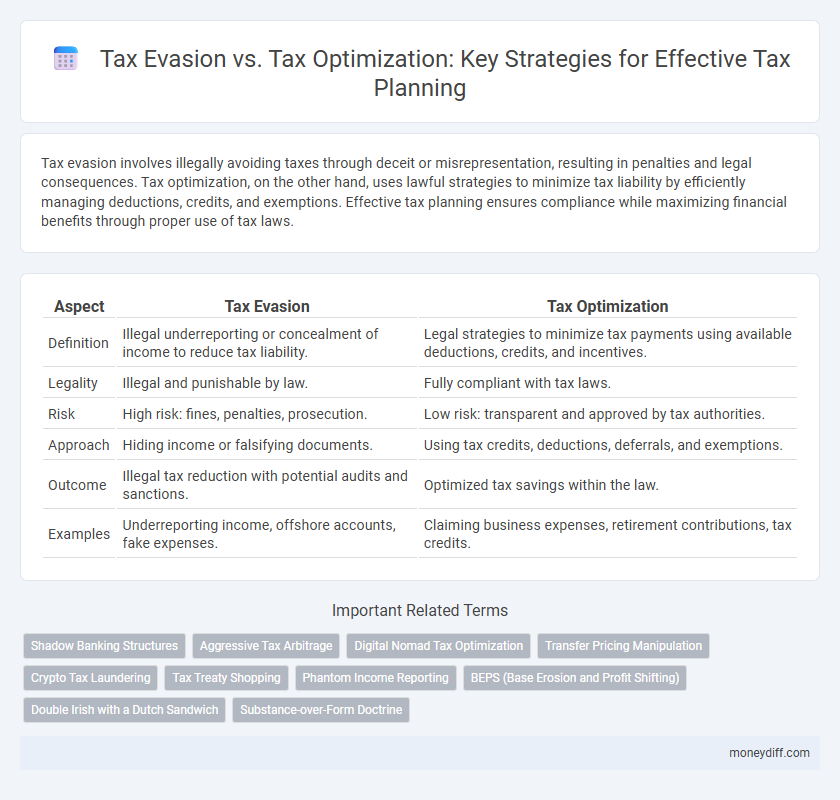

Tax evasion involves illegally avoiding taxes through deceit or misrepresentation, resulting in penalties and legal consequences. Tax optimization, on the other hand, uses lawful strategies to minimize tax liability by efficiently managing deductions, credits, and exemptions. Effective tax planning ensures compliance while maximizing financial benefits through proper use of tax laws.

Table of Comparison

| Aspect | Tax Evasion | Tax Optimization |

|---|---|---|

| Definition | Illegal underreporting or concealment of income to reduce tax liability. | Legal strategies to minimize tax payments using available deductions, credits, and incentives. |

| Legality | Illegal and punishable by law. | Fully compliant with tax laws. |

| Risk | High risk: fines, penalties, prosecution. | Low risk: transparent and approved by tax authorities. |

| Approach | Hiding income or falsifying documents. | Using tax credits, deductions, deferrals, and exemptions. |

| Outcome | Illegal tax reduction with potential audits and sanctions. | Optimized tax savings within the law. |

| Examples | Underreporting income, offshore accounts, fake expenses. | Claiming business expenses, retirement contributions, tax credits. |

Understanding Tax Evasion vs Tax Optimization

Tax evasion involves illegal practices to avoid paying taxes, such as underreporting income or inflating deductions, leading to penalties and legal consequences. Tax optimization, or tax planning, uses legitimate strategies like claiming eligible deductions and credits to minimize tax liability within the framework of the law. Understanding these distinctions is crucial for individuals and businesses to comply with tax regulations while effectively managing financial obligations.

Legal Boundaries: Tax Evasion vs Tax Optimization

Tax evasion involves illegal practices such as underreporting income or inflating deductions to reduce tax liability, violating tax laws and risking severe penalties. Tax optimization, or tax planning, utilizes legally sanctioned methods like claiming eligible deductions, credits, and timing income recognition to minimize tax burden within regulatory frameworks. Understanding these legal boundaries is crucial for compliant financial strategies that avoid the risks associated with tax fraud.

The Risks and Consequences of Tax Evasion

Tax evasion involves illegally underreporting income or falsifying documents to reduce tax liability, leading to severe legal risks such as hefty fines, penalties, and potential imprisonment. Enforcement agencies increasingly use data analytics and cross-border information sharing to detect fraudulent activities, escalating the chances of being caught. Distinguishing tax evasion from tax optimization, which employs lawful strategies like deductions and credits, is critical to ensure compliance and minimize financial exposure.

Benefits of Tax Optimization in Tax Planning

Tax optimization in tax planning legally reduces taxable income through strategic deductions, credits, and income timing, enhancing cash flow without violating regulations. It improves compliance while maximizing available tax benefits, ensuring financial efficiency and sustainability. Employing tax optimization minimizes audit risks compared to tax evasion, which involves illegal concealment and penalties.

Common Strategies for Tax Optimization

Common strategies for tax optimization include maximizing deductions and credits, utilizing tax-advantaged accounts such as IRAs and 401(k)s, and strategically timing income and expenses to reduce taxable income. Employing legal methods like income shifting, capital gains planning, and loss harvesting helps individuals and businesses minimize tax liability effectively. These approaches contrast with tax evasion, which involves illegal practices to avoid paying taxes.

Red Flags: Practices That Constitute Tax Evasion

Red flags of tax evasion include underreporting income, inflating deductions, and hiding assets or financial accounts offshore to avoid tax liabilities. Concealing sources of income or falsifying documents signifies intentional fraud, distinguishing illegal tax evasion from legitimate tax optimization strategies that comply with tax laws. Tax planners must recognize these practices to ensure adherence to regulatory frameworks and avoid severe penalties.

Key Differences in Intent: Avoidance vs Evasion

Tax evasion involves illegal practices such as underreporting income or inflating deductions to reduce tax liability, while tax optimization uses legal strategies like tax credits and deductions to minimize taxes owed. The key difference lies in intent: tax evasion seeks to deceive tax authorities, risking penalties and prosecution, whereas tax optimization aims to comply with tax laws while maximizing savings. Understanding these distinctions is crucial for effective and lawful tax planning.

Regulatory Framework Governing Tax Planning

The regulatory framework governing tax planning distinguishes tax evasion, which involves illegal methods to avoid tax liabilities, from tax optimization, a lawful strategy that minimizes tax burden within legal boundaries. Compliance with the Internal Revenue Service (IRS) regulations and the Organization for Economic Co-operation and Development (OECD) guidelines is critical to ensure that tax planning practices do not cross into evasion. Clear adherence to these frameworks promotes transparency and accuracy in reporting income and deductions, safeguarding against penalties and legal repercussions.

Case Studies: Tax Evasion vs Tax Optimization

Case studies reveal that tax evasion involves illegal practices such as underreporting income or inflating deductions, resulting in significant legal penalties and financial risks. In contrast, tax optimization utilizes legitimate strategies like tax credits, deductions, and income deferral to minimize tax liability within the boundaries of the law. Analyzing these case studies highlights the importance of compliance and strategic planning to achieve financial efficiency without incurring legal consequences.

Best Practices for Ethical Tax Planning

Effective tax planning involves legally minimizing tax liabilities through strategies such as maximizing deductions, utilizing tax credits, and investing in tax-advantaged accounts. Tax evasion, by contrast, involves illegal methods like underreporting income or inflating expenses, which can result in severe penalties and legal consequences. Best practices for ethical tax planning emphasize transparency, compliance with tax laws, and consultation with qualified tax professionals to ensure all strategies are both effective and lawful.

Related Important Terms

Shadow Banking Structures

Shadow banking structures often facilitate tax evasion by exploiting regulatory loopholes and disguising assets, whereas legitimate tax optimization leverages transparent strategies within legal frameworks to minimize tax liabilities. Understanding the differentiation is critical for tax planning, as shadow banking involves high-risk, non-compliant methods that attract severe penalties, unlike tax optimization which ensures compliance and efficient tax management.

Aggressive Tax Arbitrage

Aggressive tax arbitrage exploits differences in tax regulations across jurisdictions to minimize tax liabilities, often blurring the line between legal tax optimization and unlawful tax evasion. While tax optimization leverages legitimate strategies such as deductions and credits within the tax code, aggressive tax arbitrage can trigger regulatory scrutiny due to its potential to distort economic substance and evade true tax obligations.

Digital Nomad Tax Optimization

Digital nomad tax optimization leverages legal strategies such as optimizing residency, income sourcing, and treaty benefits to minimize tax liabilities while ensuring compliance with international tax laws. Unlike tax evasion, which involves illegal concealment of income, tax optimization employs transparent financial planning tools like establishing offshore accounts and utilizing tax credits to achieve efficient tax outcomes.

Transfer Pricing Manipulation

Transfer pricing manipulation as a form of tax evasion involves intentionally altering intercompany transaction prices to shift profits and reduce taxable income, violating compliance regulations and risking severe penalties. In contrast, tax optimization through legitimate transfer pricing strategies aligns pricing with market conditions and OECD guidelines to minimize tax liabilities while maintaining transparency and regulatory adherence.

Crypto Tax Laundering

Tax evasion involves illegal practices such as underreporting income or concealing assets to avoid paying taxes, often linked to crypto tax laundering through untraceable transactions and mixing services. In contrast, tax optimization leverages legal strategies like maximizing deductions and utilizing tax-efficient investment vehicles to minimize tax liability while ensuring compliance with cryptocurrency tax regulations.

Tax Treaty Shopping

Tax treaty shopping exploits loopholes in international agreements to artificially shift profits and reduce tax liabilities, often crossing into illegal tax evasion territory. In contrast, legitimate tax optimization leverages valid provisions within tax treaties to minimize taxes while complying with legal and regulatory frameworks.

Phantom Income Reporting

Phantom income reporting occurs when taxpayers are taxed on income that they have not actually received, often due to accrual accounting or investments like partnerships and trusts. Distinguishing tax optimization, which legally minimizes tax liabilities through strategic planning, from tax evasion, which involves illegal concealment or misrepresentation of income, is essential for compliant tax planning.

BEPS (Base Erosion and Profit Shifting)

Tax evasion involves illegal practices to avoid paying taxes, while tax optimization uses legal strategies to minimize tax liabilities, with BEPS (Base Erosion and Profit Shifting) targeting aggressive tax planning that exploits gaps in international tax rules. Addressing BEPS requires multinational corporations to enhance transparency and comply with regulations designed by the OECD to prevent profit shifting and ensure fair taxation globally.

Double Irish with a Dutch Sandwich

Tax evasion involves illegal practices to hide income or falsify information to reduce tax liability, whereas tax optimization employs legal strategies to minimize tax expenses through effective planning. The Double Irish with a Dutch Sandwich is a sophisticated tax optimization technique used by multinational corporations to shift profits through Irish and Dutch subsidiaries, exploiting differences in international tax laws to significantly lower their tax burden.

Substance-over-Form Doctrine

The Substance-over-Form Doctrine plays a crucial role in distinguishing tax evasion from tax optimization by emphasizing the true economic substance of transactions over their legal form. Tax authorities apply this principle to prevent artificial arrangements designed solely to evade taxes, ensuring that genuine tax planning aligns with the underlying reality of business activities.

Tax evasion vs Tax optimization for tax planning. Infographic

moneydiff.com

moneydiff.com