Recurring transfers provide a consistent, automated approach to saving by moving a fixed amount from checking to savings at regular intervals, fostering disciplined financial habits. Round-up savings capitalize on everyday purchases by rounding up transactions to the nearest dollar and transferring the spare change into savings, enabling effortless accumulation without noticeable impact on spending. Choosing between these methods depends on personal preference for structured saving versus passive growth, both effectively increasing savings over time.

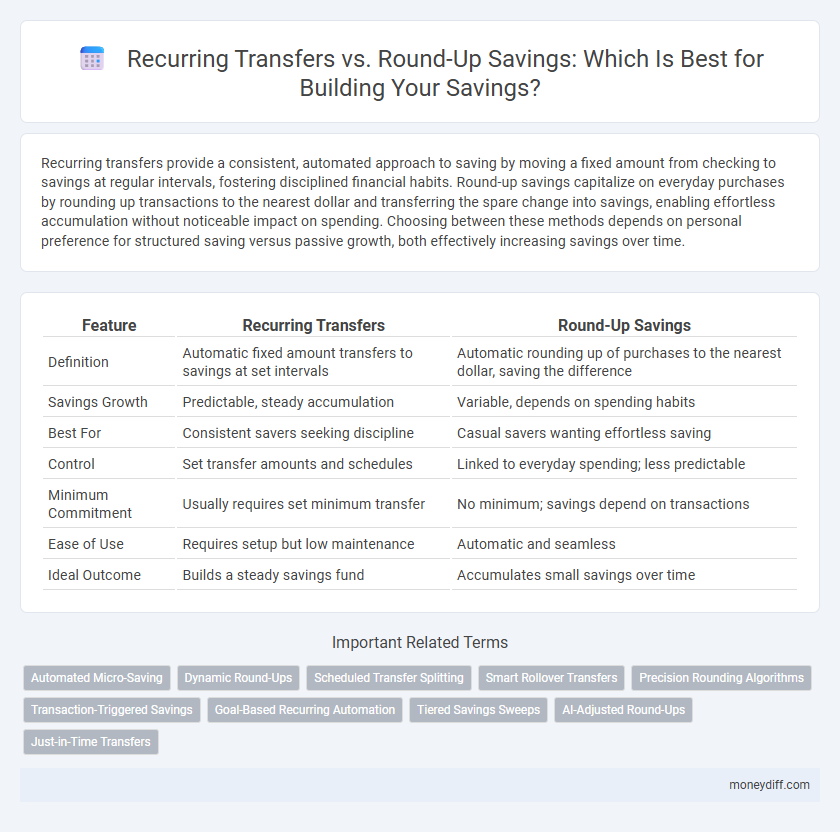

Table of Comparison

| Feature | Recurring Transfers | Round-Up Savings |

|---|---|---|

| Definition | Automatic fixed amount transfers to savings at set intervals | Automatic rounding up of purchases to the nearest dollar, saving the difference |

| Savings Growth | Predictable, steady accumulation | Variable, depends on spending habits |

| Best For | Consistent savers seeking discipline | Casual savers wanting effortless saving |

| Control | Set transfer amounts and schedules | Linked to everyday spending; less predictable |

| Minimum Commitment | Usually requires set minimum transfer | No minimum; savings depend on transactions |

| Ease of Use | Requires setup but low maintenance | Automatic and seamless |

| Ideal Outcome | Builds a steady savings fund | Accumulates small savings over time |

Understanding Recurring Transfers for Savings

Recurring transfers enable consistent, automatic movement of funds from a checking account to a dedicated savings account at specified intervals, promoting disciplined saving habits. This method ensures steady growth of savings by eliminating manual transactions and reducing the risk of spending surplus funds. Compared to round-up savings, which save small amounts from each purchase, recurring transfers provide predictable and substantial contributions, making them effective for reaching specific financial goals.

How Round-Up Savings Work

Round-Up Savings work by automatically rounding up each purchase to the nearest dollar and transferring the difference into a savings account, allowing users to save small amounts effortlessly over time. This method leverages everyday spending patterns, making it a seamless and consistent way to build savings without needing large, intentional transfers. Compared to recurring transfers, round-up savings offer a more passive and incremental approach, often resulting in a substantial savings boost with minimal impact on daily cash flow.

Key Benefits of Recurring Transfers

Recurring transfers provide a reliable method for disciplined saving by automatically moving a fixed amount from checking to savings accounts on a set schedule, enhancing financial consistency. This approach allows savers to plan and reach long-term goals efficiently without needing to remember manual transfers. Unlike round-up savings, which depend on transaction frequency, recurring transfers ensure steady contributions regardless of spending habits.

Advantages of Round-Up Savings Programs

Round-Up Savings programs automatically round up each purchase to the nearest dollar and transfer the difference into a savings account, promoting effortless and consistent saving habits. These programs leverage everyday spending behaviors to accumulate savings without requiring significant upfront effort or financial discipline. By transforming small, frequent transactions into meaningful savings, Round-Up Savings foster steady growth and better financial management over time.

Comparing Automation: Recurring vs Round-Up Methods

Recurring transfers automate savings by scheduling fixed amounts to move regularly from checking to savings accounts, ensuring consistent growth. Round-up savings automatically round up purchases to the nearest dollar and transfer the difference, providing a seamless way to save small amounts frequently. While recurring transfers offer predictable, budgetable savings, round-up methods leverage everyday spending patterns for gradual accumulation.

Which Method Builds Savings Faster?

Recurring transfers build savings faster than round-up savings by moving fixed amounts regularly, ensuring consistent growth regardless of spending habits. Round-up savings depend on transaction volume and vary monthly, often resulting in smaller, less predictable contributions. Automated recurring transfers maximize savings velocity by maintaining disciplined, scheduled deposits into your savings account.

Fees and Accessibility: What to Consider

Recurring transfers often have no fees and provide predictable, automated savings by moving fixed amounts from checking to savings accounts regularly. Round-up savings, which round up purchases to the nearest dollar and save the difference, may involve fees depending on the app or bank used, potentially reducing net savings. Accessibility varies as recurring transfers offer control over timing and amounts, while round-up savings depend on spending patterns and may cause slower accumulation.

Customization and Flexibility in Savings Strategies

Recurring Transfers enable precise control over savings through scheduled, fixed-amount deposits, ensuring consistent progress toward specific financial goals. Round-Up Savings automatically round up everyday purchases to the nearest dollar, funneling spare change into savings while requiring minimal user input. This combination of customizable and automatic methods offers a flexible approach to building savings tailored to individual preferences and habits.

Ideal Users: Who Benefits Most from Each Method?

Recurring transfers benefit individuals with steady incomes who prefer automated, consistent savings contributions, allowing them to build financial discipline effortlessly. Round-up savings suit sporadic spenders who want to save passively by rounding up everyday purchases, ideal for those seeking a hands-off approach to accumulate small amounts over time. Both methods optimize savings but cater to different spending behaviors and financial habits.

Choosing the Right Approach for Your Financial Goals

Recurring transfers provide a consistent and automated way to build savings by moving fixed amounts regularly, ideal for disciplined financial goals like emergency funds or planned expenses. Round-up savings round up everyday purchases to the nearest dollar and save the difference, making it a seamless and effortless method suited for gradual wealth accumulation. Choosing between recurring transfers and round-up savings depends on your financial discipline, spending habits, and target savings timeline for optimal goal achievement.

Related Important Terms

Automated Micro-Saving

Automated micro-saving options like recurring transfers and round-up savings both facilitate consistent savings by leveraging small, manageable amounts; recurring transfers enable scheduled, fixed-amount deposits from checking to savings accounts, promoting disciplined habit formation. Round-up savings automatically rounds purchases to the nearest dollar and transfers the difference into savings, harnessing everyday spending behavior to build funds effortlessly.

Dynamic Round-Ups

Dynamic Round-Ups automatically adjust the rounding amount based on transaction sizes, accelerating savings without impacting budgeting flexibility. Recurring transfers provide fixed savings amounts at regular intervals, but Dynamic Round-Ups optimize growth by capturing small, frequent increments from everyday spending habits.

Scheduled Transfer Splitting

Scheduled Transfer Splitting in recurring transfers allows users to allocate fixed amounts across multiple savings goals automatically, enhancing disciplined saving habits. Round-up savings, by contrast, aggregate spare change from transactions into a single savings pot, offering a passive but less customizable approach to budgeting multiple financial targets.

Smart Rollover Transfers

Smart Rollover Transfers automate moving surplus funds from checking to savings by analyzing spending patterns, making them more effective than fixed Recurring Transfers or Round-Up Savings which rely on static amounts or transaction rounding; this dynamic approach enhances saving efficiency and accelerates goal attainment. Leveraging AI-driven insights, Smart Rollover Transfers adapt to cash flow fluctuations, reducing unnecessary transfers while maximizing accumulated savings over time.

Precision Rounding Algorithms

Recurring transfers enable precise, scheduled savings by automating fixed amounts at regular intervals, ensuring consistent contribution growth. Round-up savings leverage precision rounding algorithms to convert transaction remainders into incremental deposits, optimizing spare change accumulation without manual intervention.

Transaction-Triggered Savings

Recurring transfers automate savings by scheduling fixed amounts to move regularly from checking to savings accounts, ensuring consistent growth over time. Round-up savings trigger transfers based on transaction amounts, rounding purchases up to the nearest dollar and saving the difference, which leverages everyday spending habits to effortlessly build savings.

Goal-Based Recurring Automation

Goal-based recurring automation through recurring transfers enables consistent, scheduled contributions toward specific financial objectives, enhancing disciplined savings behavior. Round-up savings complement this by automatically rounding purchases to the nearest dollar and allocating the difference, but recurring transfers offer more precise control over saving amounts aligned with defined goals.

Tiered Savings Sweeps

Tiered Savings Sweeps optimize savings by automatically transferring funds from checking to multiple savings tiers based on preset thresholds, maximizing interest earnings over simple Recurring Transfers that move fixed amounts. Unlike Round-Up Savings, which allocate small change increments, Tiered Savings Sweeps strategically prioritize higher-yield savings accounts to accelerate growth and liquidity management.

AI-Adjusted Round-Ups

AI-adjusted round-ups optimize savings by automatically rounding up transactions to the nearest dollar and analyzing spending patterns to adjust the amount saved, maximizing efficiency without affecting cash flow. Recurring transfers offer fixed, scheduled contributions but lack the dynamic, personalized savings potential driven by AI algorithms in round-up methods.

Just-in-Time Transfers

Just-in-time transfers optimize savings by moving funds precisely when a predetermined threshold or spend event occurs, enhancing cash flow efficiency compared to fixed schedules in recurring transfers. Round-up savings round transactions to the nearest dollar, indirectly saving small amounts, whereas just-in-time transfers provide targeted, timely fund allocation aligned with actual spending patterns.

Recurring Transfers vs Round-Up Savings for savings. Infographic

moneydiff.com

moneydiff.com