Excise tax targets specific goods such as alcohol, tobacco, and fuel, impacting retail businesses by increasing the cost of these products and potentially reducing demand. Sugar tax specifically applies to sugary beverages and snacks, encouraging retailers to stock healthier options while managing pricing strategies to maintain customer appeal. Both taxes influence retail pricing, inventory decisions, and overall profit margins but differ in their scope and health policy objectives.

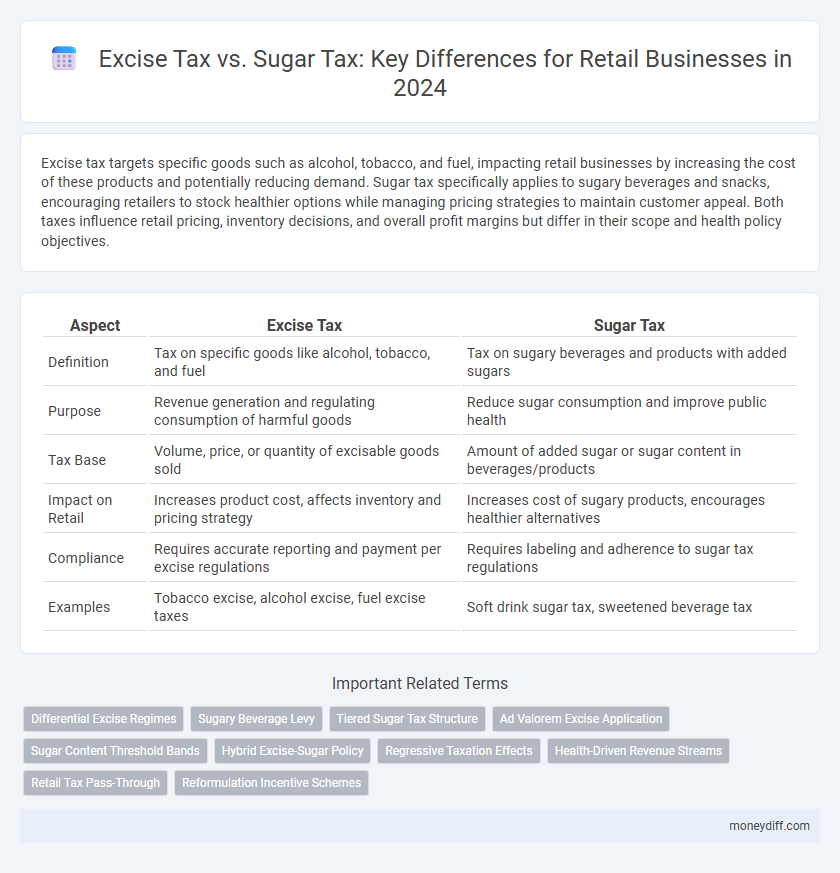

Table of Comparison

| Aspect | Excise Tax | Sugar Tax |

|---|---|---|

| Definition | Tax on specific goods like alcohol, tobacco, and fuel | Tax on sugary beverages and products with added sugars |

| Purpose | Revenue generation and regulating consumption of harmful goods | Reduce sugar consumption and improve public health |

| Tax Base | Volume, price, or quantity of excisable goods sold | Amount of added sugar or sugar content in beverages/products |

| Impact on Retail | Increases product cost, affects inventory and pricing strategy | Increases cost of sugary products, encourages healthier alternatives |

| Compliance | Requires accurate reporting and payment per excise regulations | Requires labeling and adherence to sugar tax regulations |

| Examples | Tobacco excise, alcohol excise, fuel excise taxes | Soft drink sugar tax, sweetened beverage tax |

Understanding Excise Tax: Definition and Scope

Excise tax is a government-imposed levy on specific goods or services, often applied at the production or sale point, affecting retail businesses by increasing product costs and influencing pricing strategies. Sugar tax, a subtype of excise tax, targets sugary beverages to reduce consumption and address public health concerns, impacting retailers' inventory and sales of such products. Understanding the scope of excise tax helps retailers comply with regulations, manage cost implications, and optimize product offerings to maintain profitability.

What is Sugar Tax? Key Features and Purpose

Sugar tax, a subset of excise tax, targets sugary beverages and products to reduce sugar consumption and combat obesity-related health issues. Key features include levying a specific tax per volume or sugar content, incentivizing manufacturers to reformulate products, and generating revenue for public health initiatives. This tax aims to influence consumer behavior by increasing the price of high-sugar items in retail businesses, promoting healthier choices.

Applicability: Which Retail Businesses Are Affected?

Excise tax applies to a wide range of retail businesses that sell specific goods such as alcohol, tobacco, and fuel, targeting industries with high consumption of these regulated products. Sugar tax specifically affects retail businesses selling sugar-sweetened beverages and certain sugary food products, aiming to reduce consumption due to health concerns. Convenience stores, supermarkets, and beverage retailers are primarily impacted by both taxes because they offer taxable items subject to excise or sugar tax regulations.

Calculating Excise Tax vs Sugar Tax: Methods and Examples

Excise tax for retail businesses is typically calculated based on the quantity or value of specific goods sold, such as tobacco or alcohol, using set per-unit rates or percentage values. Sugar tax calculations focus on the sugar content in beverages, charging a rate per gram of sugar exceeding defined thresholds, incentivizing reformulation towards lower sugar levels. For example, a beverage with 10 grams of sugar per 100ml might incur a sugar tax if the threshold is 5 grams, while a pack of cigarettes would be taxed per unit under excise tax regulations.

Compliance Requirements for Retailers

Retailers must navigate distinct compliance requirements for Excise Tax and Sugar Tax, with Excise Tax necessitating detailed documentation of product types, quantities, and payment schedules to federal and state authorities. Sugar Tax compliance demands precise tracking of sugary product sales, clear labeling, and adherence to specific local or regional regulatory guidelines, often involving timely reporting and remittance. Failure to comply with either tax can result in significant penalties, making robust record-keeping systems and tax software integration critical for retail businesses.

Impact on Product Pricing and Sales

Excise tax directly increases the cost of goods by adding a fixed amount per unit, leading retail businesses to raise product prices to maintain profit margins, often resulting in decreased sales volumes. Sugar tax, typically applied as a percentage on sugary beverages or products, causes price hikes that may significantly deter consumer purchases due to health-conscious trends, impacting sales disproportionately in beverage categories. Both taxes compel retailers to strategically adjust pricing and marketing to balance profitability and consumer demand while complying with tax regulations.

Recordkeeping and Reporting Obligations

Retail businesses must maintain detailed records of excise tax payments, including invoices and receipts documenting quantities and values of taxed goods. For sugar tax compliance, companies are required to track sugar content levels in products and report corresponding tax liabilities accurately to tax authorities. Both taxes mandate timely submission of reports, with excise tax often involving monthly filings and sugar tax requiring periodic declarations tied to production or sales volumes.

Tax Deductions and Exemptions: What Retailers Need to Know

Retail businesses subject to excise tax on products like alcohol or tobacco may claim specific tax deductions related to production and distribution expenses, whereas sugar tax often targets sugary beverages with fewer deductions allowed. Understanding exemptions is crucial; excise taxes sometimes exclude certain low-volume producers or essential goods, while sugar tax exemptions may apply to beverages with natural sweeteners or low sugar content. Retailers must carefully evaluate applicable state and local regulations to maximize available deductions and identify any exemptions to optimize tax liability.

Penalties for Non-Compliance With Excise and Sugar Taxes

Retail businesses face significant penalties for non-compliance with excise and sugar taxes, including fines that can reach thousands of dollars per violation and potential suspension of licenses. Failure to accurately report or remit these taxes may also result in interest charges and legal actions from tax authorities. Consistent record-keeping and timely payments are essential to avoid these financial and operational risks.

Strategies for Effective Tax Management in Retail

Retail businesses can enhance tax management by distinguishing excise tax, applied on specific goods like alcohol and tobacco, from sugar tax, which targets sugary beverages to discourage consumption. Implementing accurate product categorization and leveraging tax compliance software reduces errors and penalties. Strategic pricing and inventory management aligned with these tax structures optimize profit margins while maintaining regulatory adherence.

Related Important Terms

Differential Excise Regimes

Excise tax on retail businesses typically targets specific goods like alcohol and tobacco, imposing fixed rates based on volume or value, while sugar tax specifically imposes higher levies on beverages with high sugar content to curb consumption and promote health. Differential excise regimes create tailored tax structures that balance revenue generation and public health objectives by varying rates according to product type, sugar concentration, and health impact assessments.

Sugary Beverage Levy

The Sugary Beverage Levy targets retail businesses selling sugar-sweetened drinks by imposing excise tax rates based on sugar content to discourage consumption and reduce public health risks. This tax structure differs from general excise taxes by specifically focusing on sugar levels, incentivizing reformulation and impacting pricing strategies in the beverage retail sector.

Tiered Sugar Tax Structure

Retail businesses face distinct challenges under excise tax versus tiered sugar tax structures, with the latter imposing variable rates based on sugar content, incentivizing reduced sugar levels in products. This tiered approach directly affects pricing strategies and product formulations, prompting retailers to adapt inventory and marketing to comply with escalating tax brackets and support healthier consumer choices.

Ad Valorem Excise Application

Ad valorem excise tax on retail businesses is calculated as a percentage of the product's value, impacting pricing strategies more significantly than the fixed-rate sugar tax applied specifically to sugary beverages. While sugar tax targets health-related consumption by levying a set fee per unit of sugar content, ad valorem excise tax adjusts in proportion to product price, affecting a broader range of goods and driving variability in retail cost structures.

Sugar Content Threshold Bands

Excise tax on sugary products varies significantly based on sugar content threshold bands, with higher rates applied to beverages exceeding specified grams of sugar per 100ml, incentivizing retailers to shift towards lower-sugar alternatives. Retail businesses must closely monitor these thresholds to optimize pricing strategies and ensure compliance with evolving sugar tax regulations aimed at reducing sugar consumption and public health risks.

Hybrid Excise-Sugar Policy

Retail businesses navigating hybrid excise-sugar tax policies must strategically manage compliance complexities arising from overlapping tax bases on sugary products and excisable goods like alcohol and tobacco. Understanding differential tax rates, reporting requirements, and potential exemptions is essential for optimizing pricing strategies and minimizing fiscal liabilities under these combined tax structures.

Regressive Taxation Effects

Excise tax and sugar tax both impose financial burdens on retail businesses, but sugar tax often exacerbates regressive taxation effects by disproportionately impacting low-income consumers who spend a higher percentage of their income on sugary products. Excise taxes on broader goods may distribute costs more evenly, yet both result in reduced purchasing power and potential shifts in consumer behavior that retailers must strategically address.

Health-Driven Revenue Streams

Excise tax targets specific goods such as tobacco and alcohol, generating stable revenue streams for retail businesses while indirectly promoting public health by discouraging consumption. Sugar tax specifically aims at reducing sugar-sweetened beverage consumption, creating health-driven revenue channels that encourage product reformulation and align with growing consumer demand for healthier options.

Retail Tax Pass-Through

Excise tax on retail businesses typically applies uniformly to specific goods, allowing clearer tax pass-through to consumers, whereas sugar tax targets sugary products with varied rates that can complicate direct retail price adjustments. Retail tax pass-through effectiveness depends on the product's demand elasticity and competitive market, influencing how much of the excise or sugar tax is reflected in consumer prices.

Reformulation Incentive Schemes

Excise tax targets specific goods like tobacco and alcohol to generate revenue and reduce consumption, while sugar tax specifically imposes levies on sugary beverages to combat obesity and related health issues. Reformulation incentive schemes encourage retail businesses to reduce sugar content in products by offering tax reductions or exemptions, driving healthier product offerings and aligning corporate practices with public health goals.

Excise Tax vs Sugar Tax for retail businesses Infographic

moneydiff.com

moneydiff.com