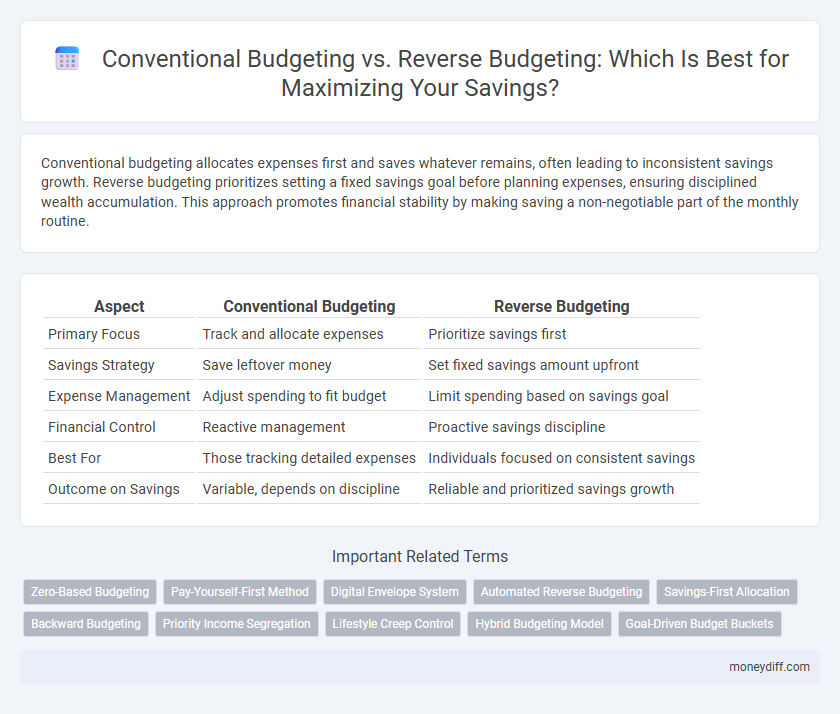

Conventional budgeting allocates expenses first and saves whatever remains, often leading to inconsistent savings growth. Reverse budgeting prioritizes setting a fixed savings goal before planning expenses, ensuring disciplined wealth accumulation. This approach promotes financial stability by making saving a non-negotiable part of the monthly routine.

Table of Comparison

| Aspect | Conventional Budgeting | Reverse Budgeting |

|---|---|---|

| Primary Focus | Track and allocate expenses | Prioritize savings first |

| Savings Strategy | Save leftover money | Set fixed savings amount upfront |

| Expense Management | Adjust spending to fit budget | Limit spending based on savings goal |

| Financial Control | Reactive management | Proactive savings discipline |

| Best For | Those tracking detailed expenses | Individuals focused on consistent savings |

| Outcome on Savings | Variable, depends on discipline | Reliable and prioritized savings growth |

Understanding Conventional Budgeting for Savings

Conventional budgeting for savings involves setting a fixed amount to save from your income after allocating funds for essential expenses such as housing, utilities, and groceries. This traditional approach prioritizes expense management first, then focuses on saving whatever is left over, which can sometimes limit the total savings potential. Understanding this method helps individuals recognize the challenges in consistently building savings if their expenses are high or unplanned costs arise.

What Is Reverse Budgeting?

Reverse budgeting is a savings strategy that prioritizes setting aside a fixed amount of money for savings before allocating funds to expenses, ensuring consistent financial growth. Unlike conventional budgeting, which tracks spending first and saves what remains, reverse budgeting secures savings as a non-negotiable expense, promoting disciplined financial habits. This method helps individuals achieve savings goals more effectively by treating savings as a primary financial commitment.

Key Differences Between Conventional and Reverse Budgeting

Conventional budgeting allocates income by prioritizing expenses and saving whatever remains, while reverse budgeting focuses first on setting a fixed savings goal and then adjusting spending around that target. Key differences include the savings-first approach of reverse budgeting, which promotes disciplined saving habits, versus the expense-driven method of conventional budgeting that may lead to inconsistent savings. Reverse budgeting often results in higher savings rates and better financial control by treating savings as a non-negotiable expense.

Pros and Cons of Conventional Budgeting

Conventional budgeting provides a clear framework by allocating fixed amounts to expense categories, helping individuals track spending and avoid overspending. However, it can be rigid and time-consuming, often failing to account for unexpected expenses or changes in income. This inflexibility may lead to frustration and reduced motivation to stick to the budget over time.

Advantages and Disadvantages of Reverse Budgeting

Reverse budgeting prioritizes savings by allocating a fixed percentage of income toward financial goals before any expenses, ensuring consistent wealth accumulation. This method improves financial discipline and reduces impulse spending but may limit flexibility in handling variable monthly expenses or emergencies. It is ideal for individuals committed to long-term savings but could feel restrictive for those with fluctuating income or unpredictable costs.

Which Budgeting Method Boosts Savings Faster?

Reverse budgeting boosts savings faster by prioritizing saving goals before allocating funds to expenses, ensuring a fixed percentage of income is saved upfront. Conventional budgeting allocates spending first, which often results in leftover savings that can be inconsistent and lower. Studies show reverse budgeting increases savings rates by up to 30% compared to traditional methods, making it a more effective approach for faster wealth accumulation.

Adapting Budgeting Methods to Your Financial Goals

Conventional budgeting involves allocating a fixed portion of income to expenses before savings, which can limit the amount saved if spending prioritizes non-essential costs. Reverse budgeting prioritizes savings by automatically setting aside a target amount first, ensuring that saving goals are met before allocating funds to expenditures. Adapting these budgeting methods to individual financial goals enhances discipline and flexibility, helping optimize savings growth according to personal priorities and income variability.

Common Mistakes in Both Budgeting Approaches

Common mistakes in conventional budgeting include underestimating expenses and failing to account for irregular costs, which often leads to overspending and insufficient savings. Reverse budgeting errors frequently involve setting unrealistic savings targets without aligning them to actual income and spending habits, causing financial strain or inconsistency. Both approaches can suffer from lack of regular review and adjustment, undermining long-term savings goals and financial stability.

Practical Steps to Transition from Conventional to Reverse Budgeting

To transition from conventional to reverse budgeting, start by identifying your fixed savings target, such as 20% of your monthly income, before allocating funds to expenses. Track your essential costs and adjust discretionary spending to align with the remaining budget after savings. Use budgeting apps or spreadsheets to monitor progress and ensure consistent savings growth while maintaining financial discipline.

Choosing the Right Budgeting Strategy for Maximum Savings

Conventional budgeting allocates expenses based on income, often limiting the amount saved by prioritizing spending categories, whereas reverse budgeting prioritizes savings first by setting aside a fixed amount before managing expenses. Choosing reverse budgeting can maximize savings by ensuring a predetermined savings goal is met, fostering disciplined financial habits. For individuals aiming to enhance their savings rate, reverse budgeting offers a more effective strategy by aligning spending with fixed saving targets.

Related Important Terms

Zero-Based Budgeting

Zero-Based Budgeting allocates every dollar of income to specific expenses, savings, and debt payments, ensuring no funds are left unassigned and promoting disciplined financial planning. In contrast, Reverse Budgeting prioritizes savings first by setting aside a fixed amount before covering expenses, encouraging consistent saving habits and effective money management.

Pay-Yourself-First Method

Conventional budgeting allocates expenses based on income, often leaving savings as a residual, whereas reverse budgeting prioritizes the Pay-Yourself-First method by setting aside savings before any other spending. The Pay-Yourself-First approach ensures consistent savings growth by automatically diverting a fixed percentage of income directly into savings accounts or investments.

Digital Envelope System

Conventional budgeting allocates fixed amounts to expenses before savings, often leading to inconsistent saving habits, whereas reverse budgeting prioritizes savings by setting aside funds first and using the remainder for expenses, enhancing financial discipline. The digital envelope system efficiently supports reverse budgeting by digitally categorizing funds into specific spending and saving envelopes, providing real-time tracking and improved adherence to savings goals.

Automated Reverse Budgeting

Automated Reverse Budgeting ensures savings are prioritized by automatically allocating a set amount to savings accounts before expenses are assigned, increasing financial discipline and consistent wealth accumulation. This method contrasts with Conventional Budgeting, which plans expenses first and saves leftover funds, often resulting in inconsistent savings and weaker financial goals.

Savings-First Allocation

Savings-first allocation prioritizes setting aside a fixed percentage of income before distributing funds to expenses, ensuring consistent wealth accumulation. Unlike conventional budgeting, which allocates leftover money to savings after expenses, reverse budgeting guarantees disciplined savings growth by treating savings as a non-negotiable expense.

Backward Budgeting

Backward budgeting prioritizes savings goals by setting aside a fixed amount first before allocating funds to expenses, ensuring disciplined financial management and stronger wealth accumulation. Unlike conventional budgeting, which starts with expenses and saves what's left, backward budgeting guarantees savings are met consistently, promoting financial stability.

Priority Income Segregation

Conventional budgeting allocates income based on fixed expense categories before savings, often leading to inconsistent saving habits, whereas reverse budgeting prioritizes savings by first setting aside a designated amount, ensuring financial goals are met efficiently. Prioritizing income segregation in reverse budgeting enhances disciplined saving by treating savings as a non-negotiable expense, optimizing financial stability and wealth accumulation.

Lifestyle Creep Control

Conventional budgeting often struggles to control lifestyle creep due to fixed expense categories that increase with income, whereas reverse budgeting prioritizes savings goals first, automatically limiting available funds for discretionary spending and curbing lifestyle inflation. By allocating savings upfront, reverse budgeting enforces disciplined financial behavior, effectively preventing gradual expenditure growth tied to income increases.

Hybrid Budgeting Model

The Hybrid Budgeting Model combines the structure of Conventional Budgeting with the flexibility of Reverse Budgeting, allowing individuals to allocate a fixed percentage of income directly to savings before managing expenses. This approach optimizes financial discipline and adaptability, enhancing long-term wealth accumulation by prioritizing savings while maintaining control over discretionary spending.

Goal-Driven Budget Buckets

Goal-driven budget buckets in reverse budgeting prioritize savings by allocating funds first to specific financial goals before covering expenses, ensuring targeted growth of savings. In contrast, conventional budgeting divides income primarily based on fixed expense categories, often limiting the proactive dedication of funds to savings goals.

Conventional Budgeting vs Reverse Budgeting for savings. Infographic

moneydiff.com

moneydiff.com