Traditional savings accounts offer straightforward security and easy access to funds but typically provide lower interest rates compared to high-yield cash management accounts. High-yield cash management accounts combine competitive interest returns with features like check-writing and debit card access, making them ideal for maximizing savings growth while maintaining liquidity. Choosing between the two depends on whether the priority is convenience or earning potential in your savings strategy.

Table of Comparison

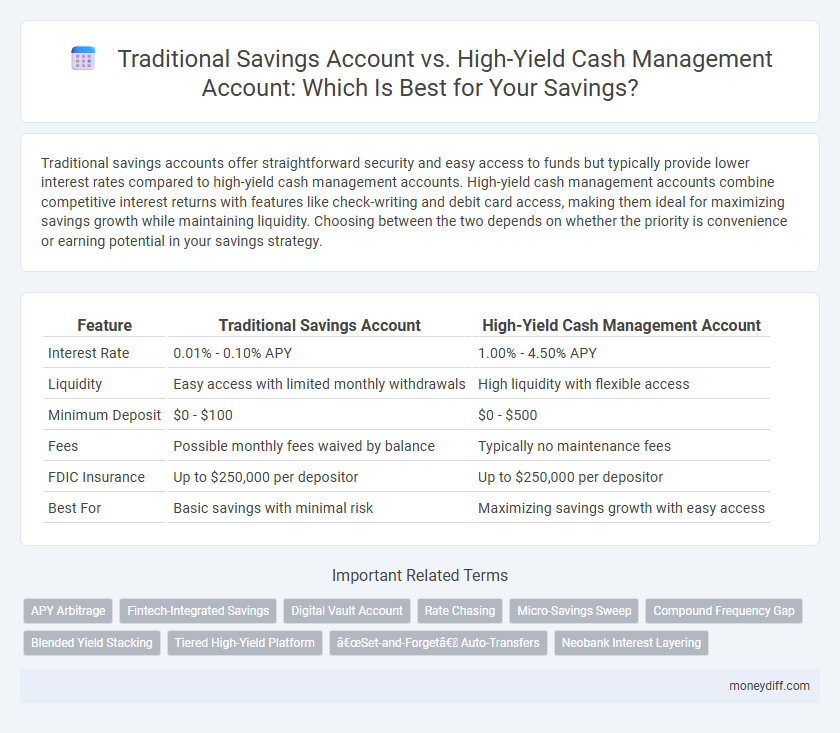

| Feature | Traditional Savings Account | High-Yield Cash Management Account |

|---|---|---|

| Interest Rate | 0.01% - 0.10% APY | 1.00% - 4.50% APY |

| Liquidity | Easy access with limited monthly withdrawals | High liquidity with flexible access |

| Minimum Deposit | $0 - $100 | $0 - $500 |

| Fees | Possible monthly fees waived by balance | Typically no maintenance fees |

| FDIC Insurance | Up to $250,000 per depositor | Up to $250,000 per depositor |

| Best For | Basic savings with minimal risk | Maximizing savings growth with easy access |

Introduction to Savings: Traditional vs High-Yield Cash Management

Traditional savings accounts offer stability and FDIC insurance with lower interest rates, making them suitable for conservative savers. High-yield cash management accounts provide significantly higher annual percentage yields (APYs) by leveraging online banking and investment strategies, often coupled with liquidity features like check-writing and ATM access. Understanding the trade-offs between safety, return on investment, and accessibility is crucial for optimizing your savings strategy.

What Is a Traditional Savings Account?

A traditional savings account is a bank account designed to hold money securely while earning modest interest, typically at rates below inflation. It offers easy access to funds through withdrawals and transfers, often insured by the FDIC up to $250,000. Unlike high-yield cash management accounts, traditional savings accounts usually have lower interest rates and limited transaction capabilities.

Understanding High-Yield Cash Management Accounts

High-yield cash management accounts offer significantly higher interest rates compared to traditional savings accounts, often ranging from 3% to 5%, which accelerates the growth of your savings. These accounts typically provide FDIC insurance up to $1 million through brokerage sweeping programs, combining safety with liquidity. Users benefit from features like easy access to funds via debit cards and check-writing capabilities, making them a flexible alternative for managing emergency funds and short-term savings.

Interest Rates: Comparing Growth Potential

Traditional savings accounts typically offer interest rates around 0.01% to 0.10%, limiting the growth potential of deposited funds. High-yield cash management accounts provide significantly higher annual percentage yields (APYs), often ranging from 1.50% to 4.00%, accelerating savings growth. This substantial difference in interest rates makes high-yield cash management accounts a more effective option for maximizing returns on savings over time.

Accessibility and Flexibility of Funds

Traditional savings accounts offer easy access to funds through ATM withdrawals and in-branch services, but they often impose withdrawal limits and lower interest rates. High-yield cash management accounts provide greater liquidity with unlimited transfers and check-writing capabilities while delivering higher returns on deposits. This combination of flexibility and enhanced accessibility makes cash management accounts ideal for individuals seeking both growth and convenient access to their savings.

Safety and FDIC Insurance Considerations

Traditional savings accounts and high-yield cash management accounts both provide FDIC insurance protection up to $250,000 per depositor, per insured bank, ensuring the safety of your funds. While traditional savings accounts are typically offered by banks and credit unions with federal regulation, high-yield cash management accounts may partner with multiple banks to extend FDIC coverage across several institutions, increasing overall insured limits. It is essential to confirm FDIC insurance status and limits for each account type to maintain full protection and safeguard your savings against institutional risks.

Minimum Balance and Maintenance Requirements

Traditional savings accounts typically require a minimum balance ranging from $100 to $500 to avoid monthly maintenance fees, which can reduce overall savings growth. High-yield cash management accounts often have lower or no minimum balance requirements and waive maintenance fees, making them more flexible for savers who want to maximize interest earnings. Managing minimum balance thresholds effectively helps optimize returns and prevent unnecessary charges in both account types.

Fees and Hidden Costs Explained

Traditional savings accounts generally feature low or no monthly fees but may impose minimum balance requirements that can trigger penalties, reducing overall savings growth. High-yield cash management accounts often offer higher interest rates but may include fees such as transfer limits, ATM usage charges, or inactivity fees that can erode returns if not carefully managed. Consumers should scrutinize fee schedules and account terms to avoid unexpected costs that negate the benefits of higher yields.

Suitability: Which Account Fits Your Savings Goals?

Traditional savings accounts offer stable, federally insured returns with easy access, making them suitable for emergency funds or short-term savings goals. High-yield cash management accounts provide significantly higher interest rates, ideal for maximizing growth on larger balances or long-term savings while maintaining liquidity. Choosing between the two depends on your need for immediate access versus maximizing interest earnings within a low-risk environment.

Making the Right Choice for Maximum Savings

Choosing between a traditional savings account and a high-yield cash management account hinges on interest rates, accessibility, and fees. Traditional savings accounts offer stability with lower interest rates, while high-yield cash management accounts often deliver significantly higher returns through competitive APYs and flexible liquidity options. For maximum savings growth, prioritizing accounts with minimal fees and optimal interest compounding schedules ensures better long-term financial gains.

Related Important Terms

APY Arbitrage

Traditional savings accounts typically offer low annual percentage yields (APYs) around 0.01% to 0.10%, limiting growth potential, while high-yield cash management accounts provide significantly higher APYs, often ranging from 3.00% to 5.00%, enabling effective arbitrage opportunities by optimizing interest earnings on deposited funds. This APY arbitrage allows savers to maximize passive income through minimal-risk, liquid savings options that outperform standard bank interest rates.

Fintech-Integrated Savings

Traditional savings accounts typically offer lower interest rates and limited digital features, while high-yield cash management accounts provided by fintech platforms integrate advanced technology to maximize returns and enhance user experience through seamless mobile access and real-time financial insights. Fintech-integrated savings solutions leverage automated budgeting tools and competitive APYs, making them ideal for tech-savvy savers seeking both growth and convenience.

Digital Vault Account

Traditional savings accounts typically offer lower interest rates, often below 0.10% APY, while High-Yield Cash Management Accounts, such as Digital Vault accounts, provide significantly higher returns, frequently exceeding 4.00% APY with added digital security features and seamless online access. Digital Vault accounts combine the benefits of high-yield interest with robust encryption protocols, ensuring both growth and protection of savings in a user-friendly digital environment.

Rate Chasing

Traditional savings accounts typically offer lower interest rates, averaging around 0.01% to 0.10%, making rate chasing less rewarding due to minimal yield differences. High-yield cash management accounts, with rates often between 3% and 5%, provide significantly better returns, encouraging savers to compare and switch accounts frequently to maximize their interest earnings.

Micro-Savings Sweep

Traditional savings accounts offer stable but low-interest rates, limiting growth on smaller balances, while high-yield cash management accounts provide significantly higher returns, especially beneficial for micro-savings sweep strategies that automatically transfer small, incremental amounts to maximize interest accumulation. Utilizing a high-yield cash management account for micro-savings sweep enhances compound growth potential by leveraging frequent, automated deposits combined with superior APYs compared to the minimal yields of traditional accounts.

Compound Frequency Gap

Traditional savings accounts typically compound interest daily or monthly, resulting in modest growth over time, while high-yield cash management accounts often compound interest daily or even multiple times per day, significantly accelerating the compounding effect and increasing overall returns. Choosing an account with a higher compound frequency can maximize savings growth by leveraging the exponential nature of compound interest.

Blended Yield Stacking

Blended yield stacking combines the steady reliability of traditional savings accounts with the enhanced returns of high-yield cash management accounts, maximizing overall interest income while maintaining liquidity and security. This strategy leverages the stability and FDIC insurance of traditional accounts alongside the competitive APYs and flexible access features of cash management accounts to optimize savings growth.

Tiered High-Yield Platform

A tiered high-yield cash management account offers escalating interest rates based on balance thresholds, significantly outperforming traditional savings accounts with flat, lower rates. This structure maximizes earnings potential by providing superior returns on larger deposits while maintaining liquidity and FDIC insurance.

“Set-and-Forget” Auto-Transfers

Traditional savings accounts often offer limited interest rates and minimal automation features, making it challenging to maximize growth through consistent contributions. High-yield cash management accounts typically provide higher interest rates combined with seamless "set-and-forget" auto-transfer options that automate regular deposits, boosting savings growth effortlessly over time.

Neobank Interest Layering

Neobank interest layering enhances high-yield cash management accounts by combining competitive base rates with bonus interest incentives, significantly outperforming traditional savings accounts that offer lower fixed rates and limited benefits. This stacking of interest boosts overall savings growth, making neobanks a more efficient choice for maximizing returns on deposited funds.

Traditional Savings Account vs High-Yield Cash Management Account for Savings. Infographic

moneydiff.com

moneydiff.com