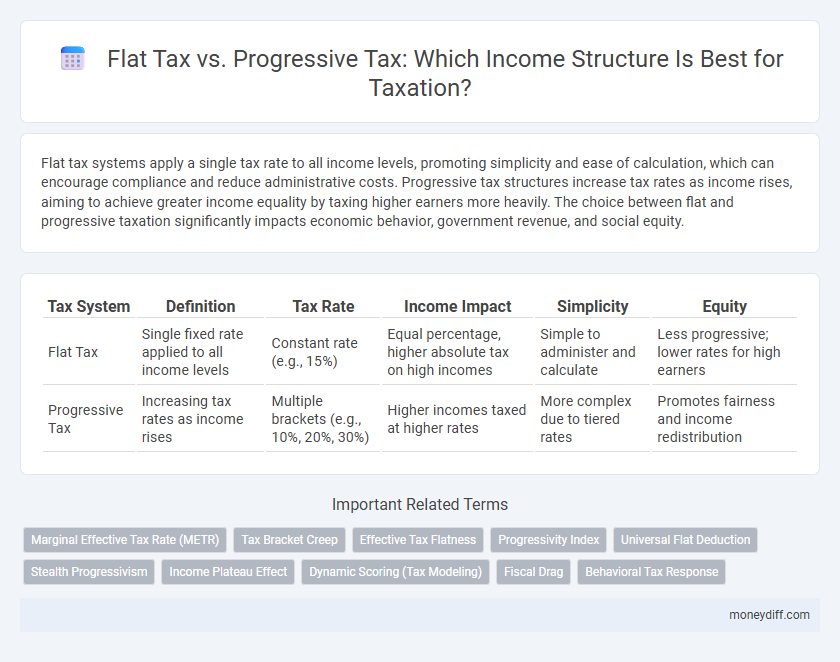

Flat tax systems apply a single tax rate to all income levels, promoting simplicity and ease of calculation, which can encourage compliance and reduce administrative costs. Progressive tax structures increase tax rates as income rises, aiming to achieve greater income equality by taxing higher earners more heavily. The choice between flat and progressive taxation significantly impacts economic behavior, government revenue, and social equity.

Table of Comparison

| Tax System | Definition | Tax Rate | Income Impact | Simplicity | Equity |

|---|---|---|---|---|---|

| Flat Tax | Single fixed rate applied to all income levels | Constant rate (e.g., 15%) | Equal percentage, higher absolute tax on high incomes | Simple to administer and calculate | Less progressive; lower rates for high earners |

| Progressive Tax | Increasing tax rates as income rises | Multiple brackets (e.g., 10%, 20%, 30%) | Higher incomes taxed at higher rates | More complex due to tiered rates | Promotes fairness and income redistribution |

Understanding Flat Tax and Progressive Tax Systems

Flat tax systems impose a uniform tax rate on all income levels, ensuring simplicity and predictable tax liability for individuals and businesses. Progressive tax systems apply increasing tax rates as income rises, aiming to reduce income inequality by taxing higher earners at higher percentages. Understanding these contrasting structures helps evaluate their impact on revenue generation, economic behavior, and social equity within tax policy debates.

Core Principles of Flat Tax

The core principles of a flat tax emphasize simplicity, uniformity, and transparency by applying a single constant rate to all income levels. This system eliminates deductions and credits, reducing administrative costs and minimizing opportunities for tax avoidance. Advocates argue it promotes fairness by treating all taxpayers equally and encourages economic growth through clearer incentives.

Key Features of Progressive Tax

Progressive tax imposes higher tax rates on higher income brackets, ensuring taxpayers with greater earnings contribute a larger share of their income. This structure promotes income redistribution by reducing the tax burden on low-income earners while increasing it progressively. It features multiple tax brackets with escalating rates that align tax liability with the ability to pay, enhancing equity and social justice within the fiscal system.

Comparing Tax Rate Structures

Flat tax employs a single fixed rate on all income levels, simplifying compliance and reducing administrative costs. Progressive tax rates increase with income, aiming to enhance equity by taxing higher earners at higher percentages. The choice between these structures impacts revenue generation, taxpayer behavior, and socioeconomic inequality differently.

Impact on Different Income Groups

Flat tax systems impose a uniform tax rate on all income levels, resulting in predictable deductions but potentially placing a heavier relative burden on low-income earners. Progressive tax structures increase tax rates with income brackets, which can alleviate financial pressure on lower-income groups while generating higher revenue from wealthy individuals. Analyzing income distribution data reveals that progressive taxation often promotes greater economic equity by redistributing wealth more effectively than flat tax models.

Economic Growth and Incentives

Flat tax systems, characterized by a single constant tax rate, provide strong incentives for increased productivity and investment by simplifying compliance and reducing marginal tax rates on higher incomes. Progressive tax structures, with rising rates at higher income brackets, aim to redistribute wealth and fund public services but may discourage additional work effort and entrepreneurship due to higher marginal tax burdens. Empirical studies suggest that flat taxes can stimulate economic growth by enhancing incentives for income generation, while progressive taxes may promote equity at the potential cost of reduced economic dynamism.

Tax Fairness and Equity Concerns

Flat tax systems apply a uniform rate to all income levels, simplifying compliance but often drawing criticism for disproportionately burdening lower-income earners. Progressive tax structures impose higher rates on higher income brackets, aiming to enhance tax fairness by reducing income inequality and funding public services more equitably. Equity concerns in tax design revolve around whether taxpayers contribute according to their ability to pay, with progressive taxes generally viewed as better aligned with vertical equity principles.

Administrative Simplicity and Complexity

Flat tax systems offer administrative simplicity through a single, consistent tax rate applied uniformly across all income levels, reducing bookkeeping, compliance costs, and simplifying tax calculations. In contrast, progressive tax structures involve multiple tax brackets and rates, increasing complexity in income reporting, withholding, and enforcement, which demands more extensive administrative resources. The simplicity of flat tax models can enhance efficiency but may limit flexibility in addressing income inequality compared to the nuanced approach of progressive taxation.

Effects on Government Revenue

Flat tax systems generate consistent and predictable government revenue streams by applying a uniform rate across all income levels, which simplifies tax administration. Progressive tax structures increase government revenue during periods of economic growth by taxing higher income brackets at elevated rates, potentially enhancing wealth redistribution. However, progressive taxes can introduce complexity and create incentives for tax avoidance, impacting overall revenue collection efficiency.

Choosing the Right Tax System for Income Structure

Choosing the right tax system for income structure depends on the goal of equity versus simplicity. Flat tax systems offer a uniform rate, promoting simplicity and easing compliance for all income levels, while progressive tax systems impose higher rates on higher income brackets to reduce income inequality. Policymakers must balance revenue needs, economic incentives, and social equity when determining an optimal tax design.

Related Important Terms

Marginal Effective Tax Rate (METR)

The Marginal Effective Tax Rate (METR) under a flat tax system remains constant across all income levels, simplifying compliance but potentially reducing progressivity in wealth distribution. In contrast, a progressive tax system increases the METR with higher income brackets, enhancing equity by imposing greater tax burdens on top earners, although it may introduce complexity and possible economic distortions.

Tax Bracket Creep

Flat tax systems apply a single tax rate regardless of income, avoiding tax bracket creep but potentially increasing the tax burden on lower-income earners. Progressive tax structures adjust rates based on income levels, often leading to bracket creep where inflation or wage growth pushes taxpayers into higher brackets, increasing tax liability without real income gains.

Effective Tax Flatness

Flat tax systems impose a uniform tax rate on all income levels, resulting in consistent effective tax flatness that simplifies compliance and reduces administrative costs. In contrast, progressive tax structures apply increasing rates with higher income brackets, decreasing effective tax flatness but aiming to enhance equity by taxing higher earners proportionally more.

Progressivity Index

The Progressivity Index measures the degree to which a tax system, such as a progressive tax, imposes higher rates on increased income levels, ensuring equitable redistribution and reducing income inequality. In contrast, a flat tax applies a constant rate regardless of income, resulting in a Progressivity Index close to zero and minimal impact on wealth disparities.

Universal Flat Deduction

A universal flat deduction simplifies income tax structures by providing a fixed amount exempt from taxation, which enhances fairness and maintains progressivity within a flat tax system. This approach balances revenue generation and taxpayer equity by reducing the tax burden on low-income earners while applying a consistent marginal tax rate on remaining income.

Stealth Progressivism

Stealth progressivism in income tax structures disguises progressive tax burdens within seemingly flat tax rates by incorporating deductions and exemptions that disproportionately benefit higher earners. This approach maintains the appearance of simplicity while effectively increasing tax progressivity and revenue redistribution.

Income Plateau Effect

Flat tax systems create an income plateau effect by taxing all income levels at a single rate, which can discourage additional earnings beyond certain thresholds due to diminishing marginal returns. Progressive tax structures mitigate this effect by imposing higher rates on increased income brackets, promoting equity but potentially disincentivizing high-income productivity.

Dynamic Scoring (Tax Modeling)

Dynamic scoring in tax modeling evaluates the economic impact of flat tax and progressive tax structures by estimating changes in GDP, employment, and taxable income over time; flat tax systems often predict increased labor supply and investment due to simplicity and lower marginal rates, while progressive tax models incorporate effects of higher marginal rates on income distribution and consumption patterns. Accurate dynamic scoring adjusts revenue projections by simulating behavioral responses, providing policymakers with data-driven insights on growth and equity trade-offs between flat and progressive income tax regimes.

Fiscal Drag

Fiscal drag occurs when inflation pushes taxpayers into higher income tax brackets under a progressive tax system, increasing tax liabilities without real income growth. A flat tax structure eliminates fiscal drag by applying a single tax rate to all income levels, preventing bracket creep and stabilizing tax burdens over time.

Behavioral Tax Response

Flat tax systems promote consistent marginal tax rates, encouraging labor supply and investment by minimizing distortions in work incentives. Progressive tax structures, while aiming for equity through higher rates on top incomes, can reduce taxable income by discouraging additional effort and encouraging tax avoidance behaviors among high earners.

Flat Tax vs Progressive Tax for income structure. Infographic

moneydiff.com

moneydiff.com