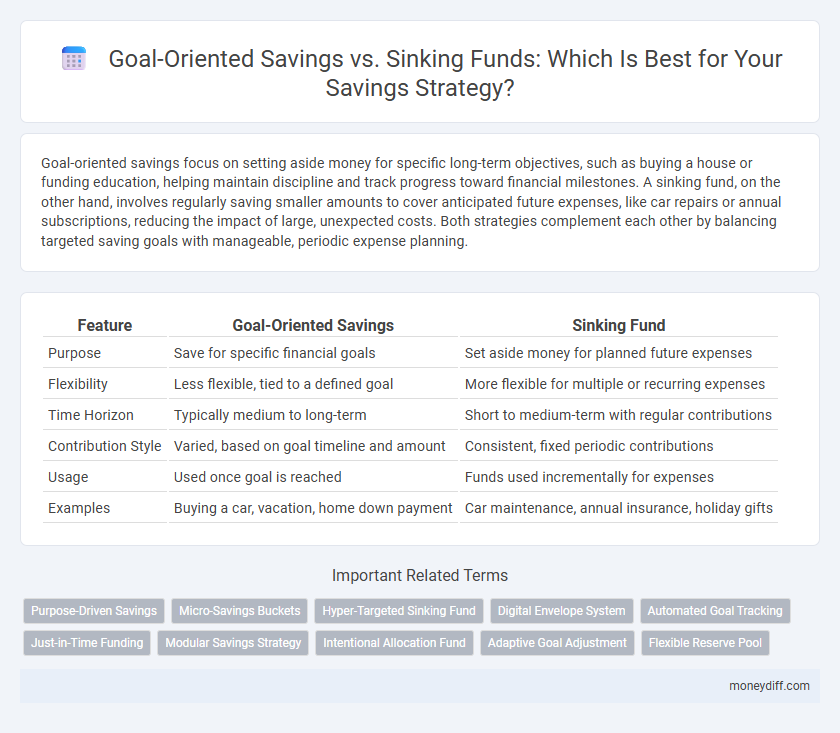

Goal-oriented savings focus on setting aside money for specific long-term objectives, such as buying a house or funding education, helping maintain discipline and track progress toward financial milestones. A sinking fund, on the other hand, involves regularly saving smaller amounts to cover anticipated future expenses, like car repairs or annual subscriptions, reducing the impact of large, unexpected costs. Both strategies complement each other by balancing targeted saving goals with manageable, periodic expense planning.

Table of Comparison

| Feature | Goal-Oriented Savings | Sinking Fund |

|---|---|---|

| Purpose | Save for specific financial goals | Set aside money for planned future expenses |

| Flexibility | Less flexible, tied to a defined goal | More flexible for multiple or recurring expenses |

| Time Horizon | Typically medium to long-term | Short to medium-term with regular contributions |

| Contribution Style | Varied, based on goal timeline and amount | Consistent, fixed periodic contributions |

| Usage | Used once goal is reached | Funds used incrementally for expenses |

| Examples | Buying a car, vacation, home down payment | Car maintenance, annual insurance, holiday gifts |

Understanding Goal-Oriented Savings

Goal-oriented savings involves setting clear financial objectives and allocating funds specifically to meet those targets, enhancing motivation and tracking progress. This method improves budgeting by providing a focused approach that aligns spending habits with priorities such as emergency funds, vacations, or large purchases. Compared to sinking funds, goal-oriented savings emphasizes defined outcomes rather than periodic saving for recurring expenses.

What Is a Sinking Fund?

A sinking fund is a dedicated savings account specifically set aside to cover future expenses or debts, allowing individuals or businesses to gradually accumulate money over time. Unlike general savings, sinking funds target particular goals such as equipment replacement, loan repayments, or planned large purchases, ensuring financial preparedness without disrupting regular cash flow. This method reduces the risk of financial strain and improves budget management by spreading out costs into manageable contributions.

Key Differences: Goal-Oriented Savings vs Sinking Fund

Goal-oriented savings focus on accumulating funds for a specific, predefined objective, such as buying a car or a vacation, with clear timelines and target amounts. A sinking fund, however, is a strategic method of setting aside money regularly to cover anticipated future expenses or liabilities, often used by businesses for debt repayment or asset replacement. The key difference lies in goal-oriented savings being driven by personal or immediate goals, whereas sinking funds are primarily for predictable, recurring financial obligations.

When to Use Goal-Oriented Savings

Goal-oriented savings is ideal for short- to medium-term financial objectives such as purchasing a car, going on a vacation, or funding education expenses, where specifying a clear target amount and timeline ensures disciplined saving. This method helps track progress precisely, providing motivation and a structured approach to reach distinct financial goals efficiently. It differs from sinking funds, which are better suited for recurring or anticipated expenses spread over time, like property taxes or insurance premiums.

When to Choose a Sinking Fund Strategy

A sinking fund strategy is ideal when saving for large, planned expenses that occur regularly or periodically, such as home repairs, car maintenance, or annual insurance premiums. This method allows for systematic, incremental savings to avoid financial strain when the payment is due, enhancing cash flow management. Unlike goal-oriented savings, which target lump-sum goals, sinking funds break down the total amount into manageable monthly contributions aligned with the expense timeline.

Financial Benefits of Goal-Oriented Savings

Goal-oriented savings provide clear financial benefits by establishing specific targets that enhance motivation and discipline, leading to more consistent saving habits. This approach allows individuals to allocate funds efficiently toward precise objectives, improving budget management and reducing the temptation to spend impulsively. Unlike sinking funds, goal-oriented savings often offer higher returns through targeted investment strategies aligned with the timeframe and risk tolerance of each financial goal.

Advantages of Sinking Funds for Budgeting

Sinking funds offer a structured approach to budgeting by allowing individuals to allocate specific amounts for future expenses, reducing the risk of financial strain. This method enhances cash flow management through consistent, planned contributions toward anticipated costs, such as car repairs or holiday spending. By breaking down large expenses into manageable segments, sinking funds promote disciplined saving habits and prevent the need for emergency borrowing.

Common Mistakes in Savings Approaches

Many savers confuse goal-oriented savings with sinking funds, often misallocating money that should be set aside for specific expenses like emergencies or planned purchases. A common mistake is treating sinking funds as general savings, which reduces financial clarity and undermines the purpose of targeted funds for future liabilities. Properly distinguishing between these approaches ensures disciplined savings habits and better financial preparedness.

How to Decide Which Method Fits Your Goals

Choosing between goal-oriented savings and a sinking fund depends on the nature and timeline of your financial objectives. Goal-oriented savings works best for specific, short-term targets such as a vacation or a new gadget, while sinking funds are ideal for recurring or anticipated large expenses like car maintenance or annual insurance premiums. Assess the frequency, predictability, and amount of your expenses to determine which method aligns more effectively with your financial planning strategy.

Building a Balanced Savings Plan with Both Strategies

Goal-oriented savings prioritize setting specific targets such as emergency funds or vacation budgets, while sinking funds allocate money regularly to cover anticipated expenses like insurance or car repairs. Combining these strategies helps create a balanced savings plan by addressing both immediate financial goals and future costs. Regular contributions to goal-oriented accounts alongside sinking funds improve financial stability and reduce the need for debt during unexpected events.

Related Important Terms

Purpose-Driven Savings

Goal-oriented savings involves setting aside money with a specific objective in mind, such as purchasing a home or funding education, ensuring disciplined and purpose-driven financial management. Sinking funds allocate regular contributions toward anticipated large expenses, like car repairs or annual insurance payments, allowing smoother budget handling without disrupting overall savings goals.

Micro-Savings Buckets

Micro-savings buckets enhance goal-oriented savings by segmenting funds into specific targets, enabling precise tracking and disciplined contributions for each financial objective. Unlike sinking funds, which accumulate gradually for irregular expenses, micro-savings buckets provide a dynamic and flexible approach to manage multiple short-term and long-term goals simultaneously.

Hyper-Targeted Sinking Fund

Hyper-targeted sinking funds allocate precise amounts for specific expenses, enhancing discipline and ensuring timely availability of funds for anticipated costs like insurance premiums or car maintenance. This method surpasses generic goal-oriented savings by reducing financial stress through structured, purpose-driven accumulation tailored to recurring or predictable obligations.

Digital Envelope System

Goal-Oriented Savings targets specific financial objectives by allocating funds into separate digital envelopes, ensuring clear tracking and disciplined spending. The Digital Envelope System enhances this approach by enabling automated transfers and real-time monitoring, making it more efficient than traditional sinking funds that accumulate money gradually for predictable expenses.

Automated Goal Tracking

Automated goal tracking in goal-oriented savings platforms enables precise monitoring of progress toward specific financial objectives, enhancing motivation and discipline. In contrast, sinking funds require manual tracking and allocation for anticipated expenses, which may lead to less consistent oversight and potential shortfalls.

Just-in-Time Funding

Goal-oriented savings target specific financial objectives with allocated funds ready exactly when needed, optimizing just-in-time funding by minimizing idle cash. In contrast, a sinking fund accumulates gradually over time for future liabilities, ensuring systematic savings without premature capital allocation.

Modular Savings Strategy

Goal-oriented savings prioritize targeting specific financial objectives with designated amounts and timelines, ensuring focused progress towards milestones, while a sinking fund involves setting aside incremental sums to cover anticipated future expenses, promoting steady accumulation without borrowing. Combining both approaches in a modular savings strategy enhances financial discipline by segmenting funds for distinct purposes, optimizing cash flow management and reducing the risk of overspending.

Intentional Allocation Fund

Goal-oriented savings involve setting aside funds with a specific purpose in mind, ensuring intentional allocation aligns directly with future financial objectives. A sinking fund, by contrast, accumulates money systematically over time for anticipated expenses, promoting disciplined saving through planned, incremental contributions toward a predetermined financial goal.

Adaptive Goal Adjustment

Goal-Oriented Savings plans allow for flexible adjustment of target amounts and timelines based on changing financial needs, supporting adaptive goal adjustment to maintain progress without sacrificing overall savings discipline. A Sinking Fund, while effective for periodic expenses, typically requires fixed contributions, limiting its adaptability to evolving financial priorities.

Flexible Reserve Pool

A Flexible Reserve Pool in goal-oriented savings allows for adaptable fund allocation across multiple goals, enhancing liquidity without strict earmarking. Sinking funds, by contrast, require fixed contributions toward a specific future expense, limiting flexibility but ensuring disciplined savings.

Goal-Oriented Savings vs Sinking Fund for savings. Infographic

moneydiff.com

moneydiff.com