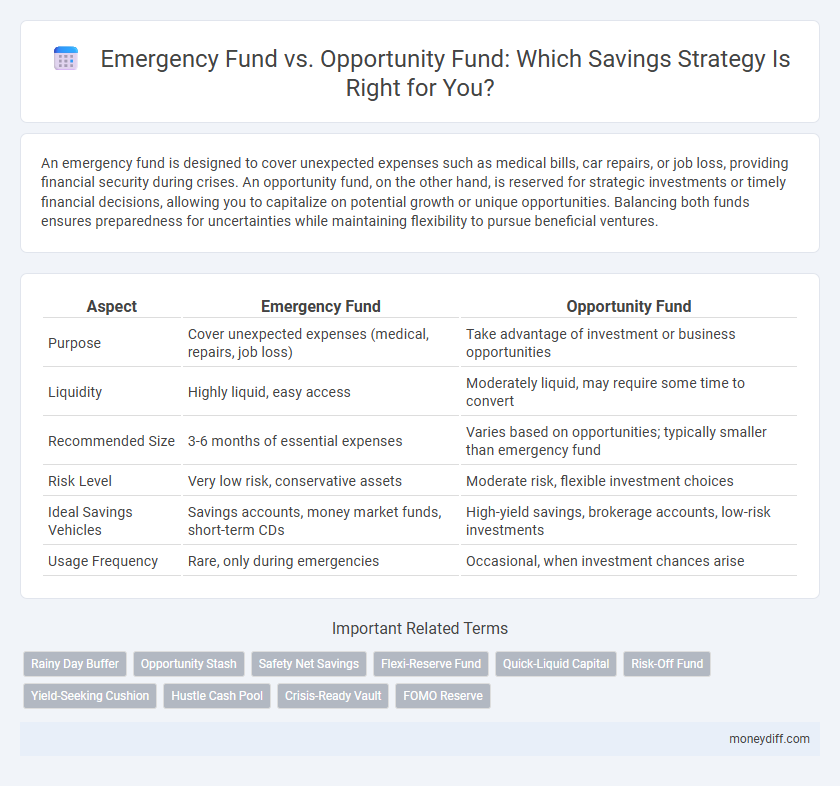

An emergency fund is designed to cover unexpected expenses such as medical bills, car repairs, or job loss, providing financial security during crises. An opportunity fund, on the other hand, is reserved for strategic investments or timely financial decisions, allowing you to capitalize on potential growth or unique opportunities. Balancing both funds ensures preparedness for uncertainties while maintaining flexibility to pursue beneficial ventures.

Table of Comparison

| Aspect | Emergency Fund | Opportunity Fund |

|---|---|---|

| Purpose | Cover unexpected expenses (medical, repairs, job loss) | Take advantage of investment or business opportunities |

| Liquidity | Highly liquid, easy access | Moderately liquid, may require some time to convert |

| Recommended Size | 3-6 months of essential expenses | Varies based on opportunities; typically smaller than emergency fund |

| Risk Level | Very low risk, conservative assets | Moderate risk, flexible investment choices |

| Ideal Savings Vehicles | Savings accounts, money market funds, short-term CDs | High-yield savings, brokerage accounts, low-risk investments |

| Usage Frequency | Rare, only during emergencies | Occasional, when investment chances arise |

Understanding Emergency Funds: Purpose and Importance

Emergency funds are crucial savings set aside to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, ensuring financial stability during crises. These funds typically hold three to six months' worth of living expenses in highly liquid accounts, providing quick access without penalty. Maintaining an emergency fund mitigates financial stress, prevents debt accumulation, and safeguards long-term savings goals.

What Is an Opportunity Fund? Key Differences Explained

An opportunity fund is a flexible savings reserve designed to quickly capitalize on unexpected chances such as investment opportunities, business ventures, or major purchases, differing from an emergency fund which is strictly for unforeseen expenses like medical bills or urgent repairs. Unlike emergency funds that prioritize liquidity and low risk, opportunity funds may tolerate higher risk or longer investment horizons to maximize potential returns. Establishing a clear distinction between these funds ensures financial preparedness while allowing growth potential through strategic opportunities.

When to Use Your Emergency Fund vs. Opportunity Fund

Use your emergency fund strictly for unexpected expenses such as medical bills, car repairs, or job loss to maintain financial stability during crises. Opportunity funds should be accessed for strategic investments like down payments on real estate, education, or starting a business to leverage growth potential. Distinguishing between these funds ensures readiness for emergencies while maximizing financial opportunities.

Building Your Emergency Savings: Best Practices

Building your emergency fund requires setting aside three to six months' worth of essential expenses in a liquid, easily accessible account to cover unexpected financial setbacks like medical emergencies or job loss. An opportunity fund, in contrast, is meant for seizing unexpected investment or personal growth opportunities and should be separate from your emergency savings to avoid compromising financial security. Prioritize consistent contributions, automate transfers, and adjust the fund based on changing lifestyle needs to ensure your emergency savings remain robust and reliable.

Opportunity Fund: Seizing Financial Opportunities Wisely

An Opportunity Fund is a dedicated savings pool designed to capitalize on unexpected financial opportunities, such as investments, business ventures, or market dips, that can yield significant returns. Unlike an Emergency Fund, which prioritizes liquidity for unforeseen expenses, an Opportunity Fund focuses on strategic growth by maintaining accessible capital ready to be deployed when promising chances arise. Maintaining a balance between both funds allows for financial security while enabling proactive wealth expansion.

Funding Strategies: How Much to Allocate to Each Fund

Allocating 3 to 6 months' worth of essential living expenses to an emergency fund ensures financial security against unexpected events such as job loss or medical emergencies. Opportunity funds, typically 10-15% of monthly income, provide liquidity for seizing investment opportunities, education, or business ventures without compromising emergency savings. Balancing contributions based on individual risk tolerance and financial goals maximizes preparedness while enabling growth potential.

Risk Management: Protecting Wealth During Uncertainty

An emergency fund provides a critical financial safety net by covering essential expenses during unexpected events, minimizing the need to incur debt and preserving long-term wealth. In contrast, an opportunity fund allows for agile investment in lucrative ventures or market dips, balancing risk with potential rewards. Effective risk management involves maintaining both funds to safeguard financial stability while capitalizing on growth opportunities amid economic uncertainty.

Liquidity Needs: Accessibility in Emergency vs. Opportunity Funds

Emergency funds prioritize maximum liquidity, ensuring immediate access to cash for unexpected expenses or financial crises without penalties or delays. Opportunity funds balance accessibility with growth potential, allowing funds to be available relatively quickly while aiming for higher returns through investments. Understanding the liquidity differences helps tailor savings strategies to meet urgent needs versus seizing timely financial opportunities.

Prioritizing Your Savings Goals: Step-by-Step Guidance

Establish an emergency fund first by saving three to six months' worth of essential living expenses to protect against unexpected financial setbacks. Once the emergency fund is fully funded, prioritize building an opportunity fund to capitalize on investment or career opportunities that can accelerate wealth growth. This step-by-step approach ensures financial security while enabling strategic use of surplus savings for potential high-return ventures.

Maximizing Growth: Balancing Security and Opportunity

Emergency funds prioritize liquidity and safety to cover unexpected expenses, typically held in low-risk, easily accessible accounts like savings or money market funds. Opportunity funds focus on higher growth potential by investing in diversified assets such as stocks, ETFs, or mutual funds, balancing risk to capitalize on market opportunities. Combining both funds ensures financial security while maximizing wealth growth through strategic allocation and timely investment decisions.

Related Important Terms

Rainy Day Buffer

An emergency fund acts as a crucial rainy day buffer, covering unexpected expenses like medical bills or urgent repairs to prevent financial instability. In contrast, an opportunity fund is reserved for investment or growth prospects, ensuring liquidity for favorable situations without compromising essential financial security.

Opportunity Stash

An Opportunity Fund complements an Emergency Fund by setting aside savings specifically for unexpected chances such as investments, education, or business ventures, allowing individuals to capitalize on growth possibilities without jeopardizing financial security. Unlike Emergency Funds, which cover urgent expenses, the Opportunity Stash maximizes financial flexibility and potential wealth accumulation through strategic, timely use.

Safety Net Savings

An Emergency Fund serves as a safety net savings designed to cover unexpected expenses such as medical emergencies, car repairs, or job loss, ensuring financial stability during crises. An Opportunity Fund, while also important, focuses on providing quick access to money for timely investments or purchases, but does not replace the essential security offered by an Emergency Fund.

Flexi-Reserve Fund

A Flexi-Reserve Fund serves as a versatile savings tool combining the safety of an emergency fund with the growth potential of an opportunity fund, offering liquidity and flexibility to cover unexpected expenses or capitalize on investment opportunities. This hybrid approach optimizes financial resilience by maintaining accessible cash reserves while enabling strategic use of surplus funds for wealth-building prospects.

Quick-Liquid Capital

Emergency funds provide quick-liquid capital to cover unexpected expenses like medical emergencies or urgent home repairs, ensuring financial stability during crises. Opportunity funds offer readily accessible savings to seize time-sensitive investments or purchases, enabling growth through strategic financial decisions.

Risk-Off Fund

An Emergency Fund ensures financial security by covering unexpected expenses during economic downturns, acting as a risk-off fund to protect against income disruptions. In contrast, an Opportunity Fund is reserved for pursuing investments or ventures when favorable conditions arise, carrying higher risk but potential growth.

Yield-Seeking Cushion

An emergency fund provides a low-risk, liquid cushion designed to cover unexpected expenses and financial shocks, typically held in savings accounts or money market funds to ensure immediate access without market volatility. In contrast, an opportunity fund acts as a yield-seeking cushion, strategically invested in higher-return assets like bonds or dividend stocks to capitalize on potential market opportunities while maintaining some liquidity for timely investments.

Hustle Cash Pool

Hustle Cash Pool serves as a versatile savings strategy by differentiating between an Emergency Fund, which covers 3-6 months of essential living expenses for unexpected financial crises, and an Opportunity Fund, reserved for high-return investments or spontaneous ventures that can accelerate wealth building. Prioritizing a well-balanced Hustle Cash Pool enhances financial resilience and empowers seizing timely opportunities without jeopardizing financial security.

Crisis-Ready Vault

A Crisis-Ready Vault balances an Emergency Fund's liquidity for unforeseen expenses with an Opportunity Fund's flexibility to seize market or personal growth chances, optimizing financial resilience and adaptability. Allocating savings into these distinct but complementary funds ensures both immediate crisis coverage and strategic investment readiness.

FOMO Reserve

An emergency fund safeguards financial stability by covering essential expenses during unforeseen crises, while an opportunity fund, often called a FOMO reserve, provides liquidity to capitalize on unexpected investments or rare deals that promise high returns. Balancing both funds enhances financial resilience and growth potential, ensuring preparedness without missing lucrative opportunities.

Emergency Fund vs Opportunity Fund for savings. Infographic

moneydiff.com

moneydiff.com