Regular deposits build savings steadily by ensuring consistent contributions over time, fostering disciplined financial growth. Cashback-boosted savings enhance this process by offering rewards on purchases, which can be redirected into your savings, accelerating wealth accumulation. Choosing between the two depends on individual spending habits and the desire to maximize returns through everyday expenditures.

Table of Comparison

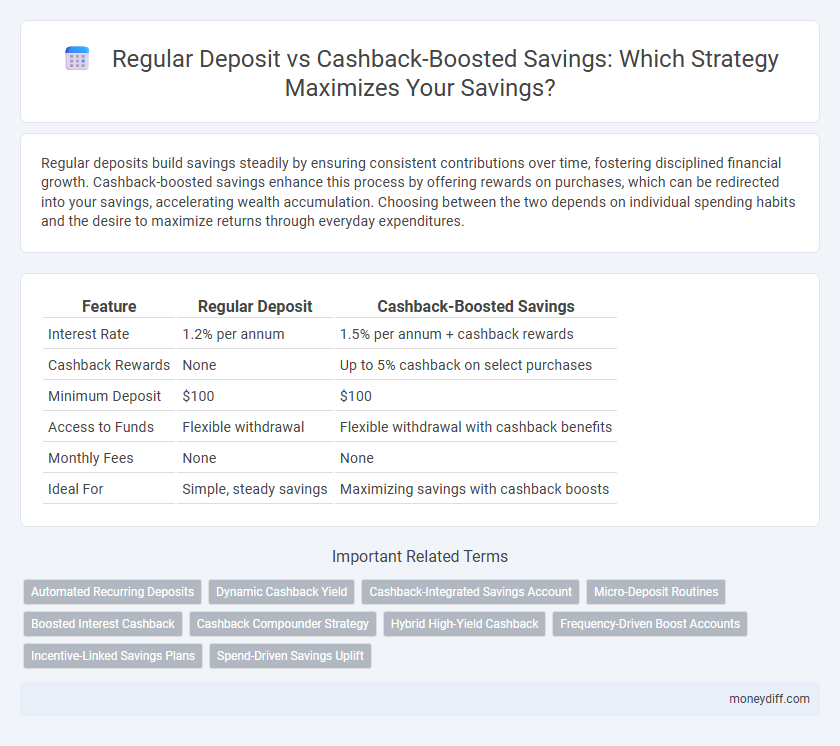

| Feature | Regular Deposit | Cashback-Boosted Savings |

|---|---|---|

| Interest Rate | 1.2% per annum | 1.5% per annum + cashback rewards |

| Cashback Rewards | None | Up to 5% cashback on select purchases |

| Minimum Deposit | $100 | $100 |

| Access to Funds | Flexible withdrawal | Flexible withdrawal with cashback benefits |

| Monthly Fees | None | None |

| Ideal For | Simple, steady savings | Maximizing savings with cashback boosts |

Understanding Regular Deposit Savings Accounts

Regular deposit savings accounts require consistent contributions, helping to build disciplined saving habits and steadily growing the balance through interest accumulation. These accounts often offer fixed interest rates, providing predictable returns compared to variable cashback-boosted savings that rely on reward incentives. Understanding the stability and long-term growth potential of regular deposits is essential for effective financial planning and wealth accumulation.

How Cashback-Boosted Savings Work

Cashback-Boosted Savings accounts enhance regular savings by offering cash rebates on everyday purchases that are automatically added to the savings balance, accelerating the growth of your funds. Unlike traditional Regular Deposit accounts that rely solely on fixed interest rates, Cashback-Boosted Savings combine routine spending with savings by converting a percentage of spending into direct savings boosts. This method increases the effective yield on savings by leveraging consumer expenditure patterns through cashback incentives linked to debit or credit card transactions.

Comparing Interest Rates: Regular vs. Cashback-Boosted

Regular deposit accounts typically offer stable interest rates ranging from 1.5% to 2.5% annually, providing predictable growth on savings. Cashback-boosted savings accounts combine competitive base interest rates, often around 1.0% to 2.0%, with cashback rewards that effectively increase the overall return, sometimes pushing yields above 3%. When comparing interest rates, cashback-boosted options can deliver higher effective returns but may require specific spending habits or conditions to maximize benefits.

Flexibility and Accessibility of Funds

Regular deposits offer consistent contributions with predictable fund availability, allowing savers to plan withdrawals without penalty. Cashback-boosted savings enhance earnings through rewards but may impose restrictions or waiting periods before accessing funds. Flexibility and accessibility are crucial factors, as regular deposits typically provide easier and immediate fund access compared to cashback savings tied to specific spending conditions or promotional terms.

Reward Structures: Maximizing Cashback Benefits

Regular Deposit accounts offer steady interest rates that compound over time, providing predictable growth for savers seeking consistent returns. Cashback-Boosted Savings accounts enhance reward structures by offering cashback on spending categories, effectively increasing overall savings through earned rewards. Maximizing cashback benefits requires strategic use of these accounts alongside regular deposits to optimize both interest accumulation and cashback earnings.

Risk Factors in Cashback-Boosted Savings

Cashback-boosted savings often involve linked spending accounts or credit cards, introducing risks such as potential overspending and accumulated debt due to rewards incentives. Unlike regular deposits, cashback benefits may include fluctuating reward rates and exclusions, increasing uncertainty in expected returns. Additionally, the reliance on promotional offers can lead to inconsistent benefits, making regular deposits a more stable and predictable savings method.

Evaluating Account Fees and Hidden Costs

Evaluating account fees and hidden costs is crucial when comparing Regular Deposit accounts with Cashback-Boosted Savings options. Regular Deposit accounts often charge maintenance fees and penalties for early withdrawal, whereas Cashback-Boosted Savings accounts may offer fee waivers but impose limits on cashback eligibility or require minimum balance thresholds. Consumers should analyze fee structures, transaction limitations, and potential cashback restrictions to optimize net savings growth.

Suitability for Different Savings Goals

Regular deposits offer a disciplined approach suitable for long-term goals like retirement or education funds, ensuring steady accumulation through consistent contributions. Cashback-boosted savings accounts enhance short-term savings by providing reward incentives, making them ideal for emergency funds or planned purchases. Selecting between these methods depends on the flexibility needed and the targeted timeline for accessing the saved funds.

Long-Term Earnings Potential Analysis

Regular Deposit accounts offer steady, predictable interest accumulation over time, ideal for conservative savers focused on consistent growth. Cashback-Boosted Savings accounts provide intermittent rewards that can enhance overall returns but may come with variable interest rates or spending conditions. Analyzing long-term earnings reveals that while cashback boosts add immediate value, regular deposits typically yield higher compounded interest benefits for sustained financial growth.

Choosing the Right Savings Strategy for Your Needs

Regular deposits build consistent savings through disciplined monthly contributions, maximizing interest accumulation over time. Cashback-boosted savings combine traditional saving with reward incentives, offering extra returns via cashbacks on spending. Selecting the ideal savings strategy depends on your financial goals, spending habits, and preference for guaranteed interest versus additional cashback rewards.

Related Important Terms

Automated Recurring Deposits

Automated Recurring Deposits in Regular Deposit accounts ensure consistent savings growth through scheduled contributions, promoting disciplined financial habits. Cashback-Boosted Savings enhance this by offering rewards on deposits, increasing overall returns without extra effort, making them ideal for maximizing savings efficiency.

Dynamic Cashback Yield

Regular deposits build a stable savings foundation with predictable growth, while cashback-boosted savings enhance returns through dynamic cashback yield that adjusts based on spending patterns and account activity. This dynamic cashback yield can significantly increase overall savings growth by rewarding consistent account engagement and higher transaction volumes.

Cashback-Integrated Savings Account

Cashback-integrated savings accounts combine regular deposit benefits with rewards, enabling customers to earn cashback on transactions while growing their savings. These accounts offer higher effective returns compared to traditional savings methods by incentivizing consistent deposits and active spending.

Micro-Deposit Routines

Regular Deposit accounts encourage disciplined saving through fixed micro-deposit routines that steadily grow your balance with predictable interest accrual. Cashback-Boosted Savings enhance micro-deposit strategies by embedding reward incentives, increasing overall returns and motivating consistent contributions over time.

Boosted Interest Cashback

Boosted interest cashback in savings accounts significantly increases returns by offering a percentage of interest earned as direct cashback, making regular deposits more rewarding compared to standard savings plans. This approach not only accelerates wealth accumulation but also incentivizes consistent savings behavior through tangible cash rewards.

Cashback Compounder Strategy

Regular Deposit accounts provide steady growth through consistent monthly contributions, while Cashback-Boosted Savings leverage the Cashback Compounder Strategy by reinvesting earned cashback rewards to accelerate overall savings growth. This method enhances compound interest benefits, effectively increasing the principal faster and maximizing long-term returns compared to traditional savings plans.

Hybrid High-Yield Cashback

Hybrid High-Yield Cashback savings accounts combine the steady growth of regular deposits with the added benefit of cashback rewards, optimizing overall returns. This hybrid approach enhances savings potential by providing both interest accumulation and periodic cashback incentives, outperforming traditional regular deposit schemes.

Frequency-Driven Boost Accounts

Frequency-driven boost savings accounts offer higher interest rates for consistent monthly deposits, maximizing growth through disciplined saving habits. Regular deposit accounts provide steady accumulation but lack incentives tied to deposit frequency, making boost accounts more advantageous for savers aiming to optimize returns.

Incentive-Linked Savings Plans

Incentive-linked savings plans like cashback-boosted savings offer additional rewards on top of regular deposit interest, enhancing overall returns and motivating consistent saving behavior. Regular deposit accounts provide steady growth through fixed interest rates but lack the extra financial incentives that cashback schemes deliver, making the latter more appealing for goal-oriented savers seeking higher yield opportunities.

Spend-Driven Savings Uplift

Regular Deposit accounts offer steady growth through fixed monthly contributions, while Cashback-Boosted Savings inject additional funds directly tied to spending habits, enhancing overall savings returns. Spend-Driven Savings Uplift leverages cashback rewards from everyday purchases to accelerate savings accumulation, making it a dynamic strategy for maximizing financial growth.

Regular Deposit vs Cashback-Boosted Savings for savings. Infographic

moneydiff.com

moneydiff.com