An emergency fund provides a financial safety net for unexpected expenses like medical bills or job loss, ensuring peace of mind during crises. Sidecar savings complement this by targeting specific short-term goals or planned expenses, such as vacations or home repairs, keeping these funds separate from emergencies. Prioritizing both helps create a balanced savings strategy that protects against uncertainty while supporting personal financial objectives.

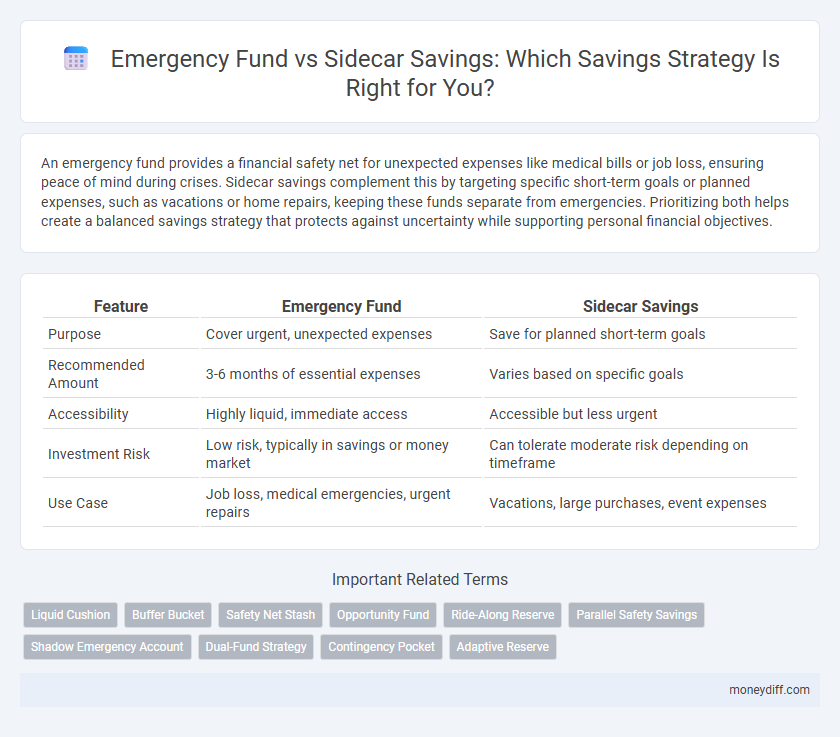

Table of Comparison

| Feature | Emergency Fund | Sidecar Savings |

|---|---|---|

| Purpose | Cover urgent, unexpected expenses | Save for planned short-term goals |

| Recommended Amount | 3-6 months of essential expenses | Varies based on specific goals |

| Accessibility | Highly liquid, immediate access | Accessible but less urgent |

| Investment Risk | Low risk, typically in savings or money market | Can tolerate moderate risk depending on timeframe |

| Use Case | Job loss, medical emergencies, urgent repairs | Vacations, large purchases, event expenses |

Understanding Emergency Funds: Purpose and Importance

An emergency fund serves as a financial safety net designed to cover unexpected expenses such as medical emergencies, car repairs, or job loss, ensuring stability and peace of mind. It is typically recommended to hold three to six months' worth of living expenses in a liquid, easily accessible account to avoid debt during unforeseen events. Unlike sidecar savings, which target specific short-term goals, the emergency fund prioritizes immediate financial security and protection against major financial disruptions.

What Are Sidecar Savings Accounts?

Sidecar savings accounts are supplemental savings vehicles linked to a primary checking or savings account, designed to help manage distinct financial goals such as short-term expenses or irregular costs. Unlike traditional emergency funds that focus solely on unexpected major expenses, sidecar accounts provide segmented savings for planned spending, allowing better budgeting and financial organization. These accounts improve liquidity and prevent depletion of emergency funds by isolating non-urgent financial goals.

Key Differences Between Emergency Funds and Sidecar Savings

Emergency funds are designed to cover essential expenses during unexpected financial crises, typically maintaining three to six months' worth of living costs in highly liquid accounts. Sidecar savings, on the other hand, allocate funds to specific short- or medium-term goals, such as vacations or home improvements, often kept in separate accounts to avoid mixing with emergency reserves. The key difference lies in purpose and accessibility: emergency funds emphasize immediate availability for unforeseen events, while sidecar savings support planned expenditures without risking core financial security.

When to Use an Emergency Fund

An emergency fund should be used exclusively for unexpected and urgent expenses, such as medical bills, car repairs, or sudden job loss, to maintain financial stability. Sidecar savings, in contrast, can cover planned or less critical expenses, like vacations or home improvements, preserving the emergency fund's availability. Maintaining a fully funded emergency fund equal to three to six months of living expenses ensures readiness for unforeseen financial shocks.

Best Uses for Sidecar Savings Accounts

Sidecar savings accounts are ideal for managing specific short-term goals like upcoming vacations, holiday expenses, or vehicle maintenance, allowing users to allocate funds separately from their emergency fund. These accounts help maintain financial discipline by segregating discretionary spending without compromising the liquidity needed for genuine emergencies. Utilizing sidecar savings enhances budgeting flexibility and prevents the depletion of core emergency reserves.

Building Your Emergency Fund: Practical Tips

Building your emergency fund involves setting aside three to six months' worth of essential expenses in a highly liquid account to cover unexpected costs such as medical bills, car repairs, or job loss. Prioritize consistency by automating monthly transfers to your emergency savings and gradually increasing contributions as your income grows. Unlike sidecar savings designed for specific short-term goals, emergency funds provide a financial safety net that ensures stability during unforeseen circumstances.

How to Set Up a Sidecar Savings Strategy

Establish a sidecar savings strategy by first identifying specific short-term goals separate from your emergency fund, such as upcoming vacations or planned large purchases. Allocate a fixed percentage of your income or monthly budget toward these sidecar accounts to maintain disciplined saving without depleting your emergency fund. Utilize automated transfers to ensure consistency and track progress separately for each sidecar account using budgeting apps or spreadsheets for better financial organization.

Emergency Fund vs Sidecar Savings: Pros and Cons

Emergency funds offer a reliable financial safety net for unexpected expenses, providing instant access to cash in emergencies without penalty, but they often yield lower interest rates compared to other savings options. Sidecar savings accounts, designed to supplement main savings or cover specific planned expenses, typically provide higher interest rates and more flexibility but may lack the immediate liquidity essential in true emergencies. Choosing between the two depends on balancing the priority of accessibility versus growth potential within an overall savings strategy.

Which Savings Account Should You Prioritize?

Prioritize an emergency fund savings account to cover at least three to six months of essential expenses, ensuring financial security during unforeseen events. Sidecar savings accounts serve as supplemental funds for specific goals or upcoming expenses, but they lack the safety net function of an emergency fund. Establishing a robust emergency fund account first provides a foundation before allocating money into sidecar savings for targeted financial objectives.

Integrating Emergency Funds and Sidecar Savings in Your Budget

Integrating emergency funds and sidecar savings within your budget enhances financial resilience by clearly defining purpose-specific reserves. Emergency funds cover unexpected expenses such as medical bills or job loss, while sidecar savings allocate money for planned but irregular costs like vacations or car maintenance. Structuring both components promotes disciplined saving habits, ensuring liquidity without compromising long-term financial goals.

Related Important Terms

Liquid Cushion

An emergency fund serves as a liquid cushion designed to cover essential expenses during unexpected financial disruptions, typically held in highly accessible accounts like savings or money market funds. Sidecar savings complement this by providing additional liquidity for non-essential but foreseeable expenses, allowing the emergency fund to remain untouched and preserving overall financial stability.

Buffer Bucket

Emergency funds serve as a crucial buffer bucket, providing immediate access to cash for unforeseen expenses and financial shocks, typically covering three to six months of living costs. Sidecar savings complement this by targeting specific short-term goals or irregular expenses, ensuring the primary emergency fund remains intact for genuine emergencies.

Safety Net Stash

Emergency funds act as a critical safety net stash, providing immediate access to cash for unforeseen expenses and financial shocks, typically covering three to six months of essential living costs. Sidecar savings complement this by targeting specific short-term goals or smaller financial gaps, ensuring the emergency fund remains intact and preserving overall financial stability.

Opportunity Fund

An opportunity fund, distinct from traditional emergency funds and sidecar savings, provides liquidity specifically aimed at seizing unexpected investments or financial opportunities without disrupting long-term savings goals. This fund enhances financial agility by balancing risk management with strategic growth potential, making it a critical component of a robust savings strategy.

Ride-Along Reserve

Emergency funds provide a crucial financial safety net for unexpected expenses, while sidecar savings, such as a Ride-Along Reserve, function as additional, purpose-specific buffers that support short-term goals or non-emergency needs without depleting the main emergency fund. The Ride-Along Reserve enhances financial flexibility by segregating funds for planned irregular expenses, optimizing overall savings strategy and reducing reliance on high-interest debt.

Parallel Safety Savings

Emergency funds provide immediate financial safety by covering essential expenses during crises, while sidecar savings offer parallel safety savings for non-urgent goals or upcoming planned costs. Together, these savings strategies create a robust financial cushion, balancing liquidity and targeted reserves.

Shadow Emergency Account

The Shadow Emergency Account acts as a sidecar savings approach, providing a flexible financial buffer for unexpected minor expenses separate from the primary emergency fund, which is reserved for major crises. Maintaining both accounts enhances financial security by ensuring immediate liquidity without depleting critical reserves, optimizing overall savings strategy.

Dual-Fund Strategy

The Dual-Fund Strategy distinguishes between an Emergency Fund, reserved for unexpected expenses and typically held in highly liquid, low-risk accounts, and Sidecar Savings, designed for planned but flexible spending goals that can offer higher returns through moderate-risk investments. This approach enhances financial resilience by ensuring immediate access to cash during emergencies while optimizing growth potential for supplementary financial needs.

Contingency Pocket

An emergency fund is a contingency pocket designed for unexpected expenses like medical bills or urgent repairs, providing immediate financial security without disrupting regular finances. Sidecar savings serve as supplementary buffers for short-term goals or planned irregular expenses, enhancing overall financial resilience beyond the core emergency fund.

Adaptive Reserve

An Emergency Fund serves as a financial safety net covering 3 to 6 months of essential expenses, while Sidecar Savings offer flexible, adaptive reserves for planned or unexpected opportunities beyond emergencies. Adaptive Reserve strategies optimize liquidity and growth potential by dynamically allocating funds between these accounts based on risk tolerance and financial goals.

Emergency fund vs Sidecar savings for savings. Infographic

moneydiff.com

moneydiff.com