Automatic savings transfers a fixed amount from your checking account to your savings on a regular schedule, promoting consistent growth over time. Round-up savings rounds each purchase up to the nearest dollar, transferring the difference to your savings, which helps accumulate funds passively without a noticeable impact on daily spending. Both methods encourage disciplined saving habits but cater to different financial behaviors--automatic transfers suit those who prefer structure, while round-ups appeal to those who save effortlessly through everyday transactions.

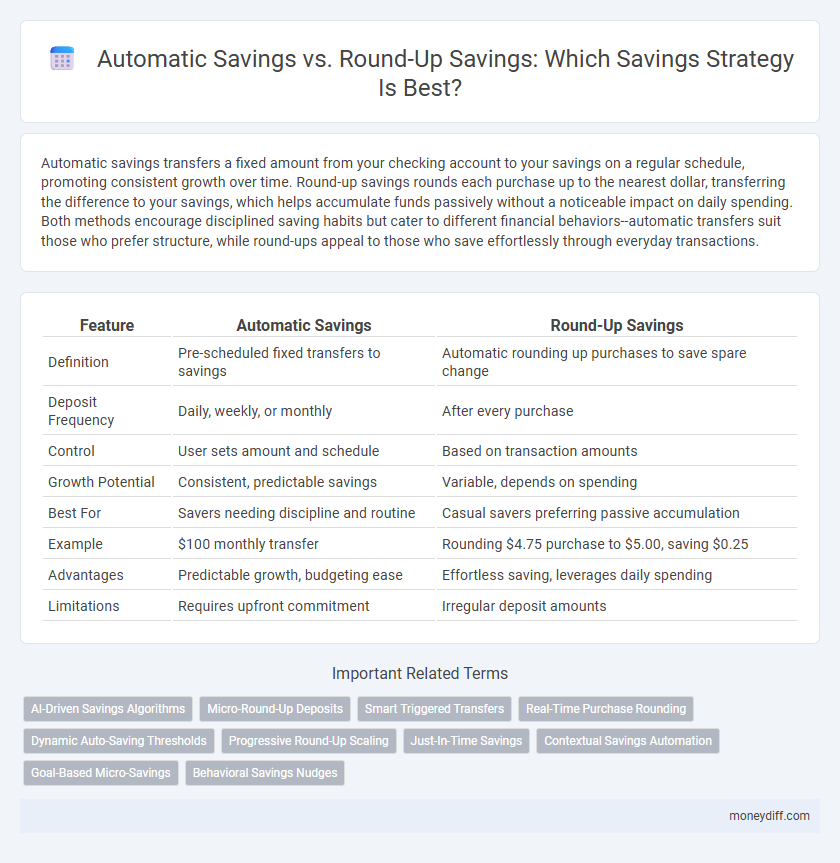

Table of Comparison

| Feature | Automatic Savings | Round-Up Savings |

|---|---|---|

| Definition | Pre-scheduled fixed transfers to savings | Automatic rounding up purchases to save spare change |

| Deposit Frequency | Daily, weekly, or monthly | After every purchase |

| Control | User sets amount and schedule | Based on transaction amounts |

| Growth Potential | Consistent, predictable savings | Variable, depends on spending |

| Best For | Savers needing discipline and routine | Casual savers preferring passive accumulation |

| Example | $100 monthly transfer | Rounding $4.75 purchase to $5.00, saving $0.25 |

| Advantages | Predictable growth, budgeting ease | Effortless saving, leverages daily spending |

| Limitations | Requires upfront commitment | Irregular deposit amounts |

Understanding Automatic Savings: Definition and Benefits

Automatic Savings involves setting up scheduled transfers from checking to savings accounts, ensuring consistent contributions without manual intervention. This method promotes disciplined saving by leveraging automation to build wealth over time with minimal effort. Benefits include reducing the temptation to spend, improving financial goals attainment, and enhancing overall money management efficiency.

What Are Round-Up Savings and How Do They Work?

Round-up savings automatically round up each purchase to the nearest dollar and transfer the difference to a savings account, making saving effortless and consistent. This method leverages everyday spending habits by converting small change into a growing savings balance without requiring active decisions. Round-up savings offers a seamless way to build a financial cushion by turning routine transactions into incremental savings progress.

Key Differences Between Automatic Savings and Round-Up Savings

Automatic savings involves scheduling fixed transfers from a checking to a savings account on a regular basis, promoting consistent growth of savings over time. Round-up savings links transactions to savings by rounding up purchases to the nearest dollar and transferring the spare change, encouraging incremental, effortless savings. The key difference lies in automatic savings relying on set amounts and schedules, while round-up savings depends on spending behavior to accumulate funds.

Pros and Cons of Automatic Savings Strategies

Automatic savings strategies offer consistent financial discipline by transferring fixed amounts regularly, ensuring steady accumulation of funds without requiring active management. However, they may lack flexibility, potentially leading to challenges in adjusting contributions during fluctuating income periods or unexpected expenses. Round-up savings enhance casual saving habits by rounding purchases to the nearest dollar and saving the difference, but this method results in smaller, less predictable savings growth compared to automatic transfers.

Advantages and Disadvantages of Round-Up Savings

Round-up savings automatically round up each purchase to the nearest dollar and transfer the difference into a savings account, promoting effortless saving without requiring active decision-making. This method encourages small, consistent contributions, making it easier to accumulate savings over time, but may result in slower growth compared to larger, planned deposits. A potential drawback is the limited impact on savings for those with infrequent or low-cost transactions, which might reduce the overall effectiveness of round-up programs.

Which Is More Effective: Automatic or Round-Up Savings?

Automatic savings consistently deposits fixed amounts into savings accounts, ensuring predictable growth of funds and disciplined financial habits. Round-up savings transfers spare change from everyday purchases, creating a low-effort method to accumulate savings with minimal impact on daily cash flow. Comparing effectiveness, automatic savings typically results in higher and more consistent contributions, while round-ups offer a convenient, incremental boost ideal for those seeking gentle saving strategies.

Ideal User Profiles: Who Should Choose Automatic Savings?

Automatic savings suits individuals with steady income who prefer a consistent, hands-off approach to building their savings. This method benefits salaried employees, freelancers with predictable cash flow, and those aiming to establish emergency funds or retirement accounts through fixed, recurring deposits. Users seeking discipline and simplicity in their savings strategy find automatic transfers ideal for maintaining financial goals without frequent manual intervention.

Who Benefits Most From Round-Up Savings?

Round-up savings primarily benefit individuals who make frequent small purchases and want to save effortlessly without altering their spending habits. This method is ideal for habitual spenders looking for a passive way to accumulate savings by rounding each transaction up to the nearest dollar and transferring the difference automatically. Consumers with variable incomes or irregular saving patterns find round-up savings a convenient tool to build a financial cushion gradually.

Combining Automatic and Round-Up Savings: Is It Worth It?

Combining automatic savings with round-up savings maximizes the potential for consistent financial growth by leveraging recurring transfers alongside incremental transaction-based deposits. Studies show that automatic savings ensure a fixed amount is set aside regularly, while round-up savings capture spare change from purchases, together creating a seamless, layered approach to building emergency funds or achieving financial goals. This hybrid method increases overall savings rates without requiring significant changes to spending behavior, making it a highly effective strategy for long-term financial security.

Tips for Maximizing Your Savings With Digital Tools

Leverage automatic savings by setting fixed transfer amounts from checking to savings accounts consistently to build wealth effortlessly. Use round-up savings features to round each purchase to the nearest dollar, funneling spare change into your savings, which can add up significantly over time. Combine both methods with budgeting apps like Mint or YNAB to track progress and optimize savings goals efficiently.

Related Important Terms

AI-Driven Savings Algorithms

AI-driven savings algorithms enhance Automatic Savings by analyzing spending patterns to transfer optimal amounts regularly, ensuring consistent growth in savings without user intervention. Round-Up Savings leverage similar algorithms to detect and round up purchase transactions to the nearest dollar, funneling micro-savings into dedicated accounts and maximizing surplus funds discreetly.

Micro-Round-Up Deposits

Micro-round-up deposits enhance savings by automatically rounding up everyday purchases to the nearest dollar, depositing the spare change into a dedicated savings account. This seamless approach leverages small, frequent contributions that accumulate over time, offering a practical alternative to traditional automatic transfers by promoting consistent saving without affecting monthly budgets.

Smart Triggered Transfers

Smart triggered transfers in automatic savings enable precise, scheduled deposits based on user-defined criteria, optimizing cash flow management and ensuring consistent growth without manual intervention. Round-up savings complement this approach by converting everyday transactions into micro-savings, effectively maximizing spare change accumulation to boost overall savings effortlessly.

Real-Time Purchase Rounding

Round-up savings automatically round each purchase to the nearest dollar, transferring the difference into a savings account in real-time, accelerating small but consistent growth. Automatic savings, while scheduled, lack the immediate real-time adjustment of round-up methods, making round-up savings more dynamic for incrementally increasing funds.

Dynamic Auto-Saving Thresholds

Dynamic auto-saving thresholds in automatic savings adjust the transfer amount based on spending patterns, maximizing flexibility and growth potential compared to fixed round-up savings that round purchases to the nearest dollar. This adaptive strategy ensures consistent accumulation by responding to real-time financial behavior rather than static increments.

Progressive Round-Up Scaling

Progressive round-up scaling enhances automatic savings by incrementally increasing the rounded-up amount based on spending behavior, accelerating the growth of savings without impacting daily budgets. This dynamic approach optimizes saving efficiency compared to standard round-up methods by adapting to spending patterns and boosting accumulated funds over time.

Just-In-Time Savings

Automatic savings transfers fixed amounts at scheduled intervals, ensuring consistent contributions without manual intervention, while Round-Up savings round each purchase to the nearest dollar and save the difference, promoting micro-savings with minimal impact on daily spending. Just-In-Time savings optimize cash flow by transferring funds immediately after income deposits or bills, maximizing savings efficiency and minimizing liquidity constraints.

Contextual Savings Automation

Automatic savings transfers a fixed amount regularly to a savings account, establishing consistent growth through disciplined deposits; round-up savings, by contrast, rounds each purchase up to the nearest dollar and deposits the difference, incrementally boosting savings based on spending habits. Both methods leverage contextual savings automation to simplify the process and encourage steady accumulation without requiring active management.

Goal-Based Micro-Savings

Goal-based micro-savings leverage automatic savings by transferring set amounts regularly to dedicated goals, ensuring consistent progress toward specific financial targets. Round-up savings complement this by rounding up everyday transactions to the nearest dollar and allocating the difference to savings, maximizing small, frequent contributions without impacting cash flow.

Behavioral Savings Nudges

Automatic savings deduct a fixed amount regularly to build savings steadily through consistent contributions, while round-up savings leverage behavioral nudges by rounding up purchases to the nearest dollar and transferring the difference into savings, making saving effortless and psychologically rewarding. Both methods harness behavioral economics principles, but round-up savings capitalize more on frequent micro-transactions that reduce friction and increase saving frequency without requiring active decisions.

Automatic Savings vs Round-Up Savings for savings. Infographic

moneydiff.com

moneydiff.com