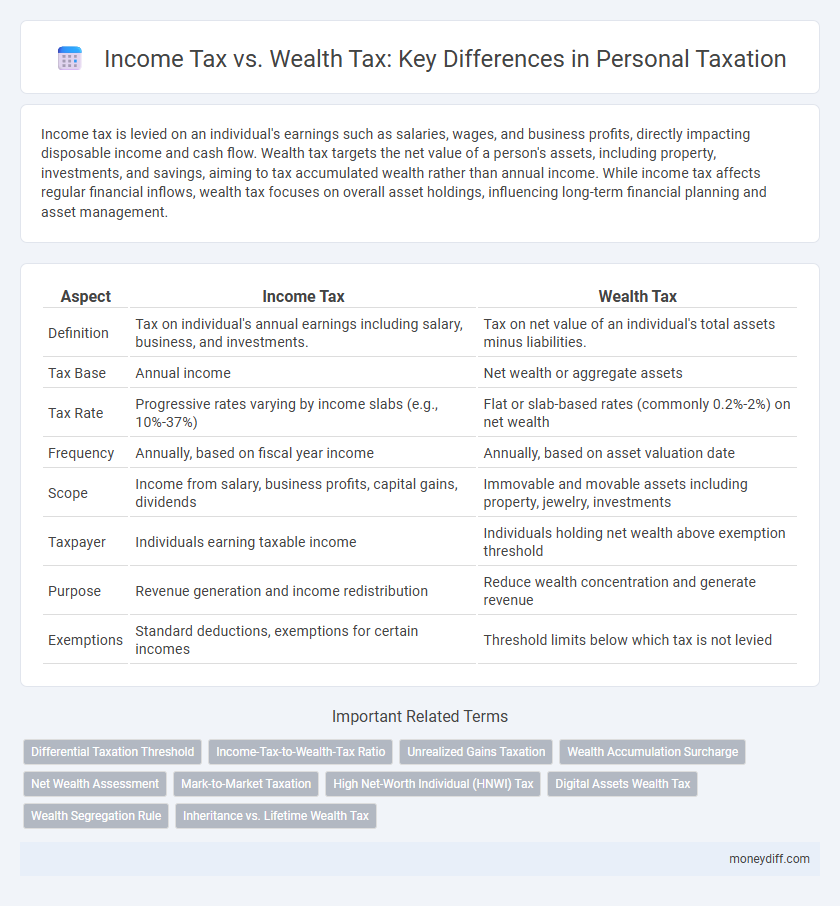

Income tax is levied on an individual's earnings such as salaries, wages, and business profits, directly impacting disposable income and cash flow. Wealth tax targets the net value of a person's assets, including property, investments, and savings, aiming to tax accumulated wealth rather than annual income. While income tax affects regular financial inflows, wealth tax focuses on overall asset holdings, influencing long-term financial planning and asset management.

Table of Comparison

| Aspect | Income Tax | Wealth Tax |

|---|---|---|

| Definition | Tax on individual's annual earnings including salary, business, and investments. | Tax on net value of an individual's total assets minus liabilities. |

| Tax Base | Annual income | Net wealth or aggregate assets |

| Tax Rate | Progressive rates varying by income slabs (e.g., 10%-37%) | Flat or slab-based rates (commonly 0.2%-2%) on net wealth |

| Frequency | Annually, based on fiscal year income | Annually, based on asset valuation date |

| Scope | Income from salary, business profits, capital gains, dividends | Immovable and movable assets including property, jewelry, investments |

| Taxpayer | Individuals earning taxable income | Individuals holding net wealth above exemption threshold |

| Purpose | Revenue generation and income redistribution | Reduce wealth concentration and generate revenue |

| Exemptions | Standard deductions, exemptions for certain incomes | Threshold limits below which tax is not levied |

Understanding Income Tax and Wealth Tax: Key Differences

Income tax is levied on an individual's earnings such as salaries, wages, and investment income, calculated based on income brackets set by tax authorities. Wealth tax, on the other hand, is imposed on the net value of an individual's assets, including property, cash, and investments, often applying thresholds for taxable wealth. Understanding these distinctions is crucial for personal taxation planning, as income tax affects cash flow annually while wealth tax targets accumulated wealth and can influence long-term asset management.

Taxable Sources: What Gets Taxed Under Each System

Income tax targets earnings from salaries, wages, interest, dividends, and business profits, taxing individuals based on annual income flows. Wealth tax applies to the net value of owned assets, including real estate, investments, savings, and valuable personal properties, assessed at a specific date or period. Understanding these taxable sources helps clarify the distinction between taxing income generation versus accumulated wealth holdings.

Calculation Methods for Income Tax vs Wealth Tax

Income tax is calculated based on an individual's annual earnings, including salaries, bonuses, and investment income, using progressive tax rates that increase with higher income brackets. Wealth tax is assessed on the net value of an individual's assets, such as real estate, cash, investments, and luxury goods, typically applying a fixed percentage to the total net wealth above a certain threshold. While income tax focuses on periodic income flows subject to deductions and exemptions, wealth tax targets the cumulative asset holdings regardless of income earned.

Exemptions and Deductions: Maximizing Tax Efficiency

Income tax offers various exemptions and deductions such as standard deductions, exemptions for dependents, and deductions under Sections 80C to 80U, enabling taxpayers to lower their taxable income significantly. In contrast, wealth tax, where applicable, generally lacks extensive exemptions, though certain assets like agricultural land or specific types of property may be excluded from the tax base. Maximizing tax efficiency involves leveraging income tax deductions effectively while understanding the limited scope of wealth tax exemptions to optimize overall personal tax liability.

Impact on Personal Finances: Short-Term and Long-Term Effects

Income tax directly reduces disposable income in the short term by taxing earned wages, salaries, and investment returns, potentially limiting immediate spending and saving capacity. Wealth tax imposes a recurring levy on accumulated assets, affecting long-term personal finances by decreasing net worth and possibly influencing investment strategies or asset retention. Both taxes shape financial behavior, with income tax impacting cash flow and consumption, while wealth tax primarily alters wealth accumulation and distribution over time.

Compliance and Reporting Requirements

Income tax requires annual filing of detailed income statements and proof of deductions, whereas wealth tax mandates comprehensive reporting of net assets and valuation documents. Compliance for income tax often involves payroll documentation, investment income records, and expense receipts, while wealth tax demands periodic asset revaluations and disclosures of property holdings. Both taxes necessitate adherence to stringent deadlines and accurate documentation to avoid penalties and ensure transparent personal taxation.

International Comparisons: How Countries Apply Each Tax

Income tax is widely implemented worldwide as a progressive tax on individual earnings, with countries like the United States, Germany, and Japan applying graduated rates based on income brackets. Wealth tax, less common internationally, is levied on net assets, seen in countries such as Spain and Norway, targeting high-net-worth individuals to reduce wealth inequality. Many nations prefer income tax due to easier administration and consistent revenue, while wealth tax remains controversial due to valuation challenges and potential capital flight.

Strategies for Minimizing Income and Wealth Tax Liability

Effective strategies for minimizing income and wealth tax liability include income shifting to lower-tax brackets, maximizing allowable deductions, and utilizing tax-advantaged accounts such as IRAs and 401(k)s for income tax reduction. For wealth tax, careful asset structuring through trusts, gifting strategies, and investing in tax-exempt or tax-deferred instruments can significantly decrease taxable net worth. Regular consultation with a tax professional ensures compliance while optimizing personal taxation within the specific legal frameworks of income and wealth tax regulations.

Pros and Cons: Income Tax vs Wealth Tax

Income tax offers a progressive structure that taxes earnings directly, promoting fairness based on annual income levels, but it may discourage higher earnings due to steep rates. Wealth tax targets accumulated assets such as real estate and investments, potentially reducing wealth inequality but can be complex to administer and may lead to asset undervaluation or avoidance. While income tax generates steady revenue annually, wealth tax revenues can be unpredictable, and imposing wealth tax risks liquidity issues for asset-rich but cash-poor individuals.

Future Trends in Personal Taxation: Shifting Between Income and Wealth Taxes

Future trends in personal taxation indicate a potential shift from income tax dominance toward increased reliance on wealth taxes to address economic inequality and fund social programs. Policymakers may implement higher wealth tax rates on ultra-high-net-worth individuals while adjusting income tax brackets to balance revenue generation and economic growth. Advances in data analytics and asset valuation technologies will enhance tax authorities' ability to accurately assess wealth, making wealth taxes more feasible and enforceable in the coming decades.

Related Important Terms

Differential Taxation Threshold

Income tax applies progressively to earned and unearned income above specific annual thresholds, typically starting at lower income levels, while wealth tax targets net assets exceeding much higher valuation limits, often exempting average earners. Differential taxation thresholds establish distinct entry points, ensuring income tax affects broader populations whereas wealth tax concentrates on individuals with substantial asset holdings.

Income-Tax-to-Wealth-Tax Ratio

The income-tax-to-wealth-tax ratio measures the proportion of tax revenue derived from annual earnings compared to assets held, highlighting disparities in tax burdens between income and accumulated wealth. A higher ratio indicates greater reliance on income tax, while a lower ratio suggests increased emphasis on taxing wealth, affecting personal tax strategies and economic equity.

Unrealized Gains Taxation

Income tax typically targets realized income, including wages and capital gains from sold assets, whereas wealth tax focuses on the total net value of an individual's assets, potentially encompassing unrealized gains. Taxing unrealized gains under wealth tax frameworks can create liquidity challenges for taxpayers but allows governments to capture value appreciation without asset sales.

Wealth Accumulation Surcharge

The Wealth Accumulation Surcharge targets high-net-worth individuals by imposing an additional tax on accumulated wealth beyond a specified threshold, effectively complementing income tax liabilities. Unlike income tax, which is levied on earnings, the surcharge directly addresses asset concentration to discourage excessive wealth accumulation and promote tax equity.

Net Wealth Assessment

Income tax targets annual earnings from wages, investments, and other sources, while wealth tax focuses on an individual's net wealth, assessing the total value of assets minus liabilities. Net wealth assessment provides a comprehensive measure of personal financial status by valuing real estate, investments, savings, and debts to determine taxable wealth.

Mark-to-Market Taxation

Mark-to-Market Taxation applies primarily to income tax by taxing unrealized gains annually based on the current market value of assets, optimizing liquidity and tax efficiency, whereas wealth tax targets the total net worth including all assets regardless of income generated. Income tax under mark-to-market rules ensures timely revenue realization and reduces tax deferral opportunities compared to wealth tax, which focuses on asset holding without recognizing gains.

High Net-Worth Individual (HNWI) Tax

High Net-Worth Individuals (HNWI) face income tax on earnings, dividends, and capital gains, which directly targets annual cash flow, whereas wealth tax imposes a levy on the total net assets, including property, investments, and savings. Income tax affects liquidity and disposable income, while wealth tax focuses on accumulated wealth, influencing long-term financial strategies and estate planning for HNWIs.

Digital Assets Wealth Tax

Income tax on digital assets is calculated based on realized gains during transactions, while wealth tax targets the total value of digital holdings at a specific assessment date. Digital assets wealth tax requires accurate valuation methods to address the volatile nature of cryptocurrencies and NFTs, ensuring fair taxation on accumulated wealth rather than just income.

Wealth Segregation Rule

The Wealth Segregation Rule distinguishes assets by separating personal income tax liabilities from wealth tax obligations, ensuring that taxation on income earned is treated differently from taxation based on net wealth holdings. This rule prevents overlap between income tax and wealth tax assessments, optimizing compliance and targeting high-net-worth individuals with clearer asset categorization.

Inheritance vs. Lifetime Wealth Tax

Inheritance tax targets the transfer of assets upon death, taxing beneficiaries on the value received, while lifetime wealth tax imposes an annual levy on an individual's total net assets during their lifetime. Inheritance tax often impacts estate planning and wealth transfer timing, whereas lifetime wealth tax affects ongoing asset accumulation and portfolio management.

Income tax vs Wealth tax for personal taxation. Infographic

moneydiff.com

moneydiff.com