Automatic transfers ensure consistent saving by moving a fixed amount from checking to savings accounts on a set schedule, promoting disciplined financial habits. Round-up apps boost savings incrementally by rounding up everyday purchases to the nearest dollar and transferring the difference, making saving effortless and less noticeable. Both methods enhance saving strategies, with automatic transfers offering predictability and round-up apps encouraging gradual growth through everyday spending.

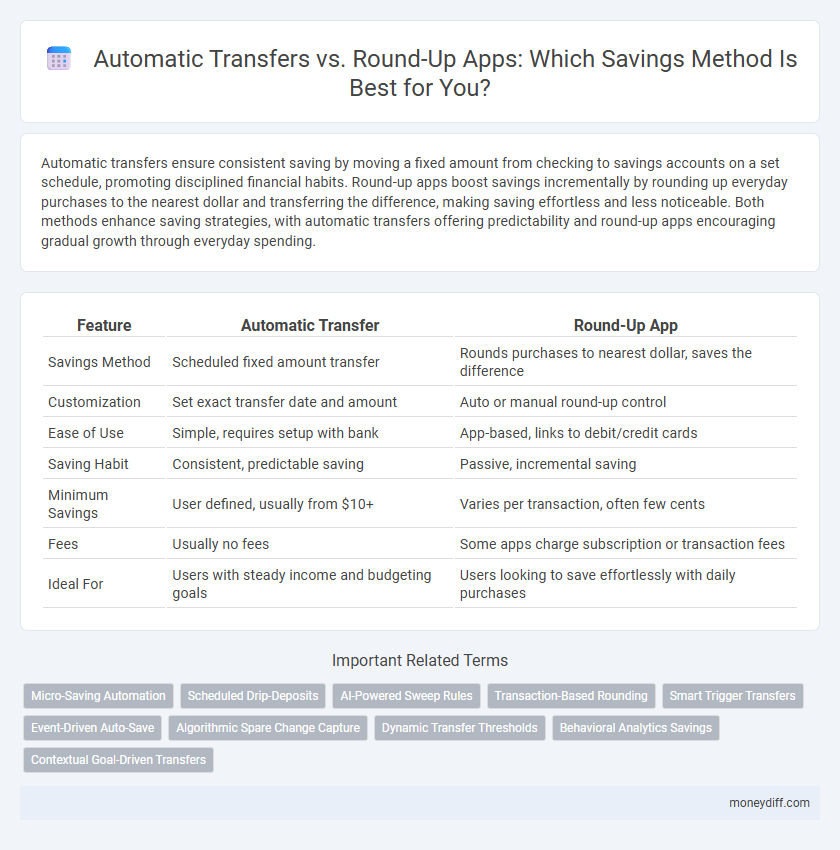

Table of Comparison

| Feature | Automatic Transfer | Round-Up App |

|---|---|---|

| Savings Method | Scheduled fixed amount transfer | Rounds purchases to nearest dollar, saves the difference |

| Customization | Set exact transfer date and amount | Auto or manual round-up control |

| Ease of Use | Simple, requires setup with bank | App-based, links to debit/credit cards |

| Saving Habit | Consistent, predictable saving | Passive, incremental saving |

| Minimum Savings | User defined, usually from $10+ | Varies per transaction, often few cents |

| Fees | Usually no fees | Some apps charge subscription or transaction fees |

| Ideal For | Users with steady income and budgeting goals | Users looking to save effortlessly with daily purchases |

Understanding Automatic Transfers for Savings

Automatic transfers for savings enable individuals to schedule fixed amounts from checking to savings accounts at regular intervals, ensuring consistent, disciplined saving habits. This method provides predictability and control over savings goals by setting specific transfer dates and amounts, reducing the risk of spending funds intended for savings. Compared to round-up apps that save small change from purchases, automatic transfers allow larger, customizable contributions that can accelerate growth in savings.

How Round-Up Apps Help You Save Effortlessly

Round-up apps simplify savings by automatically rounding up everyday purchases to the nearest dollar and transferring the difference into a dedicated savings account. This micro-savings strategy leverages small, frequent contributions without requiring active effort, promoting consistent saving habits. By integrating seamlessly with your spending patterns, round-up apps help build savings gradually and effortlessly over time.

Key Differences: Automatic Transfer vs Round-Up Apps

Automatic transfers move fixed amounts of money from checking to savings at scheduled intervals, ensuring consistent savings growth. Round-up apps save spare change by rounding purchases up to the nearest dollar and transferring the difference into a savings account, allowing for incremental, passive accumulation. The key difference lies in predictability and savings approach: automatic transfers use predetermined amounts, while round-up apps rely on spending behavior to drive savings.

Pros and Cons of Automatic Transfer Savings

Automatic transfer savings offer the advantage of consistent, scheduled contributions directly from a checking account to a savings account, promoting disciplined saving habits without requiring daily effort. This method ensures predictable growth of savings, reduces the risk of spending those funds impulsively, and is highly customizable in terms of amount and frequency. However, it may lack flexibility during months with variable income, can lead to overdraft risks if not carefully managed, and might not capitalize on small, frequent savings opportunities like round-up apps provide.

Pros and Cons of Round-Up Savings Apps

Round-up savings apps automatically round up everyday purchases to the nearest dollar, transferring the spare change into a savings account, which encourages consistent saving without significant effort. These apps promote micro-savings and behavioral change but can result in frequent small transactions that might clutter bank statements or incur minor fees. However, round-up apps might save less aggressively compared to automatic transfers, which allow for larger, scheduled deposits directly from checking to savings accounts.

Which Method Grows Your Savings Faster?

Automatic transfers consistently grow savings faster by moving a fixed amount directly into your savings account on a set schedule, ensuring disciplined and substantial contributions. Round-up apps save smaller, irregular amounts by rounding each purchase to the nearest dollar, which may lead to slower overall growth despite added convenience. For maximizing savings growth speed, automatic transfers provide predictable, higher-value deposits that compound more effectively over time.

Security and Privacy: Comparing Both Methods

Automatic transfers offer robust security through direct bank integration and encrypted transactions, minimizing exposure to third-party apps, while round-up apps may require access to spending data, raising potential privacy concerns. Round-up apps often use secure APIs and comply with data protection regulations, but the aggregation of transaction details can present privacy risks absent in automatic transfers. Choosing between these methods depends on the user's comfort level with data sharing and preference for direct bank-managed security versus convenience offered by third-party round-up tools.

Flexibility and Customization Options

Automatic transfers offer greater flexibility by allowing users to schedule fixed amounts to move into savings accounts at preferred intervals, ensuring consistent contributions tailored to individual budgets. Round-up apps provide customization by rounding up everyday purchases to the nearest dollar and saving the difference, enabling small, frequent savings without requiring manual input. Both methods enhance savings habits, but automatic transfers are better suited for users seeking predictable, adjustable saving schedules, while round-up apps appeal to those preferring effortless, incremental growth.

Ideal Users: Who Benefits Most from Each Method?

Automatic transfers benefit individuals with steady incomes who prefer disciplined, consistent savings by setting fixed amounts to move regularly into savings accounts. Round-up apps are ideal for casual savers or those with variable spending habits, as they convert small, spare change from purchases into incremental savings without requiring active budgeting. Both methods help increase savings, but automatic transfers suit goal-driven savers, while round-up apps appeal to users seeking effortless, gradual accumulation.

Choosing the Best Savings Strategy for Your Goals

Automatic transfers provide consistent, scheduled contributions to your savings, ensuring steady growth aligned with your financial goals. Round-up apps boost savings effortlessly by rounding purchases to the nearest dollar and depositing the difference into your savings account, ideal for those seeking gradual accumulation without manual effort. Evaluating your income stability, spending habits, and target savings timeline helps determine whether a fixed automatic transfer or flexible round-up strategy best supports your financial objectives.

Related Important Terms

Micro-Saving Automation

Automatic transfers enable consistent, scheduled savings by directly moving fixed amounts into savings accounts, fostering disciplined financial habits without user intervention. Round-up apps leverage micro-saving automation by rounding up everyday purchases to the nearest dollar and depositing the spare change into savings, creating seamless, incremental wealth accumulation through everyday spending.

Scheduled Drip-Deposits

Scheduled drip-deposits enable consistent, automated savings by transferring fixed amounts at regular intervals directly into savings accounts, promoting disciplined financial growth. Unlike round-up apps that save small change from transactions, automatic transfers ensure predictable, substantial contributions that better build savings over time.

AI-Powered Sweep Rules

AI-powered sweep rules in automatic transfers optimize savings by intelligently allocating funds based on spending patterns and account balances, ensuring consistent growth without manual input. Round-up apps leverage AI algorithms to aggregate small spare change from transactions into savings, maximizing incremental deposits for effortless wealth accumulation.

Transaction-Based Rounding

Transaction-based rounding apps automatically round up each purchase to the nearest dollar, transferring the difference into a savings account, which encourages consistent, incremental savings without manual intervention. In contrast, automatic transfers typically move fixed amounts on scheduled dates, lacking the personalized adjustment that transaction-based rounding provides for maximizing spare change savings.

Smart Trigger Transfers

Smart trigger transfers use personalized spending patterns and income schedules to automatically move funds into savings accounts at optimal times, maximizing growth without manual intervention. Unlike round-up apps that save spare change, automatic smart transfers strategically allocate larger, tailored amounts based on financial behavior, accelerating savings goals efficiently.

Event-Driven Auto-Save

Event-driven auto-save methods like round-up apps trigger savings automatically based on specific spending actions, rounding up each purchase to the nearest dollar and transferring the difference into a savings account. Automatic transfers, in contrast, schedule fixed amounts to move regularly, providing consistent savings growth without depending on individual spending events.

Algorithmic Spare Change Capture

Automatic transfer savings rely on fixed, scheduled deductions from a bank account to build funds steadily, whereas round-up apps utilize algorithmic spare change capture by rounding up each purchase and saving the difference, optimizing micro-savings with minimal user effort. Algorithmic spare change capture enhances savings efficiency by leveraging transaction data patterns to maximize incremental deposits without disrupting regular cash flow.

Dynamic Transfer Thresholds

Automatic transfers use predefined amounts scheduled regularly, while round-up apps adjust savings based on transaction activity, enabling dynamic transfer thresholds that respond to spending patterns. These dynamic thresholds optimize savings by increasing transfers during low spending periods and minimizing impact on cash flow when expenditures rise.

Behavioral Analytics Savings

Automatic transfers leverage consistent, scheduled deposits to reinforce habitual saving patterns, while round-up apps utilize behavioral analytics by linking spending to micro-savings, effectively nudging users to save incrementally without conscious effort. Behavioral data indicates that round-up apps increase user engagement with saving goals due to real-time spending feedback, whereas automatic transfers primarily benefit those with a disciplined budget framework.

Contextual Goal-Driven Transfers

Automatic transfers enable consistent, goal-driven savings by scheduling fixed amounts into dedicated accounts, ensuring steady progress towards financial objectives. Round-up apps complement this by intelligently rounding purchases to the nearest dollar and allocating the spare change, creating incremental savings without disrupting cash flow.

Automatic transfer vs Round-up app for savings. Infographic

moneydiff.com

moneydiff.com