The standard deduction provides a fixed reduction in taxable income without requiring itemization, simplifying tax filing for many taxpayers. Qualified charitable distributions (QCDs) allow individuals over 70 1/2 to transfer up to $100,000 directly from an IRA to a qualified charity, reducing taxable income by excluding the distribution. Choosing between the standard deduction and QCD depends on individual circumstances, with QCDs offering a strategic way to lower taxable income while supporting charitable causes.

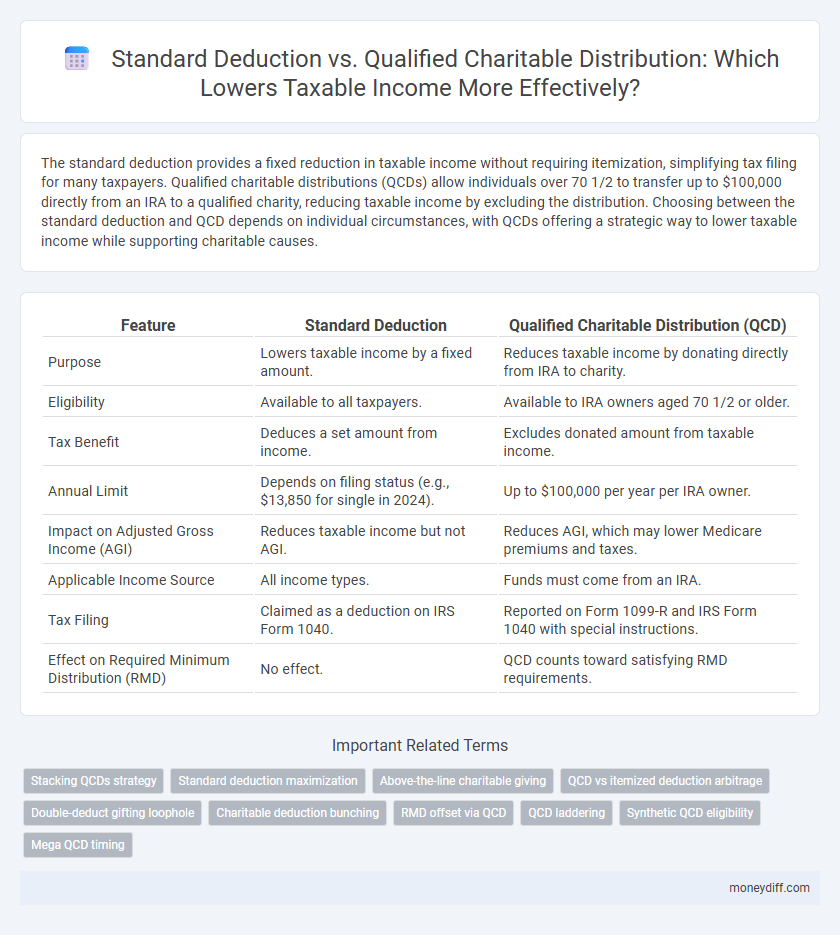

Table of Comparison

| Feature | Standard Deduction | Qualified Charitable Distribution (QCD) |

|---|---|---|

| Purpose | Lowers taxable income by a fixed amount. | Reduces taxable income by donating directly from IRA to charity. |

| Eligibility | Available to all taxpayers. | Available to IRA owners aged 70 1/2 or older. |

| Tax Benefit | Deduces a set amount from income. | Excludes donated amount from taxable income. |

| Annual Limit | Depends on filing status (e.g., $13,850 for single in 2024). | Up to $100,000 per year per IRA owner. |

| Impact on Adjusted Gross Income (AGI) | Reduces taxable income but not AGI. | Reduces AGI, which may lower Medicare premiums and taxes. |

| Applicable Income Source | All income types. | Funds must come from an IRA. |

| Tax Filing | Claimed as a deduction on IRS Form 1040. | Reported on Form 1099-R and IRS Form 1040 with special instructions. |

| Effect on Required Minimum Distribution (RMD) | No effect. | QCD counts toward satisfying RMD requirements. |

Understanding Standard Deduction: Basics and Benefits

The standard deduction is a fixed dollar amount that reduces taxable income, varying by filing status and adjusted annually for inflation. It simplifies tax filing by eliminating the need to itemize deductions, offering a straightforward method to lower tax liability. Unlike qualified charitable distributions, which specifically benefit individuals over 70 1/2 donating directly from IRAs, the standard deduction provides a broad baseline reduction applicable to all eligible taxpayers.

What is a Qualified Charitable Distribution (QCD)?

A Qualified Charitable Distribution (QCD) allows individuals aged 70 1/2 or older to transfer up to $100,000 annually directly from their IRA to a qualified charity, reducing taxable income without itemizing deductions. Unlike the standard deduction, which is a fixed amount available to all taxpayers, a QCD specifically lowers adjusted gross income by excluding the transferred amount from taxable income. Using a QCD can also satisfy required minimum distributions (RMDs), making it a strategic tax planning tool for retirees aiming to reduce their taxable income while supporting charitable causes.

Eligibility Criteria for Standard Deduction and QCD

The standard deduction is available to all taxpayers with no specific eligibility requirements, with amounts varying by filing status--$13,850 for single filers and $27,700 for married filing jointly in 2024. Qualified Charitable Distributions (QCDs) require donors to be at least 70 1/2 years old and can be made directly from an IRA to eligible charities, with a maximum annual exclusion of $100,000. QCDs reduce taxable income dollar-for-dollar by excluding the distribution from gross income, while the standard deduction reduces income based on preset amounts regardless of specific expenses.

Tax Benefits: Standard Deduction vs. QCD

The standard deduction reduces taxable income by a fixed amount based on filing status, simplifying tax calculations without requiring documentation of expenses. Qualified Charitable Distributions (QCDs) allow individuals aged 70 1/2 or older to transfer up to $100,000 annually directly from an IRA to a qualified charity, excluding the distribution from taxable income and satisfying required minimum distributions. While the standard deduction benefits all taxpayers, QCDs provide targeted tax advantages by lowering adjusted gross income and potentially reducing overall tax liability through charitable giving.

How QCD Lowers Taxable Income

Qualified Charitable Distributions (QCDs) directly lower taxable income by allowing individuals aged 70 1/2 or older to transfer up to $100,000 per year from their IRAs to qualified charities, excluding the distributed amount from their adjusted gross income (AGI). This exclusion reduces AGI, which can help taxpayers avoid phaseouts on other deductions and credits, unlike the standard deduction, which only reduces taxable income after AGI is calculated. By decreasing AGI through QCDs, taxpayers can strategically lower their overall tax liability more effectively than relying solely on the standard deduction.

Comparing Standard Deduction and QCD Scenarios

The standard deduction offers a fixed reduction to taxable income based on filing status, simplifying tax calculations without the need for itemization. Qualified charitable distributions (QCDs) allow taxpayers aged 70 1/2 or older to donate directly from their IRAs, exclusion from taxable income that can reduce adjusted gross income (AGI). Comparing scenarios reveals QCDs provide a strategic benefit for those who do not itemize deductions, effectively lowering taxable income beyond the standard deduction limit.

Required Minimum Distributions (RMDs) and Their Role

Required Minimum Distributions (RMDs) mandate retirees to withdraw a specific amount from their retirement accounts annually, impacting taxable income based on age and account balance. Standard deductions provide a fixed reduction in taxable income, whereas Qualified Charitable Distributions (QCDs) allow individuals over 70 1/2 to directly transfer up to $100,000 from IRAs to charities, excluding those funds from taxable income and satisfying RMD requirements. Utilizing QCDs effectively lowers taxable income while fulfilling RMD obligations, often offering greater tax benefits compared to standard deductions alone.

Limitations and Rules for Claiming QCDs

Qualified Charitable Distributions (QCDs) allow individuals aged 70 1/2 or older to donate up to $100,000 directly from their IRA to a qualified charity, excluding the amount from taxable income and satisfying required minimum distributions (RMDs). QCDs cannot be used to claim a itemized deduction and must be made directly by the IRA trustee to the charity to qualify. Unlike the standard deduction, which applies broadly to all taxpayers, QCDs specifically reduce taxable income by offsetting IRA distributions under IRS rules, with strict limitations on eligible charities and timing for contribution.

Who Should Choose Standard Deduction over QCD?

Taxpayers who do not itemize deductions or have charitable contributions below the standard deduction threshold should choose the standard deduction for lowering taxable income. Individuals under 70 1/2 years old cannot make Qualified Charitable Distributions (QCDs) from IRAs, so the standard deduction remains their optimal tax strategy. Taxpayers with limited taxable income or who have non-IRA retirement accounts also benefit more from the standard deduction rather than pursuing QCDs.

Strategic Tips for Maximizing Tax Savings

Maximizing tax savings involves carefully choosing between the standard deduction and qualified charitable distributions (QCDs) based on individual financial situations. For taxpayers over 70 1/2, utilizing QCDs from IRAs up to $100,000 can directly lower taxable income without itemizing deductions, offering a strategic advantage over the standard deduction. Balancing QCDs with the standard deduction threshold ensures optimized tax efficiency, particularly for those who are close to the itemization limit or want to reduce adjusted gross income for other tax benefits.

Related Important Terms

Stacking QCDs strategy

Stacking Qualified Charitable Distributions (QCDs) allows taxpayers to reduce taxable income beyond the standard deduction by directly transferring IRA funds to eligible charities, effectively lowering adjusted gross income (AGI) without itemizing deductions. This strategy maximizes tax efficiency by leveraging QCDs for individuals over 70 1/2, potentially minimizing Medicare premiums and other AGI-based surtaxes.

Standard deduction maximization

Maximizing the standard deduction reduces taxable income by allowing taxpayers to claim a fixed deduction amount based on filing status without itemizing, making it beneficial for individuals whose total deductions are less than the standard amount. In contrast, qualified charitable distributions (QCDs) require IRA donations directly to charities and primarily benefit taxpayers over 70 1/2 by excluding these amounts from taxable income, but leveraging the standard deduction often provides a simpler and broader tax reduction strategy.

Above-the-line charitable giving

Standard deduction offers a fixed amount to reduce taxable income without itemizing, while qualified charitable distributions (QCDs) allow individuals over 70 1/2 to donate up to $100,000 directly from IRAs, lowering adjusted gross income (AGI) above-the-line. Utilizing QCDs not only satisfies required minimum distributions but also provides a strategic advantage by reducing AGI, which can impact tax credits and deductions more effectively than the standard deduction alone.

QCD vs itemized deduction arbitrage

Qualified Charitable Distributions (QCDs) directly reduce taxable income by allowing IRA owners aged 70 1/2 or older to transfer up to $100,000 annually to qualified charities without itemizing deductions. This strategy surpasses standard deduction benefits and outperforms itemized charitable deductions by eliminating the need to exceed deduction thresholds for tax savings.

Double-deduct gifting loophole

Standard deduction lowers taxable income by a fixed amount based on filing status, while a Qualified Charitable Distribution allows IRA owners over 70 1/2 to donate directly to charity, excluding the donation from taxable income. Utilizing the double-deduct gifting loophole, taxpayers can both reduce their taxable IRA balance through the QCD and still claim the full standard deduction, effectively maximizing tax savings.

Charitable deduction bunching

Charitable deduction bunching involves aggregating donations into a single tax year to surpass the standard deduction threshold, maximizing itemized deductions and reducing taxable income more effectively than standard deductions alone. Qualified charitable distributions (QCDs) allow taxpayers aged 70 1/2 or older to exclude up to $100,000 of IRA distributions given directly to a qualified charity, lowering taxable income without itemizing deductions.

RMD offset via QCD

Qualified charitable distributions (QCDs) directly offset required minimum distributions (RMDs) by allowing individuals aged 70 1/2 or older to donate up to $100,000 from their IRAs to qualified charities, thereby reducing taxable income dollar-for-dollar. Unlike the standard deduction, QCDs specifically target RMD obligations, providing a tax-efficient strategy to lower adjusted gross income and potentially minimize Medicare premiums and tax brackets.

QCD laddering

Qualified Charitable Distribution (QCD) laddering strategically spreads IRA donations over multiple years, reducing taxable income incrementally without affecting the standard deduction, making it a tax-efficient alternative especially for taxpayers aged 70 1/2 or older. Unlike the standard deduction, which offers a fixed amount regardless of charitable contributions, QCD laddering directly lowers adjusted gross income by transferring funds from an IRA to eligible charities, thereby minimizing tax liability and potentially reducing Medicare premiums and Social Security taxation.

Synthetic QCD eligibility

Qualified charitable distributions (QCDs) allow taxpayers aged 70 1/2 or older to transfer up to $100,000 annually from an IRA directly to a qualified charity, reducing taxable income without itemizing deductions, unlike the Standard Deduction which applies uniformly regardless of charitable giving. Synthetic QCDs, involving distributions from non-traditional IRA assets or certain conversion strategies, have eligibility constraints requiring careful adherence to IRS rules to ensure the distribution qualifies for tax exclusion.

Mega QCD timing

Mega Qualified Charitable Distributions (QCDs) allow individuals aged 70 1/2 or older to donate up to $100,000 directly from an IRA to a charity, effectively lowering taxable income without itemizing deductions, unlike the standard deduction which offers a fixed reduction. Timing Mega QCDs before year-end maximizes tax benefits by offsetting required minimum distributions (RMDs) and reducing adjusted gross income (AGI) to limit tax brackets and potential Medicare surcharges.

Standard deduction vs Qualified charitable distribution for lowering taxable income. Infographic

moneydiff.com

moneydiff.com