Term deposits offer higher interest rates by locking in funds for a fixed period, providing stability and predictable returns. Flexible savings accounts allow easy access to funds with lower interest rates, ideal for emergency cash needs and short-term goals. Choosing between them depends on your financial priorities: growth versus liquidity.

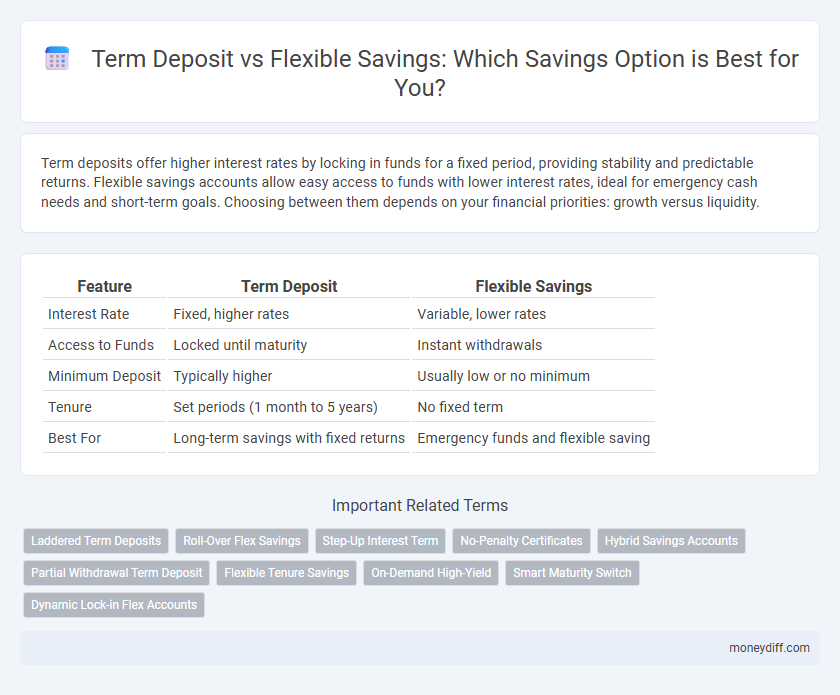

Table of Comparison

| Feature | Term Deposit | Flexible Savings |

|---|---|---|

| Interest Rate | Fixed, higher rates | Variable, lower rates |

| Access to Funds | Locked until maturity | Instant withdrawals |

| Minimum Deposit | Typically higher | Usually low or no minimum |

| Tenure | Set periods (1 month to 5 years) | No fixed term |

| Best For | Long-term savings with fixed returns | Emergency funds and flexible saving |

Understanding Term Deposits and Flexible Savings

Term deposits offer fixed interest rates over a predetermined period, providing stability and predictable returns ideal for long-term savings goals. Flexible savings accounts, on the other hand, allow easy access to funds with variable interest rates, catering to short-term needs and liquidity preferences. Assessing interest rates, withdrawal restrictions, and financial goals helps determine whether a term deposit or flexible savings best suits an individual's saving strategy.

Key Differences Between Term Deposits and Flexible Savings

Term deposits offer fixed interest rates over a predetermined period, ensuring higher returns but limited liquidity, whereas flexible savings accounts provide easy access to funds with variable interest rates that may be lower. Term deposits are ideal for savers seeking guaranteed growth without frequent withdrawals, while flexible savings suit those who prioritize accessibility and short-term savings goals. The choice between the two depends on the balance between earning potential and the need for financial flexibility.

Pros and Cons of Term Deposits

Term deposits offer higher interest rates compared to flexible savings accounts, providing a predictable return over a fixed period, which is ideal for long-term financial goals. However, the funds are locked in until maturity, limiting liquidity and access to cash during emergencies. This lack of flexibility contrasts with flexible savings accounts, which allow easy withdrawals but typically offer lower interest rates.

Advantages and Disadvantages of Flexible Savings

Flexible savings accounts offer the advantage of easy access to funds without fixed lock-in periods, providing liquidity and convenience compared to term deposits. They typically have lower interest rates, which can reduce overall earnings but allow for flexible deposits and withdrawals at any time. The lack of penalty for early withdrawal makes flexible savings ideal for emergency funds, though this flexibility often comes with lower returns than fixed-term investments.

Interest Rates: Term Deposit vs Flexible Savings

Term Deposits typically offer higher fixed interest rates compared to Flexible Savings accounts, making them advantageous for savers seeking predictable returns over a set period. Flexible Savings accounts provide lower, variable interest rates but allow easy access to funds without penalties, appealing to those prioritizing liquidity. Choosing between the two depends on balancing the need for higher interest income against the flexibility of accessing savings at any time.

Liquidity and Accessibility Comparison

Term deposits offer higher interest rates but restrict access to funds for a fixed period, making liquidity limited compared to flexible savings accounts. Flexible savings provide easier accessibility with no lock-in periods, allowing withdrawals or deposits anytime, which enhances liquidity despite typically lower interest yields. Choosing between the two depends on balancing immediate access needs against maximizing interest returns.

Security and Risk Factors

Term deposits offer higher security with fixed interest rates and guaranteed returns, making them ideal for risk-averse savers seeking stable growth. Flexible savings accounts provide easier access to funds and liquidity but expose savers to variable interest rates and potential inflation risk. Assessing personal risk tolerance and financial goals is crucial when choosing between the assured stability of term deposits and the adaptable nature of flexible savings.

Best Scenarios for Choosing Term Deposits

Term deposits offer the best scenario for savers seeking guaranteed interest rates and capital preservation over a fixed period, making them ideal for medium to long-term financial goals. They suit individuals who do not require immediate access to funds and prefer predictable returns without market volatility. Term deposits provide a disciplined savings approach, minimizing the temptation to withdraw prematurely and potentially reducing the impact of fluctuating interest rates on overall earnings.

When to Opt for Flexible Savings Accounts

Flexible savings accounts are ideal when you require easy access to your funds without penalties, making them perfect for emergency savings or short-term goals. They offer competitive interest rates with the advantage of liquidity, unlike term deposits that lock funds for a fixed period. Choose flexible savings when prioritizing account accessibility and modest interest over the higher returns but restricted access of term deposits.

Making the Right Choice for Your Savings Goals

Term deposits offer fixed interest rates and guaranteed returns over a set period, making them ideal for savers prioritizing stability and disciplined growth. Flexible savings accounts provide easier access to funds with variable interest rates, suiting those who need liquidity and short-term flexibility. Assessing your savings timeline, risk tolerance, and access needs ensures you select the option that aligns best with your financial goals.

Related Important Terms

Laddered Term Deposits

Laddered term deposits offer higher fixed interest rates and predictable returns by spreading investments across multiple maturity dates, reducing interest rate risk compared to flexible savings accounts that provide liquidity but typically lower yields. This strategy maximizes earnings potential while maintaining partial access to funds as each term deposit matures.

Roll-Over Flex Savings

Roll-Over Flex Savings offer greater liquidity than Term Deposits by allowing automatic extension of the savings term while providing access to funds without penalties. This flexible feature combines competitive interest rates with the convenience of adjusting to changing financial needs, making it a smart choice for savers seeking both growth and accessibility.

Step-Up Interest Term

Step-Up Interest Term Deposits offer progressively higher interest rates at set intervals, maximizing returns for savers committed to locking funds over a fixed period. Flexible Savings accounts provide liquidity but typically yield lower interest, making Step-Up Term Deposits ideal for those seeking increased earnings without frequent withdrawals.

No-Penalty Certificates

No-penalty certificates in term deposits offer fixed interest rates with the advantage of early withdrawal without penalties, making them a secure and flexible savings option compared to traditional term deposits. Flexible savings accounts provide immediate access to funds and variable interest rates, but typically yield lower returns than no-penalty certificates, which balance liquidity with higher earnings.

Hybrid Savings Accounts

Hybrid savings accounts combine the higher interest rates of term deposits with the liquidity of flexible savings, offering savers both competitive returns and easy access to funds. These accounts optimize savings by allowing partial withdrawals without penalty, unlike fixed term deposits, making them ideal for individuals seeking balance between growth and flexibility.

Partial Withdrawal Term Deposit

Partial withdrawal term deposits offer a fixed interest rate with the benefit of accessing a portion of your funds without breaking the entire deposit, combining the security of locked-in returns with flexibility. In contrast, flexible savings accounts provide easy access and frequent withdrawals but typically yield lower interest rates compared to term deposits.

Flexible Tenure Savings

Flexible tenure savings accounts offer the advantage of accessible funds without penalties, making them ideal for savers seeking liquidity and variable investment periods compared to fixed-term deposits, which lock funds for predetermined durations with higher interest rates. This flexibility supports dynamic financial planning, enabling adjustments to savings goals without compromising earning potential or facing withdrawal restrictions.

On-Demand High-Yield

Term deposits offer fixed interest rates with locked-in periods, providing higher guaranteed returns but limited liquidity, whereas flexible savings accounts provide on-demand access to funds with variable, often lower interest rates. On-demand high-yield flexible savings combine competitive interest with immediate withdrawal options, ideal for savers prioritizing both growth and accessibility.

Smart Maturity Switch

Term Deposit accounts offer higher interest rates locked for fixed periods, while Flexible Savings provide easy access and adjustable balances; the Smart Maturity Switch automatically transfers funds from maturing Term Deposits into higher-yield Flexible Savings to maximize returns without sacrificing liquidity. This feature optimizes savings growth by balancing fixed-term interest benefits with the flexibility of readily available funds.

Dynamic Lock-in Flex Accounts

Dynamic Lock-in Flex Accounts offer the security of fixed interest rates like Term Deposits while providing the flexibility to access funds without penalties, making them ideal for savers seeking both growth and liquidity. Unlike traditional Term Deposits, these accounts adjust lock-in periods based on market conditions, optimizing returns and cash flow management.

Term Deposit vs Flexible Savings for savings. Infographic

moneydiff.com

moneydiff.com