Tax consultancy offers personalized guidance and expert insights that ensure accurate filing and maximized deductions, which automated DIY tax tools may overlook. DIY tax automation can streamline simple returns and reduce costs but often lacks the nuance needed for complex tax situations or strategic planning. Selecting between the two depends on the taxpayer's comfort with tax regulations, complexity of their financial situation, and need for tailored advice.

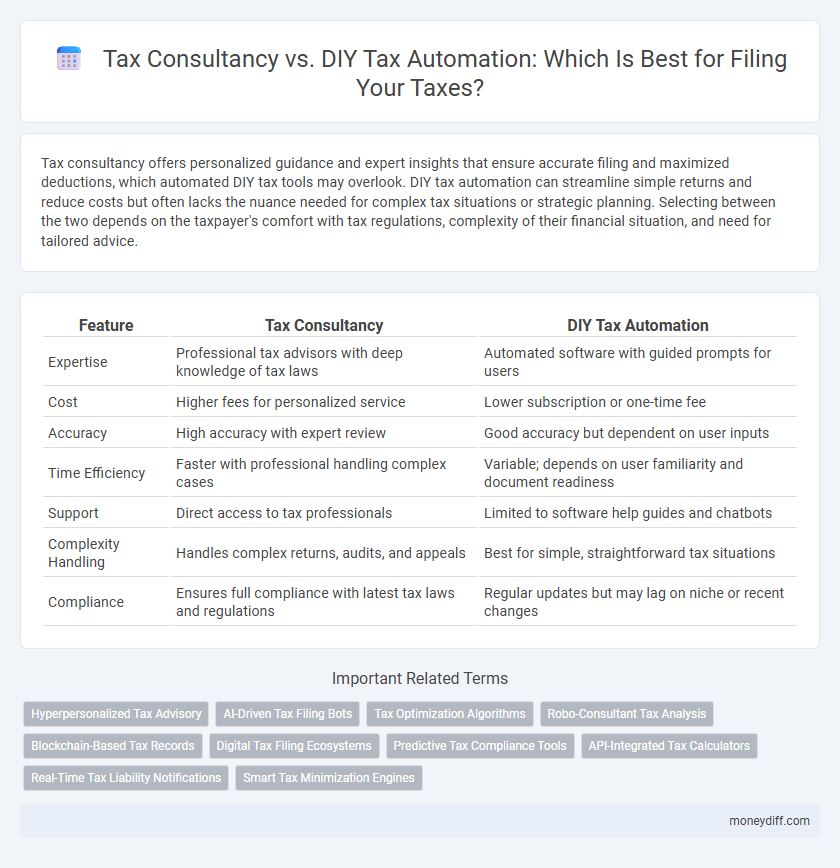

Table of Comparison

| Feature | Tax Consultancy | DIY Tax Automation |

|---|---|---|

| Expertise | Professional tax advisors with deep knowledge of tax laws | Automated software with guided prompts for users |

| Cost | Higher fees for personalized service | Lower subscription or one-time fee |

| Accuracy | High accuracy with expert review | Good accuracy but dependent on user inputs |

| Time Efficiency | Faster with professional handling complex cases | Variable; depends on user familiarity and document readiness |

| Support | Direct access to tax professionals | Limited to software help guides and chatbots |

| Complexity Handling | Handles complex returns, audits, and appeals | Best for simple, straightforward tax situations |

| Compliance | Ensures full compliance with latest tax laws and regulations | Regular updates but may lag on niche or recent changes |

Understanding Tax Consultancy and DIY Tax Automation

Tax consultancy offers personalized expertise by leveraging experienced professionals to navigate complex tax laws, optimize deductions, and ensure compliance, reducing the risk of errors and audits. DIY tax automation utilizes advanced software and algorithms to streamline the filing process, provide real-time tax calculations, and deliver step-by-step guidance, making tax preparation accessible and cost-effective for individuals with straightforward financial situations. Understanding the trade-offs between expert-driven consultancy and automated DIY tools helps taxpayers choose based on complexity, budget, and desired accuracy.

Key Differences Between Professional Tax Consultants and Automation Tools

Professional tax consultants offer personalized advice tailored to complex financial situations, ensuring compliance with the latest tax laws and maximizing deductions. DIY tax automation tools provide cost-effective solutions with step-by-step guidance, ideal for straightforward tax returns but may lack nuanced understanding of unique tax scenarios. The key difference lies in the expert judgment and customized strategies from consultants versus the efficiency and accessibility of automated software.

Benefits of Hiring a Tax Consultant

Hiring a tax consultant offers personalized expertise that ensures accurate deductions and compliance with the latest tax laws, minimizing the risk of errors and audits. Tax professionals provide tailored strategies for complex financial situations, maximizing refunds and reducing liabilities more effectively than generic DIY tax automation. Their deep knowledge and experience save time and stress by handling intricate filings and responding promptly to IRS inquiries.

Advantages of Using DIY Tax Automation Software

DIY tax automation software offers significant advantages such as cost savings by eliminating pricey consultancy fees and providing instant, accurate tax calculations through advanced algorithms. These platforms seamlessly integrate with financial accounts, ensuring real-time data updates and minimizing manual errors for faster filing. Accessibility and user-friendly interfaces empower taxpayers to manage returns efficiently while retaining control over their tax information.

Cost Comparison: Consultancy Fees vs. Automation Expenses

Tax consultancy fees typically range from $200 to $500 per return, reflecting personalized service and expert advice. DIY tax automation tools usually cost between $20 and $100 annually, offering a cost-effective alternative with software-driven accuracy. Although automation reduces upfront expenses, complex tax situations may necessitate consultancy to avoid costly errors and maximize deductions.

Accuracy and Error Reduction in Tax Filing

Tax consultancy services offer specialized expertise and personalized review, significantly enhancing accuracy and minimizing errors in complex tax filings. DIY tax automation tools provide user-friendly interfaces with built-in error checks and real-time guidance, reducing mistakes for straightforward tax situations. Combining professional oversight with advanced software can optimize error reduction, ensuring compliance and maximizing tax benefits.

Security and Data Privacy: Manual vs. Automated Methods

Tax consultancy offers personalized security measures, ensuring sensitive financial data is handled by trusted professionals bound by confidentiality laws. DIY tax automation relies on encrypted software platforms that provide real-time data protection, but risks increase if users fail to update security protocols or use unsecured networks. Manual methods reduce exposure to cyber threats but may be prone to human error, whereas automated systems enhance accuracy but require vigilant data privacy management.

Time Efficiency: Consultants vs. Self-Service Automation

Tax consultancy services streamline filing through expert knowledge, reducing errors and minimizing audit risks, ultimately saving clients valuable time during tax season. In contrast, DIY tax automation platforms offer user-friendly interfaces and real-time data integration, allowing taxpayers to complete returns quickly without professional assistance. While consultants provide personalized advice and complex issue resolution, automated tools excel in handling straightforward filings efficiently, optimizing overall time management based on individual tax situations.

Ideal Situations for Choosing Each Approach

Tax consultancy is ideal for complex financial situations, such as high-income earners, business owners, or those with multiple income streams, where expert advice ensures compliance and maximizes deductions. DIY tax automation suits individuals with straightforward tax returns, limited deductions, and a solid understanding of tax software, providing cost-effective and efficient filing. Choosing between these approaches depends on the taxpayer's financial complexity, need for personalized guidance, and tolerance for handling tax-related details independently.

Making the Right Choice for Your Tax Filing Needs

Tax consultancy offers personalized expertise, ensuring accurate deductions and compliance tailored to complex financial situations, reducing audit risks. DIY tax automation provides convenience and cost savings with guided software support, suitable for straightforward returns and tech-savvy filers. Evaluating your tax complexity, comfort with tax laws, and budget helps determine the ideal filing method for maximizing refunds and minimizing errors.

Related Important Terms

Hyperpersonalized Tax Advisory

Hyperpersonalized tax advisory delivers tailored strategies leveraging individual financial data, outperforming generic DIY tax automation by maximizing deductions and minimizing audit risks. Advanced tax consultants use real-time analytics and AI-driven insights to adapt to evolving tax laws, ensuring precise compliance and optimized returns.

AI-Driven Tax Filing Bots

AI-driven tax filing bots enhance accuracy and speed by automating data entry and deduction optimization, reducing human errors often encountered in DIY tax filing methods. Tax consultancy leverages personalized expertise to navigate complex tax laws and ensure compliance, offering tailored strategies beyond the capabilities of automated solutions.

Tax Optimization Algorithms

Tax consultancy leverages advanced tax optimization algorithms tailored by experts to maximize deductions and minimize liabilities based on individual financial nuances. DIY tax automation tools utilize generalized algorithms designed for broad applicability, which may overlook complex tax-saving opportunities available through personalized consultancy.

Robo-Consultant Tax Analysis

Robo-consultant tax analysis leverages AI-driven algorithms to provide precise, personalized tax filing recommendations, reducing human error and increasing efficiency compared to traditional tax consultancy. DIY tax automation tools integrate real-time tax code updates and data import features, enabling users to optimize deductions and credits without professional intervention.

Blockchain-Based Tax Records

Blockchain-based tax records offer enhanced security and transparency, reducing errors and fraud in tax filings compared to traditional methods. While DIY tax automation provides convenience, tax consultancy leverages blockchain insights to ensure compliance with complex regulations and optimize tax savings.

Digital Tax Filing Ecosystems

Tax consultancy offers personalized expertise and risk mitigation within digital tax filing ecosystems, enhancing accuracy and compliance with evolving regulations. DIY tax automation platforms leverage AI and real-time data integration to streamline filing processes but may lack the nuanced understanding of complex tax scenarios handled by professional consultants.

Predictive Tax Compliance Tools

Predictive tax compliance tools leverage artificial intelligence and machine learning algorithms to analyze financial data, reducing errors and optimizing deductions for accurate filing in both tax consultancy and DIY tax automation. Tax consultants benefit from these tools to enhance client advisory services, while DIY platforms empower individuals with real-time insights and compliance forecasts, streamlining the filing process.

API-Integrated Tax Calculators

API-integrated tax calculators streamline the filing process by automating complex calculations and ensuring real-time compliance with evolving tax regulations, offering greater accuracy compared to manual DIY tax software. Tax consultancy leverages expert insights alongside these advanced tools to tailor tax strategies, reduce liabilities, and address specific client needs that automated systems might overlook.

Real-Time Tax Liability Notifications

Real-time tax liability notifications enhance accuracy by immediately alerting taxpayers to potential tax dues, reducing errors compared to DIY tax automation tools that may lack instant updates. Tax consultancy services provide expert interpretation of these real-time alerts, ensuring compliance and optimized filing strategies tailored to individual financial situations.

Smart Tax Minimization Engines

Smart Tax Minimization Engines integrated in tax consultancy services leverage advanced algorithms and real-time data to optimize deductions and credits more effectively than DIY tax automation tools. These engines analyze complex financial scenarios and regulatory changes, ensuring precise tax strategies that minimize liabilities beyond the capacity of generic software solutions.

Tax Consultancy vs DIY Tax Automation for Filing Infographic

moneydiff.com

moneydiff.com