Certificate of Deposit (CD) offers a fixed interest rate with guaranteed returns over a set term, making it ideal for risk-averse savers seeking predictable growth. Prize-Linked Savings Accounts (PLSA) combine the safety of regular savings with the excitement of lottery-style prizes, incentivizing saving without risking the principal. Comparing both, CDs prioritize steady, reliable earnings, while PLSAs provide the chance for larger rewards alongside the security of savings.

Table of Comparison

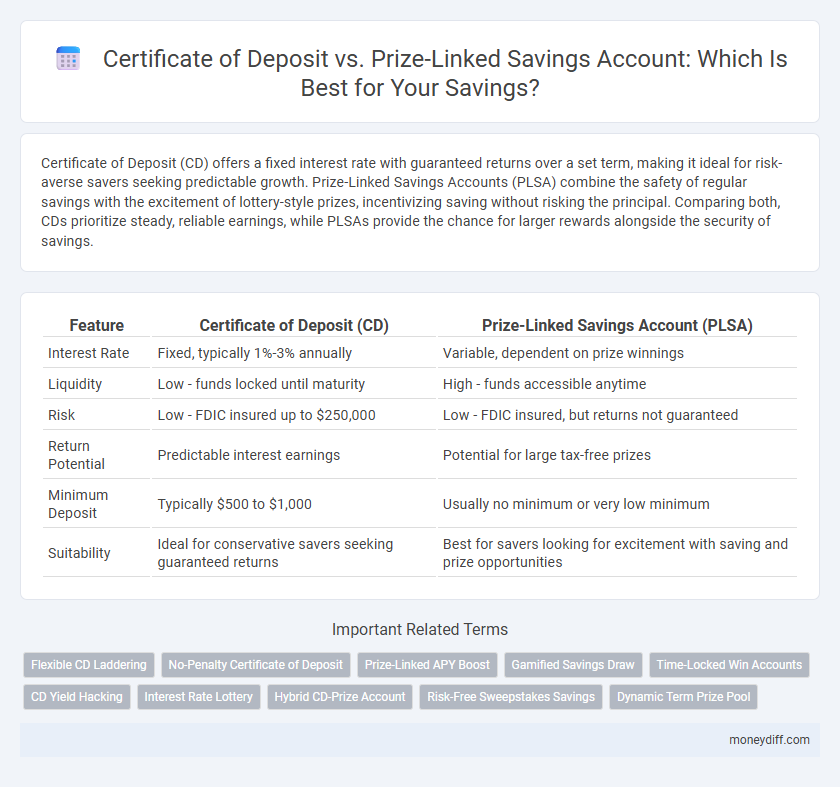

| Feature | Certificate of Deposit (CD) | Prize-Linked Savings Account (PLSA) |

|---|---|---|

| Interest Rate | Fixed, typically 1%-3% annually | Variable, dependent on prize winnings |

| Liquidity | Low - funds locked until maturity | High - funds accessible anytime |

| Risk | Low - FDIC insured up to $250,000 | Low - FDIC insured, but returns not guaranteed |

| Return Potential | Predictable interest earnings | Potential for large tax-free prizes |

| Minimum Deposit | Typically $500 to $1,000 | Usually no minimum or very low minimum |

| Suitability | Ideal for conservative savers seeking guaranteed returns | Best for savers looking for excitement with saving and prize opportunities |

Introduction to CD and Prize-Linked Savings Accounts

A Certificate of Deposit (CD) is a time-bound savings product offering fixed interest rates in exchange for locking funds for a specified term, often ranging from months to years. Prize-Linked Savings Accounts (PLSAs) combine traditional savings benefits with lottery-style incentives, offering chances to win cash prizes while maintaining principal safety. Both instruments encourage disciplined saving but differ significantly in risk, liquidity, and reward structures.

How Certificates of Deposit Work

Certificates of Deposit (CDs) are time-bound savings instruments that lock funds for a fixed term, typically ranging from a few months to several years, earning a predetermined interest rate. Investors receive guaranteed returns without market risk, with penalties applied for early withdrawal, which enforces disciplined saving. Unlike Prize-Linked Savings Accounts, CDs prioritize stable, predictable earnings over chance-based rewards, making them suitable for risk-averse savers seeking steady growth.

Understanding Prize-Linked Savings Accounts

Prize-Linked Savings Accounts (PLSAs) combine the safety of traditional savings with the excitement of lottery-style prizes, encouraging higher savings rates through the chance to win cash rewards. Unlike Certificates of Deposit (CDs) that offer fixed interest over a set term, PLSAs provide variable incentives without risking principal, often administered by credit unions or community banks. The appeal of PLSAs lies in their ability to promote financial discipline and engagement while preserving liquidity and earning potential.

Interest Rates: Fixed vs. Potential Winnings

Certificate of Deposit (CD) offers fixed interest rates, providing predictable and guaranteed returns over a set term, typically higher than standard savings accounts. Prize-Linked Savings Accounts (PLSA) combine the safety of regular savings with the chance to win cash prizes, where interest is replaced by lottery-like rewards, making potential winnings variable and less predictable. Savers prioritizing stability benefit from CDs' fixed rates, while those seeking excitement and variable gains may prefer PLSAs for their prize-based incentives.

Liquidity and Withdrawal Limitations

Certificate of Deposit (CD) offers fixed terms with penalties for early withdrawal, limiting liquidity compared to Prize-Linked Savings Accounts (PLSA), which typically allow more flexible access to funds without penalties. PLSAs combine savings growth with the chance to win prizes, encouraging regular deposits while maintaining higher liquidity. Withdrawals from CDs before maturity often result in forfeited interest, whereas PLSA withdrawals generally do not impose strict limits, making them preferable for savers needing accessible funds.

Risk Comparison: Security and Guarantees

Certificates of Deposit (CDs) offer principal protection backed by federal insurance through the FDIC or NCUA, ensuring deposited funds are secure up to allowable limits. Prize-linked savings accounts provide similar safety when held at insured institutions but introduce variability in returns by tying rewards to periodic drawings rather than fixed interest rates. Both instruments minimize risk of loss, but CDs deliver guaranteed returns, while prize-linked accounts emphasize saving motivation with uncertain prize incentives.

Minimum Deposit Requirements

Certificate of Deposit (CD) accounts typically require a higher minimum deposit, often starting at $500 to $1,000, making them less accessible for some savers. Prize-Linked Savings Accounts (PLSA) usually have much lower or no minimum deposit requirements, encouraging regular saving with minimal upfront cost. This difference in minimum deposit barriers can significantly impact how easily savers can begin building their savings with each option.

Tax Implications for Savers

Certificate of Deposit (CD) interest earnings are subject to federal and state income taxes, which can reduce the overall return for savers. Prize-Linked Savings Accounts (PLSAs) offer a tax advantage by typically deferring taxes on interest until withdrawal, and winnings from prize drawings are considered taxable income but can provide additional benefits without guaranteed returns. Evaluating the tax treatment alongside interest rates and prize structures is essential for maximizing after-tax savings growth.

Who Should Choose CDs or Prize-Linked Accounts?

Certificates of Deposit (CDs) are ideal for conservative savers seeking guaranteed, fixed returns over a specified term with minimal risk and early withdrawal penalties. Prize-Linked Savings Accounts appeal to those willing to accept variable returns and enjoy the chance to win cash prizes while maintaining access to their funds without fixed terms. Savers prioritizing predictable growth should opt for CDs, whereas individuals motivated by lottery-style rewards and flexible access may benefit more from prize-linked accounts.

Key Takeaways: Making the Right Choice for Your Savings

Certificates of Deposit (CDs) offer fixed interest rates with guaranteed returns over a set term, making them ideal for risk-averse savers seeking predictable growth. Prize-Linked Savings Accounts (PLSAs) combine the safety of traditional savings with lottery-style incentives, appealing to those who want savings potential alongside the chance to win cash prizes. Choosing between CDs and PLSAs depends on your preference for steady, assured returns versus the possibility of higher rewards through prize opportunities.

Related Important Terms

Flexible CD Laddering

Flexible CD laddering in Certificates of Deposit (CDs) offers a strategic way to balance liquidity and higher yields by staggering maturity dates, allowing savers to access funds periodically without sacrificing interest rates. Unlike Prize-Linked Savings Accounts, which emphasize chance-based rewards with modest returns, CD laddering prioritizes predictable growth and structured access to savings, making it ideal for disciplined investors seeking steady returns.

No-Penalty Certificate of Deposit

No-penalty Certificate of Deposit (CD) offers guaranteed fixed interest rates with the flexibility to withdraw funds before maturity without incurring penalties, making it a secure savings option. Prize-Linked Savings Accounts combine the safety of traditional savings with the excitement of lottery-style prizes but typically offer lower guaranteed returns compared to no-penalty CDs.

Prize-Linked APY Boost

Prize-Linked Savings Accounts (PLSAs) offer an APY boost by combining traditional interest with the chance to win cash prizes, incentivizing consistent saving without risking principal. Unlike Certificates of Deposit (CDs), which provide fixed interest rates over a set term, PLSAs encourage higher balances through lottery-style rewards, potentially increasing overall earnings while maintaining liquidity.

Gamified Savings Draw

Certificate of Deposit (CD) offers fixed interest rates with guaranteed returns over a set term, while Prize-Linked Savings Accounts (PLSA) combine traditional savings growth with the chance to win cash prizes through gamified savings draws, enhancing motivation to save. Gamified savings draws in PLSAs provide an engaging financial incentive by awarding periodic prize entries based on deposit amounts, making them an attractive alternative for savers seeking excitement and potential rewards alongside steady savings growth.

Time-Locked Win Accounts

Certificate of Deposit (CD) accounts offer fixed interest rates with funds locked for specific terms, providing predictable returns but limited liquidity. Prize-Linked Savings Accounts combine savings with chances to win cash prizes, encouraging higher deposits without sacrificing accessibility, making them more flexible for savers seeking both growth and engagement.

CD Yield Hacking

Certificate of Deposit (CD) yield hacking leverages laddering strategies to maximize fixed interest returns, often surpassing standard savings rates, whereas Prize-Linked Savings Accounts (PLSAs) offer lower guaranteed yields but incentivize saving through lottery-like prize opportunities. Savers prioritizing predictable, higher yield growth typically benefit more from CDs, while those seeking occasional windfalls without risking principal might prefer PLSAs.

Interest Rate Lottery

Certificate of Deposit (CD) offers a fixed interest rate over a set term, ensuring predictable returns, while Prize-Linked Savings Accounts (PLSA) combine standard interest rates with chances to win cash prizes through lotteries, potentially increasing overall earnings. Investors seeking guaranteed growth may prefer CDs, whereas savers motivated by gamified incentives and variable winnings might opt for PLSAs.

Hybrid CD-Prize Account

A Hybrid CD-Prize Account combines the guaranteed fixed interest of a Certificate of Deposit (CD) with the chance to win cash prizes through a Prize-Linked Savings Account (PLSA), offering both steady growth and engaging incentives. This innovative savings product enhances traditional CD benefits by incorporating lottery-style rewards, maximizing returns while maintaining principal security.

Risk-Free Sweepstakes Savings

Certificate of Deposit (CD) offers guaranteed fixed interest rates with FDIC insurance, ensuring principal protection without market risk, while Prize-Linked Savings Accounts (PLSA) combine risk-free savings with the chance to win cash prizes, promoting higher savings rates through the allure of sweepstakes. Both options provide secure, low-risk growth of funds, but CDs guarantee steady returns whereas PLSAs incentivize saving through prize-linked rewards without risking principal.

Dynamic Term Prize Pool

Certificate of Deposit (CD) offers fixed interest rates with guaranteed returns over a set term, while Prize-Linked Savings Accounts (PLSA) feature a dynamic term prize pool that incentivizes saving by awarding entrants periodic chances to win cash prizes based on deposit size and account duration. The dynamic term prize pool continuously adjusts prize values and frequencies, enhancing the appeal of PLSAs by combining the security of savings with lottery-like rewards to encourage longer-term deposits.

Certificate of Deposit vs Prize-Linked Savings Account for Savings. Infographic

moneydiff.com

moneydiff.com