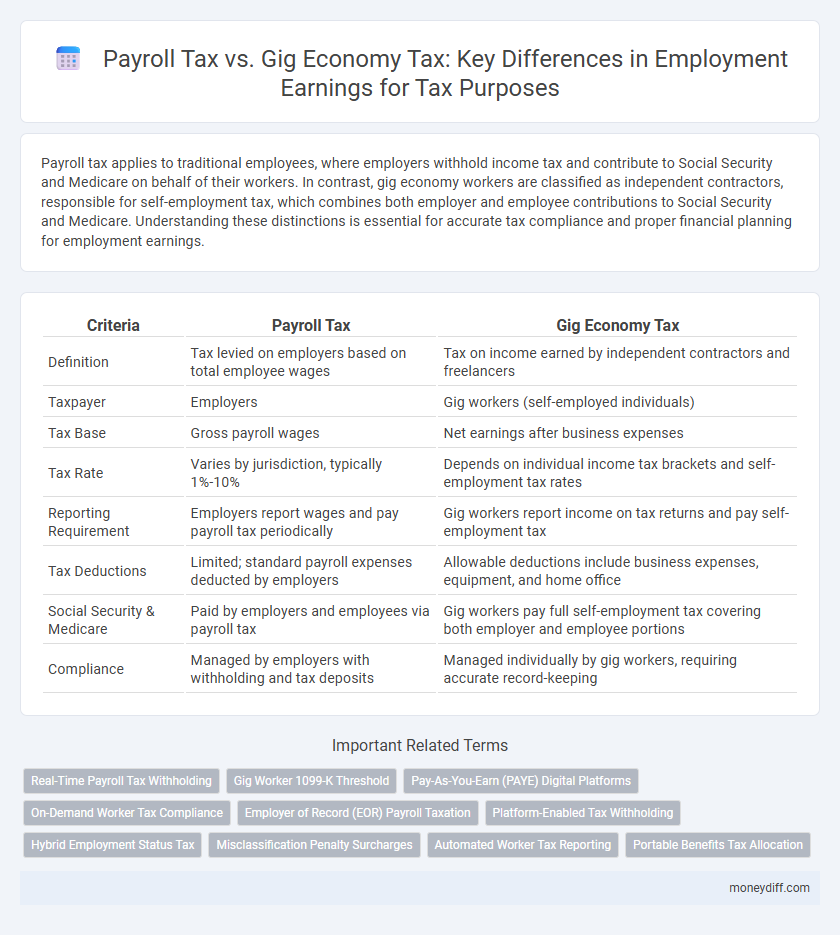

Payroll tax applies to traditional employees, where employers withhold income tax and contribute to Social Security and Medicare on behalf of their workers. In contrast, gig economy workers are classified as independent contractors, responsible for self-employment tax, which combines both employer and employee contributions to Social Security and Medicare. Understanding these distinctions is essential for accurate tax compliance and proper financial planning for employment earnings.

Table of Comparison

| Criteria | Payroll Tax | Gig Economy Tax |

|---|---|---|

| Definition | Tax levied on employers based on total employee wages | Tax on income earned by independent contractors and freelancers |

| Taxpayer | Employers | Gig workers (self-employed individuals) |

| Tax Base | Gross payroll wages | Net earnings after business expenses |

| Tax Rate | Varies by jurisdiction, typically 1%-10% | Depends on individual income tax brackets and self-employment tax rates |

| Reporting Requirement | Employers report wages and pay payroll tax periodically | Gig workers report income on tax returns and pay self-employment tax |

| Tax Deductions | Limited; standard payroll expenses deducted by employers | Allowable deductions include business expenses, equipment, and home office |

| Social Security & Medicare | Paid by employers and employees via payroll tax | Gig workers pay full self-employment tax covering both employer and employee portions |

| Compliance | Managed by employers with withholding and tax deposits | Managed individually by gig workers, requiring accurate record-keeping |

Understanding Payroll Tax for Traditional Employees

Payroll tax for traditional employees involves mandatory employer contributions to Social Security, Medicare, and unemployment insurance based on wages paid. These taxes are automatically withheld from employees' paychecks and reported by employers, ensuring compliance with federal and state regulations. Understanding payroll tax obligations is essential for accurate financial planning and tax reporting in conventional employment settings.

Overview of Gig Economy Tax Obligations

Gig economy workers must navigate specific payroll tax obligations that differ from traditional employment, primarily involving self-employment tax responsibilities covering Social Security and Medicare contributions. Unlike standard payroll taxes withheld by employers, gig workers are required to calculate and remit these taxes directly to tax authorities, often through estimated quarterly payments. Understanding these distinct tax requirements ensures compliance and helps avoid penalties associated with underpayment or misclassification.

Key Differences Between Payroll Tax and Gig Economy Tax

Payroll tax is a mandatory deduction imposed on employers based on employee wages, primarily funding Social Security and Medicare, while gig economy tax applies to independent contractors who must report and pay self-employment taxes directly. Payroll tax obligations typically involve employer withholding and contribution responsibilities, whereas gig workers handle their own tax payments through estimated quarterly filings. Key differences include the tax structure, reporting mechanism, and the responsibility for remittance between traditional employment and gig economy arrangements.

Withholding Requirements: Employees vs. Gig Workers

Payroll tax withholding mandates employers to deduct federal and state income taxes, Social Security, and Medicare from employees' wages, ensuring compliant tax remittance. Gig workers, classified as independent contractors, are responsible for self-reporting earnings and paying estimated taxes directly, as gig economy platforms typically do not withhold taxes. The distinction in withholding requirements affects cash flow management and tax compliance obligations for individuals earning income through traditional employment versus gig work.

Tax Filing Processes for Payroll and Gig Income

Payroll tax filing requires employers to withhold federal and state taxes, submit periodic payroll tax returns, and comply with Social Security and Medicare tax regulations using forms like the IRS Form 941. In contrast, gig economy workers must independently report income using Schedule C and calculate self-employment taxes on IRS Schedule SE, managing quarterly estimated tax payments to avoid penalties. Both tax filing processes demand accurate income tracking, but payroll tax involves employer-managed withholding, while gig workers handle direct tax remittance and recordkeeping.

Social Security and Medicare Contributions Explained

Payroll tax encompasses mandatory Social Security and Medicare contributions withheld from employee wages to fund federal social insurance programs. In the gig economy, workers classified as independent contractors are responsible for the full self-employment tax, covering both the employee and employer portions of Social Security and Medicare taxes. Understanding the distinction between payroll tax withholding and self-employment tax obligations is essential for compliance and accurate financial planning in employment earnings.

Deductions and Allowances: Comparing Both Tax Types

Payroll tax deductions typically include mandatory contributions such as social security, Medicare, and federal withholding allowances, reducing taxable income based on employee status and income levels. Gig economy tax deductions often focus on business-related expenses like equipment, home office, and mileage, allowing independent contractors to offset income beyond standard allowances. Understanding these differences helps optimize tax liabilities by leveraging specific deductions and allowances applicable to either traditional employment or gig work.

Compliance Challenges in Payroll vs. Gig Economy Taxation

Payroll tax compliance is streamlined through established employer reporting systems, allowing consistent withholding and remittance of Social Security, Medicare, and unemployment taxes. In contrast, gig economy tax compliance presents challenges due to the classification of workers as independent contractors, necessitating self-reporting of income and handling of estimated tax payments. This disparity increases the risk of underreporting earnings and creates enforcement complexities for tax authorities.

Penalties for Misclassification of Workers

Misclassifying gig economy workers as independent contractors instead of employees leads to significant penalties under payroll tax laws, including fines and back taxes owed on unpaid payroll tax contributions. The IRS and state tax authorities impose strict enforcement actions to recover Social Security, Medicare, and unemployment taxes from employers who fail to correctly classify workers. Proper classification ensures compliance with payroll tax obligations and avoids costly legal and financial repercussions associated with worker misclassification.

Best Practices for Managing Employment Tax Liabilities

Employers should accurately classify workers to determine the correct payroll tax obligations and avoid penalties. Implementing automated payroll systems ensures timely withholding and remittance of employment taxes, including gig economy earnings subject to self-employment tax. Regular audits and consultations with tax professionals help optimize compliance with evolving regulations and minimize audit risks.

Related Important Terms

Real-Time Payroll Tax Withholding

Real-time payroll tax withholding ensures accurate, immediate deduction of employment taxes from wages, enhancing compliance and cash flow management for businesses. In contrast, gig economy tax obligations often require self-reporting and estimated payments, resulting in varied timelines and increased complexity for independent contractors.

Gig Worker 1099-K Threshold

The Gig Worker 1099-K Threshold requires platforms to report payments exceeding $600 annually, significantly impacting gig economy tax obligations compared to traditional payroll tax systems where employers withhold income and payroll taxes. This threshold increases transparency and tax compliance for gig workers, who must manage self-employment tax responsibilities without automatic withholding.

Pay-As-You-Earn (PAYE) Digital Platforms

Payroll tax typically applies to traditional employment earnings where employers withhold Pay-As-You-Earn (PAYE) taxes directly from employee wages, ensuring tax compliance and simplified reporting. In contrast, gig economy tax obligations often involve digital platforms acting as intermediaries to collect and remit PAYE taxes on behalf of freelancers or independent contractors, addressing challenges in income tracking and tax enforcement.

On-Demand Worker Tax Compliance

Payroll tax applies to traditional employment earnings where employers withhold and remit taxes on behalf of employees, while gig economy tax compliance requires on-demand workers to self-report and pay taxes on their variable income streams. Understanding differences in tax obligations and leveraging digital tools can enhance accurate reporting and ensure timely tax payments for gig workers operating without conventional payroll systems.

Employer of Record (EOR) Payroll Taxation

Employer of Record (EOR) payroll taxation simplifies compliance by centralizing payroll tax obligations, including Social Security, Medicare, and unemployment taxes, for gig economy workers classified as employees rather than independent contractors. This shifts the burden from individual freelancers to the EOR, ensuring accurate withholdings and remittance, and reducing misclassification risks often encountered in gig economy tax reporting.

Platform-Enabled Tax Withholding

Platform-enabled tax withholding automates payroll tax deductions by gig economy platforms, ensuring compliance with employment earnings regulations and reducing underreporting risks. This system enhances tax collection efficiency by directly withholding applicable payroll taxes such as Social Security and Medicare from gig workers' income.

Hybrid Employment Status Tax

Hybrid employment status tax requires gig economy workers to navigate both payroll tax obligations traditionally applied to employees and the self-employment tax framework affecting independent contractors. Understanding the differential impact of these taxes on earnings is crucial for compliance, as hybrid workers must reconcile income reporting under IRS guidelines that blend payroll withholding and self-employment tax responsibilities.

Misclassification Penalty Surcharges

Payroll tax liabilities typically include employer contributions to social security and unemployment insurance, while gig economy tax obligations often hinge on self-employment tax requirements, where misclassification of workers can trigger substantial penalty surcharges. Misclassification penalties arise when gig workers are incorrectly treated as independent contractors instead of employees, resulting in back taxes, interest, and fines that can significantly increase overall tax liability for businesses.

Automated Worker Tax Reporting

Automated worker tax reporting streamlines payroll tax compliance by accurately capturing employment earnings, while addressing the complexities of gig economy tax obligations for independent contractors. This system enhances tax transparency and reduces errors by integrating real-time income data from both traditional payroll and gig platforms.

Portable Benefits Tax Allocation

Payroll tax typically funds traditional employee benefits like Social Security and Medicare, while gig economy tax systems are evolving to allocate portable benefits for independent contractors, ensuring tax contributions correspond to income earned across multiple platforms. Portable benefits tax allocation addresses the challenge of fragmented gig earnings by enabling consistent funding for health insurance, retirement, and other social protections regardless of employment classification.

Payroll Tax vs Gig Economy Tax for employment earnings. Infographic

moneydiff.com

moneydiff.com