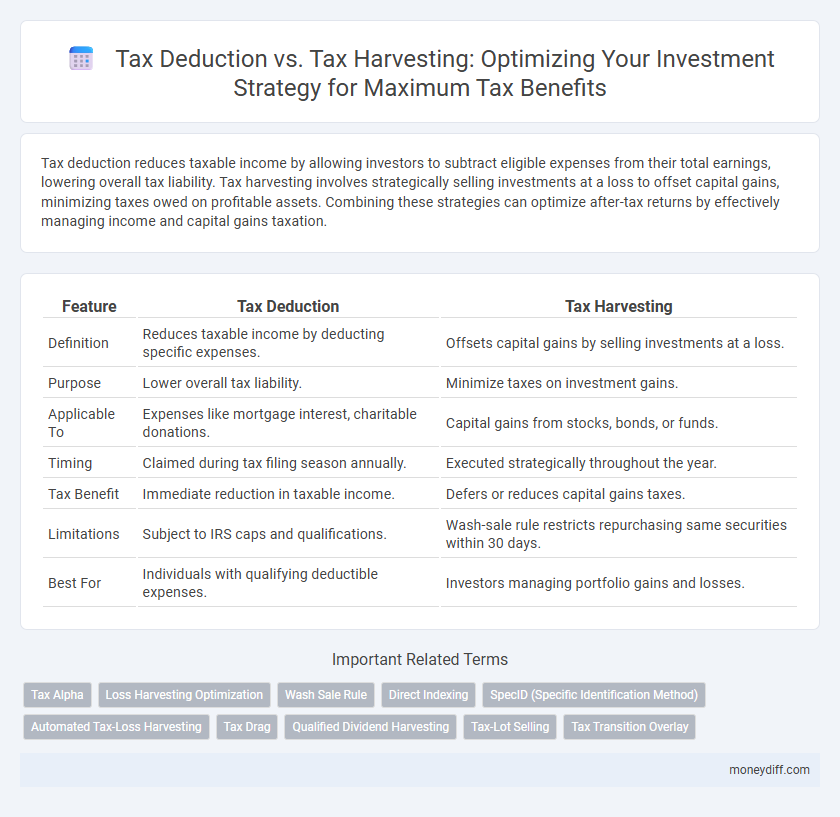

Tax deduction reduces taxable income by allowing investors to subtract eligible expenses from their total earnings, lowering overall tax liability. Tax harvesting involves strategically selling investments at a loss to offset capital gains, minimizing taxes owed on profitable assets. Combining these strategies can optimize after-tax returns by effectively managing income and capital gains taxation.

Table of Comparison

| Feature | Tax Deduction | Tax Harvesting |

|---|---|---|

| Definition | Reduces taxable income by deducting specific expenses. | Offsets capital gains by selling investments at a loss. |

| Purpose | Lower overall tax liability. | Minimize taxes on investment gains. |

| Applicable To | Expenses like mortgage interest, charitable donations. | Capital gains from stocks, bonds, or funds. |

| Timing | Claimed during tax filing season annually. | Executed strategically throughout the year. |

| Tax Benefit | Immediate reduction in taxable income. | Defers or reduces capital gains taxes. |

| Limitations | Subject to IRS caps and qualifications. | Wash-sale rule restricts repurchasing same securities within 30 days. |

| Best For | Individuals with qualifying deductible expenses. | Investors managing portfolio gains and losses. |

Understanding Tax Deduction in Investment Management

Tax deduction in investment management reduces taxable income by allowing investors to subtract specific expenses, such as investment advisory fees or interest on margin loans, from their total earnings. Unlike tax harvesting, which involves selling securities to realize losses and offset gains, tax deduction focuses on eligible expenses that can lower an investor's overall tax liability. Proper identification and documentation of deductible expenses optimize tax efficiency without altering the investment portfolio.

What is Tax Harvesting?

Tax harvesting is an investment strategy that involves selling securities at a loss to offset capital gains and reduce taxable income. This technique optimizes tax efficiency by strategically timing asset sales, allowing investors to minimize tax liabilities while maintaining their desired portfolio allocation. Unlike standard tax deductions, tax harvesting specifically targets realized investment losses to balance gains, enhancing after-tax returns.

Key Differences Between Tax Deduction and Tax Harvesting

Tax deduction reduces taxable income by allowing investors to subtract eligible expenses, such as mortgage interest or charitable donations, directly lowering the overall tax liability. Tax harvesting involves strategically selling investments at a loss to offset capital gains, thereby minimizing taxes owed on investment profits. The key difference lies in tax deductions lowering income tax based on expenses, while tax harvesting targets capital gains tax through realized losses.

How Tax Deduction Impacts Investment Returns

Tax deduction lowers taxable income by reducing the amount of income subject to taxes, effectively increasing an investor's after-tax returns. This reduction in taxable income can result in immediate tax savings, freeing up capital that can be reinvested, thereby compounding investment growth over time. Unlike tax harvesting, which defers taxes by realizing losses, tax deduction provides direct, upfront tax relief, influencing the net profitability of an investment strategy.

Tax Harvesting Strategies for Portfolio Optimization

Tax harvesting strategies involve strategically selling losing investments to offset capital gains tax liabilities, effectively reducing taxable income within an investment portfolio. This method maximizes after-tax returns by realizing losses that can be used to counterbalance gains, thereby enhancing portfolio efficiency without altering overall asset allocation. Implementing tax-loss harvesting regularly enables investors to defer tax payments and reinvest proceeds, contributing to optimized long-term portfolio growth.

Comparing Long-Term Benefits: Tax Deduction vs. Tax Harvesting

Tax deduction reduces taxable income in the year expenses are incurred, providing immediate tax savings, whereas tax harvesting involves selling investments at a loss to offset capital gains, thereby optimizing tax liabilities over time. Long-term tax harvesting can significantly enhance after-tax returns by strategically managing gains and losses across multiple years. Investors prioritizing ongoing portfolio efficiency often gain more from tax harvesting compared to the one-time benefit of tax deductions.

Common Mistakes in Tax Deduction and Harvesting Strategies

Common mistakes in tax deduction strategies include overlooking eligible expenses and failing to maximize itemized deductions, which can result in higher taxable income. In tax harvesting, investors often mistime the sale of securities, either selling too early and missing potential gains or too late and failing to offset gains effectively. Ignoring wash-sale rules can also negate the benefits of tax loss harvesting, leading to disallowed losses and missed opportunities for tax efficiency.

Eligibility Criteria for Tax Deduction and Tax Harvesting

Eligibility criteria for tax deduction require investors to qualify based on specific expenses such as mortgage interest, retirement contributions, or charitable donations, which directly reduce taxable income. Tax harvesting eligibility depends on having unrealized losses in the investment portfolio that can be sold to offset capital gains, subject to wash-sale rules preventing repurchase of identical securities within 30 days. Both strategies require careful documentation and timing to maximize tax benefits while adhering to IRS regulations.

Integrating Tax Deduction and Harvesting in Your Investment Plan

Integrating tax deduction and tax harvesting in your investment plan maximizes after-tax returns by strategically reducing taxable income and capital gains. Tax deductions lower your overall tax liability through eligible contributions, while tax harvesting involves selling losing investments to offset gains, optimizing tax efficiency throughout the year. Coordinating both strategies requires careful portfolio monitoring and timing to align with your financial goals and tax bracket.

Choosing the Right Tax Strategy for Your Investment Goals

Choosing the right tax strategy involves understanding the key differences between tax deduction and tax harvesting for investments. Tax deductions reduce taxable income based on eligible expenses, while tax loss harvesting strategically sells investments at a loss to offset capital gains and minimize tax liability. Aligning your approach with investment goals and tax brackets ensures optimal tax efficiency and maximizes after-tax returns.

Related Important Terms

Tax Alpha

Tax deduction lowers taxable income directly, reducing overall tax liability by offsetting investment earnings with eligible expenses or losses. Tax harvesting strategically sells securities at a loss to offset gains realized in other investments, maximizing Tax Alpha by enhancing after-tax portfolio returns through effective loss utilization.

Loss Harvesting Optimization

Tax loss harvesting optimizes investment portfolios by strategically selling securities at a loss to offset capital gains, thereby reducing taxable income and improving after-tax returns. This approach differs from standard tax deductions, which typically lower ordinary income but do not directly offset capital gains, making loss harvesting a more effective tool for long-term investment tax efficiency.

Wash Sale Rule

Tax deduction reduces taxable income directly through allowable expenses, while tax harvesting involves selling securities at a loss to offset gains and minimize tax liabilities; the Wash Sale Rule disallows claiming a loss if the same or substantially identical security is repurchased within 30 days, impacting timing strategies in tax harvesting. Investors must carefully navigate this rule to avoid disallowed losses and maximize the tax benefits of their investment strategies.

Direct Indexing

Direct indexing allows investors to customize portfolios by directly owning individual securities, enabling precise tax-loss harvesting to offset gains and reduce taxable income more effectively than broad tax deduction strategies. This approach enhances after-tax returns by strategically realizing losses within the index components, optimizing overall tax efficiency in investment management.

SpecID (Specific Identification Method)

The Specific Identification Method (SpecID) allows investors to selectively sell particular securities to maximize tax deductions by targeting assets with the highest cost basis or largest unrealized losses, enhancing tax harvesting strategies. Utilizing SpecID optimizes portfolio tax efficiency by precisely controlling capital gains and losses, unlike the default FIFO method which may result in less favorable tax outcomes.

Automated Tax-Loss Harvesting

Automated tax-loss harvesting strategically sells underperforming investments to realize losses that offset capital gains, reducing tax liability and enhancing after-tax returns. This method surpasses basic tax deductions by actively managing portfolio taxes and preserving investment growth potential through timely asset replacement.

Tax Drag

Tax deduction lowers taxable income by directly reducing the amount of income subject to tax, while tax harvesting minimizes tax drag by strategically selling investments at a loss to offset gains, enhancing overall portfolio efficiency. Tax harvesting effectively reduces the tax drag on investment returns, preserving capital growth and improving after-tax performance compared to relying solely on tax deductions.

Qualified Dividend Harvesting

Qualified dividend harvesting maximizes after-tax returns by strategically selling investments that generate qualified dividends, allowing investors to offset gains with losses and reduce taxable income. This approach differs from traditional tax deductions because it specifically targets timing and management of dividend-related capital gains to optimize tax efficiency within investment portfolios.

Tax-Lot Selling

Tax-lot selling strategically selects specific investment lots to sell, optimizing tax outcomes by minimizing capital gains or maximizing losses for tax deduction benefits; this contrasts with tax harvesting, which systematically sells losing investments to offset gains. Employing precise tax-lot identification methods such as FIFO, LIFO, or specific identification enhances the efficiency of tax deductions and tax-loss harvesting within an investment strategy.

Tax Transition Overlay

Tax Transition Overlay enhances investment portfolios by strategically managing tax deductions and tax harvesting to optimize after-tax returns. This approach leverages harvesting losses to offset gains, while aligning with tax deduction opportunities to minimize overall taxable income in fluctuating market conditions.

Tax Deduction vs Tax Harvesting for investment strategy. Infographic

moneydiff.com

moneydiff.com