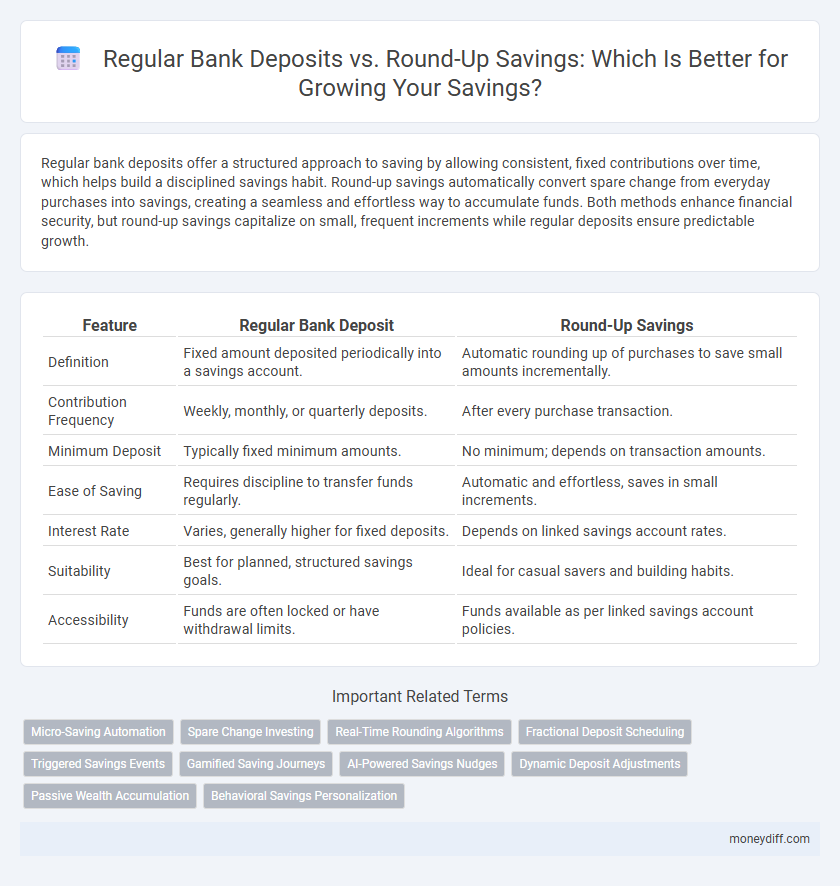

Regular bank deposits offer a structured approach to saving by allowing consistent, fixed contributions over time, which helps build a disciplined savings habit. Round-up savings automatically convert spare change from everyday purchases into savings, creating a seamless and effortless way to accumulate funds. Both methods enhance financial security, but round-up savings capitalize on small, frequent increments while regular deposits ensure predictable growth.

Table of Comparison

| Feature | Regular Bank Deposit | Round-Up Savings |

|---|---|---|

| Definition | Fixed amount deposited periodically into a savings account. | Automatic rounding up of purchases to save small amounts incrementally. |

| Contribution Frequency | Weekly, monthly, or quarterly deposits. | After every purchase transaction. |

| Minimum Deposit | Typically fixed minimum amounts. | No minimum; depends on transaction amounts. |

| Ease of Saving | Requires discipline to transfer funds regularly. | Automatic and effortless, saves in small increments. |

| Interest Rate | Varies, generally higher for fixed deposits. | Depends on linked savings account rates. |

| Suitability | Best for planned, structured savings goals. | Ideal for casual savers and building habits. |

| Accessibility | Funds are often locked or have withdrawal limits. | Funds available as per linked savings account policies. |

Understanding Regular Bank Deposits

Regular bank deposits offer a predictable and secure way to save money through fixed monthly contributions or lump sums, often earning interest at a set rate determined by the bank. These deposits provide clear terms regarding maturity periods and interest payouts, making them ideal for individuals seeking stable growth without frequent account monitoring. Understanding the fixed nature and potential penalties for early withdrawal helps savers maximize returns and align their savings goals effectively.

What Are Round-Up Savings Accounts?

Round-up savings accounts automatically round up each purchase to the nearest dollar and transfer the difference into a savings account, making saving effortless and consistent. Unlike regular bank deposits that require manual transfers, round-up savings capitalize on everyday spending to boost savings gradually. This method leverages micro-savings, helping users accumulate funds without feeling a significant impact on their daily budget.

Key Differences Between Regular Deposits and Round-Up Savings

Regular bank deposits involve fixed, scheduled contributions to a savings account, providing predictable growth and easier financial planning. Round-up savings automatically transfer the difference between purchase amounts and the nearest dollar into a savings account, enabling incremental, effortless accumulation over time. While regular deposits encourage disciplined saving habits, round-up savings leverage everyday spending behavior to increase savings without requiring explicit action.

Interest Rates: Regular Deposit vs Round-Up Savings

Regular bank deposits typically offer fixed interest rates ranging from 2% to 5% annually, providing predictable growth on larger, consistent amounts. Round-up savings accounts often feature variable interest rates, usually lower than traditional deposits, averaging around 1% to 3%, designed to encourage micro-savings through small, frequent increments. Comparing interest returns, regular deposits yield higher earnings over time due to larger principal amounts and stable rates, while round-up savings prioritize ease and incremental saving habits.

Automation: How Round-Up Savings Simplify Saving

Round-Up Savings automate the saving process by linking to everyday purchases and rounding transactions to the nearest dollar, instantly transferring the difference into a dedicated savings account. This seamless automation reduces the need for manual deposits, ensuring consistent saving without disrupting daily budgeting. Regular Bank Deposits require scheduled manual transfers, making Round-Up Savings a more effortless and efficient method for building savings over time.

Saving Discipline: Manual Deposits vs Micro-Savings

Regular bank deposits require disciplined manual contributions, fostering conscious saving habits through scheduled transfers of fixed amounts into savings accounts. Round-up savings automate micro-savings by rounding up daily purchases and transferring the spare change, encouraging consistent accumulation without active effort. Both methods promote saving discipline, but manual deposits enhance intentional budgeting while round-up savings offer seamless, incremental growth.

Fees and Account Requirements

Regular bank deposits often require minimum balance maintenance and may charge monthly fees, impacting overall savings growth. Round-up savings accounts typically have lower or no fees and minimal account requirements, making them more accessible for consistent, small-scale savings. Choosing a round-up savings option can optimize fee management while enabling seamless, automatic fund accumulation from everyday transactions.

Accessibility and Withdrawal Flexibility

Regular bank deposits offer high accessibility with easy and immediate withdrawals, making them ideal for users who need frequent access to their savings. Round-up savings automatically transfer spare change into a separate account but often impose restrictions on withdrawals to encourage long-term saving. Users seeking flexible access to funds benefit more from regular bank deposits, whereas round-up savings favor those prioritizing gradual accumulation.

Ideal Users: Who Benefits Most from Each Method?

Regular bank deposits benefit individuals with consistent income streams who prefer structured, disciplined saving plans, such as salaried employees and retirees seeking steady growth. Round-up savings appeal to users with frequent small transactions, like millennials and digital shoppers, who favor effortless, incremental savings without altering their spending habits. Both methods serve distinct needs, with regular deposits ideal for predictable budgeting and round-ups suited for gradual, automatic accumulation.

Choosing the Right Savings Strategy for Your Goals

Regular bank deposits provide a structured approach to savings with fixed contributions and predictable interest rates, ideal for long-term financial goals requiring stability. Round-up savings automatically collects spare change from everyday purchases, promoting effortless growth and flexibility for short-term or emergency funds. Selecting the right strategy depends on your savings timeline and consistency, balancing disciplined deposits with automated, incremental savings boosts.

Related Important Terms

Micro-Saving Automation

Regular bank deposits require manual transfers at fixed intervals, limiting flexibility and consistency, while round-up savings automate micro-transactions by rounding up everyday purchases to the nearest dollar and saving the difference, enhancing seamless, incremental wealth accumulation. This micro-saving automation fosters disciplined savings growth without significant impact on daily cash flow, making it ideal for users seeking effortless, consistent savings habits.

Spare Change Investing

Round-up savings automatically invests spare change from everyday purchases into diversified portfolios, enhancing the power of micro-investments without requiring large initial deposits. Regular bank deposits offer predictable interest but lack the compounding potential and dynamic growth associated with continuous round-up investing.

Real-Time Rounding Algorithms

Real-time rounding algorithms in round-up savings automatically adjust transactions to the nearest dollar, seamlessly accumulating small amounts into savings, enhancing the frequency of deposits compared to traditional regular bank deposits. This technology maximizes savings growth through consistent micro-deposits, leveraging behavioral economics to promote habitual saving without requiring large, upfront capital.

Fractional Deposit Scheduling

Regular bank deposits rely on fixed amounts transferred at set intervals, providing predictable savings growth, while round-up savings use fractional deposit scheduling by rounding up everyday purchases to the nearest dollar, automatically funneling the spare change into savings accounts. Fractional deposit scheduling maximizes incremental savings without impacting cash flow, making round-up savings a more dynamic and effortless strategy for gradual wealth accumulation.

Triggered Savings Events

Regular bank deposits rely on scheduled, fixed contributions often tied to paydays or monthly budgets, creating predictable saving patterns. Round-up savings trigger micro-deposits by rounding-up everyday purchases to the nearest dollar, effectively automating incremental savings without investor intervention.

Gamified Saving Journeys

Regular bank deposits offer a structured savings method with fixed amounts and interest rates, promoting consistent fund growth over time. Round-up savings leverage gamified saving journeys by automatically rounding transactions to the nearest dollar and transforming spare change into incremental savings, enhancing user engagement and motivation through interactive goals and rewards.

AI-Powered Savings Nudges

AI-powered savings nudges enhance both regular bank deposits and round-up savings by analyzing spending patterns and suggesting optimal deposit amounts or rounding thresholds, maximizing savings efficiency. These personalized recommendations increase the likelihood of consistent saving behavior by automating discipline and adjusting targets based on real-time financial data.

Dynamic Deposit Adjustments

Regular bank deposits provide fixed, predictable contributions ideal for consistent growth, while round-up savings dynamically adjust deposits by rounding up transactions to the nearest dollar, maximizing micro-savings effortlessly. This real-time, adaptive approach leverages everyday spending patterns to optimize incremental savings without altering user behavior.

Passive Wealth Accumulation

Regular bank deposits offer a structured approach to passive wealth accumulation through fixed contributions and predictable interest returns, providing stability for long-term savings goals. Round-up savings optimize the saving process by automatically rounding up everyday purchases and transferring the difference into a savings account, enabling effortless and incremental wealth growth without active effort.

Behavioral Savings Personalization

Regular bank deposits establish consistent saving habits through automated transfers of fixed amounts, reinforcing discipline and predictability in personal finance management. Round-up savings leverage behavioral insights by linking to everyday purchases and automatically saving small change, creating a personalized, effortless approach that maximizes idle cash without requiring conscious effort.

Regular Bank Deposit vs Round-Up Savings for savings. Infographic

moneydiff.com

moneydiff.com