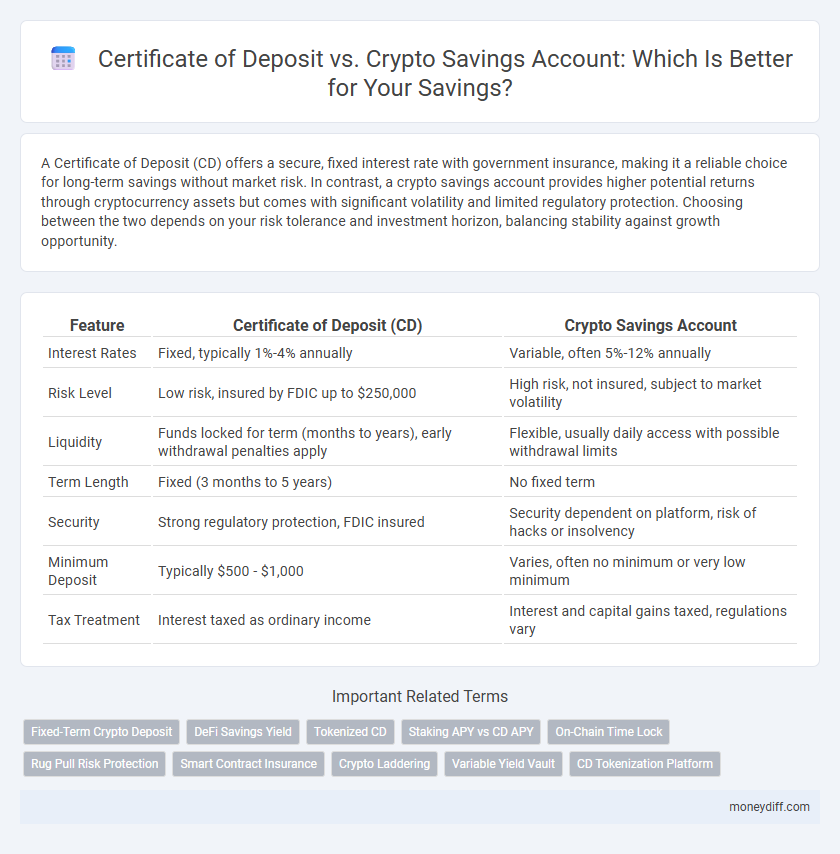

A Certificate of Deposit (CD) offers a secure, fixed interest rate with government insurance, making it a reliable choice for long-term savings without market risk. In contrast, a crypto savings account provides higher potential returns through cryptocurrency assets but comes with significant volatility and limited regulatory protection. Choosing between the two depends on your risk tolerance and investment horizon, balancing stability against growth opportunity.

Table of Comparison

| Feature | Certificate of Deposit (CD) | Crypto Savings Account |

|---|---|---|

| Interest Rates | Fixed, typically 1%-4% annually | Variable, often 5%-12% annually |

| Risk Level | Low risk, insured by FDIC up to $250,000 | High risk, not insured, subject to market volatility |

| Liquidity | Funds locked for term (months to years), early withdrawal penalties apply | Flexible, usually daily access with possible withdrawal limits |

| Term Length | Fixed (3 months to 5 years) | No fixed term |

| Security | Strong regulatory protection, FDIC insured | Security dependent on platform, risk of hacks or insolvency |

| Minimum Deposit | Typically $500 - $1,000 | Varies, often no minimum or very low minimum |

| Tax Treatment | Interest taxed as ordinary income | Interest and capital gains taxed, regulations vary |

Understanding Certificate of Deposit (CD) Accounts

Certificate of Deposit (CD) accounts offer fixed interest rates and a guaranteed return over a specified term, making them a low-risk savings option compared to volatile crypto savings accounts. CDs are insured by the FDIC up to $250,000, providing security against bank failure, while crypto savings accounts carry higher risk due to market fluctuations and lack of regulatory protection. With CDs, early withdrawal penalties can impact liquidity, whereas crypto accounts often allow flexible access but with less predictable returns.

What Are Crypto Savings Accounts?

Crypto savings accounts allow users to deposit cryptocurrencies and earn interest over time, often at higher rates compared to traditional certificates of deposit (CDs). These accounts leverage blockchain technology and decentralized finance (DeFi) platforms to provide liquidity and flexible terms, unlike CDs which typically lock funds for fixed periods with lower returns. However, crypto savings accounts carry higher risks including market volatility and regulatory uncertainty, contrasting the federally insured security of traditional CDs.

Safety and Security: CD vs Crypto Savings

Certificates of Deposit (CDs) offer federally insured safety through the FDIC, ensuring principal protection and fixed interest rates, making them highly secure for conservative savers. In contrast, crypto savings accounts involve higher risk due to market volatility and lack of federal insurance, exposing investors to potential loss from hacking or platform insolvency. Evaluating safety, CDs provide guaranteed returns and regulatory oversight, whereas crypto savings demand careful consideration of security measures and the inherent unpredictability of digital assets.

Interest Rates Comparison: CDs vs Crypto Accounts

Certificate of Deposit (CD) accounts typically offer fixed interest rates ranging from 1% to 5% annually, providing stable and predictable returns over a set term. Crypto savings accounts, however, can yield much higher interest rates, often between 6% and 12%, but carry increased risk due to market volatility and regulatory uncertainties. Comparing interest rates, CDs offer security with lower yields, while crypto savings accounts present opportunities for higher returns accompanied by greater risk exposure.

Accessibility and Withdrawal Rules

Certificate of Deposit (CD) accounts typically have fixed terms ranging from months to years, requiring funds to remain locked in until maturity, which limits accessibility and may incur early withdrawal penalties. Crypto savings accounts offer more flexible access with the ability to withdraw funds at any time, though they can be subject to market volatility and potential transaction fees. Understanding these withdrawal rules is crucial for savers prioritizing liquidity and timely access to their funds.

Risks Involved: Traditional Banking vs Crypto Platforms

Certificate of deposit (CD) accounts offer low-risk savings with federally insured deposits through the FDIC, ensuring principal protection and fixed interest returns. Crypto savings accounts, while potentially providing higher yields, expose savers to risks such as platform insolvency, hacking, and regulatory uncertainty, lacking government-backed insurance. Investors must weigh traditional banking's stability against crypto platforms' volatility and security vulnerabilities when selecting a savings option.

Minimum Deposits and Terms

Certificate of Deposit (CD) accounts typically require higher minimum deposits, often ranging from $500 to $10,000, with fixed terms lasting from 3 months to 5 years. Crypto savings accounts generally have lower minimum deposit requirements, sometimes starting as low as $10, and offer more flexible terms that can be adjusted or withdrawn at any time. The fixed-term nature of CDs guarantees interest rates but limits liquidity, while crypto accounts provide more access but expose deposits to market volatility.

FDIC Insurance vs Digital Asset Protection

Certificates of Deposit (CDs) offer FDIC insurance, providing up to $250,000 coverage per depositor, ensuring principal safety even during bank failures. Crypto savings accounts rely on digital asset protection mechanisms, such as private keys and custodial insurance, but lack FDIC coverage, exposing funds to cybersecurity risks. Choosing between FDIC-insured CDs and digitally protected crypto accounts depends on risk tolerance and preference for traditional security versus potential higher yields.

Tax Implications for CD and Crypto Savings

Certificates of Deposit (CDs) generate interest income that is typically subject to federal and state income taxes in the year the interest is earned, with rates based on your ordinary income tax bracket. Crypto savings accounts may yield interest paid in cryptocurrency, which is generally taxed as ordinary income upon receipt at the fair market value, and any future appreciation or depreciation in the crypto's value can trigger capital gains or losses upon sale or exchange. Tax reporting complexity increases with crypto savings due to volatile asset valuation and potential IRS scrutiny, whereas CDs offer more straightforward, traditional tax treatment.

Which Savings Option Is Right for You?

A Certificate of Deposit (CD) offers guaranteed interest rates and federal insurance, making it ideal for risk-averse savers seeking stable returns over a fixed term. Crypto savings accounts provide higher potential yields through decentralized finance but carry significant market volatility and lack of FDIC protection. Choosing between a CD and crypto savings depends on your risk tolerance, investment timeline, and need for liquidity.

Related Important Terms

Fixed-Term Crypto Deposit

Fixed-term crypto deposits offer higher interest rates compared to traditional Certificates of Deposit (CDs), leveraging blockchain technology to provide greater liquidity and flexibility without sacrificing security. While CDs guarantee principal and fixed returns insured by institutions like the FDIC, crypto savings accounts carry risks related to market volatility and lack of regulatory protection, making them suitable for investors seeking potentially higher yields within specified lock-in periods.

DeFi Savings Yield

DeFi savings accounts offer significantly higher yields compared to traditional Certificates of Deposit, with APYs often exceeding 5-12%, leveraging blockchain technology and liquidity mining protocols. Certificates of Deposit provide fixed interest rates typically between 0.5-2%, backed by federal insurance, ensuring principal safety but with limited growth potential compared to the dynamic returns found in decentralized finance platforms.

Tokenized CD

A Tokenized Certificate of Deposit (CD) offers the security and fixed interest rates of traditional CDs with enhanced liquidity through blockchain technology, enabling faster transactions and fractional ownership. In contrast, crypto savings accounts provide higher yield potentials but carry increased volatility and risk, making tokenized CDs a balanced option for conservative savers seeking stability and ease of access.

Staking APY vs CD APY

Certificate of Deposit (CD) APYs typically range from 3% to 5% depending on term length and financial institution, offering guaranteed returns with FDIC insurance protection. Crypto savings accounts provide higher staking APYs often between 7% and 15%, but these yields come with increased volatility and lack of regulatory insurance.

On-Chain Time Lock

Certificate of Deposit (CD) offers a traditional on-chain time lock that guarantees fixed interest rates and principal security for a specified term, whereas crypto savings accounts leverage smart contracts to enforce flexible time-locked deposits with variable yields based on market conditions. On-chain time locks in CDs provide predictable returns and reduced counterparty risk, while crypto savings accounts enable programmability and rapid access to funds after the lock period, balancing liquidity with potential high-yield opportunities.

Rug Pull Risk Protection

Certificates of Deposit (CDs) offer FDIC insurance up to $250,000, providing strong protection against rug pull risks commonly associated with crypto savings accounts that operate without regulatory oversight. Crypto savings accounts, while potentially yielding higher returns, expose investors to smart contract vulnerabilities and platform insolvency, significantly increasing the risk of losing savings through fraudulent schemes.

Smart Contract Insurance

Certificate of Deposit (CD) offers fixed interest rates with FDIC insurance protecting principal up to $250,000, providing stable, low-risk savings. Crypto Savings Accounts utilize smart contract insurance protocols to safeguard funds against contract vulnerabilities, offering higher interest rates but with varying coverage and increased risk compared to traditional CDs.

Crypto Laddering

Crypto laddering in savings accounts offers a strategic advantage over traditional Certificates of Deposit by enabling staggered maturity dates that increase liquidity and reduce interest rate risk. This method enhances yield optimization while maintaining access to funds, contrasting with the fixed terms and penalties associated with CDs.

Variable Yield Vault

Certificate of Deposit (CD) offers fixed interest rates and federal insurance through the FDIC, providing stable returns but limited liquidity, whereas Crypto Savings Accounts like Variable Yield Vault deliver potentially higher, variable yields by leveraging decentralized finance protocols, albeit with increased risk and no traditional insurance. Variable Yield Vault optimizes returns by dynamically reallocating crypto assets across multiple DeFi platforms to maximize interest rates, appealing to savers seeking growth beyond conventional banking products.

CD Tokenization Platform

Certificate of Deposit (CD) tokenization platforms revolutionize traditional savings by enabling fractional ownership and enhanced liquidity of CDs through blockchain technology, offering higher security and faster transactions compared to conventional Crypto Savings Accounts. These platforms bridge the gap between the stability of CDs and the flexibility of crypto assets, providing savers with innovative options to diversify their portfolios while maintaining low risk.

Certificate of Deposit vs Crypto Savings Account for savings. Infographic

moneydiff.com

moneydiff.com