Tax consultants provide personalized, professional guidance based on thorough knowledge of tax laws and regulations, ensuring accurate and compliant tax filing. Tax influencers offer general advice that may lack the specificity and reliability required for complex tax situations. Relying on a certified tax consultant reduces the risk of errors and penalties compared to following tips shared by social media influencers.

Table of Comparison

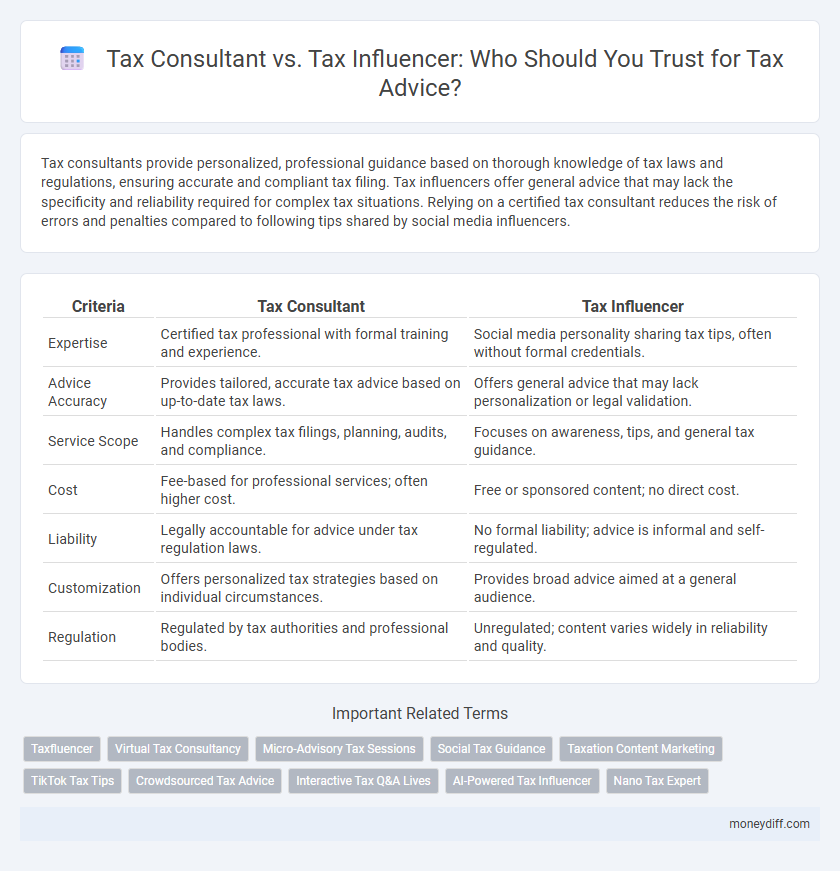

| Criteria | Tax Consultant | Tax Influencer |

|---|---|---|

| Expertise | Certified tax professional with formal training and experience. | Social media personality sharing tax tips, often without formal credentials. |

| Advice Accuracy | Provides tailored, accurate tax advice based on up-to-date tax laws. | Offers general advice that may lack personalization or legal validation. |

| Service Scope | Handles complex tax filings, planning, audits, and compliance. | Focuses on awareness, tips, and general tax guidance. |

| Cost | Fee-based for professional services; often higher cost. | Free or sponsored content; no direct cost. |

| Liability | Legally accountable for advice under tax regulation laws. | No formal liability; advice is informal and self-regulated. |

| Customization | Offers personalized tax strategies based on individual circumstances. | Provides broad advice aimed at a general audience. |

| Regulation | Regulated by tax authorities and professional bodies. | Unregulated; content varies widely in reliability and quality. |

Understanding the Roles: Tax Consultant vs Tax Influencer

Tax consultants are certified professionals with in-depth knowledge of tax laws and regulations, offering personalized and accurate tax planning and compliance services. Tax influencers primarily share general tax tips and trends on social media, often lacking formal credentials and tailored advice. Choosing a tax consultant ensures reliable expertise for complex tax situations, while tax influencers provide accessible information for basic understanding.

Qualifications and Expertise: Who Offers Reliable Tax Advice?

Tax consultants possess formal qualifications, including certifications like CPA or Enrolled Agent status, and extensive experience in complex tax codes, ensuring precise and legally compliant advice. Tax influencers, while often knowledgeable and influential on social media, typically lack formal credentials and may provide generalized or anecdotal guidance that doesn't account for individual tax situations. For reliable tax advice tailored to specific financial circumstances, professionally accredited tax consultants offer superior expertise compared to tax influencers.

Compliance and Legal Responsibility in Tax Guidance

Tax consultants provide expert, legally compliant advice based on extensive training and certification, ensuring adherence to tax laws and minimizing audit risks. In contrast, tax influencers often share general tips without formal credentials, which may lead to non-compliance or misinterpretation of tax regulations. Relying on certified tax professionals guarantees accurate, up-to-date guidance aligned with current legal responsibilities and regulatory requirements.

Personalized Consultation: Pros and Cons

Tax consultants offer personalized consultation based on in-depth knowledge of individual financial situations and current tax laws, ensuring tailored advice and compliance. Tax influencers provide broad, generalized tax guidance that may lack the specificity needed for complex personal or business tax scenarios. Choosing a tax consultant ensures detailed, professional assistance, while tax influencers offer accessible insights but carry the risk of outdated or non-personalized information.

Social Media Influence on Tax Decisions

Tax consultants provide expert, personalized advice based on current tax laws and individual financial situations, ensuring compliance and optimized tax strategies. Tax influencers leverage social media platforms to share general tax tips, trends, and insights, often reaching a wider audience but lacking the depth of personalized guidance. Social media influence can shape public perception and awareness of tax issues, but decisions based solely on influencers' advice risk inaccuracies without professional validation from certified tax consultants.

Cost Comparison: Tax Consultant Fee vs Free Influencer Advice

Tax consultants typically charge fees ranging from $150 to $500 per hour, reflecting their professional expertise and personalized services. In contrast, tax influencers offer free advice through social media platforms, online videos, and blogs, which can be beneficial for basic tax questions but lack customization. While free influencer advice reduces upfront costs, relying solely on it may result in overlooked deductions or compliance risks that a paid consultant would help mitigate.

Risk of Following Unverified Advice

Relying on unverified advice from tax influencers can lead to significant legal and financial risks including audits, fines, and penalties. Tax consultants possess professional certifications and adhere to regulatory standards, ensuring accurate and personalized tax guidance. Ignoring the expertise of certified tax consultants in favor of unvetted sources increases the likelihood of errors and compliance issues with tax authorities.

Updates and Accuracy: Staying Current with Tax Laws

Tax consultants provide professionally vetted and up-to-date guidance based on the latest tax codes, regulations, and IRS rulings, ensuring accurate tax planning and compliance. Tax influencers often share generalized opinions or outdated information that may lack verification from authoritative sources, increasing risks of errors. For precise and legally sound tax advice, relying on certified tax consultants guarantees alignment with current tax laws and official updates.

Privacy and Data Security Concerns

Tax consultants ensure strict confidentiality and compliance with data protection laws when handling sensitive financial information, minimizing risks of data breaches. Tax influencers often share advice on public platforms, which can expose personal data and increase privacy vulnerabilities. Choosing a tax consultant over a tax influencer provides stronger safeguards for private financial data and reduces the likelihood of unauthorized information exposure.

Making the Right Choice for Your Tax Needs

Choosing between a tax consultant and a tax influencer depends on the complexity of your financial situation and the need for personalized advice. Tax consultants provide expert, tailored guidance based on current laws and regulations, ensuring compliance and optimized tax strategies. Tax influencers offer general tips and trends that may not account for individual circumstances, making consultants the safer choice for accurate and reliable tax planning.

Related Important Terms

Taxfluencer

Taxfluencers combine deep tax expertise with social media influence, making complex tax topics accessible and timely for a broad audience. Their real-time updates and user-friendly content often provide practical, current advice that complements the personalized, detailed guidance of traditional tax consultants.

Virtual Tax Consultancy

Virtual tax consultancy offers personalized, accurate tax planning and compliance guidance from certified tax consultants who leverage in-depth knowledge of current tax laws and regulations. Tax influencers, while providing general advice and trends, lack the tailored expertise and accountability needed for complex tax situations and official filings.

Micro-Advisory Tax Sessions

Micro-advisory tax sessions provided by tax consultants offer personalized, expert guidance tailored to specific financial situations, ensuring compliance and optimized tax strategies. In contrast, tax influencers primarily share general tax tips and trends on social media without personalized advice or in-depth analysis of individual tax cases.

Social Tax Guidance

Tax consultants offer personalized, expert advice based on in-depth knowledge of tax laws and regulations, ensuring compliance and optimized tax strategies tailored to individual or business needs. Tax influencers provide broad, socially-driven tax guidance often based on general trends and public opinions, which may lack the precision and customization necessary for complex financial situations.

Taxation Content Marketing

Tax consultants provide personalized, expert guidance tailored to individual financial situations, ensuring compliance with complex tax laws, while tax influencers leverage social media platforms to disseminate broadly appealing tax tips and trends that drive engagement and brand visibility in taxation content marketing. Prioritizing a tax consultant enhances accuracy and legal compliance, whereas collaborating with tax influencers amplifies outreach and educates a wider audience on evolving tax strategies.

TikTok Tax Tips

Tax consultants provide expert, personalized advice based on up-to-date regulations, ensuring compliance and optimized returns, while tax influencers on TikTok offer accessible, trendy tips often simplified for a broad audience but lacking professional accountability; choosing a certified tax consultant guarantees accurate guidance tailored to individual tax situations beyond general social media content.

Crowdsourced Tax Advice

Crowdsourced tax advice from tax influencers offers diverse perspectives but lacks the personalized accuracy and legal accountability that certified tax consultants provide. Relying on expert tax consultants ensures tailored strategies aligned with current tax laws, minimizing risks of errors or audits.

Interactive Tax Q&A Lives

Tax consultants offer personalized, expert advice based on current tax laws and individual financial situations, ensuring accurate and compliant tax filing. Interactive Tax Q&A Lives hosted by tax influencers provide real-time answers and general tips but may lack the depth and customization needed for complex tax issues.

AI-Powered Tax Influencer

AI-powered tax influencers leverage advanced algorithms and real-time data analytics to offer personalized tax advice, often surpassing traditional tax consultants in speed and accessibility. Their ability to integrate the latest tax law changes and simulate outcomes enhances decision-making for individuals and businesses navigating complex tax scenarios.

Nano Tax Expert

Nano tax experts offer specialized, personalized tax advice leveraging in-depth knowledge and up-to-date regulations, ensuring accurate compliance and optimized deductions. Unlike tax influencers who primarily provide general tips to broad audiences, nano tax experts deliver tailored solutions based on individual financial situations for maximized tax benefits.

Tax Consultant vs Tax Influencer for advice. Infographic

moneydiff.com

moneydiff.com