An emergency fund is specifically set aside for unexpected expenses or financial emergencies, providing a safety net to cover urgent needs without incurring debt. In contrast, a sinking fund is a targeted savings account used to gradually accumulate money for planned future expenses, such as vacations or large purchases. Both funds are essential components of a comprehensive savings strategy, ensuring financial stability and preparedness for both unforeseen and anticipated costs.

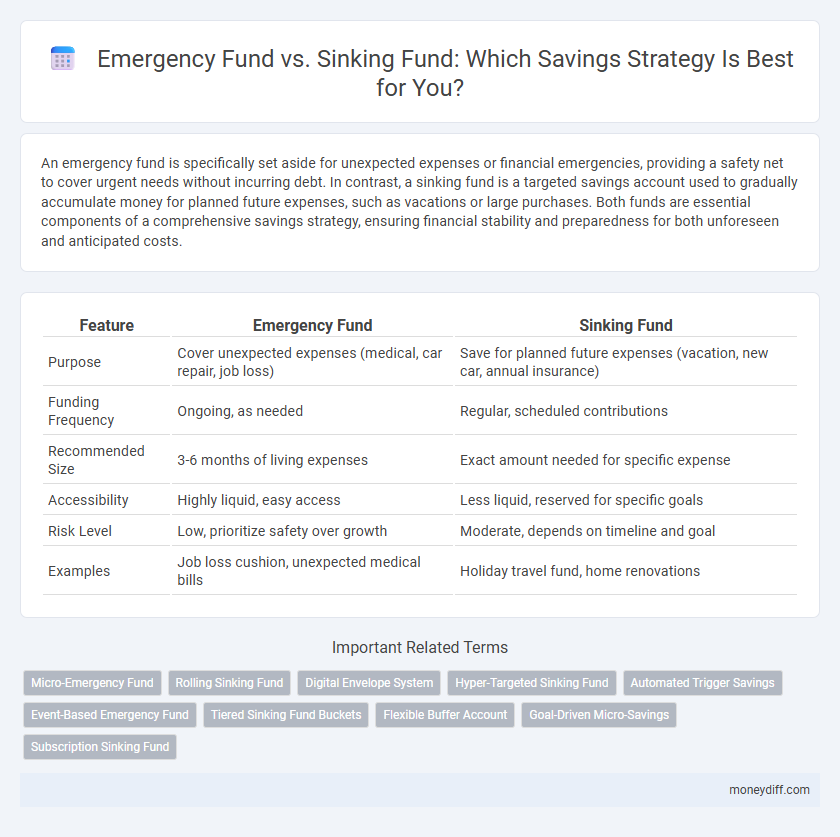

Table of Comparison

| Feature | Emergency Fund | Sinking Fund |

|---|---|---|

| Purpose | Cover unexpected expenses (medical, car repair, job loss) | Save for planned future expenses (vacation, new car, annual insurance) |

| Funding Frequency | Ongoing, as needed | Regular, scheduled contributions |

| Recommended Size | 3-6 months of living expenses | Exact amount needed for specific expense |

| Accessibility | Highly liquid, easy access | Less liquid, reserved for specific goals |

| Risk Level | Low, prioritize safety over growth | Moderate, depends on timeline and goal |

| Examples | Job loss cushion, unexpected medical bills | Holiday travel fund, home renovations |

Understanding Emergency Funds: Purpose and Importance

An emergency fund is a critical financial safety net designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, ensuring financial stability without incurring debt. Unlike a sinking fund, which is set aside for anticipated future expenses like a vacation or home improvement, an emergency fund demands immediate liquidity and accessibility. Building and maintaining an emergency fund with three to six months' worth of living expenses provides peace of mind and protects against financial disruptions.

What is a Sinking Fund? Key Concepts Explained

A sinking fund is a strategic savings tool designed to accumulate money over time for a specific future expense, helping to avoid debt or financial strain. It differs from an emergency fund, which is reserved for unexpected and urgent financial needs, by targeting planned costs such as a new car purchase, home renovations, or vacation. Key concepts include setting a clear goal amount, determining a timeline, and making regular contributions to ensure the fund is fully prepared when the expense arises.

Emergency Fund vs Sinking Fund: Core Differences

An emergency fund is designed to cover unexpected, urgent expenses such as medical emergencies or sudden job loss, typically holding three to six months' worth of living expenses in highly liquid accounts. In contrast, a sinking fund is a planned savings strategy for anticipated future expenses like vacations, home repairs, or large purchases, with funds allocated periodically to meet specific goals. The core difference lies in purpose and timing: emergency funds address unpredictable financial crises, while sinking funds prepare for predictable costs over a defined timeframe.

When to Use an Emergency Fund

An emergency fund is crucial for covering unexpected expenses such as medical emergencies, car repairs, or sudden job loss, providing financial stability during unforeseen events. It typically holds three to six months' worth of essential living expenses, ensuring immediate access to cash without incurring debt. Unlike a sinking fund designed for planned purchases, the emergency fund should only be tapped when facing true financial emergencies to maintain financial security.

Common Uses for Sinking Funds

Sinking funds are commonly used for planned expenses such as home repairs, car maintenance, or annual insurance premiums, allowing individuals to save gradually and avoid large lump-sum payments. Unlike emergency funds, which cover unexpected financial crises, sinking funds help manage predictable costs by setting aside specific amounts regularly. This method of saving promotes financial discipline and reduces reliance on credit, providing a structured approach to handling foreseeable expenses.

Benefits of Separating Emergency and Sinking Funds

Separating emergency and sinking funds enhances financial organization by clearly distinguishing between unexpected expenses and planned future purchases, reducing the risk of depleting critical reserves. An emergency fund provides immediate liquidity for unforeseen events like medical bills or job loss, while a sinking fund accumulates targeted savings for predictable expenditures such as home repairs or vacations. Maintaining these distinct funds improves budget discipline and ensures both short-term security and long-term financial goals are effectively managed.

How Much Should You Save in Each Fund?

An emergency fund should ideally cover three to six months' worth of essential living expenses, ensuring financial security during unexpected events like job loss or medical emergencies. A sinking fund, on the other hand, is tailored to specific future expenses, so savings amounts depend on the cost and timeline of each planned purchase or obligation. Prioritizing sufficient emergency fund coverage while systematically contributing to sinking funds enables balanced and goal-oriented savings management.

Step-by-Step Guide to Setting Up Both Funds

Establish an emergency fund by calculating three to six months of essential expenses, then deposit amounts consistently until the target is reached to cover unexpected financial crises. Create a sinking fund by identifying future anticipated expenses, such as car repairs or home maintenance, estimating their costs, and dividing the total by the number of months until the expense is due to determine monthly savings goals. Use separate savings accounts to manage each fund clearly, ensuring quick access for emergencies while systematically building sinking fund reserves without impacting daily finances.

Common Mistakes to Avoid with Emergency and Sinking Funds

Failing to clearly differentiate the purposes of emergency funds and sinking funds often leads to misallocation of savings and financial stress during unexpected events. Common mistakes include underfunding emergency funds, which should cover 3-6 months of essential expenses, and using sinking funds for unplanned emergencies instead of planned future expenses. Consistently reviewing fund balances and avoiding premature withdrawals ensures both funds serve their intended goals effectively.

Choosing the Best Saving Strategies for Your Needs

Emergency funds provide liquidity for unexpected expenses like medical bills or job loss, ensuring financial stability without incurring debt. Sinking funds, on the other hand, involve setting aside money for planned future expenses such as vacations or major purchases, promoting disciplined saving and preventing disruption to regular budgets. Evaluating your financial goals and risk tolerance helps determine the best strategy to balance immediate security with future spending needs.

Related Important Terms

Micro-Emergency Fund

A micro-emergency fund is a small, easily accessible savings reserve designed to cover minor unexpected expenses such as car repairs or medical co-pays, minimizing the need to disrupt larger financial goals. Unlike sinking funds, which are earmarked for planned future purchases, micro-emergency funds provide rapid liquidity and financial stability during short-term, unforeseen challenges.

Rolling Sinking Fund

A rolling sinking fund is a strategic savings method that involves consistently setting aside money to cover predictable, recurring expenses, ensuring funds are available without disrupting emergency savings. Unlike an emergency fund reserved for unforeseen crises, a rolling sinking fund anticipates upcoming costs like annual insurance premiums or vehicle maintenance, optimizing financial stability and cash flow management.

Digital Envelope System

An Emergency Fund offers immediate liquidity for unforeseen expenses, while a Sinking Fund systematically accumulates savings for planned large purchases or debt repayment, both effectively managed through a Digital Envelope System that allocates money into distinct virtual envelopes to ensure disciplined saving and clear financial goals. By using this method, savers can optimize cash flow, track progress in real-time, and prevent overspending within each category.

Hyper-Targeted Sinking Fund

A hyper-targeted sinking fund is a strategic savings approach where money is allocated to specific future expenses, such as car repairs or annual subscriptions, ensuring funds are ready without disrupting emergency savings. This method contrasts with an emergency fund, which covers unforeseen urgent needs like medical crises or job loss, providing a clear separation that enhances financial stability and goal-oriented budgeting.

Automated Trigger Savings

Emergency funds provide immediate financial security for unexpected expenses, while sinking funds target planned future costs by accumulating savings over time; automated trigger savings technology enhances both by initiating deposits based on predefined criteria such as account balance thresholds or scheduled intervals. Utilizing automated triggers ensures disciplined saving habits, optimizes cash flow management, and reduces the risk of overspending or underfunding essential reserves.

Event-Based Emergency Fund

An Event-Based Emergency Fund is specifically allocated to cover unexpected, event-driven financial setbacks such as urgent home repairs, medical emergencies, or sudden job loss, ensuring liquidity without disrupting regular savings goals. Unlike a Sinking Fund, which is methodically saved for anticipated expenses like vacations or car replacements, this fund prioritizes immediate access and flexibility to safeguard financial stability during unforeseen crises.

Tiered Sinking Fund Buckets

Emergency funds provide a financial safety net covering 3 to 6 months of essential expenses for unexpected events, while tiered sinking fund buckets allocate savings into specific categories with targeted goals and timelines, such as car repairs, vacations, or home maintenance. This strategic segmentation enhances cash flow management and ensures funds are available for planned expenditures without disrupting emergency reserves.

Flexible Buffer Account

An Emergency Fund serves as a flexible buffer account designed to cover unexpected expenses such as medical emergencies or urgent home repairs, providing immediate financial relief without disrupting long-term savings goals. In contrast, a Sinking Fund allocates money for planned, anticipated expenses like annual insurance premiums or holiday gifts, ensuring funds are methodically set aside over time without impacting the emergency buffer.

Goal-Driven Micro-Savings

An emergency fund is a dedicated savings account designed to cover unexpected expenses such as medical emergencies or job loss, providing financial security during crises. In contrast, a sinking fund is a goal-driven micro-saving strategy where money is systematically set aside for specific future expenses like vacations, home repairs, or annual insurance premiums.

Subscription Sinking Fund

A Subscription Sinking Fund is a targeted savings approach designed to accumulate funds over time specifically for upcoming subscription payments, ensuring liquidity without disrupting emergency savings. Unlike an Emergency Fund, which safeguards against unexpected financial crises, a Subscription Sinking Fund optimizes budgeting by allocating fixed amounts regularly to cover recurring service fees, preventing debt accumulation and enhancing financial stability.

Emergency Fund vs Sinking Fund for savings. Infographic

moneydiff.com

moneydiff.com