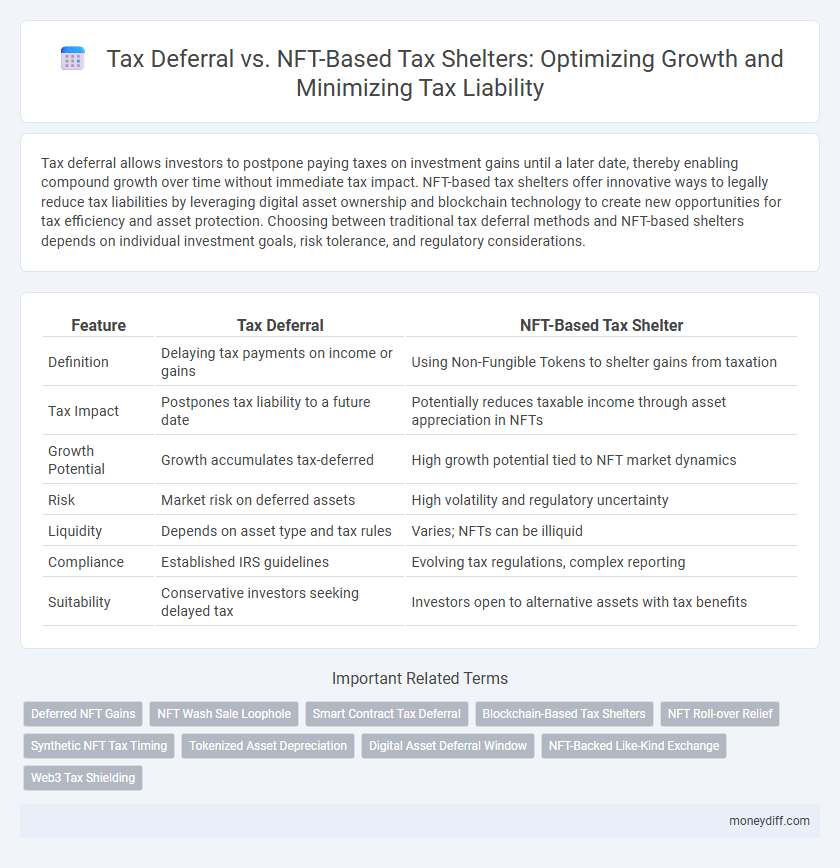

| Feature | Tax Deferral | NFT-Based Tax Shelter |

|---|---|---|

| Definition | Delaying tax payments on income or gains | Using Non-Fungible Tokens to shelter gains from taxation |

| Tax Impact | Postpones tax liability to a future date | Potentially reduces taxable income through asset appreciation in NFTs |

| Growth Potential | Growth accumulates tax-deferred | High growth potential tied to NFT market dynamics |

| Risk | Market risk on deferred assets | High volatility and regulatory uncertainty |

| Liquidity | Depends on asset type and tax rules | Varies; NFTs can be illiquid |

| Compliance | Established IRS guidelines | Evolving tax regulations, complex reporting |

| Suitability | Conservative investors seeking delayed tax | Investors open to alternative assets with tax benefits |

Understanding Tax Deferral in Wealth Growth

Tax deferral allows investors to postpone tax payments on earnings, enhancing compounding growth by reinvesting funds that would otherwise be paid as immediate tax. This strategy accelerates wealth accumulation by minimizing liquidity constraints compared to immediate taxation on gains. Understanding the mechanics of tax deferral is crucial for optimizing portfolio growth and maximizing after-tax returns over time.

NFT-Based Tax Shelters: An Emerging Trend

NFT-based tax shelters offer innovative opportunities for capital growth by leveraging the unique, blockchain-verified ownership of digital assets, enabling investors to defer or mitigate tax liabilities. These shelters capitalize on the rapidly expanding NFT market, allowing holders to benefit from potential appreciation while utilizing legal frameworks to optimize tax outcomes. As regulatory clarity improves, NFT-based strategies are increasingly recognized for their ability to balance growth potential with sophisticated tax planning advantages.

Key Differences Between Tax Deferral and NFT Shelters

Tax deferral allows investors to postpone paying taxes on gains until a future date, maximizing immediate capital growth, while NFT-based tax shelters use digital assets to potentially reduce taxable income through innovative structures. Unlike traditional tax deferral strategies tied to retirement accounts or reinvestments, NFT tax shelters leverage blockchain technology and the unique valuation of non-fungible tokens to create alternative tax planning opportunities. Key differences also include regulatory complexity, with tax deferral being well-established under IRS guidelines, whereas NFT shelters face evolving legal scrutiny and valuation challenges.

How Tax Deferral Impacts Investment Returns

Tax deferral allows investors to postpone tax payments on investment gains, enabling the entire amount to compound and grow over time without immediate tax erosion. By delaying taxes until withdrawal, either at retirement or a later date, the effective investment returns can increase due to the reinvestment of funds that would have otherwise gone to taxes. However, the ultimate benefit depends on future tax rates and the investor's withdrawal strategy, making tax deferral a critical consideration in optimizing long-term portfolio growth.

Legal Framework for NFT-Based Tax Strategies

The legal framework for NFT-based tax strategies remains complex and evolving, requiring adherence to securities laws, intellectual property rights, and tax regulations set by authorities like the IRS and SEC. Unlike traditional tax deferral methods, NFT-based tax shelters must navigate uncertain classification issues--whether NFTs are treated as collectible assets, capital property, or income-generating instruments--which directly impacts their tax treatment and eligibility for deferral benefits. Ensuring compliance with existing tax codes and ongoing regulatory guidance is crucial to mitigate risks of audits or legal challenges in leveraging NFTs for tax-efficient growth.

Risks and Rewards of Tax Deferral Methods

Tax deferral methods allow investors to postpone tax payments on gains, providing potential growth advantages through compound interest but carry risks such as changes in tax laws and the uncertainty of future tax rates. While deferral can enhance cash flow and investment growth, improper planning may result in unexpected tax liabilities or penalties. Understanding the balance between immediate tax relief and long-term obligations is crucial for optimizing returns in tax-advantaged growth strategies.

NFT Tax Shelters: Compliance and Red Flags

NFT tax shelters require strict compliance with IRS guidelines to avoid classification as abusive tax avoidance schemes. Key red flags include lack of genuine economic substance, misrepresentation of asset value, and failure to report transactions accurately. Proper documentation and transparent valuation methods are essential to ensure adherence to tax regulations and minimize audit risk.

Tax Efficiency: Traditional vs. Digital Asset Approaches

Tax deferral strategies, commonly used in traditional investments like retirement accounts, allow investors to postpone tax payments until withdrawal, optimizing cash flow and leveraging compound growth. NFT-based tax shelters represent a novel approach, utilizing digital asset structures and blockchain technology to potentially minimize immediate tax liabilities while enhancing portfolio diversification. Comparing both methods reveals that traditional deferral offers predictable regulatory frameworks, whereas NFT-based solutions demand careful navigation of evolving tax laws to maximize long-term tax efficiency.

Evaluating Long-Term Growth with Tax Deferral

Tax deferral strategies enable investors to postpone tax liabilities on capital gains, allowing for compounding growth over extended periods without immediate tax impact. Evaluating long-term growth with tax deferral highlights the advantage of reinvesting pre-tax returns, which can significantly enhance portfolio value. In contrast, NFT-based tax shelters introduce unique challenges and uncertainties, making traditional tax deferral a more predictable mechanism for maximizing cumulative investment growth.

Future of Tax Planning: NFTs and Deferred Taxes

Tax deferral strategies allow investors to postpone tax payments, enhancing cash flow and investment growth over time. NFT-based tax shelters utilize non-fungible tokens to create innovative opportunities for asset appreciation while minimizing immediate tax liabilities. Integrating NFTs into deferred tax planning represents the future of tax optimization by combining digital asset growth with strategic tax management.

Related Important Terms

Deferred NFT Gains

Deferred NFT gains enable investors to postpone capital gains tax liabilities by reinvesting profits into qualifying assets, maximizing long-term growth potential. Unlike traditional tax deferral strategies, NFT-based tax shelters leverage blockchain transparency and asset uniqueness to optimize tax efficiency and enhance portfolio diversification.

NFT Wash Sale Loophole

Tax deferral strategies offer postponed tax liabilities on investments, whereas NFT-based tax shelters exploit the NFT wash sale loophole by allowing investors to sell and repurchase NFTs without triggering taxable events, effectively resetting cost basis and deferring gains. The NFT wash sale loophole arises because current IRS regulations do not explicitly cover digital assets, enabling repeated loss harvesting and potential tax benefits unavailable in traditional securities markets.

Smart Contract Tax Deferral

Smart contract tax deferral leverages blockchain technology to automate and enforce tax obligations, enabling investors to delay tax payments until asset liquidation without traditional intermediaries. NFTs used as tax shelters create programmable, transparent records that optimize growth by deferring taxable events while maintaining compliance through automated smart contract triggers.

Blockchain-Based Tax Shelters

Blockchain-based tax shelters leverage NFT ownership to defer taxes by converting capital gains into non-taxable assets, providing a novel approach compared to traditional tax deferral strategies. These innovative shelters utilize decentralized ledger technology to enhance transparency, security, and compliance while facilitating growth by preserving capital within the digital asset ecosystem.

NFT Roll-over Relief

Tax deferral strategies allow investors to postpone capital gains tax liabilities, enhancing portfolio growth through delayed taxation. NFT roll-over relief specifically enables seamless transfer of gains from one digital asset to another without immediate tax consequences, promoting sustained investment growth within the evolving NFT marketplace.

Synthetic NFT Tax Timing

Synthetic NFT tax timing leverages blockchain technology to defer capital gains taxes by converting traditional assets into synthetic NFTs, allowing investors to delay tax liabilities without triggering immediate taxable events. This innovative tax deferral strategy contrasts with conventional deferral methods by enhancing liquidity and growth potential through programmable smart contracts embedded in the NFT structure.

Tokenized Asset Depreciation

Tax deferral strategies allow investors to postpone tax liabilities on gains, enhancing capital growth potential by reinvesting deferred taxes, while NFT-based tax shelters leverage tokenized asset depreciation to create unique write-offs that reduce taxable income. Tokenized asset depreciation in NFTs introduces a novel mechanism to accelerate tax benefits, optimizing portfolio performance through innovative digital asset valuation methods.

Digital Asset Deferral Window

Tax deferral strategies allow investors to postpone capital gains taxes, preserving investment capital for longer periods and enhancing compounding potential within the digital asset deferral window. NFT-based tax shelters offer innovative mechanisms to extend this deferral period, leveraging non-fungible tokens to capitalize on growth while minimizing immediate tax liabilities.

NFT-Backed Like-Kind Exchange

NFT-backed like-kind exchanges enable taxpayers to defer capital gains taxes by exchanging appreciated assets for NFTs classified as similar property under IRS guidelines, leveraging blockchain transparency for enhanced asset valuation. This method offers a strategic alternative to traditional tax deferral, combining the liquidity and uniqueness of NFTs with the tax shelter benefits of Section 1031 exchanges.

Web3 Tax Shielding

Tax deferral strategies temporarily postpone tax liabilities on investment gains, allowing capital to grow tax-free until realization, while NFT-based tax shelters leverage Web3 blockchain technology to securely encode tax benefits and optimize digital asset holdings. Utilizing smart contracts and decentralized finance (DeFi) platforms, NFT-based tax shelters offer enhanced transparency, automation, and potentially greater tax efficiency for crypto investors seeking growth within compliant frameworks.

Tax Deferral vs NFT-Based Tax Shelter for Growth Infographic

moneydiff.com

moneydiff.com