Traditional piggy banks offer a tactile and visual way to save money, promoting discipline through physical coin deposits. Savings gamification apps enhance engagement by integrating challenges, rewards, and progress tracking, making saving more interactive and motivating. Comparing both, gamification apps provide personalized financial insights and accessibility, while piggy banks rely on simplicity and direct saving habits.

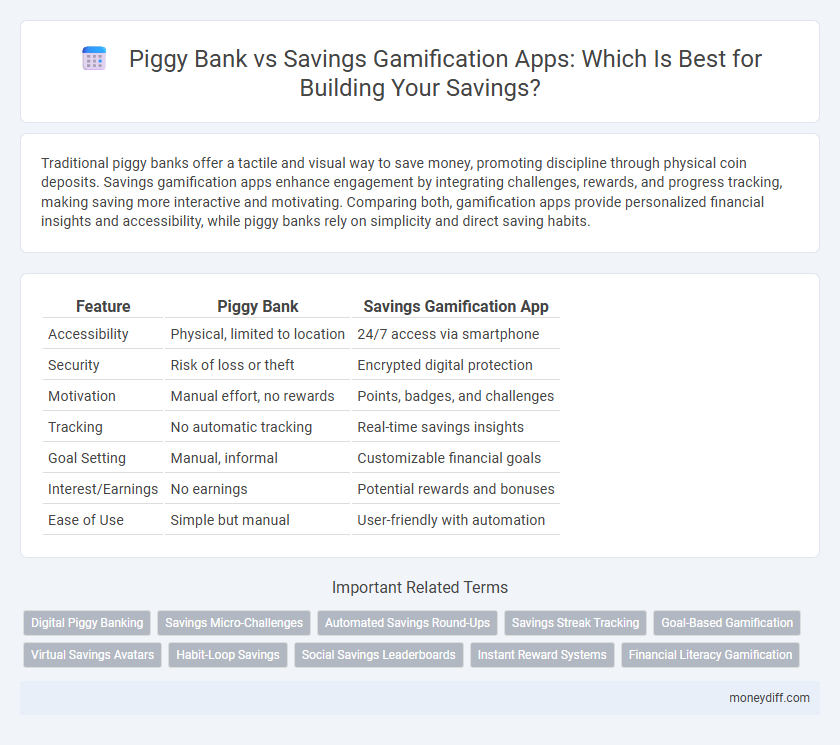

Table of Comparison

| Feature | Piggy Bank | Savings Gamification App |

|---|---|---|

| Accessibility | Physical, limited to location | 24/7 access via smartphone |

| Security | Risk of loss or theft | Encrypted digital protection |

| Motivation | Manual effort, no rewards | Points, badges, and challenges |

| Tracking | No automatic tracking | Real-time savings insights |

| Goal Setting | Manual, informal | Customizable financial goals |

| Interest/Earnings | No earnings | Potential rewards and bonuses |

| Ease of Use | Simple but manual | User-friendly with automation |

Piggy Bank vs Savings Gamification App: An Overview

Piggy banks offer a straightforward, physical approach to saving by encouraging users to deposit spare change regularly, fostering a basic habit of money management. Savings gamification apps leverage digital technology and game mechanics, such as rewards and challenges, to motivate consistent saving and enhance user engagement. While piggy banks provide tactile interaction and simplicity, gamification apps deliver personalized insights, progress tracking, and social competition to optimize saving behavior effectively.

Traditional Saving Methods: The Piggy Bank Approach

The piggy bank remains a classic savings tool, encouraging physical saving habits by providing a tangible way to collect spare change. Its simplicity and ease of use make it effective for teaching children the value of money and consistent saving. However, the lack of digital tracking limits its ability to offer personalized savings goals and progress insights, features commonly found in savings gamification apps.

Modern Savings: How Gamification Apps Work

Gamification savings apps leverage behavioral psychology by incorporating rewards, challenges, and progress tracking to motivate consistent saving habits, unlike traditional piggy banks that rely solely on physical money storage. These apps use data-driven insights and personalized goals, enabling users to optimize savings strategies with real-time feedback and automated reminders. By integrating social sharing and achievement badges, gamification apps create a dynamic and engaging experience that enhances long-term financial discipline.

Motivation Factors: Physical Piggy Banks vs Digital Rewards

Physical piggy banks offer tangible satisfaction that enhances saving motivation through direct interaction, reinforcing habits via visual and tactile feedback. Savings gamification apps leverage digital rewards, such as points, badges, and progress tracking, to create engaging and personalized experiences that stimulate user commitment. The combination of immediate physical cues and virtual incentives uniquely drives consistent saving behavior by appealing to both emotional and cognitive motivators.

Tracking Progress: Visibility and Accountability

A Piggy Bank offers a physical, tangible way to save money, but it lacks real-time progress tracking and detailed analytics. Savings gamification apps provide enhanced visibility with features like goal tracking, spending insights, and automated reminders, increasing user accountability. These apps leverage data visualization and behavioral incentives, making it easier to monitor savings growth and stay motivated.

Security and Accessibility: Digital vs Physical Savings

Physical piggy banks offer straightforward security through tangible control but are vulnerable to theft and loss, limiting accessibility outside the home. Savings gamification apps provide advanced security features like encryption, two-factor authentication, and remote access, enabling users to monitor and manage funds anytime with added convenience. Digital platforms also offer accessibility across devices and integrate with financial tools, enhancing user engagement and control compared to traditional physical savings methods.

Engaging Children: Which Method Works Best?

Piggy banks provide a tangible, hands-on method for children to save money, fostering early financial responsibility through physical interaction. Savings gamification apps leverage digital engagement, offering interactive challenges, rewards, and progress tracking that motivate sustained saving habits in tech-savvy children. Research indicates gamification apps can enhance motivation and consistent savings by integrating fun elements, but combining both methods often yields the most effective results in building long-term financial skills.

Saving Goals: Customization and Flexibility

Piggy banks offer simple, physical savings solutions but lack customization and flexibility for setting diverse saving goals. Savings gamification apps provide personalized goal-setting features, allowing users to tailor targets and timelines according to their financial needs. These apps enhance motivation through interactive challenges and progress tracking, making saving more adaptable and engaging.

Long-term Habits: Building Financial Discipline

Piggy banks provide a simple, tangible method for fostering long-term savings discipline by encouraging consistent money deposits. Savings gamification apps enhance this process through interactive challenges, rewards, and real-time progress tracking, which increase user engagement and motivation. Combining physical saving tools with digital gamification can effectively cultivate strong financial habits and sustained commitment over time.

Choosing the Best Savings Tool for Your Needs

Choosing between a traditional piggy bank and a savings gamification app depends on your financial habits and goals; piggy banks offer tangible, accessible storage for small cash savings, ideal for those who prefer physical reminders and simplicity. Savings gamification apps provide interactive features like challenges, rewards, and progress tracking, which can motivate consistent saving behavior and offer insights through data analytics, making them suitable for tech-savvy users seeking engagement and accountability. Evaluate your preferences for convenience, motivation, and financial discipline to select the savings tool that best supports your personalized savings journey.

Related Important Terms

Digital Piggy Banking

Digital piggy banking leverages gamification features to enhance savings habits through interactive challenges, rewards, and progress tracking, offering a more engaging alternative to traditional piggy banks. Savings gamification apps provide personalized goals, instant feedback, and social sharing options that boost motivation and accelerate financial discipline.

Savings Micro-Challenges

Savings micro-challenges in gamification apps gamify the saving process by setting small, achievable goals that boost motivation and consistency, unlike traditional piggy banks that lack interactive engagement and goal-tracking features. These apps use behavioral economics principles to create personalized challenges, improving financial habits and accelerating savings growth through rewards and progress visualization.

Automated Savings Round-Ups

Automated savings round-ups in gamification apps enable users to effortlessly boost their savings by rounding up everyday purchases to the nearest dollar and transferring the difference into a savings account. Unlike traditional piggy banks, these apps combine automation with engaging features that encourage consistent saving habits and provide real-time progress tracking.

Savings Streak Tracking

Savings streak tracking in a savings gamification app offers real-time progress monitoring, motivating users through visual milestones and rewards, unlike traditional piggy banks that lack interactive feedback. This digital approach enhances commitment by turning savings into a continuous, engaging habit, increasing the likelihood of long-term financial discipline.

Goal-Based Gamification

Goal-based gamification apps enhance savings by providing personalized challenges and rewards that align with individual financial objectives, increasing motivation and engagement more effectively than traditional piggy banks. These digital platforms incorporate real-time progress tracking and interactive features that transform routine saving habits into dynamic goal-oriented experiences.

Virtual Savings Avatars

Virtual savings avatars in gamification apps provide personalized, interactive experiences that motivate users to save consistently by visualizing progress and setting dynamic goals. Unlike traditional piggy banks, these avatars use behavioral incentives and real-time feedback to enhance user engagement and accelerate savings growth.

Habit-Loop Savings

Habit-loop savings in piggy banks rely on physical interaction and visual cues to reinforce saving behavior, creating a simple reward system through tactile engagement. Savings gamification apps enhance habit formation by integrating real-time feedback, challenges, and social rewards to strengthen motivation and consistency in saving.

Social Savings Leaderboards

Social savings leaderboards in gamification apps boost user motivation by showcasing real-time rankings and progress among peers, encouraging consistent deposits and healthy competition. Traditional piggy banks lack this interactive feature, making digital platforms more effective for social engagement and goal achievement in savings habits.

Instant Reward Systems

Piggy banks offer a simple, tactile way to save money but lack instant reward systems that gamification apps provide, which use real-time feedback, badges, and points to motivate continuous saving. Savings gamification apps enhance user engagement by leveraging psychological triggers like instant rewards, goal tracking, and social sharing, resulting in higher saving rates compared to traditional methods.

Financial Literacy Gamification

Financial literacy gamification apps enhance savings by employing interactive challenges, rewards, and progress tracking that motivate consistent saving behaviors beyond the traditional piggy bank's passive storage. These digital platforms leverage behavioral economics and personalized feedback to strengthen money management skills, promoting long-term financial discipline and goal achievement.

Piggy Bank vs Savings Gamification App for savings. Infographic

moneydiff.com

moneydiff.com