High-yield savings accounts offer consistently higher interest rates compared to traditional accounts, making them ideal for steady growth and easy access to funds. Prize-linked savings accounts combine savings with the excitement of lottery-style drawings, encouraging disciplined saving through the chance to win cash prizes without risking principal. Choosing between these options depends on whether you prioritize guaranteed returns or the potential for additional rewards while maintaining financial security.

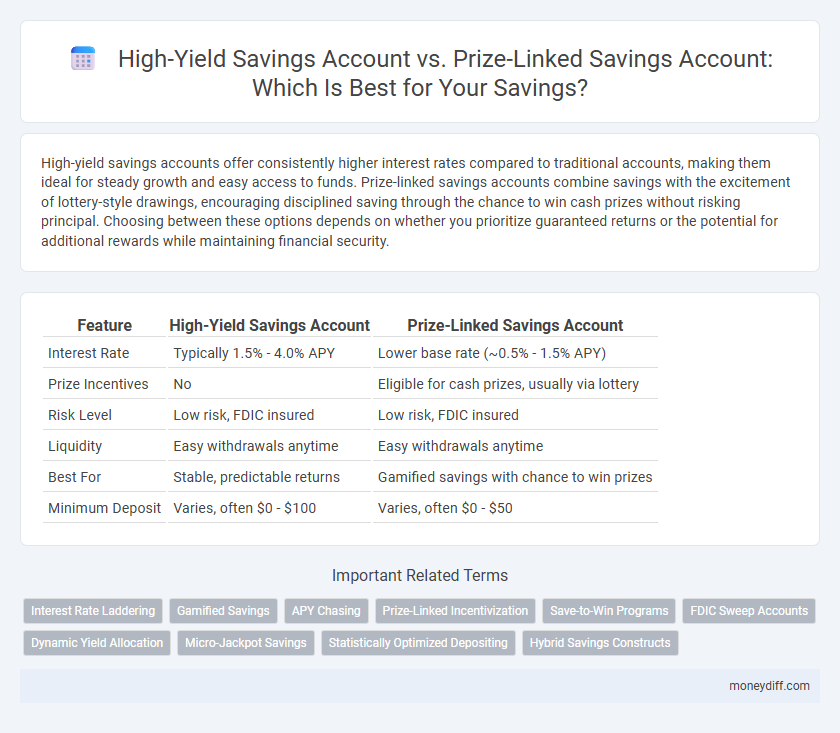

Table of Comparison

| Feature | High-Yield Savings Account | Prize-Linked Savings Account |

|---|---|---|

| Interest Rate | Typically 1.5% - 4.0% APY | Lower base rate (~0.5% - 1.5% APY) |

| Prize Incentives | No | Eligible for cash prizes, usually via lottery |

| Risk Level | Low risk, FDIC insured | Low risk, FDIC insured |

| Liquidity | Easy withdrawals anytime | Easy withdrawals anytime |

| Best For | Stable, predictable returns | Gamified savings with chance to win prizes |

| Minimum Deposit | Varies, often $0 - $100 | Varies, often $0 - $50 |

Introduction: Comparing High-Yield and Prize-Linked Savings Accounts

High-yield savings accounts offer competitive interest rates that exceed traditional savings options, maximizing growth through compound interest. Prize-linked savings accounts combine the security of savings with the excitement of lottery-like prizes, incentivizing regular deposits without risking principal. Both account types provide unique advantages for savers aiming to increase their funds, depending on preferences for guaranteed returns versus potential rewards.

What is a High-Yield Savings Account?

A high-yield savings account offers significantly higher interest rates compared to traditional savings accounts, often ranging from 2% to 4% APY, allowing your savings to grow faster. These accounts are typically offered by online banks and credit unions with minimal fees and easy access to funds through ATM withdrawals or transfers. FDIC or NCUA insurance protects your deposits up to $250,000, making high-yield savings accounts a safe and efficient option for building emergency funds or short-term savings.

What is a Prize-Linked Savings Account?

A Prize-Linked Savings Account (PLSA) is a unique savings tool that combines traditional interest earnings with the chance to win cash prizes through periodic drawings. Unlike conventional high-yield savings accounts that offer fixed interest rates, PLSAs incentivize saving by rewarding depositors with lottery-style prizes, encouraging consistent contributions and long-term saving behavior. This innovative approach enhances saving habits while still providing the security and liquidity of a regular savings account.

Interest Rates: Guaranteed Growth vs. Prize Incentives

High-yield savings accounts offer consistently higher interest rates, providing guaranteed growth on deposited funds, typically ranging from 3% to 5% APY. Prize-linked savings accounts combine modest interest rates, often around 0.10% to 1% APY, with the chance to win cash prizes, incentivizing regular deposits through lottery-style rewards. Choosing between the two depends on prioritizing steady returns versus motivational reward-based savings strategies.

Risk Factors: Security and Stability Considerations

High-yield savings accounts offer FDIC insurance up to $250,000, providing strong security and stable interest rates tied to market conditions. Prize-linked savings accounts combine modest returns with the chance to win cash prizes, but the variability in winnings introduces uncertainty in overall savings growth. Evaluating account risk factors requires balancing guaranteed principal protection against potential reward fluctuations inherent in prize-linked models.

Accessibility and Withdrawal Flexibility

High-yield savings accounts offer easy accessibility with no restrictions on withdrawals, allowing savers to access funds anytime without penalties. Prize-linked savings accounts often limit withdrawal frequency and may impose restrictions to maintain eligibility for prizes, potentially reducing liquidity. Choosing between these accounts depends on prioritizing immediate access to funds or the chance to win rewards while saving.

Minimum Balance and Account Requirements

A High-Yield Savings Account typically requires a minimum balance ranging from $100 to $1,000 to avoid fees and earn competitive interest rates, while Prize-Linked Savings Accounts often have low or no minimum balance requirements, making them accessible for all savers. High-Yield accounts usually mandate a linked checking account or specific monthly deposit amounts to maintain account benefits, whereas Prize-Linked accounts focus on saving with the chance to win cash prizes without stringent monthly deposit obligations. Both account types offer unique benefits, but understanding their minimum balance and account requirements is essential for optimizing savings strategies.

Suitability for Different Financial Goals

High-Yield Savings Accounts offer consistent interest rates ideal for individuals seeking steady growth and easy access to emergency funds. Prize-Linked Savings Accounts appeal to savers motivated by the chance to win cash prizes while maintaining the habit of regular savings, suited for those who prefer a gamified approach to increasing wealth. Choosing between these accounts depends on whether the saver prioritizes guaranteed returns or the potential for additional rewards alongside savings accumulation.

User Experience and Account Management

High-yield savings accounts provide straightforward account management with predictable interest growth, ideal for users prioritizing consistent returns and easy access to funds. Prize-linked savings accounts enhance user experience by combining saving with the excitement of winning cash prizes, motivating regular deposits while maintaining principal security. Both options offer digital platforms for convenient account monitoring, but prize-linked accounts uniquely encourage engagement through gamification elements.

Which Savings Account is Right for You?

Choosing between a High-Yield Savings Account and a Prize-Linked Savings Account depends on your financial goals and risk tolerance. High-Yield Savings Accounts offer consistent, above-average interest rates ideal for steady growth and liquidity, while Prize-Linked Savings Accounts provide a chance to win cash prizes, appealing to those who want to combine saving with a lottery-like incentive. Assess your preference for guaranteed returns versus the excitement of potential rewards to determine the best savings vehicle for your needs.

Related Important Terms

Interest Rate Laddering

High-yield savings accounts offer consistently higher interest rates compared to traditional savings but typically lack tiered rate structures, whereas prize-linked savings accounts provide a unique interest rate laddering effect by combining standard interest accrual with chances to win cash prizes, incentivizing increased deposits and sustained saving habits. This laddering mechanism in prize-linked accounts effectively enhances potential returns over time, especially for savers prioritizing both steady growth and the excitement of lottery-style rewards.

Gamified Savings

High-yield savings accounts provide steady, competitive interest rates that grow your savings securely over time, while prize-linked savings accounts add a gamified element by offering lottery-style prizes, increasing engagement and motivation to save. Gamified savings through prize-linked accounts combine the benefits of traditional saving with the excitement of potential rewards, encouraging consistent deposits and long-term financial discipline.

APY Chasing

High-yield savings accounts typically offer a consistently higher APY, ranging from 3% to 5%, providing predictable growth on savings balances. Prize-linked savings accounts combine moderate APYs, often around 0.5% to 1%, with the opportunity to win cash prizes, appealing to savers attracted by potential rewards rather than fixed interest rates.

Prize-Linked Incentivization

Prize-linked savings accounts incentivize saving by offering entrants a chance to win cash prizes while maintaining principal security, promoting consistent deposits without risk of loss. Unlike traditional high-yield accounts that provide fixed interest rates, prize-linked accounts leverage the appeal of lottery-style rewards to motivate higher saving rates among consumers.

Save-to-Win Programs

High-Yield Savings Accounts offer consistently higher interest rates compared to traditional savings, maximizing growth through compound interest, while Prize-Linked Savings Accounts like Save-to-Win Programs combine savings with lottery-style cash prizes, incentivizing deposits by rewarding savers with chances to win without risking principal. Save-to-Win Programs encourage regular saving habits by blending financial growth and entertainment, appealing to individuals who seek both security and potential extra rewards.

FDIC Sweep Accounts

High-yield savings accounts offer competitive interest rates with FDIC insurance through sweep accounts, ensuring secure and accessible funds while maximizing returns. Prize-linked savings accounts combine the security of FDIC-insured deposits with the chance to win cash prizes, incentivizing saving without risking principal.

Dynamic Yield Allocation

High-yield savings accounts offer consistent interest rates generally ranging from 3% to 5%, providing predictable growth on deposits, while prize-linked savings accounts allocate returns dynamically by combining modest interest with randomized cash prizes, incentivizing deposits through potential rewards rather than fixed yields. Dynamic yield allocation in prize-linked accounts adjusts payout structures based on deposit volumes and prize fund sizes, creating an engaging saving mechanism that balances steady earnings with the excitement of lottery-style incentives.

Micro-Jackpot Savings

High-yield savings accounts offer consistent interest rates typically ranging from 3% to 4% APY, providing steady growth on deposits, while prize-linked savings accounts, such as Micro-Jackpot Savings, combine traditional savings benefits with the chance to win cash prizes in periodic drawings, incentivizing saving behavior without risking principal. Micro-Jackpot Savings accounts uniquely attract savers by offering multiple small-scale jackpot prizes, increasing engagement and promoting consistent deposits compared to standard high-yield savings options.

Statistically Optimized Depositing

High-yield savings accounts offer consistent interest rates ranging from 3% to 5% APY, maximizing steady growth through compounded returns, while prize-linked savings accounts provide lower average interest but enhance potential gains by awarding cash prizes, motivating increased deposits through lottery-style incentives. Statistically optimized depositing balances regular contributions with prize frequency, leveraging probabilistic outcomes to enhance overall savings accumulation and reduce opportunity costs between guaranteed interest and potential windfalls.

Hybrid Savings Constructs

Hybrid savings constructs combine features of high-yield savings accounts, which offer competitive interest rates on deposits, with prize-linked savings accounts that provide chances to win cash rewards, enhancing growth potential and engagement simultaneously. This approach maximizes returns through both steady interest accumulation and periodic incentives, appealing to savers who value both security and motivational rewards.

High-Yield Savings Account vs Prize-Linked Savings Account for savings. Infographic

moneydiff.com

moneydiff.com