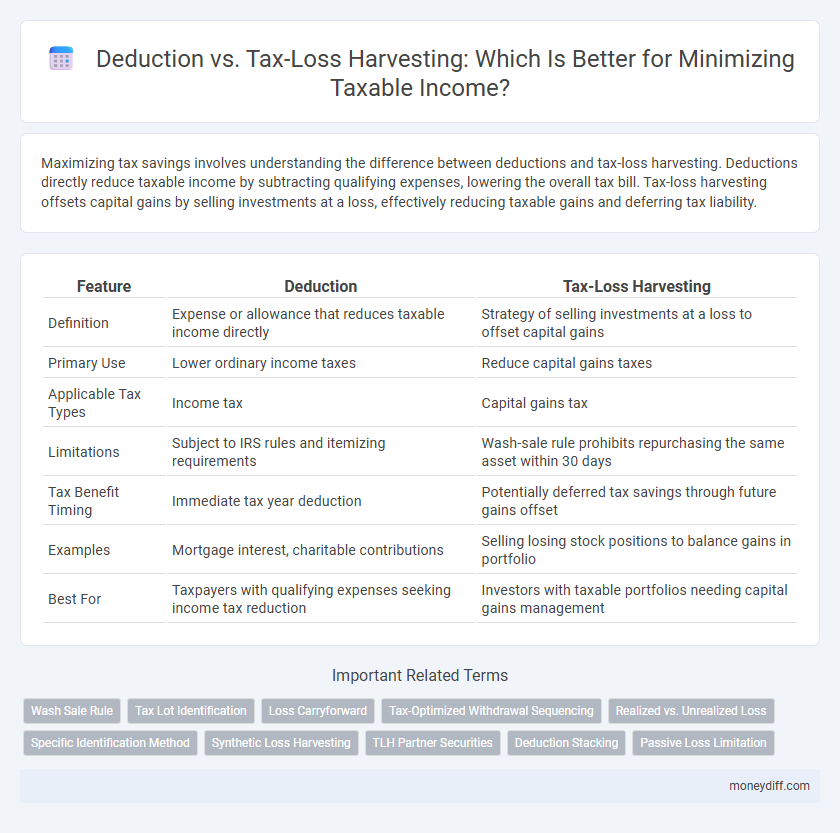

Maximizing tax savings involves understanding the difference between deductions and tax-loss harvesting. Deductions directly reduce taxable income by subtracting qualifying expenses, lowering the overall tax bill. Tax-loss harvesting offsets capital gains by selling investments at a loss, effectively reducing taxable gains and deferring tax liability.

Table of Comparison

| Feature | Deduction | Tax-Loss Harvesting |

|---|---|---|

| Definition | Expense or allowance that reduces taxable income directly | Strategy of selling investments at a loss to offset capital gains |

| Primary Use | Lower ordinary income taxes | Reduce capital gains taxes |

| Applicable Tax Types | Income tax | Capital gains tax |

| Limitations | Subject to IRS rules and itemizing requirements | Wash-sale rule prohibits repurchasing the same asset within 30 days |

| Tax Benefit Timing | Immediate tax year deduction | Potentially deferred tax savings through future gains offset |

| Examples | Mortgage interest, charitable contributions | Selling losing stock positions to balance gains in portfolio |

| Best For | Taxpayers with qualifying expenses seeking income tax reduction | Investors with taxable portfolios needing capital gains management |

Understanding Tax Deductions: The Basics

Tax deductions reduce your taxable income by allowing you to subtract specific expenses, such as mortgage interest, student loan interest, and charitable contributions, from your gross income. Understanding which deductions apply can lower your overall tax liability, often optimizing financial outcomes more straightforwardly than tax-loss harvesting. Properly leveraging standard and itemized deductions ensures you maximize eligible reductions, directly impacting the amount of income subject to taxation.

What Is Tax-Loss Harvesting?

Tax-loss harvesting is a strategic method for minimizing taxable income by selling investments at a loss to offset capital gains. This technique allows investors to reduce their tax liability by matching realized losses against realized gains within the same tax year. Unlike standard deductions, tax-loss harvesting specifically targets investment portfolios to optimize after-tax returns.

Key Differences Between Deductions and Tax-Loss Harvesting

Deductions reduce taxable income by lowering the amount of income subject to tax through qualifying expenses like mortgage interest or charitable donations. Tax-loss harvesting offsets capital gains by selling investments at a loss, directly reducing taxable capital gains and potentially carrying forward excess losses to future tax years. The primary difference lies in deductions applying to ordinary income while tax-loss harvesting specifically targets capital gains, offering strategic opportunities for investors to minimize tax liability within different income categories.

When to Use Tax Deductions vs. Harvesting Losses

Tax deductions reduce taxable income by subtracting eligible expenses directly from gross income, proving most beneficial during high-income years or when specific deductible expenses are significant. Tax-loss harvesting involves selling investments at a loss to offset capital gains, optimal when realizing capital gains triggers substantial tax liability or to carry losses forward to future tax years. Choosing between deductions and harvesting losses depends on income levels, investment portfolios, and timing of realized gains, maximizing tax efficiency through strategic application.

Impact on Short-Term vs. Long-Term Gains

Tax deductions reduce taxable income dollar-for-dollar, primarily lowering tax liability without directly influencing the character of gains, while tax-loss harvesting strategically offsets capital gains by realizing losses, targeting both short-term and long-term gains to optimize tax outcomes. Short-term gains, taxed at higher ordinary income rates, benefit more from harvesting losses to avoid steep taxation, whereas long-term gains, subject to lower capital gains rates, may warrant a balanced approach combining deductions and selective loss harvesting. Effective tax planning involves analyzing the timing and type of gains to maximize the impact of deductions and harvested losses on reducing overall tax burdens.

Maximizing Deductions to Reduce Taxable Income

Maximizing deductions reduces taxable income by directly lowering the amount subject to tax, including expenses like mortgage interest, charitable contributions, and business costs. Tax-loss harvesting involves selling investments at a loss to offset capital gains, primarily benefiting those with significant investment portfolios. Prioritizing deductions offers broader immediate relief on income taxes, while tax-loss harvesting targets capital gains tax, making deductions more effective for most taxpayers aiming to minimize taxable income.

Strategies for Effective Tax-Loss Harvesting

Tax-loss harvesting involves strategically selling securities at a loss to offset capital gains and reduce taxable income, maximizing tax efficiency. Effective strategies include timing sales to realize losses before year-end, repurchasing similar assets to maintain portfolio exposure while avoiding the wash-sale rule, and integrating losses with income and capital gain projections for optimal tax benefits. Tracking cost basis and holding periods ensures accurate identification of losses, enhancing the potential to reduce tax liability and improve after-tax investment returns.

Common Mistakes in Claiming Deductions and Harvesting Losses

Common mistakes in claiming deductions include failing to maintain proper documentation, inadvertently deducting non-allowable expenses, and misclassifying personal expenses as business-related. In tax-loss harvesting, errors often arise from overlooking the wash-sale rule, harvesting losses without a well-planned investment strategy, and neglecting to account for transaction costs that can reduce net tax benefits. Proper adherence to IRS guidelines and strategic planning are essential to maximizing tax benefits and minimizing audit risks.

Tax Implications for Different Asset Classes

Deduction strategies reduce taxable income by lowering reported earnings through allowable expenses, primarily affecting ordinary income and certain asset classes like wages, interest, and rental properties. Tax-loss harvesting involves selling securities at a loss to offset capital gains, specifically targeting long-term and short-term capital gains from stocks, bonds, and mutual funds, thereby minimizing capital gains tax liability. Different asset classes respond uniquely to these methods, with tax-loss harvesting offering greater benefits for volatile assets prone to price fluctuations, while deductions primarily impact income from fixed assets and ordinary income sources.

Combining Deduction and Harvesting Strategies for Greater Savings

Combining tax deductions with tax-loss harvesting strategies amplifies taxable income reduction by leveraging both expense write-offs and realized capital losses to offset gains. Deductions directly lower adjusted gross income (AGI), while harvesting capital losses can offset capital gains and up to $3,000 of ordinary income annually, maximizing overall tax savings. Integrating these approaches requires careful timing of expenses and strategic capital loss realization to optimize year-end tax efficiency and increase after-tax portfolio returns.

Related Important Terms

Wash Sale Rule

Tax-loss harvesting strategically sells securities at a loss to offset capital gains, but the IRS Wash Sale Rule disallows deduction if the same or substantially identical security is repurchased within 30 days. Properly navigating the Wash Sale Rule ensures taxpayers maximize deductions without triggering disallowed losses that increase taxable income.

Tax Lot Identification

Tax lot identification plays a crucial role in both deduction strategies and tax-loss harvesting by specifying which shares to sell, thereby maximizing capital loss realization and minimizing taxable income. Selecting high-cost basis lots during sales optimizes deductions while effectively managing realized gains to reduce overall tax liability.

Loss Carryforward

Loss carryforward enables taxpayers to apply current year capital losses to offset future taxable income, maximizing tax benefits over multiple years. Unlike immediate deductions, tax-loss harvesting strategically realizes losses to reduce taxable gains today while preserving loss carryforward advantages for long-term tax minimization.

Tax-Optimized Withdrawal Sequencing

Tax-optimized withdrawal sequencing leverages strategic timing of deductions and tax-loss harvesting to minimize taxable income by prioritizing asset liquidation from taxable, tax-deferred, and tax-exempt accounts. This method enhances tax efficiency by reducing the overall tax burden through the coordinated use of deductions and realized capital losses within the same tax year.

Realized vs. Unrealized Loss

Deduction allows taxpayers to lower taxable income by subtracting eligible expenses directly from gross income, while tax-loss harvesting involves selling investments at a realized loss to offset capital gains and reduce overall tax liability. Unlike unrealized losses, which exist only on paper without affecting taxes, realized losses must be actualized through a transaction to be utilized for minimizing taxable income.

Specific Identification Method

The Specific Identification Method allows precise selection of individual securities to sell, strategically realizing losses and gains to optimize tax-loss harvesting and maximize deductions. By targeting shares with the highest cost basis, investors minimize taxable income efficiently while avoiding unintended capital gains.

Synthetic Loss Harvesting

Synthetic loss harvesting involves using derivatives like options to create artificial losses that offset taxable gains, maximizing tax benefits without selling the underlying assets. This strategy differs from traditional deduction methods by specifically targeting realized gains for tax deferral, enhancing portfolio efficiency and minimizing taxable income.

TLH Partner Securities

Tax-loss harvesting with TLH Partner Securities strategically offsets capital gains by selling underperforming assets, maximizing deferred tax benefits and optimizing portfolio efficiency. Unlike standard deductions that reduce taxable income by predetermined amounts, TLH Partner leverages market movements to enhance after-tax returns through targeted capital loss realization.

Deduction Stacking

Deduction stacking involves strategically combining multiple tax deductions within a single year to maximize taxable income reduction, often leading to greater immediate tax savings compared to tax-loss harvesting, which primarily offsets capital gains by realizing investment losses. Prioritizing deduction stacking can amplify the overall impact on taxable income by leveraging available itemized deductions, such as mortgage interest, charitable contributions, and medical expenses, before applying tax-loss harvesting strategies.

Passive Loss Limitation

Passive loss limitation rules restrict the deduction of losses from passive activities, allowing taxpayers to only offset passive income, not active or portfolio income. Tax-loss harvesting involves strategically selling investments at a loss to offset capital gains, but it cannot bypass passive loss limitations that often limit the immediate tax benefit of passive losses.

Deduction vs Tax-Loss Harvesting for minimizing taxable income. Infographic

moneydiff.com

moneydiff.com