Sales tax directly increases the cost of consumer goods by adding a percentage to the purchase price, impacting everyday spending. Carbon tax targets the carbon content of fossil fuels, raising prices on goods and services linked to carbon emissions, which indirectly influences consumption choices. Both taxes aim to generate revenue, but a carbon tax specifically incentivizes lower-carbon consumption, whereas sales tax applies broadly without environmental differentiation.

Table of Comparison

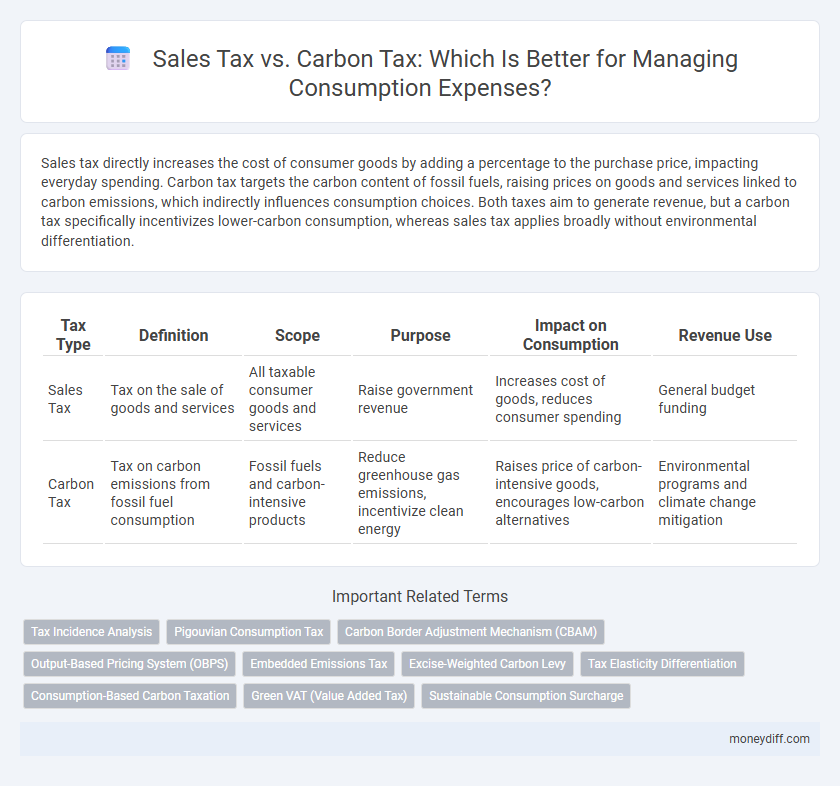

| Tax Type | Definition | Scope | Purpose | Impact on Consumption | Revenue Use |

|---|---|---|---|---|---|

| Sales Tax | Tax on the sale of goods and services | All taxable consumer goods and services | Raise government revenue | Increases cost of goods, reduces consumer spending | General budget funding |

| Carbon Tax | Tax on carbon emissions from fossil fuel consumption | Fossil fuels and carbon-intensive products | Reduce greenhouse gas emissions, incentivize clean energy | Raises price of carbon-intensive goods, encourages low-carbon alternatives | Environmental programs and climate change mitigation |

Understanding Sales Tax and Carbon Tax

Sales tax is a consumption tax imposed on the sale of goods and services, typically calculated as a percentage of the purchase price and collected at the point of sale. Carbon tax is a regulatory fee on the carbon content of fossil fuels, designed to reduce greenhouse gas emissions by increasing the cost of carbon-intensive products and activities. Understanding these taxes is crucial for assessing their impact on consumer expenses and environmental policy effectiveness.

Key Differences Between Sales Tax and Carbon Tax

Sales tax is a consumption-based tax applied on goods and services at the point of sale, varying by jurisdiction, while carbon tax specifically targets carbon emissions by taxing fossil fuels based on their carbon content to incentivize environmental responsibility. Sales tax directly affects consumer spending by increasing the cost of a wide range of products, whereas carbon tax indirectly impacts consumption by raising energy and fuel prices to reduce greenhouse gas emissions. The primary difference lies in their purpose: sales tax generates general government revenue, whereas carbon tax aims to internalize environmental externalities and promote sustainable consumption.

Impact on Consumer Behavior

Sales tax directly increases the cost of a wide range of goods and services, often leading consumers to reduce overall consumption or switch to untaxed alternatives. Carbon tax specifically targets products with high carbon emissions, incentivizing consumers to choose cleaner energy options and eco-friendly products. The targeted nature of carbon tax generally drives more environmentally conscious behavior compared to the broad-brush impact of sales tax.

Revenue Generation for Governments

Sales tax generates significant revenue for governments by applying a percentage charge on the sale of goods and services, capturing a broad consumer base with consistent inflows. Carbon tax targets emissions linked to fossil fuel consumption, incentivizing lower carbon footprints while creating a growing revenue stream aligned with environmental policy goals. Combining both taxes diversifies government income sources and supports sustainable economic strategies through balanced fiscal and ecological measures.

Effects on Cost of Living

Sales tax directly increases the price of goods and services, which can raise the overall cost of living by reducing consumers' purchasing power. Carbon tax specifically targets fossil fuel consumption, driving up energy and transportation costs that disproportionately affect low- and middle-income households. Both taxes influence consumption patterns, but carbon tax often leads to higher utility bills and fuel prices, thereby exerting a more significant impact on everyday expenses.

Environmental Incentives and Sustainability

Sales tax on consumption expenses generally generates revenue without directly influencing consumer behavior toward environmental sustainability, while carbon tax specifically targets carbon emissions by increasing costs for carbon-intensive goods and services. By internalizing the social cost of carbon, carbon taxes create strong environmental incentives for reducing greenhouse gas emissions and promoting sustainable consumption patterns. Implementing carbon taxes encourages investment in cleaner technologies and shifts consumer demand toward low-carbon alternatives, fostering long-term sustainability.

Economic Efficiency of Sales vs Carbon Tax

Sales tax applies uniformly to a broad range of consumption goods, often causing distortions by taxing necessities and non-polluting products equally, which can reduce economic efficiency. Carbon tax targets the externality of greenhouse gas emissions by internalizing the environmental cost, leading to more efficient resource allocation as consumers and producers adjust behavior towards lower-carbon options. Empirical studies show carbon taxes generate higher economic efficiency gains by directly addressing negative externalities, whereas sales taxes often exacerbate market inefficiencies due to their broad, non-discriminatory nature.

Equity and Fairness in Taxation

Sales tax on consumption expenses tends to be regressive, disproportionately impacting low-income households who spend a larger share of their income on taxed goods, whereas carbon tax can be designed with rebates or credits to alleviate this burden and promote equity. Implementing carbon taxes with revenue recycling mechanisms can enhance fairness by offsetting costs for vulnerable populations and encouraging environmentally responsible behavior across all income levels. Evaluating distributional impacts and targeting fiscal policies ensures both taxes align better with progressive equity goals and social justice in taxation.

Implementation and Administrative Challenges

Sales tax implementation involves extensive point-of-sale systems and real-time transaction tracking, requiring coordination across retailers and tax authorities, resulting in high administrative costs and potential evasion risks. Carbon tax administration demands accurate measurement of carbon emissions associated with goods and services, necessitating complex data collection, verification processes, and monitoring of supply chains to ensure compliance. Both taxes pose significant challenges in enforcement, with sales tax grappling with varied product categories and exemptions, while carbon tax faces difficulties in emission attribution and international trade implications.

Policy Implications for Future Consumption

Sales tax directly increases the cost of goods and services, potentially reducing consumption uniformly across all sectors, while carbon tax specifically targets emissions-intensive products, encouraging shifts toward greener alternatives. Policy implications suggest carbon tax promotes sustainable consumption patterns by internalizing environmental costs, whereas sales tax lacks targeted environmental incentives. Future consumption trends may shift more effectively under carbon tax frameworks that align economic behavior with climate goals and drive innovation in low-carbon technologies.

Related Important Terms

Tax Incidence Analysis

Sales tax imposes a direct burden on consumers by increasing the price of goods and services at the point of purchase, leading to higher consumption expenses and potential shifts in consumer behavior. Carbon tax, by targeting emissions embedded in goods and services, indirectly raises costs along the supply chain, with varying incidence depending on the price elasticity of demand and production, often resulting in a differentiated impact across sectors and consumer groups.

Pigouvian Consumption Tax

Sales tax primarily targets general consumption without internalizing environmental externalities, whereas carbon tax functions as a Pigouvian consumption tax by directly pricing carbon emissions to correct negative environmental impacts. Implementing a carbon tax aligns consumption expenses with environmental costs, promoting sustainable behavior through market-based incentives.

Carbon Border Adjustment Mechanism (CBAM)

The Carbon Border Adjustment Mechanism (CBAM) imposes a carbon tax on imported goods based on their embedded emissions, contrasting with traditional sales taxes that apply uniformly on consumption regardless of environmental impact. CBAM aims to prevent carbon leakage by equalizing carbon costs between domestic producers subject to carbon pricing and foreign producers from countries with laxer climate policies.

Output-Based Pricing System (OBPS)

Output-Based Pricing System (OBPS) effectively integrates carbon taxes into sales tax frameworks by targeting emissions associated with production output rather than merely consumption, incentivizing businesses to reduce carbon intensity without directly increasing consumer prices. This approach balances environmental goals and economic efficiency by aligning tax burdens with industrial emissions, contrasting with traditional sales taxes that focus solely on consumption expenditures.

Embedded Emissions Tax

Embedded emissions tax targets the indirect carbon footprint within supply chains, influencing consumption expenses more directly than traditional sales tax, which applies uniformly to the sale of goods and services regardless of environmental impact. By integrating embedded emissions tax, policymakers can incentivize low-carbon production and consumption patterns, encouraging sustainable choices that traditional sales tax fails to address.

Excise-Weighted Carbon Levy

The excise-weighted carbon levy strategically targets carbon-intensive consumption by imposing higher taxes on goods with greater carbon footprints, enhancing environmental incentives beyond the general sales tax framework. This levy complements traditional sales taxes by directly integrating carbon emission costs, promoting sustainable consumer behavior while generating revenue for green initiatives.

Tax Elasticity Differentiation

Sales tax exhibits higher tax elasticity on consumption expenses as it directly increases the cost of goods, prompting consumers to reduce discretionary spending, while carbon tax elasticity tends to be lower due to its indirect effect on energy-intensive products and the availability of substitutes. Differentiating tax elasticity between sales and carbon taxes helps optimize policy by targeting behavioral changes in consumption patterns relevant to environmental and economic objectives.

Consumption-Based Carbon Taxation

Consumption-based carbon taxation targets the carbon content embedded in goods and services, encouraging environmentally sustainable consumption by directly taxing products with higher carbon footprints. In contrast to traditional sales tax, which uniformly applies to all purchases regardless of environmental impact, consumption-based carbon taxes incentivize reduced carbon emissions through altered consumer behavior and product choices.

Green VAT (Value Added Tax)

Green VAT, designed to incentivize sustainable consumption, integrates environmental considerations into traditional sales tax by applying higher rates on carbon-intensive goods and services, unlike carbon tax which directly targets emissions per unit of carbon content. This approach shifts consumer behavior towards eco-friendly products through consumption-based fiscal policy, leveraging the established VAT framework for efficient administration and broader economic impact.

Sustainable Consumption Surcharge

Sales tax directly increases the cost of goods and services at the point of purchase, while a carbon tax targets the environmental impact by charging based on the carbon emissions associated with consumption, effectively promoting sustainable consumption behavior. Implementing a Sustainable Consumption Surcharge integrates a carbon tax component into sales tax systems, incentivizing eco-friendly purchasing decisions and reducing the carbon footprint linked to everyday expenses.

Sales Tax vs Carbon Tax for consumption expenses. Infographic

moneydiff.com

moneydiff.com