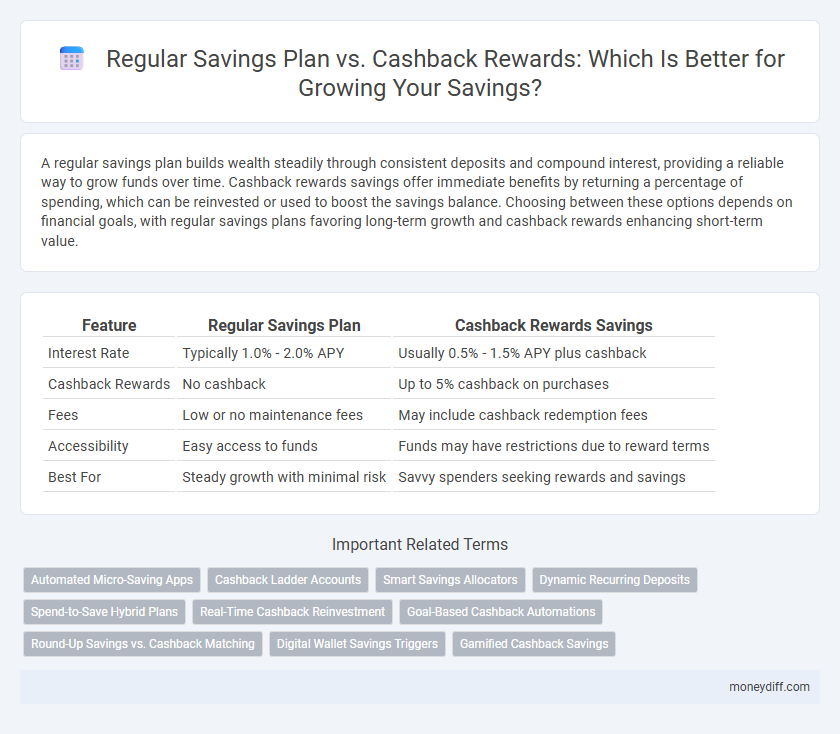

A regular savings plan builds wealth steadily through consistent deposits and compound interest, providing a reliable way to grow funds over time. Cashback rewards savings offer immediate benefits by returning a percentage of spending, which can be reinvested or used to boost the savings balance. Choosing between these options depends on financial goals, with regular savings plans favoring long-term growth and cashback rewards enhancing short-term value.

Table of Comparison

| Feature | Regular Savings Plan | Cashback Rewards Savings |

|---|---|---|

| Interest Rate | Typically 1.0% - 2.0% APY | Usually 0.5% - 1.5% APY plus cashback |

| Cashback Rewards | No cashback | Up to 5% cashback on purchases |

| Fees | Low or no maintenance fees | May include cashback redemption fees |

| Accessibility | Easy access to funds | Funds may have restrictions due to reward terms |

| Best For | Steady growth with minimal risk | Savvy spenders seeking rewards and savings |

Understanding Regular Savings Plans

Regular savings plans involve consistent, scheduled contributions to a dedicated savings account, allowing for disciplined wealth accumulation over time. These plans typically offer fixed or variable interest rates, helping savers grow their funds securely without the temptation of immediate spending. Understanding the structure and benefits of regular savings plans is crucial for long-term financial stability compared to fluctuating gains from cashback rewards savings.

What Are Cashback Rewards Savings?

Cashback rewards savings accounts offer a unique way to grow your savings by earning a percentage of your spending back as cash dividends, which are then added to your savings balance. These accounts incentivize regular consumer spending by providing a financial return linked directly to purchases made with linked debit or credit cards. Unlike traditional regular savings plans that focus solely on deposit growth through interest rates, cashback rewards savings combine both savings accumulation and reward benefits, making them ideal for consumers looking to maximize returns from everyday transactions.

Key Differences Between Regular Savings and Cashback Rewards

Regular savings plans offer predictable interest accrual on fixed deposits, promoting disciplined saving habits and long-term financial growth. Cashback rewards savings provide users with percentage-based returns on everyday spending, enhancing liquidity and providing instant benefits alongside saving. The key difference lies in the method of value generation: interest-based growth versus spending-linked rewards, impacting saving strategies and potential returns.

Pros and Cons of Regular Savings Plans

Regular savings plans offer consistent, disciplined contributions that help build a steady financial foundation and often include fixed interest rates providing predictable growth. However, their rigid structure may lack flexibility, limiting access to funds without penalties, and interest rates can be lower compared to other savings options. Unlike cashback rewards savings, regular plans do not provide immediate benefits or cash incentives, which can make them less attractive for short-term savers seeking quick returns.

Advantages and Drawbacks of Cashback Rewards Savings

Cashback rewards savings accounts offer the advantage of earning a percentage of purchases back as cash, providing an additional incentive to save while spending. However, these accounts often come with lower interest rates compared to regular savings plans, potentially limiting overall growth of savings. Fees and spending requirements may also reduce the net benefit of cashback rewards, making it essential to evaluate individual spending habits before choosing this option.

Which Savings Method Offers Better Returns?

Regular savings plans typically offer steady interest rates that accumulate predictably over time, making them a reliable choice for long-term growth. Cashback rewards savings accounts provide immediate benefits through cash rebates on purchases, boosting savings with everyday spending but often yield lower interest rates compared to regular savings plans. Evaluating which method offers better returns depends on individual spending habits and financial goals, with regular savings plans favoring consistent growth and cashback savings benefiting active consumers.

Risk Factors in Regular vs. Cashback Savings

Regular savings plans typically involve low-risk investments with stable but modest returns, minimizing exposure to market volatility. Cashback rewards savings carry minimal financial risk but can be limited by spending requirements and potential fees, impacting net savings. Understanding the trade-offs in liquidity, reward conditions, and opportunity costs is essential when comparing risk factors between these savings options.

How to Choose the Right Savings Strategy

Evaluating your financial goals is crucial when deciding between a regular savings plan and cashback rewards savings; a consistent contribution habit suits long-term growth while cashback savings maximize short-term benefits through reward incentives. Analyze interest rates, fees, and reward structures to determine which option aligns with your spending patterns and savings objectives. Prioritize accounts offering reliable returns and flexibility, ensuring your strategy supports both immediate needs and future financial security.

Combining Regular Savings and Cashback Rewards

Combining a regular savings plan with cashback rewards maximizes financial growth by leveraging consistent contributions alongside earned rewards from everyday purchases. This dual approach enhances overall savings efficiency, as cashback incentives effectively reduce expenses while funds in a regular savings account accumulate interest over time. Utilizing both strategies simultaneously optimizes wealth building by integrating disciplined saving habits with value-driven rewards.

Maximizing Savings: Expert Tips and Best Practices

Establishing a regular savings plan ensures consistent accumulation of funds through disciplined contributions, leveraging compound interest over time for maximum growth. Cashback rewards savings accounts enhance this growth by offering a percentage of spending back as additional savings, effectively boosting returns without extra effort. Combining both methods allows savers to optimize returns by maintaining steady deposits while capitalizing on reward incentives, maximizing overall savings potential.

Related Important Terms

Automated Micro-Saving Apps

Automated micro-saving apps optimize Regular Savings Plans by systematically transferring small amounts into high-yield accounts, fostering consistent growth and disciplined savings habits. Cashback rewards savings integrate these apps with everyday purchases, converting spending into incremental savings boosts, enhancing overall returns without additional effort.

Cashback Ladder Accounts

Cashback Ladder Accounts offer a strategic advantage by combining tiered interest rates with cashback rewards, enhancing overall savings growth compared to regular savings plans that typically provide fixed interest rates without additional incentives. This hybrid approach maximizes returns through increased liquidity and rewards, making Cashback Ladder Accounts a superior choice for savers seeking both flexibility and higher effective yields.

Smart Savings Allocators

Smart Savings Allocators strategically balance Regular Savings Plans with Cashback Rewards Savings to maximize growth and immediate benefits, optimizing interest accrual while leveraging cashback incentives for everyday spending. This dual approach enhances financial discipline and accelerates wealth accumulation by integrating steady contributions with value-driven cash returns.

Dynamic Recurring Deposits

Dynamic Recurring Deposits in regular savings plans offer flexible monthly contributions with consistent interest accrual, maximizing long-term growth through disciplined saving habits. Cashback rewards savings combine instant monetary returns on transactions with competitive interest rates, providing immediate value while still promoting reserve buildup.

Spend-to-Save Hybrid Plans

Spend-to-save hybrid plans combine the benefits of regular savings plans with cashback rewards, allowing users to build savings through routine deposits while earning cashback on everyday purchases. This approach maximizes growth potential by integrating disciplined saving habits with incentives tied directly to spending behavior, enhancing overall financial health.

Real-Time Cashback Reinvestment

Regular savings plans provide steady growth through fixed interest accumulation, while cashback rewards savings capitalize on real-time cashback reinvestment, allowing instant boosts to savings balances with each qualifying purchase. Real-time cashback reinvestment optimizes compound growth by converting rewards into immediate deposits, accelerating wealth accumulation compared to traditional saving methods.

Goal-Based Cashback Automations

Goal-based cashback automations enhance regular savings plans by automatically allocating cashback rewards into designated savings goals, accelerating progress without manual transfers. This strategy maximizes both routine deposits and reward earnings, optimizing overall savings growth efficiently.

Round-Up Savings vs. Cashback Matching

Round-Up Savings automatically rounds up each purchase to the nearest dollar, transferring the difference into a savings account, creating a consistent, effortless growth of funds. Cashback Matching enhances this by matching a percentage of cashback earned from purchases, accelerating savings accumulation and maximizing rewards benefits.

Digital Wallet Savings Triggers

Regular savings plans offer consistent, automatic contributions to grow funds steadily, while cashback rewards savings leverage everyday digital wallet transactions to boost savings through earned cashback incentives. Digital wallet savings triggers such as purchase frequency, bill payments, and subscription renewals activate cashback rewards that directly increase the savings balance, optimizing both disciplined saving and reward-based growth.

Gamified Cashback Savings

Gamified Cashback Savings transform routine savings into an engaging experience by rewarding users with cashback bonuses tied to specific saving milestones, encouraging consistent deposits and financial discipline. Unlike regular savings plans that offer fixed interest rates, these cashback rewards boost overall returns through game-like incentives, enhancing motivation and long-term wealth accumulation.

Regular savings plan vs Cashback rewards savings for savings. Infographic

moneydiff.com

moneydiff.com