Corporate tax applies to a company's overall profits, taxing earnings derived from traditional business activities based on jurisdictional tax laws. Digital Services Tax (DST) specifically targets revenues generated from digital services, aiming to capture tax from tech-driven business models that may earn significant global income without a physical presence. Understanding the distinctions between corporate tax and DST is crucial for businesses to ensure compliance and optimize tax liabilities in evolving digital markets.

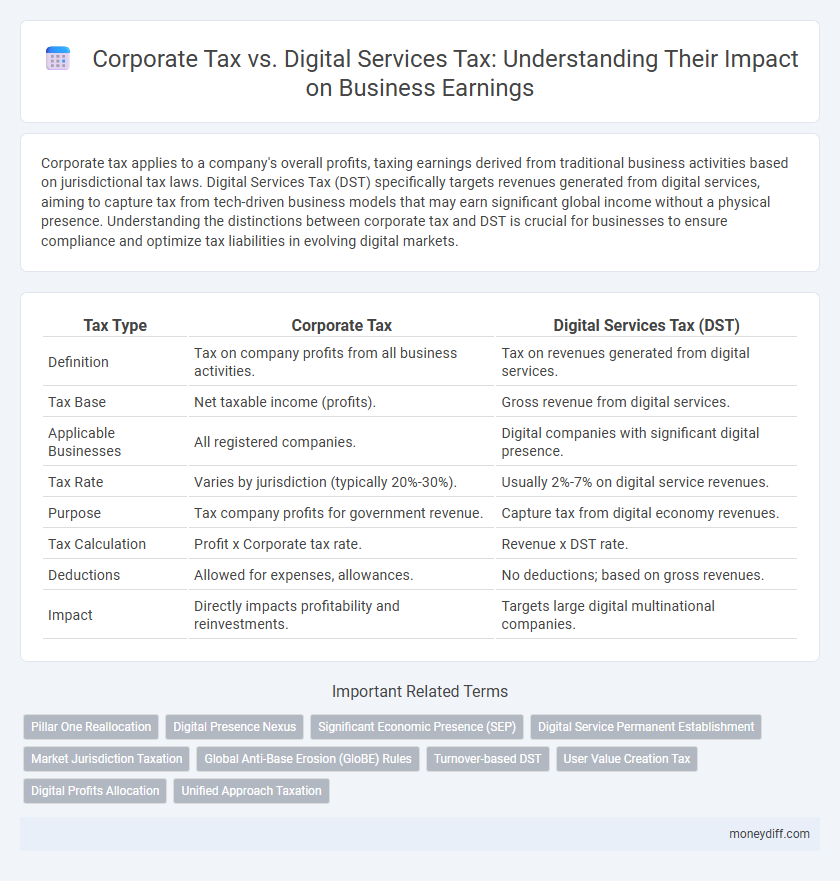

Table of Comparison

| Tax Type | Corporate Tax | Digital Services Tax (DST) |

|---|---|---|

| Definition | Tax on company profits from all business activities. | Tax on revenues generated from digital services. |

| Tax Base | Net taxable income (profits). | Gross revenue from digital services. |

| Applicable Businesses | All registered companies. | Digital companies with significant digital presence. |

| Tax Rate | Varies by jurisdiction (typically 20%-30%). | Usually 2%-7% on digital service revenues. |

| Purpose | Tax company profits for government revenue. | Capture tax from digital economy revenues. |

| Tax Calculation | Profit x Corporate tax rate. | Revenue x DST rate. |

| Deductions | Allowed for expenses, allowances. | No deductions; based on gross revenues. |

| Impact | Directly impacts profitability and reinvestments. | Targets large digital multinational companies. |

Overview of Corporate Tax and Digital Services Tax

Corporate tax is a tax imposed on a company's profits, typically calculated as a percentage of net income and varying by jurisdiction, directly impacting overall business earnings. Digital Services Tax (DST) targets revenue generated from specific digital activities such as online advertising, digital marketplaces, and user data sales, applying a percentage on gross revenues rather than profits. While corporate tax affects the bottom-line profitability of all businesses, DST specifically addresses the digital economy's tax challenges by taxing revenue streams often underrepresented in traditional tax frameworks.

Key Differences Between Corporate Tax and Digital Services Tax

Corporate tax is a tax on the overall profits of a company, calculated based on net income from various business activities, while digital services tax (DST) specifically targets revenue generated from digital services such as online advertising, digital marketplaces, and streaming services. Corporate tax rates vary by jurisdiction and are generally imposed on global earnings, whereas DST applies only to revenues from digital transactions within a specific country, often at a flat rate. Understanding the distinction is crucial for businesses operating in digital markets to ensure compliance and optimize tax planning strategies effectively.

Taxation Scope: Who Pays What?

Corporate Tax applies to a company's overall profits, affecting businesses with physical presence and substantial economic activities within a jurisdiction. Digital Services Tax (DST) targets revenues generated from digital activities, specifically impacting multinational tech companies that provide digital services without a traditional physical footprint. Businesses with extensive digital transactions pay DST on specific digital revenues, while Corporate Tax covers broader operational earnings.

Impact on Traditional vs Digital Businesses

Corporate tax primarily targets the overall profits of traditional businesses, impacting manufacturers, retailers, and service providers with established physical presence. Digital services tax (DST) specifically addresses revenue generated by digital platforms and online services, capturing earnings from activities like online advertising, streaming, and e-commerce that may not be fully taxed under conventional corporate tax rules. The implementation of DST creates a distinct tax burden for digital businesses, potentially reducing competitive disparities by ensuring tech giants contribute tax relative to their local market earnings, while traditional firms face more straightforward profit-based taxation.

Calculation Methods for Business Earnings

Corporate Tax on business earnings is typically calculated using a progressive or flat rate applied to net profits after allowable deductions, such as operational expenses and depreciation. Digital Services Tax (DST) specifically targets revenues generated from digital activities, generally imposing a fixed percentage on gross digital turnover without deductions for expenses. Businesses engaged in both traditional and digital markets must accurately differentiate earnings sources to comply with the distinct calculation methods of Corporate Tax and DST.

Compliance Requirements for Corporations

Corporate Tax requires businesses to report global income, maintain accurate financial records, and file annual returns according to jurisdictional tax codes, ensuring compliance with established tax rates and regulations. Digital Services Tax (DST) mandates businesses operating digital platforms to track revenues from specific digital services, report taxable digital transactions, and adhere to local DST thresholds and reporting standards. Both taxes demand rigorous documentation, timely filings, and an understanding of applicable tax treaties to avoid penalties and optimize compliance strategies.

Global Trends in Digital Services Taxation

Global trends in digital services taxation reveal an increasing number of countries implementing Digital Services Taxes (DSTs) targeting revenues generated from online platforms and digital activities, aiming to capture value where traditional Corporate Tax systems fall short. These DSTs often impose a percentage tax on gross revenues derived from digital services such as online advertising, digital marketplaces, and data transmission, contrasting with Corporate Tax which taxes net profits. The evolving international landscape reflects efforts to address tax challenges posed by digitalization, with organizations like the OECD promoting agreements to harmonize digital tax rules and prevent double taxation.

Tax Avoidance Risks and Regulations

Corporate Tax regimes typically impose taxes on overall business earnings, requiring comprehensive reporting of global income, which provides less scope for tax avoidance when properly enforced. Digital Services Tax (DST) targets revenues generated from digital platforms and services, often at fixed rates on gross revenues, aiming to curb profit shifting and tax base erosion in the digital economy. Regulatory frameworks around both taxes are evolving rapidly to close loopholes, with increased transparency measures and stricter compliance requirements to mitigate risks of tax avoidance and evasion.

Strategic Tax Planning for Modern Businesses

Strategic tax planning for modern businesses requires a clear understanding of Corporate Tax and Digital Services Tax (DST) implications on earnings. Corporate Tax generally applies to global profits of companies, while DST targets revenues from digital activities in specific jurisdictions, impacting tech-driven business models differently. Optimizing tax liabilities involves navigating these frameworks to maximize compliance benefits and minimize effective tax rates through tailored investment and operational decisions.

Future Outlook: Evolving Tax Landscapes for Businesses

The future of corporate tax and digital services tax (DST) reflects an evolving landscape where governments aim to balance fair taxation with economic growth. As digital economies expand, DST frameworks are increasingly integrated with traditional corporate tax systems to address challenges of cross-border digital transactions and profit shifting. Businesses must anticipate regulatory updates emphasizing transparency, compliance, and the adaptation of tax strategies to align with global tax reforms like the OECD's Pillar Two initiatives.

Related Important Terms

Pillar One Reallocation

Pillar One Reallocation targets reallocating taxing rights between countries for multinational corporations, impacting corporate tax frameworks by shifting profit allocation based on digital presence and consumer location instead of traditional physical presence. This approach contrasts with the Digital Services Tax (DST), which levies taxes on digital revenues at a unilateral level, potentially leading to double taxation and trade disputes, while Pillar One aims for a multilateral, consensus-based solution to address tax challenges in the digital economy.

Digital Presence Nexus

Corporate tax is traditionally applied based on a physical presence and profits earned within a jurisdiction, whereas Digital Services Tax targets revenue generated from digital activities without requiring a physical nexus. The Digital Presence Nexus concept enables tax authorities to levy taxes on businesses with substantial digital engagement in a country, ensuring companies with significant online operations contribute fairly despite lacking conventional tax nexus.

Significant Economic Presence (SEP)

Significant Economic Presence (SEP) defines taxable nexus criteria based on digital activity rather than physical presence, impacting the application of Digital Services Tax (DST) on business earnings from digital services. This framework differs from traditional Corporate Tax, which relies on physical establishment, thereby targeting revenue generated in a jurisdiction even without a tangible presence.

Digital Service Permanent Establishment

Digital Service Permanent Establishment (DSPE) rules target businesses earning revenue from digital services without a physical presence, leading to tax obligations based on digital economic activity rather than traditional corporate tax frameworks. This contrasts with Corporate Tax, which applies to profits generated by entities with physical presence, triggering tax liabilities through established permanent establishments under conventional international tax laws.

Market Jurisdiction Taxation

Corporate tax applies to business earnings based on the physical presence and incorporated location within a market jurisdiction, while digital services tax targets revenue generated from digital activities in jurisdictions where companies may lack a tangible presence. Market jurisdiction taxation increasingly emphasizes taxing rights aligned with value creation, leading to the implementation of digital services taxes to capture income from cross-border digital services that traditional corporate tax rules may overlook.

Global Anti-Base Erosion (GloBE) Rules

The Global Anti-Base Erosion (GloBE) Rules under Pillar Two set a minimum effective tax rate for multinational enterprises, reducing the incentive to shift profits through low-tax jurisdictions, which impacts both Corporate Tax and Digital Services Tax (DST) liabilities. While Corporate Tax targets overall business earnings globally, Digital Services Tax specifically addresses revenues generated from digital services, requiring companies to navigate overlapping tax obligations in multiple jurisdictions under the GloBE framework.

Turnover-based DST

Corporate Tax applies to a company's net profits, taxing earnings after deductible expenses, while Digital Services Tax (DST) targets turnover generated specifically from digital activities, such as online advertising, digital marketplaces, and data sales. Turnover-based DST is calculated on gross revenues from digital services without accounting for costs, often affecting multinational tech companies with significant online presence regardless of overall profitability.

User Value Creation Tax

User Value Creation Tax emphasizes taxing businesses based on the economic value generated from user activity, contrasting with traditional Corporate Tax which targets overall business earnings and profits. Digital Services Tax specifically targets revenues from digital platforms exploiting user data and engagement, ensuring fair taxation aligned with the digital economy's value creation.

Digital Profits Allocation

Digital Services Tax (DST) targets revenue generated from digital activities within specific jurisdictions, ensuring digital profits allocation reflects user location and economic presence, contrasting with traditional Corporate Tax based on physical establishment and overall profit. DST addresses challenges of taxing intangible digital transactions by reallocating taxable income from multinational tech firms to countries where digital consumers reside.

Unified Approach Taxation

Unified Approach Taxation aims to allocate corporate tax revenues more equitably by taxing multinational digital enterprises based on market jurisdictions rather than solely on physical presence, addressing gaps left by traditional Corporate Tax regimes. Digital Services Tax complements this by targeting revenue generated specifically from digital activities, ensuring businesses with significant digital footprints contribute appropriately to the tax base.

Corporate Tax vs Digital Services Tax for business earnings. Infographic

moneydiff.com

moneydiff.com