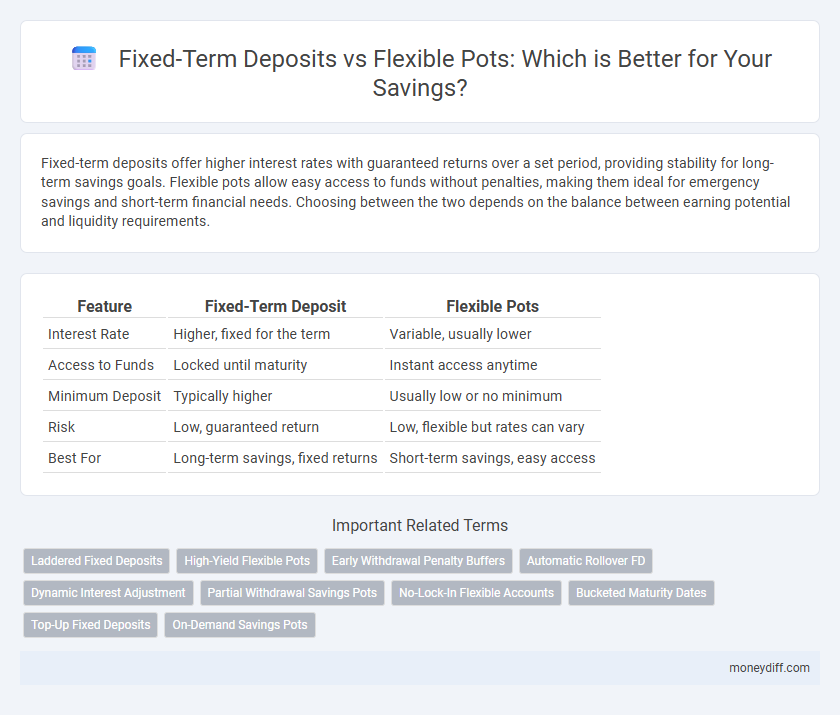

Fixed-term deposits offer higher interest rates with guaranteed returns over a set period, providing stability for long-term savings goals. Flexible pots allow easy access to funds without penalties, making them ideal for emergency savings and short-term financial needs. Choosing between the two depends on the balance between earning potential and liquidity requirements.

Table of Comparison

| Feature | Fixed-Term Deposit | Flexible Pots |

|---|---|---|

| Interest Rate | Higher, fixed for the term | Variable, usually lower |

| Access to Funds | Locked until maturity | Instant access anytime |

| Minimum Deposit | Typically higher | Usually low or no minimum |

| Risk | Low, guaranteed return | Low, flexible but rates can vary |

| Best For | Long-term savings, fixed returns | Short-term savings, easy access |

Understanding Fixed-Term Deposits: Key Features

Fixed-term deposits lock a specific amount of money for a predetermined period, typically ranging from one month to several years, offering a fixed interest rate that ensures predictable returns. Unlike flexible pots, funds in fixed-term deposits cannot be accessed without penalties before maturity, providing a disciplined savings approach. These deposits usually yield higher interest rates compared to regular savings accounts, making them ideal for savers seeking stable growth with low risk.

What Are Flexible Savings Pots?

Flexible savings pots are digital savings accounts that allow easy access to funds without penalties, making them ideal for short-term goals or emergency savings. Unlike fixed-term deposits, flexible pots offer variable interest rates and the ability to move money between accounts instantly. They provide a convenient way to organize savings into separate goals while maintaining liquidity and earning competitive interest.

Core Differences Between Fixed-Term Deposits and Flexible Pots

Fixed-term deposits lock savings for a set period, offering higher interest rates and guaranteed returns, while flexible pots provide easy access and liquidity but typically yield lower interest. Fixed-term deposits carry penalties for early withdrawal, contrasting with the instant availability of funds in flexible pots. Choosing between them depends on the saver's need for growth stability versus accessibility.

Interest Rates: Which Option Offers Better Returns?

Fixed-term deposits typically offer higher interest rates compared to flexible pots, as the funds are locked in for a set period, allowing banks to invest with more certainty. Flexible pots provide easier access to savings but usually feature lower interest rates due to the liquidity offered. Investors seeking better returns should consider fixed-term deposits for their guaranteed rates, while those prioritizing accessibility may prefer flexible pots despite the trade-off in earnings.

Accessibility: Withdrawing Funds from Fixed vs Flexible Accounts

Fixed-term deposits often restrict access to funds until the maturity date, imposing penalties for early withdrawals that can reduce overall returns. Flexible savings pots provide instant accessibility, allowing savers to withdraw money anytime without losing interest or facing fees. This accessibility makes flexible pots ideal for emergency funds or short-term goals, while fixed-term deposits suit those prioritizing higher interest rates over liquidity.

Risk Factors in Fixed-Term and Flexible Savings

Fixed-term deposits offer lower risk with fixed interest rates and guaranteed returns but limit access to funds during the term, potentially incurring penalties for early withdrawal. Flexible savings pots provide higher liquidity and easier access to money, though they often come with variable interest rates subject to market fluctuations, increasing exposure to interest rate risk. Choosing between the two depends on balancing the need for security against the flexibility of accessing funds without penalties.

Penalties and Restrictions: What to Watch Out For

Fixed-term deposits often impose penalties such as early withdrawal fees or loss of accrued interest when funds are accessed before maturity, limiting liquidity. Flexible savings pots provide easier access to funds without penalties, but typically offer lower interest rates compared to fixed-term deposits. Understanding these restrictions and penalties is crucial for savers aiming to balance returns with flexibility and access needs.

Who Should Choose Fixed-Term Deposits?

Fixed-term deposits suit savers who prioritize guaranteed interest rates and capital protection over liquidity, making them ideal for individuals with a fixed savings goal and a timeline of several months to years. Those seeking stable returns without the temptation to withdraw funds prematurely benefit from the locked-in period and predictable earnings of fixed-term deposits. Fixed-term products are particularly advantageous for risk-averse investors or those saving for specific future expenses like education, home purchases, or retirement.

When Flexible Pots Make More Sense

Flexible pots offer greater liquidity and accessibility, making them ideal for savers who anticipate needing quick access to funds without penalties. Unlike fixed-term deposits that lock funds for a predetermined period, flexible savings pots allow ongoing contributions and withdrawals, catering to fluctuating financial goals. This flexibility often outweighs the slightly higher interest rates of fixed deposits for those prioritizing emergency access and short-term savings growth.

Making the Right Savings Choice for Your Financial Goals

Fixed-term deposits offer guaranteed interest rates and higher returns for savers with specific time horizons, ensuring predictable growth aligned with long-term financial goals. Flexible pots provide easy access and frequent contributions, ideal for those prioritizing liquidity and short-term savings objectives. Choosing between these options depends on balancing the need for accessibility with desired interest earnings to optimize savings performance.

Related Important Terms

Laddered Fixed Deposits

Laddered Fixed Deposits involve splitting savings into multiple fixed-term deposits with staggered maturities, optimizing interest earnings and liquidity compared to Flexible Pots, which offer immediate access but typically lower interest rates. This strategic approach balances higher returns from fixed rates with periodic access to funds, enhancing overall savings growth and financial planning.

High-Yield Flexible Pots

High-yield flexible pots offer superior interest rates compared to standard fixed-term deposits, allowing savers to earn competitive returns while maintaining easy access to their funds without penalty. These flexible savings options provide optimal liquidity and growth potential, making them ideal for individuals seeking both financial security and adaptability.

Early Withdrawal Penalty Buffers

Fixed-term deposits offer higher interest rates with strict early withdrawal penalties, making them ideal for committed savings without immediate access needs. Flexible pots provide lower interest but allow penalty-free early withdrawals, offering greater liquidity and financial flexibility for emergency funds.

Automatic Rollover FD

Fixed-term deposits often feature automatic rollover options that reinvest principal and interest at maturity, preserving compounded returns without requiring manual intervention. In contrast, flexible pots offer liquidity and access but typically lack the higher, fixed interest rates and guaranteed returns associated with automatic rollover fixed-term deposits.

Dynamic Interest Adjustment

Fixed-term deposits offer a predetermined fixed interest rate, providing stable returns over a set period, while flexible pots feature dynamic interest adjustment that allows rates to fluctuate based on market conditions, potentially maximizing earnings during rate increases. This dynamic mechanism in flexible pots can optimize savings growth by adapting to economic changes, unlike fixed-term deposits that lock in interest rates regardless of market trends.

Partial Withdrawal Savings Pots

Fixed-term deposits lock funds for a set period, offering higher interest rates but no access to partial withdrawals without penalties, while flexible savings pots provide instant access to partial withdrawals, allowing savers to manage cash flow without compromising interest earnings. For savers prioritizing liquidity and flexibility, partial withdrawal savings pots present a strategic advantage by combining ease of access with competitive interest rates.

No-Lock-In Flexible Accounts

No-lock-in flexible savings accounts offer immediate access to funds without penalties, unlike fixed-term deposits that lock money away for a set period with higher interest rates. These flexible pots allow savers to adapt their withdrawals and deposits according to changing financial needs while still earning interest, making them ideal for emergency savings or fluctuating cash flow.

Bucketed Maturity Dates

Fixed-term deposits offer set maturity dates that enable precise financial planning and often provide higher interest rates locked in for the duration. Flexible pots allow more liquidity but typically lack the structured, bucketed maturity dates that help optimize earnings and manage cash flow efficiently.

Top-Up Fixed Deposits

Top-Up Fixed Deposits offer higher interest rates compared to Flexible Pots by allowing savers to add funds during the term while locking in competitive rates, maximizing returns on incremental savings. Flexible Pots provide liquidity and easy access but generally yield lower interest, making Top-Up Fixed Deposits ideal for disciplined savers seeking better growth with controlled flexibility.

On-Demand Savings Pots

On-demand savings pots offer the flexibility to access funds anytime without penalties, contrasting with fixed-term deposits that lock savings for a predetermined period to earn higher interest rates. These flexible pots are ideal for emergency funds or short-term goals where liquidity and immediacy outweigh the benefits of fixed returns.

Fixed-Term Deposit vs Flexible Pots for savings. Infographic

moneydiff.com

moneydiff.com