Piggy banks offer a simple, physical method for saving money, ideal for developing the habit of setting aside small cash amounts. Round-up savings apps automate the process by rounding up daily purchases and transferring the difference into a digital savings account, maximizing growth potential with minimal effort. Both methods promote consistent saving, but round-up apps provide convenience and the opportunity to build savings faster through automated contributions.

Table of Comparison

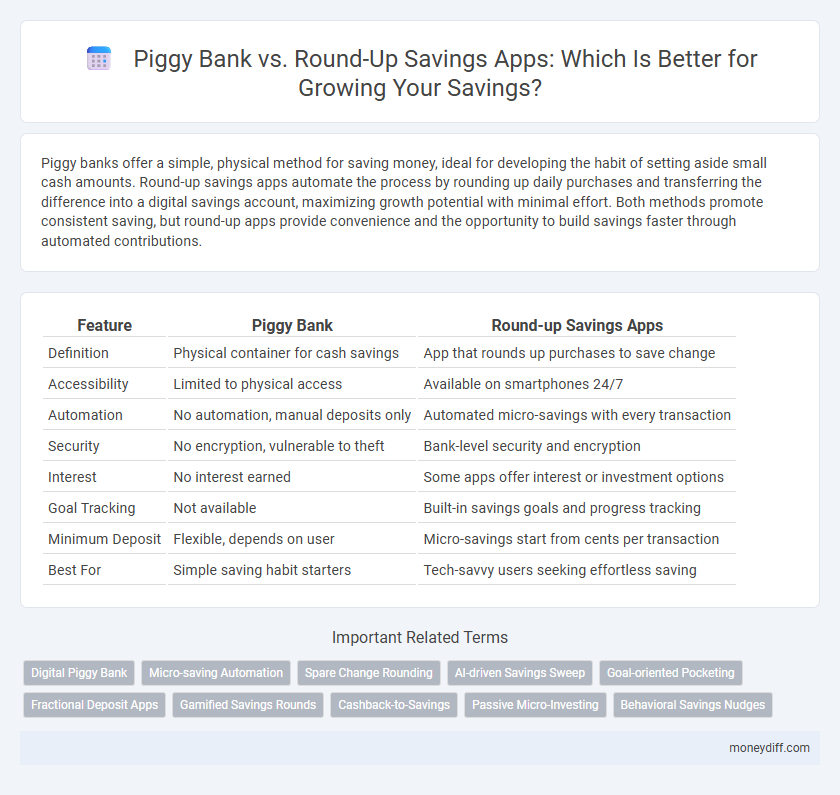

| Feature | Piggy Bank | Round-up Savings Apps |

|---|---|---|

| Definition | Physical container for cash savings | App that rounds up purchases to save change |

| Accessibility | Limited to physical access | Available on smartphones 24/7 |

| Automation | No automation, manual deposits only | Automated micro-savings with every transaction |

| Security | No encryption, vulnerable to theft | Bank-level security and encryption |

| Interest | No interest earned | Some apps offer interest or investment options |

| Goal Tracking | Not available | Built-in savings goals and progress tracking |

| Minimum Deposit | Flexible, depends on user | Micro-savings start from cents per transaction |

| Best For | Simple saving habit starters | Tech-savvy users seeking effortless saving |

Piggy Banks vs Round-Up Apps: Which is Better for Saving Money?

Piggy banks provide a tangible, visual way to save money by physically setting aside cash, which can be effective for simple savings goals and encouraging saving habits in children. Round-up savings apps automatically link to bank accounts or credit cards, rounding up purchases to the nearest dollar and transferring the difference into a savings or investment account, offering a hands-off, consistent saving method. For those seeking convenience and incremental growth, round-up apps typically outperform piggy banks, especially for users comfortable with digital financial tools.

Traditional Piggy Banks: Timeless Savings or Outdated Method?

Traditional piggy banks offer a tangible way to save money by physically storing coins and bills, fostering saving habits especially among children. However, round-up savings apps automate micro-savings by rounding up everyday purchases to the nearest dollar and transferring the difference to a digital account, providing convenience and steady growth. While piggy banks lack interest accrual and are vulnerable to loss or theft, round-up apps integrate with bank accounts, enhancing security and maximizing savings potential through automated contributions.

How Round-Up Savings Apps Work: A Quick Overview

Round-up savings apps automatically round up everyday purchases to the nearest dollar, transferring the difference into a designated savings account, which accelerates saving without requiring active effort. These apps link directly to your debit or credit card, seamlessly accumulating small amounts that compound over time into substantial savings. By utilizing technology to automate micro-savings, round-up apps help users build financial discipline and grow their savings with minimal disruption to daily spending habits.

Pros and Cons of Using a Piggy Bank for Savings

Piggy banks offer a tangible and visual way to save money, making them ideal for teaching children about financial discipline, but they lack security and can be easily lost or stolen. Their simplicity encourages regular deposits without fees or requirements, though the absence of interest growth limits long-term value compared to digital options. Unlike round-up savings apps that automate saving through small transactions and provide higher interest potential, piggy banks rely solely on manual effort and physical cash storage.

Advantages and Disadvantages of Round-Up Savings Apps

Round-up savings apps automatically round up everyday purchases to the nearest dollar, transferring the difference into a savings account, which promotes consistent, effortless saving. Their advantages include seamless integration with existing bank accounts, customizable round-up amounts, and the ability to build savings without impacting monthly budgets. Disadvantages involve potential overdraft risks if linked to accounts with low balances and limited control over saving pace compared to manual deposits or traditional piggy banks.

Security: Physical Piggy Bank vs. Digital Savings Apps

A physical piggy bank offers tangible security through direct control and absence of digital vulnerabilities, making it immune to cyber threats. Digital savings apps employ advanced encryption, multi-factor authentication, and fraud monitoring to protect users' funds, but remain susceptible to hacking and data breaches. The security choice depends on balancing physical access control against the sophisticated protection layers of digital platforms.

Motivation and Habit-Building: Manual vs. Automatic Savings

Piggy banks encourage motivation through manual effort, making the act of saving tangible and reinforcing discipline by physically depositing coins or cash. Round-up savings apps automate the process by linking to spending accounts, rounding up purchases, and transferring the difference to a savings account, fostering consistent saving habits without conscious effort. While piggy banks build savings discipline through active participation, round-up apps leverage automation to develop seamless, long-term habit formation.

Accessibility: Easy Withdrawals vs. Digital Lock-In

Piggy banks offer immediate physical access to cash, allowing for easy withdrawals whenever needed, making them highly accessible for spontaneous savings use. Round-up savings apps, however, digitally lock funds by rounding up everyday purchases and transferring the difference into a savings account, which may restrict immediate access but encourages disciplined saving. This digital lock-in can foster long-term savings growth, while piggy banks prioritize liquidity and simplicity.

Fees and Costs: Piggy Banks vs. Savings Apps

Traditional piggy banks have no fees or hidden costs, making them a cost-effective option for saving cash physically. Round-up savings apps often charge nominal monthly or transaction fees, which can reduce overall savings growth over time. Users should evaluate app fee structures carefully to ensure digital convenience does not outweigh expense drawbacks.

Choosing the Right Savings Method: Piggy Bank or Round-Up App?

Piggy banks offer a tangible, traditional method for saving small amounts of cash, ideal for those who prefer physical money management and want to build a habit of saving visually. Round-up savings apps automatically link to your bank accounts or cards, rounding up purchases to the nearest dollar and transferring the difference into a savings account, providing a seamless, hands-off approach to saving without requiring manual effort. The choice depends on your preference for physical saving versus automated, data-driven micro-savings that leverage digital tools for incremental wealth building.

Related Important Terms

Digital Piggy Bank

Digital piggy banks offer a modern twist on traditional saving by allowing users to set specific financial goals and automate deposits, making disciplined saving easier and more interactive. Unlike round-up savings apps that save spare change from transactions, digital piggy banks provide customizable saving plans, better tracking features, and instant access to funds, enhancing both control and motivation for users.

Micro-saving Automation

Piggy banks provide a simple, tangible method for accumulating coins, ideal for teaching basic savings habits, while round-up savings apps automate micro-savings by rounding up purchases to the nearest dollar and transferring the difference to savings accounts, efficiently leveraging everyday spending. These apps offer seamless integration with digital transactions, promoting consistent, effortless saving growth compared to manual deposit methods.

Spare Change Rounding

Piggy banks provide a physical method to save spare change, but round-up savings apps automatically round up everyday purchases to the nearest dollar and transfer the difference to a savings account, making saving effortless and consistent. These apps leverage spare change rounding algorithms to accumulate savings incrementally without disrupting daily budgets, enhancing long-term financial discipline.

AI-driven Savings Sweep

AI-driven Savings Sweep technology in round-up savings apps automatically transfers small change from daily transactions into a savings account, optimizing savings growth with minimal effort. Piggy banks offer a traditional, manual method lacking real-time analysis and growth potential enabled by AI algorithms in digital platforms.

Goal-oriented Pocketing

Piggy banks offer a tangible, goal-oriented pocketing method by physically separating cash for specific savings targets, reinforcing visual progress and discipline. Round-up savings apps automate goal-oriented pocketing by rounding up everyday purchases and digitally transferring the spare change into dedicated savings goals, optimizing consistent growth with minimal effort.

Fractional Deposit Apps

Fractional deposit apps automatically round up everyday purchases to the nearest dollar and transfer the difference into a savings account, facilitating effortless incremental savings unlike traditional piggy banks that require manual deposits. These apps leverage technology to optimize savings growth by accumulating small amounts consistently, making them more effective for long-term financial goals.

Gamified Savings Rounds

Piggy banks offer a tactile, visual method for saving money by physically depositing coins, fostering habit formation through tangible progress. Round-up savings apps employ gamified savings rounds by automatically rounding up purchases and transferring the spare change into savings, using engaging challenges and rewards to motivate consistent saving behavior.

Cashback-to-Savings

Cashback-to-savings features in round-up savings apps automatically redirect earned cashback into savings accounts, maximizing growth without extra effort, unlike traditional piggy banks which require manual deposits and lack interest accrual. These apps seamlessly integrate spending behavior with saving goals, offering higher returns and enhanced financial discipline through automated micro-investments.

Passive Micro-Investing

Piggy banks offer tangible, physical savings that develop basic money habits, but Round-up savings apps automate Passive Micro-Investing by rounding up everyday purchases and investing the spare change into diversified portfolios. These apps provide continuous, effortless wealth growth through small, frequent contributions without requiring active management or significant upfront capital.

Behavioral Savings Nudges

Piggy banks leverage physical interaction to reinforce savings habits through tangible progress, while round-up savings apps use automated micro-transactions as behavioral nudges to seamlessly encourage consistent saving without conscious effort. Both methods capitalize on psychological triggers--visual accumulation in piggy banks and effortless rounding up in apps--to promote incremental wealth building and improve financial discipline.

Piggy bank vs Round-up savings apps for savings. Infographic

moneydiff.com

moneydiff.com