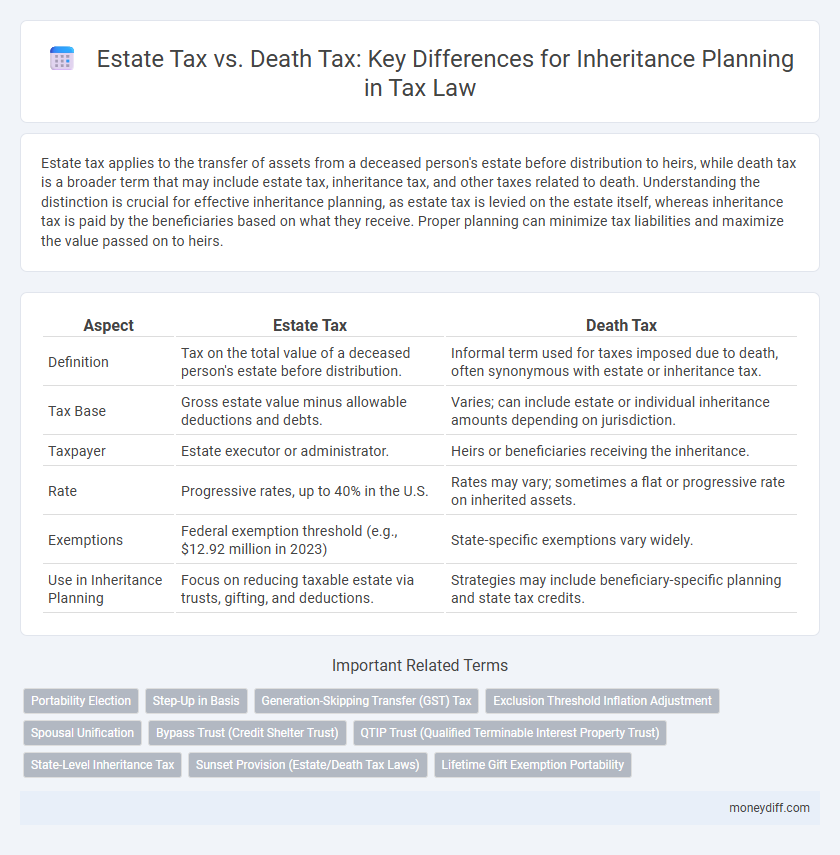

Estate tax applies to the transfer of assets from a deceased person's estate before distribution to heirs, while death tax is a broader term that may include estate tax, inheritance tax, and other taxes related to death. Understanding the distinction is crucial for effective inheritance planning, as estate tax is levied on the estate itself, whereas inheritance tax is paid by the beneficiaries based on what they receive. Proper planning can minimize tax liabilities and maximize the value passed on to heirs.

Table of Comparison

| Aspect | Estate Tax | Death Tax |

|---|---|---|

| Definition | Tax on the total value of a deceased person's estate before distribution. | Informal term used for taxes imposed due to death, often synonymous with estate or inheritance tax. |

| Tax Base | Gross estate value minus allowable deductions and debts. | Varies; can include estate or individual inheritance amounts depending on jurisdiction. |

| Taxpayer | Estate executor or administrator. | Heirs or beneficiaries receiving the inheritance. |

| Rate | Progressive rates, up to 40% in the U.S. | Rates may vary; sometimes a flat or progressive rate on inherited assets. |

| Exemptions | Federal exemption threshold (e.g., $12.92 million in 2023) | State-specific exemptions vary widely. |

| Use in Inheritance Planning | Focus on reducing taxable estate via trusts, gifting, and deductions. | Strategies may include beneficiary-specific planning and state tax credits. |

Estate Tax vs Death Tax: Understanding the Terminology

Estate tax and death tax are often used interchangeably but can differ in scope depending on jurisdiction; estate tax specifically refers to a tax on the deceased person's estate before distribution to heirs, while death tax may include other taxes imposed upon death, such as inheritance tax. Understanding the terminology is crucial for inheritance planning, as estate tax is typically levied on the total value of assets owned at death, whereas inheritance tax is charged on the beneficiary's received portion. Proper planning requires analysis of applicable federal and state laws, exemptions, and tax rates to minimize liabilities affecting asset transfer to heirs.

How Estate and Death Taxes Impact Inheritance

Estate tax and death tax both reduce the value of an inheritance by taxing the transfer of assets after an individual's death. Estate tax is levied on the total value of the deceased's estate before distribution, while death tax commonly refers to inheritance tax imposed on beneficiaries receiving their share. Understanding the differences and applicable rates helps optimize inheritance planning and minimize tax liabilities for heirs.

Federal vs State-Level Taxation on Inherited Assets

Federal estate tax applies to estates exceeding $12.92 million in 2023, while state-level inheritance taxes vary widely, with some states like Maryland and Nebraska imposing them on beneficiaries. Unlike the federal estate tax, which is levied on the total estate value, state inheritance taxes are assessed on the value received by each heir and depend on their relationship to the deceased. Effective inheritance planning requires understanding both federal thresholds and specific state tax rates to minimize liabilities on inherited assets.

Key Differences Between Estate Tax and Death Tax

Estate tax applies to the total value of a deceased person's taxable estate before distribution, while death tax is a broader term that can include various taxes triggered by death, such as inheritance tax. The estate tax is levied on the estate itself, often at the federal level with specific exemption thresholds, whereas inheritance tax is imposed on beneficiaries and varies by state. Understanding these distinctions is crucial for effective inheritance planning to minimize tax liabilities and optimize asset transfer.

Exemptions and Thresholds: Who Pays What?

Estate tax and death tax often refer to the same federal tax imposed on the transfer of a deceased person's estate, with exemptions and thresholds varying by jurisdiction. The federal estate tax exemption in 2024 stands at $12.92 million per individual, meaning estates valued below this amount generally owe no federal estate tax. State-level death taxes may apply with much lower thresholds, sometimes as low as $1 million, requiring careful planning to minimize liabilities for heirs.

Planning Strategies to Minimize Estate and Death Taxes

Effective planning strategies to minimize estate and death taxes include establishing irrevocable trusts, which remove assets from the taxable estate, and gifting assets during the grantor's lifetime to utilize annual gift tax exclusions. Utilizing the lifetime exemption amount strategically through tax-efficient transfers can significantly reduce the taxable estate. Working closely with estate tax professionals to structure charitable donations and family limited partnerships also offers substantial tax savings in inheritance planning.

Legal Tools for Reducing Inheritance Tax Burdens

Legal tools such as revocable living trusts, irrevocable trusts, and qualified personal residence trusts (QPRTs) play a crucial role in reducing estate tax burdens by removing assets from the taxable estate. Grantor retained annuity trusts (GRATs) and charitable remainder trusts (CRTs) also help minimize death tax liabilities by transferring wealth efficiently while preserving income or supporting philanthropy. Utilizing these strategies in inheritance planning allows for significant tax savings and ensures a smoother transfer of assets to beneficiaries.

Recent Legislative Changes in Estate and Death Taxes

Recent legislative changes have significantly altered both estate tax and death tax regulations, impacting inheritance planning strategies. The Inflation Reduction Act of 2022 introduced stricter reporting requirements and adjusted exemption thresholds, which now require more precise asset valuation and timely filings. Taxpayers must closely monitor federal and state-specific amendments to optimize estate tax liabilities and avoid unexpected penalties in wealth transfer planning.

Common Misconceptions About Estate and Death Taxes

Many individuals confuse estate tax and death tax, assuming they are different when in fact death tax is a colloquial term often used to refer to estate tax or inheritance tax depending on jurisdiction. Estate tax applies to the transfer of an estate's value after death before distribution to heirs, while inheritance tax is levied on beneficiaries receiving assets. Misunderstandings about exemption limits, tax rates, and applicable states lead to poor inheritance planning and potential unexpected tax liabilities.

Expert Tips for Navigating Estate Planning and Taxation

Understanding the distinction between estate tax and death tax is crucial for effective inheritance planning, as estate tax applies to the total value of a deceased person's assets before distribution, whereas death tax often refers to state-level taxes imposed on beneficiaries. Expert tax advisors recommend comprehensive asset valuation and strategic use of exemptions, such as the federal estate tax exemption limit of $12.92 million (2023), to minimize tax liabilities. Incorporating trusts, gifting strategies, and timely tax filings ensures smoother estate administration and reduces the risk of unexpected tax burdens for heirs.

Related Important Terms

Portability Election

Estate tax allows the transfer of unused exemption amounts between spouses through the portability election, enabling the surviving spouse to maximize their estate tax exemption. Death tax is a broader term encompassing estate and inheritance taxes, but portability specifically applies only to the federal estate tax, not state-level inheritance taxes.

Step-Up in Basis

Estate tax applies to the total value of a decedent's assets and can reduce the taxable estate, while death tax is a more general term often used interchangeably with estate tax. The step-up in basis allows heirs to reset the asset's cost basis to its fair market value at the date of death, minimizing capital gains tax liability when inherited property is sold.

Generation-Skipping Transfer (GST) Tax

Generation-Skipping Transfer (GST) Tax applies to transfers of assets to beneficiaries more than one generation below the grantor, such as grandchildren, to prevent avoidance of estate and gift taxes across generations. Effective inheritance planning requires careful consideration of GST tax exemption limits and strategies like GST trust creation to minimize overall tax liability.

Exclusion Threshold Inflation Adjustment

The estate tax exclusion threshold adjusts annually for inflation, significantly impacting the amount of an inheritance exempt from taxation, whereas the death tax is often used interchangeably but may vary in definition depending on state laws. Understanding the inflation-adjusted exclusion limits allows estate planners to optimize inheritance strategies and minimize tax liabilities effectively.

Spousal Unification

Estate tax and death tax often refer to the same federal tax imposed on the transfer of assets after death, but terminology varies by state and jurisdiction; spousal unification strategies allow transfer of unlimited assets between spouses without incurring estate tax, leveraging the marital deduction to minimize tax liabilities. Effective inheritance planning incorporates spousal unification to maximize exemptions and defer estate taxes until the death of the surviving spouse, optimizing asset preservation for heirs.

Bypass Trust (Credit Shelter Trust)

A Bypass Trust, also known as a Credit Shelter Trust, strategically utilizes the federal estate tax exemption to minimize estate taxes by holding assets up to the exemption limit outside the taxable estate, thus protecting inherited wealth from both Estate and Death Taxes. This trust structure allows surviving spouses to benefit from trust assets while preserving the deceased spouse's exemption for transfer to heirs, optimizing inheritance planning and reducing overall tax liability.

QTIP Trust (Qualified Terminable Interest Property Trust)

Estate tax applies to the total value of a deceased person's estate before distribution, while death tax commonly refers to any tax imposed upon inheritance transfer, with the QTIP Trust specifically allowing a surviving spouse to receive income from trust assets while deferring estate taxes until their death. Utilizing a QTIP Trust in inheritance planning enables control over asset distribution, provides marital deduction benefits, and ensures proper management of estate tax liabilities for the subsequent beneficiaries.

State-Level Inheritance Tax

State-level inheritance tax is imposed on beneficiaries receiving assets from a decedent, varying significantly by state and often depending on the heir's relationship to the deceased, with spouses usually exempt. Estate tax, distinct from inheritance tax, is levied on the total value of the decedent's estate before distribution, but only a few states impose their own estate taxes alongside the federal tax system.

Sunset Provision (Estate/Death Tax Laws)

Estate tax and death tax often refer to the same federal tax on inherited assets, but differences arise at state levels where some states impose a death tax with unique exemptions and rates. The sunset provision in estate tax laws, such as those in the 2017 Tax Cuts and Jobs Act, schedules the expiration of lower estate tax exemptions by 2026, significantly impacting inheritance planning strategies.

Lifetime Gift Exemption Portability

Lifetime Gift Exemption portability allows heirs to combine the deceased's unused exemption with their own, significantly reducing estate tax liability during inheritance planning by maximizing tax-free transfer limits. Proper utilization of this strategy optimizes wealth preservation and minimizes exposure to both estate tax and death tax liabilities.

Estate Tax vs Death Tax for inheritance planning. Infographic

moneydiff.com

moneydiff.com