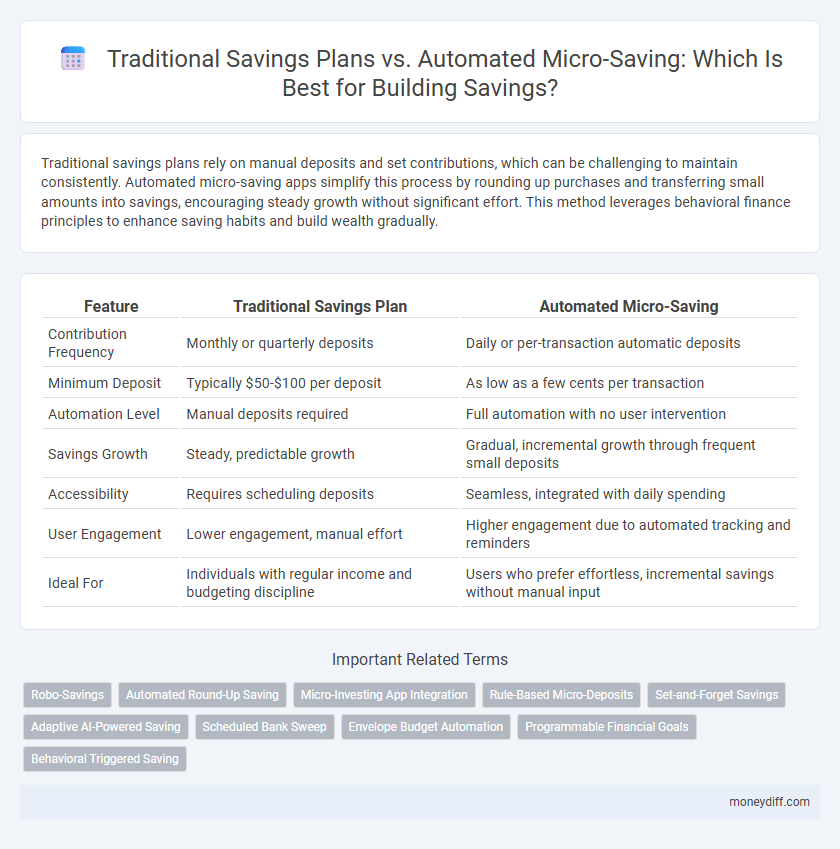

Traditional savings plans rely on manual deposits and set contributions, which can be challenging to maintain consistently. Automated micro-saving apps simplify this process by rounding up purchases and transferring small amounts into savings, encouraging steady growth without significant effort. This method leverages behavioral finance principles to enhance saving habits and build wealth gradually.

Table of Comparison

| Feature | Traditional Savings Plan | Automated Micro-Saving |

|---|---|---|

| Contribution Frequency | Monthly or quarterly deposits | Daily or per-transaction automatic deposits |

| Minimum Deposit | Typically $50-$100 per deposit | As low as a few cents per transaction |

| Automation Level | Manual deposits required | Full automation with no user intervention |

| Savings Growth | Steady, predictable growth | Gradual, incremental growth through frequent small deposits |

| Accessibility | Requires scheduling deposits | Seamless, integrated with daily spending |

| User Engagement | Lower engagement, manual effort | Higher engagement due to automated tracking and reminders |

| Ideal For | Individuals with regular income and budgeting discipline | Users who prefer effortless, incremental savings without manual input |

Understanding Traditional Savings Plans

Traditional savings plans involve setting aside fixed amounts of money regularly, often through bank-held accounts or certificates of deposit, which typically offer stable but modest interest rates. These plans emphasize disciplined saving habits and provide predictable growth, making them suitable for individuals seeking low-risk options with liquidity. Compared to automated micro-saving, traditional plans require active management and larger minimum deposits, potentially limiting accessibility for those with fluctuating incomes.

What Are Automated Micro-Saving Apps?

Automated micro-saving apps help users save money effortlessly by rounding up everyday purchases to the nearest dollar and transferring the spare change into a savings account or investment fund. These apps use algorithms to analyze spending habits and set aside small, manageable amounts without requiring manual deposits. Compared to traditional savings plans, automated micro-saving apps promote consistent saving through seamless integration with daily financial activities.

Key Differences Between Traditional and Automated Saving

Traditional savings plans require manual deposits and consistent discipline to grow funds, often leading to irregular saving habits and slower accumulation. Automated micro-saving apps transfer small amounts frequently, improving saving consistency by leveraging behavioral triggers and reducing the impact of forgetfulness. The key difference lies in automation's ability to enhance saving frequency and build wealth incrementally without active user intervention.

Benefits of Traditional Savings Methods

Traditional savings plans offer a reliable and structured way to build financial security through consistent deposits into a designated account, often earning higher interest rates compared to non-traditional methods. These plans provide clear visibility and control over funds without the need for digital tools, appealing to individuals who prefer straightforward, low-risk saving strategies. Moreover, traditional methods foster disciplined saving habits, which can lead to substantial long-term wealth accumulation and financial stability.

Advantages of Automated Micro-Saving Tools

Automated micro-saving tools offer the advantage of consistent, small-scale contributions that accumulate over time without requiring active effort, promoting disciplined saving habits. These tools often sync with spending patterns, rounding up purchases to the nearest dollar and saving the difference, which minimizes financial strain while maximizing savings growth. Compared to traditional savings plans, automated micro-savings enable increased compounding benefits through frequent deposits and reduce the risk of missed contributions due to forgetfulness or irregular income.

Accessibility: Which Savings Approach Is More Convenient?

Traditional savings plans often require minimum initial deposits and scheduled contributions, which can be less accessible for individuals with irregular income or limited funds. Automated micro-saving tools enable seamless, small, frequent transfers directly from spending accounts, increasing convenience and participation for a broader demographic. This approach leverages technology to simplify savings, promoting consistent habit formation without the need for active management.

Cost and Fees: Comparing Savings Solutions

Traditional Savings Plans often involve higher fees such as account maintenance charges and minimum balance penalties, reducing overall returns. Automated Micro-Saving solutions typically charge lower or no fees, enabling incremental deposits without significant cost impact. Choosing an option with minimal fees maximizes savings growth and improves long-term financial benefits.

Security and Reliability of Both Saving Styles

Traditional savings plans offer high security through FDIC-insured bank accounts, ensuring principal protection and consistent interest earnings. Automated micro-saving apps leverage encryption, two-factor authentication, and regulatory compliance to secure small, frequent transactions, while providing reliable round-up or scheduled deposits that build savings effortlessly. Both methods maintain reliability, but traditional plans benefit from long-established financial institutions, whereas micro-saving platforms excel in user-friendly automation and accessible money management.

Personalization: Tailoring Savings to Your Goals

Traditional savings plans often follow fixed schedules and amounts, limiting flexibility for personalized goals. Automated micro-saving apps adjust deposits based on spending habits and financial patterns, providing a customized approach to reach individual savings targets effectively. Personalization in micro-saving tools enhances motivation and consistency by aligning contributions with real-time income fluctuations and specific financial objectives.

Which Savings Approach Fits Your Lifestyle?

Traditional savings plans offer structured, regular deposits often favored by individuals with steady income and disciplined budgeting habits, while automated micro-saving apps enable frequent, small transfers ideal for those seeking seamless, hands-off saving aligned with daily spending patterns. Automated micro-saving tools leverage round-ups and algorithm-driven transfers, optimizing savings growth without requiring significant financial planning effort. Choosing between these approaches depends on your income consistency, financial goals, and preference for manual control versus automated convenience in managing your savings.

Related Important Terms

Robo-Savings

Robo-savings leverage automated micro-saving technology to transfer small amounts into savings consistently, outperforming traditional savings plans that rely on manual deposits and fixed schedules. This approach increases saving frequency and minimizes user effort, resulting in higher overall savings accumulation and improved financial discipline.

Automated Round-Up Saving

Automated round-up saving enhances traditional savings plans by seamlessly rounding up everyday purchases to the nearest dollar and transferring the difference into a savings account, promoting consistent, effortless accumulation. This micro-saving strategy leverages technology to boost saving habits without requiring significant changes in spending behavior, making it highly effective for gradual wealth building.

Micro-Investing App Integration

Traditional savings plans rely on manual deposits with fixed amounts and schedules, often limiting flexibility and growth potential, while automated micro-saving plans integrated with micro-investing apps enable seamless, incremental contributions that grow through diversified portfolios, maximizing wealth accumulation over time. The integration of micro-investing apps allows real-time tracking and automatic investment of spare change, optimizing savings efficiency and financial discipline without requiring significant upfront capital.

Rule-Based Micro-Deposits

Traditional Savings Plans rely on fixed monthly deposits, often limiting flexibility and growth opportunities, while Automated Micro-Saving leverages rule-based micro-deposits triggered by user-defined conditions to incrementally boost savings without noticeable impact on daily finances. Rule-Based Micro-Deposits optimize cash flow management by automatically transferring small amounts based on spending patterns, thresholds, or calendar events, enhancing consistency and accelerating savings accumulation.

Set-and-Forget Savings

Traditional Savings Plans require manual deposits and regular attention, often leading to inconsistent saving habits, while Automated Micro-Saving apps enable set-and-forget savings by automatically transferring small amounts from checking accounts, promoting steady growth with minimal effort. This seamless automation leverages behavioral economics to encourage consistent saving, resulting in higher accumulation over time compared to conventional methods.

Adaptive AI-Powered Saving

Adaptive AI-powered saving optimizes traditional savings plans by analyzing spending patterns and automatically adjusting micro-savings to maximize growth while minimizing user effort. This intelligent system enhances financial discipline and accelerates wealth accumulation through personalized, data-driven increments.

Scheduled Bank Sweep

Scheduled Bank Sweep in a Traditional Savings Plan automatically transfers fixed amounts to savings at set intervals, ensuring disciplined savings accumulation. Automated Micro-Saving leverages frequent, small transfers based on spending patterns, creating a seamless, incremental saving process without requiring manual input.

Envelope Budget Automation

Traditional Savings Plans typically involve manual allocation of fixed amounts into designated accounts, while Automated Micro-Saving leverages envelope budget automation to categorize expenses and automatically transfer small, frequent savings into targeted funds. This method enhances disciplined saving by integrating spending habits with real-time budget adjustments, increasing overall savings efficiency.

Programmable Financial Goals

Traditional savings plans rely on fixed contributions and manual adjustments, limiting flexibility in reaching programmable financial goals. Automated micro-saving solutions enable customizable, goal-driven deposits that dynamically adapt to spending patterns, enhancing consistent progress toward specific objectives.

Behavioral Triggered Saving

Behavioral triggered savings in automated micro-saving tools use real-time spending patterns and psychological nudges to encourage small, consistent deposits, significantly improving saving habits compared to traditional savings plans that rely on fixed schedules and less frequent contributions. This dynamic approach leverages behavioral economics to reduce friction and increase saving frequency, resulting in higher overall savings accumulation and better financial discipline.

Traditional Savings Plan vs Automated Micro-Saving for savings. Infographic

moneydiff.com

moneydiff.com