A piggy bank offers a tangible and visual way to save money, encouraging physical saving habits especially for children. In contrast, a digital savings jar provides convenience, instant access, and often features like automatic transfers and goal tracking through mobile apps. Choosing between the two depends on personal preferences for accessibility and the motivation style needed to maintain consistent savings.

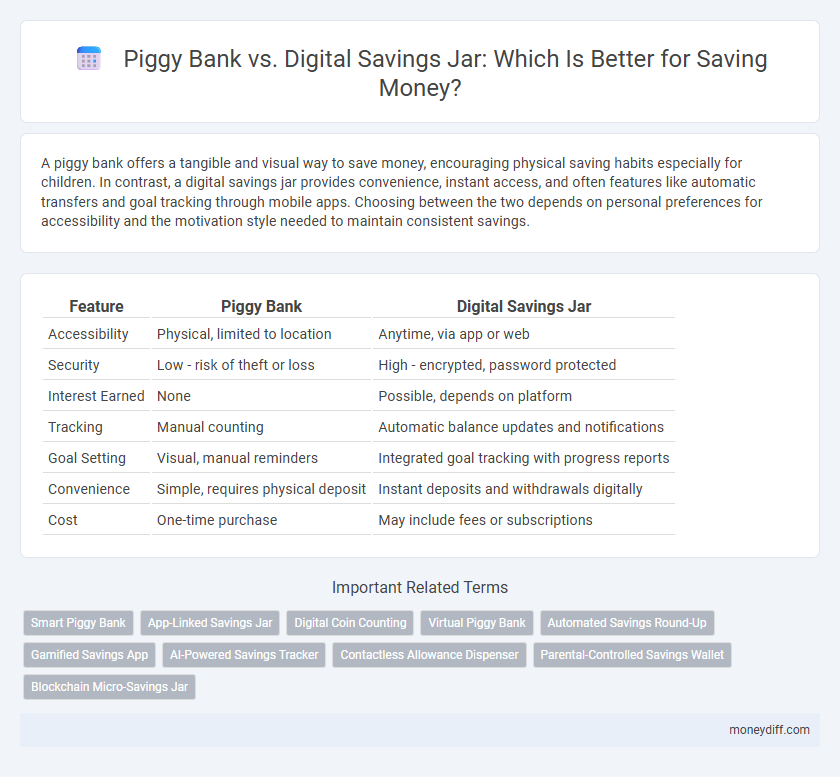

Table of Comparison

| Feature | Piggy Bank | Digital Savings Jar |

|---|---|---|

| Accessibility | Physical, limited to location | Anytime, via app or web |

| Security | Low - risk of theft or loss | High - encrypted, password protected |

| Interest Earned | None | Possible, depends on platform |

| Tracking | Manual counting | Automatic balance updates and notifications |

| Goal Setting | Visual, manual reminders | Integrated goal tracking with progress reports |

| Convenience | Simple, requires physical deposit | Instant deposits and withdrawals digitally |

| Cost | One-time purchase | May include fees or subscriptions |

Introduction: Piggy Banks and Digital Savings Jars Compared

Piggy banks offer a tangible, traditional method of saving money, fostering a physical connection to cash by allowing users to deposit coins and bills in a small, often decorative container. Digital savings jars provide a modern alternative through mobile apps and online platforms that track and manage savings automatically, often integrating budgeting tools and financial goals. Both methods enhance savings habits, but digital jars offer greater convenience, security, and the ability to monitor progress in real-time.

Traditional Piggy Bank: How It Works for Saving Money

A traditional piggy bank is a physical container, often shaped like a pig, designed to store coins and small bills, encouraging saving through the tactile experience of dropping money inside. It operates on a simple concept: individuals insert spare change regularly, fostering a habit of saving without the need for digital tools or accounts. This method provides a tangible visual and physical reminder of accumulated funds, making it effective for teaching children basic financial discipline and the value of money management.

Digital Savings Jar: Features and Functionality

Digital savings jars offer automated money transfers, real-time balance tracking, and customizable saving goals, enhancing financial discipline through intuitive app interfaces. Integration with mobile banking and personalized notifications improves user engagement and goal completion rates. Advanced features like spending insights and multi-goal management provide a comprehensive savings experience unmatched by traditional piggy banks.

Accessibility: Physical vs. Digital Savings Options

Physical piggy banks provide tangible, immediate access to cash, fostering a hands-on saving experience ideal for children and those who prefer visual progress. Digital savings jars offer 24/7 accessibility through smartphones and apps, enabling real-time monitoring, automatic transfers, and easier goal adjustments. While piggy banks rely on physical presence, digital options enhance accessibility by integrating with online banking, ensuring savings are accessible anytime and anywhere.

Security: Protecting Savings in Piggy Banks and Digital Jars

Piggy banks offer physical security by limiting access to cash, which reduces the risk of impulsive spending but are vulnerable to theft or loss from physical damage. Digital savings jars provide enhanced security features such as encryption, password protection, and two-factor authentication, safeguarding funds against unauthorized access and cyber threats. Users benefit from digital transaction monitoring and automatic backup options, ensuring savings remain secure and recoverable in case of device failure.

Gamification and Motivation: Engaging Savers Through Technology

Gamification in digital savings jars leverages interactive features such as goal-setting, progress tracking, and reward systems to enhance user motivation and engagement, unlike traditional piggy banks that rely on visual cues alone. Digital platforms use real-time notifications and challenges to maintain savers' interest and promote consistent saving habits. Integrating technology-driven motivational tools transforms saving into an active and enjoyable experience, driving higher savings rates and financial discipline.

Parental Controls and Teaching Kids Financial Responsibility

Piggy banks offer tactile savings experiences that help children grasp basic money concepts through physical interaction and parental oversight. Digital savings jars provide advanced parental controls, allowing real-time monitoring, spending limits, and goal tracking to teach kids financial responsibility in a tech-savvy manner. Combining both tools enhances financial literacy by blending hands-on learning with digital accountability features.

Tracking Progress: Visualizing Savings Growth

A piggy bank provides tangible, physical feedback that helps visualize savings growth through visible coins and bills, fostering a stronger emotional connection to money saved. Digital savings jars, equipped with real-time tracking and detailed analytics, offer precise progress visualization with graphs and notifications that enhance motivation. Combining both methods can optimize savings habits by balancing emotional engagement and data-driven insights.

Pros and Cons: Piggy Banks vs. Digital Savings Jars

Piggy banks offer a tangible way to save money, fostering physical interaction and visual motivation, but they lack security and do not support interest growth. Digital savings jars provide convenience, real-time tracking, and can include features like automatic transfers and interest accrual, yet they may require internet access and pose cybersecurity risks. Choosing between the two depends on personal preferences for accessibility, security, and savings goals.

Choosing the Right Savings Tool for Your Financial Goals

Choosing the right savings tool depends on your financial goals and spending habits. A piggy bank offers a tangible way to save cash, promoting discipline for small, short-term goals, while a digital savings jar provides automated deposits and detailed tracking suitable for long-term planning and higher savings targets. Integrating both can optimize saving strategies by balancing accessibility and financial management technology.

Related Important Terms

Smart Piggy Bank

Smart Piggy Banks integrate digital tracking and automated savings features that enhance financial discipline compared to traditional piggy banks. These devices often connect to apps, enabling real-time progress monitoring and personalized saving goals, which outperform plain digital savings jars in user engagement and motivation.

App-Linked Savings Jar

App-linked digital savings jars offer real-time tracking and automatic transfers, enhancing savings discipline and financial goal achievement compared to traditional piggy banks. Features like customizable categories, interest earnings, and integrated budgeting tools optimize saving strategies for tech-savvy users.

Digital Coin Counting

Digital coin counting in a digital savings jar offers precise tracking and instant updates on savings progress, outperforming traditional piggy banks that require manual counting and lack real-time data. Leveraging apps with digital coin counting features enhances saving habits through detailed analytics and goal-setting tools unavailable in physical piggy banks.

Virtual Piggy Bank

A Virtual Piggy Bank offers enhanced security and instant accessibility compared to traditional savings jars, enabling users to track their savings goals electronically and automate deposits via linked bank accounts or apps. Integration with financial tools provides real-time notifications and customizable saving plans, making digital savings jars a smarter option for efficient money management.

Automated Savings Round-Up

Automated savings round-up technology in digital savings jars seamlessly rounds up everyday purchases to the nearest dollar, instantly transferring the difference into a savings account, boosting savings without requiring manual effort. Unlike traditional piggy banks, which rely on physical deposits and inertia, digital savings jars leverage real-time data and automation to accelerate growth and foster consistent saving habits.

Gamified Savings App

Gamified savings apps leverage real-time goal tracking and rewards systems to motivate users, outperforming traditional piggy banks by providing interactive challenges and instant feedback. Digital savings jars integrate with financial accounts, enabling automated deposits and personalized insights that enhance saving habits through behavioral nudges.

AI-Powered Savings Tracker

AI-powered savings trackers integrate with digital savings jars to provide real-time insights, personalized goal-setting, and spending analysis, enhancing saving efficiency beyond traditional piggy banks. These advanced tools use machine learning algorithms to optimize savings habits and automate contributions, ensuring consistent progress toward financial goals.

Contactless Allowance Dispenser

Contactless allowance dispensers integrated into digital savings jars offer secure, hygienic transactions that reduce physical contact and streamline savings tracking compared to traditional piggy banks. These devices use RFID or NFC technology to enable instant, cashless allowance transfers, promoting modern financial habits for children and teens.

Parental-Controlled Savings Wallet

Parental-controlled savings wallets offer enhanced security and real-time monitoring, allowing parents to set spending limits and track their children's saving habits more effectively than traditional piggy banks. These digital tools integrate educational features and instant notifications, promoting financial literacy while ensuring controlled access to funds.

Blockchain Micro-Savings Jar

Blockchain micro-savings jars provide enhanced security and transparency compared to traditional piggy banks, enabling users to track small, frequent deposits with immutable ledger technology. These digital savings jars facilitate automated micro-transactions and smart contract rules, optimizing savings growth through decentralized finance (DeFi) protocols while eliminating physical storage risks.

Piggy Bank vs Digital Savings Jar for savings. Infographic

moneydiff.com

moneydiff.com