Corporate tax directly impacts a business's profitability and investment capacity, influencing decisions on growth and sustainability initiatives. Carbon tax specifically targets environmental impact by imposing costs on carbon emissions, incentivizing companies to adopt greener technologies and reduce their carbon footprint. Sustainable businesses benefit from integrating carbon tax strategies with corporate tax planning to enhance both financial performance and environmental responsibility.

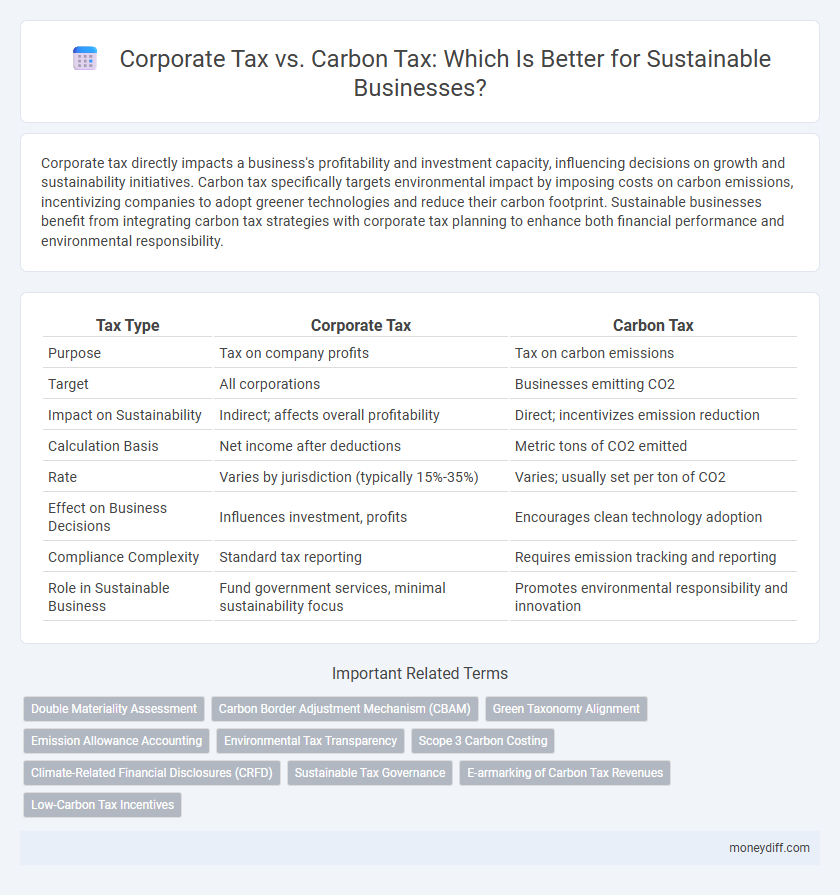

Table of Comparison

| Tax Type | Corporate Tax | Carbon Tax |

|---|---|---|

| Purpose | Tax on company profits | Tax on carbon emissions |

| Target | All corporations | Businesses emitting CO2 |

| Impact on Sustainability | Indirect; affects overall profitability | Direct; incentivizes emission reduction |

| Calculation Basis | Net income after deductions | Metric tons of CO2 emitted |

| Rate | Varies by jurisdiction (typically 15%-35%) | Varies; usually set per ton of CO2 |

| Effect on Business Decisions | Influences investment, profits | Encourages clean technology adoption |

| Compliance Complexity | Standard tax reporting | Requires emission tracking and reporting |

| Role in Sustainable Business | Fund government services, minimal sustainability focus | Promotes environmental responsibility and innovation |

Understanding Corporate Tax and Carbon Tax

Corporate tax is a levy imposed on a company's profits, directly affecting business investments and financial strategies. Carbon tax targets the emission of greenhouse gases, encouraging businesses to reduce their carbon footprint by making pollution more costly. Understanding the differences helps sustainable businesses balance profitability with environmental responsibility.

Key Differences Between Corporate Tax and Carbon Tax

Corporate tax is levied on a company's profits and affects overall financial performance, while carbon tax targets the emission of greenhouse gases to encourage environmentally responsible practices. Corporate tax rates vary by jurisdiction, impacting business investment decisions, whereas carbon tax rates are designed to internalize environmental costs and drive sustainability. The key difference lies in corporate tax focusing on economic income, while carbon tax directly incentivizes reduction in carbon footprint through fiscal measures.

Impact of Corporate Tax on Business Sustainability

Corporate tax directly affects business sustainability by influencing investment capacity and resource allocation for eco-friendly initiatives. Higher corporate tax rates can reduce available capital for sustainable innovations, limiting a company's ability to implement green technologies or meet environmental standards. Balancing corporate tax policies to encourage reinvestment in sustainability practices is critical for fostering long-term ecological and economic growth.

Carbon Tax: Driving Environmental Responsibility

Carbon tax incentivizes sustainable businesses to reduce greenhouse gas emissions by assigning a direct cost to carbon output, promoting cleaner production methods and energy efficiency. Unlike corporate tax, which targets overall profit regardless of environmental impact, carbon tax aligns financial responsibility with ecological sustainability, encouraging innovation in green technologies. This fiscal mechanism supports global climate goals by making carbon-intensive operations less economically viable, thus driving long-term environmental responsibility.

Financial Implications for Sustainable Businesses

Corporate tax directly impacts a sustainable business's profitability by reducing net income and influencing reinvestment capacity, while carbon tax imposes additional operational costs linked to carbon emissions, incentivizing greener practices. Sustainable businesses may benefit from tax credits or deductions under corporate tax codes promoting environmental initiatives, but carbon taxes can increase expenses unless offset by carbon reduction strategies. Evaluating the financial implications of both taxes is crucial for sustainable businesses aiming to optimize cash flow, enhance environmental responsibility, and ensure long-term economic viability.

Tax Compliance Challenges in Sustainable Enterprises

Sustainable enterprises face significant tax compliance challenges balancing corporate tax obligations with emerging carbon tax regulations aimed at reducing environmental impact. Complex reporting requirements for carbon emissions alongside traditional financial disclosures increase administrative burdens and risk of non-compliance. Accurate tracking and integration of environmental data into tax filings demand advanced systems and specialized expertise to meet both tax types effectively.

Incentives for Green Innovation in Tax Policies

Corporate tax policies offering credits and deductions for investments in renewable energy and energy-efficient technologies significantly encourage sustainable business practices. Carbon tax frameworks that allocate revenue towards research and development create strong financial incentives for companies to innovate in reducing emissions. These targeted tax incentives drive green innovation by lowering costs and accelerating the adoption of clean technologies in corporate operations.

Balancing Profitability and Environmental Goals

Corporate tax policies directly impact a company's net profitability and investment capacity, while carbon taxes impose costs linked to greenhouse gas emissions, incentivizing sustainable practices. Balancing these taxes requires businesses to integrate environmental goals into financial planning, leveraging carbon tax credits and deductions to maintain competitive profitability. Effective tax strategies for sustainable businesses optimize the trade-off between fiscal obligations and environmental responsibility, promoting long-term economic and ecological benefits.

International Perspectives on Corporate and Carbon Taxes

International perspectives on corporate tax and carbon tax reveal contrasting approaches to promoting sustainability within businesses, with corporate tax policies often emphasizing profitability and investment incentives while carbon taxes directly target greenhouse gas emissions to drive environmental responsibility. Countries like Sweden and Canada implement carbon taxes to encourage sustainable practices by imposing fees proportional to carbon emissions, effectively integrating environmental costs into business operations. Conversely, nations such as Ireland and Singapore focus on competitive corporate tax rates to attract international investment, which may sometimes challenge the alignment of fiscal policies with sustainability goals.

Strategic Tax Planning for Sustainable Businesses

Strategic tax planning for sustainable businesses involves balancing corporate tax obligations with carbon tax incentives to optimize financial performance while promoting environmental responsibility. Integrating corporate tax credits for green investments alongside carbon tax liabilities encourages companies to adopt sustainable practices and reduce emissions cost-effectively. Effective management of these tax structures supports long-term profitability and compliance with evolving environmental regulations.

Related Important Terms

Double Materiality Assessment

Corporate tax impacts sustainable businesses by influencing financial performance, while carbon tax directly targets environmental externalities, incentivizing emission reductions; the Double Materiality Assessment evaluates both financial and environmental impacts, ensuring comprehensive risk management and value creation. Integrating corporate and carbon tax considerations through Double Materiality enhances decision-making by addressing regulatory compliance, reputational risk, and long-term sustainability goals.

Carbon Border Adjustment Mechanism (CBAM)

The Carbon Border Adjustment Mechanism (CBAM) imposes a carbon tax on imported goods to equalize carbon costs between domestic and foreign producers, encouraging sustainable business practices by addressing carbon leakage. Corporate tax remains a fixed levy on company profits, whereas CBAM specifically targets carbon emissions, incentivizing businesses to reduce their carbon footprint in global supply chains.

Green Taxonomy Alignment

Corporate Tax structures should integrate Green Taxonomy criteria to incentivize sustainable business practices, promoting reductions in carbon emissions and environmentally responsible investments. Carbon Tax directly targets emission-heavy activities by assigning a cost to carbon output, driving companies to align with green taxonomy standards and transition towards low-carbon operations.

Emission Allowance Accounting

Corporate tax impacts sustainable businesses by taxing overall profits, while carbon tax directly targets greenhouse gas emissions, incentivizing emission reductions through financial penalties. Emission allowance accounting tracks and manages permitted emission levels, enabling companies to optimize carbon tax liabilities and align corporate tax strategies with sustainability goals.

Environmental Tax Transparency

Corporate tax systems often lack clarity on environmental impacts, whereas carbon taxes provide transparent incentives by directly pricing carbon emissions, promoting sustainable business practices. Environmental tax transparency enhances corporate accountability, making carbon tax a more effective tool for driving reductions in greenhouse gas emissions within sustainable enterprises.

Scope 3 Carbon Costing

Corporate tax policies impact sustainable businesses by influencing overall profitability, whereas carbon tax specifically targets greenhouse gas emissions, encouraging reductions across Scope 3 emissions from supply chains and product use. Incorporating Scope 3 carbon costing into tax frameworks incentivizes companies to address indirect emissions, driving comprehensive sustainability efforts beyond direct operational impacts.

Climate-Related Financial Disclosures (CRFD)

Corporate tax policies directly impact sustainable businesses' financial planning, while carbon tax incentivizes reduction of greenhouse gas emissions by assigning a cost to carbon output; integrating Climate-Related Financial Disclosures (CRFD) ensures transparent reporting of climate risks and tax-related liabilities, enhancing investor confidence and regulatory compliance. Effective CRFD frameworks enable companies to align corporate tax strategies with carbon tax obligations, promoting sustainability and long-term financial resilience.

Sustainable Tax Governance

Sustainable tax governance for businesses prioritizes integrating corporate tax compliance with carbon tax strategies to enhance environmental responsibility and economic efficiency. Aligning corporate tax practices with carbon taxation frameworks incentivizes sustainable investments and reduces overall tax risk while promoting transparency and accountability in reporting environmental impacts.

E-armarking of Carbon Tax Revenues

Corporate tax rates influence business investment decisions, but carbon tax revenues earmarked specifically for environmental projects drive sustainable innovation by funding renewable energy and emission reduction initiatives. E-armarking of carbon tax revenues ensures transparent allocation, enhancing the effectiveness of climate policies while supporting corporate sustainability commitments.

Low-Carbon Tax Incentives

Low-carbon tax incentives within corporate tax frameworks encourage sustainable business practices by reducing tax liabilities for companies investing in renewable energy, energy-efficient technologies, and carbon reduction initiatives. These incentives create financial benefits that make adopting eco-friendly strategies economically viable, distinguishing corporate tax advantages from traditional carbon taxes that primarily impose costs on carbon emissions without direct fiscal rewards.

Corporate Tax vs Carbon Tax for sustainable businesses Infographic

moneydiff.com

moneydiff.com