Money Market Accounts offer stable returns with low risk, providing easy access to funds and FDIC insurance protection, making them ideal for conservative savers seeking liquidity. Digital Asset Funds present opportunities for higher growth by investing in cryptocurrencies and blockchain-based assets but come with increased volatility and regulatory uncertainty. Choosing between them depends on one's risk tolerance, investment horizon, and desire for immediate access versus long-term growth potential.

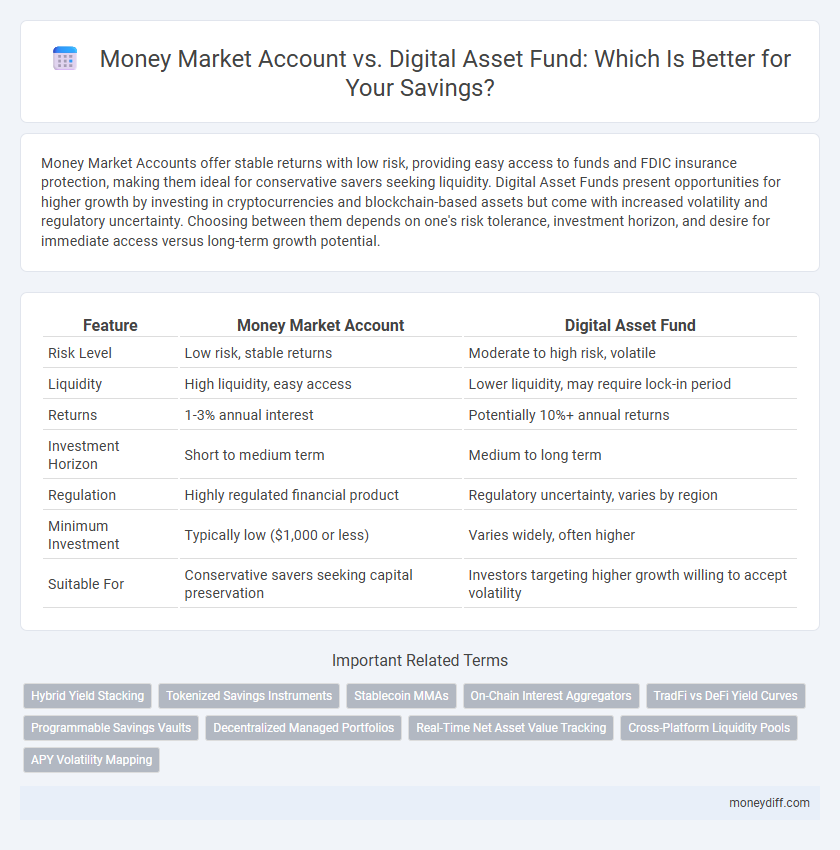

Table of Comparison

| Feature | Money Market Account | Digital Asset Fund |

|---|---|---|

| Risk Level | Low risk, stable returns | Moderate to high risk, volatile |

| Liquidity | High liquidity, easy access | Lower liquidity, may require lock-in period |

| Returns | 1-3% annual interest | Potentially 10%+ annual returns |

| Investment Horizon | Short to medium term | Medium to long term |

| Regulation | Highly regulated financial product | Regulatory uncertainty, varies by region |

| Minimum Investment | Typically low ($1,000 or less) | Varies widely, often higher |

| Suitable For | Conservative savers seeking capital preservation | Investors targeting higher growth willing to accept volatility |

Understanding Money Market Accounts: Key Features

Money Market Accounts offer higher interest rates than regular savings accounts, typically ranging from 0.5% to 2% annually, backed by FDIC insurance up to $250,000, ensuring safety of principal. They provide limited check-writing and debit card access, combining liquidity with relatively stable returns compared to volatile digital asset funds. Understanding these key features helps savers prioritize capital preservation and steady growth in their savings strategy.

What Is a Digital Asset Fund? An Overview

A digital asset fund is an investment vehicle that pools capital to invest in cryptocurrencies and blockchain-based assets, offering exposure to digital currencies without direct ownership. Unlike traditional money market accounts that provide stable, low-risk interest through cash-equivalent instruments, digital asset funds involve higher volatility and potential for significant returns. These funds are managed by professionals who assess market trends, regulatory environments, and technological advancements in the digital asset space to optimize portfolio performance.

Safety and Security: Money Market vs Digital Asset Funds

Money Market Accounts offer high safety and security through FDIC insurance, protecting principal up to $250,000, and stable investments in low-risk instruments like treasury bills and certificates of deposit. Digital Asset Funds provide exposure to cryptocurrencies but carry higher volatility and lack traditional insurance, increasing potential risk of loss due to market fluctuations and cybersecurity threats. Investors prioritizing preservation of capital and regulatory oversight often prefer Money Market Accounts over Digital Asset Funds for more secure savings.

Comparing Returns: Yield Potential and Risks

Money Market Accounts typically offer stable, low-risk returns averaging around 1-2% annually, making them suitable for conservative savers prioritizing capital preservation. Digital Asset Funds, while highly volatile, have the potential for significantly higher yields, sometimes exceeding 20% in favorable market conditions, but they carry increased risk of loss due to cryptocurrency market fluctuations. Evaluating yield potential against risk tolerance is crucial when choosing between the predictable security of a Money Market Account and the dynamic, high-reward nature of a Digital Asset Fund.

Liquidity and Accessibility: Which Option is Better?

Money Market Accounts offer high liquidity with easy access to funds through ATM withdrawals, checks, and transfers, making them ideal for short-term savings and emergencies. Digital Asset Funds may provide higher returns but often come with limited liquidity and potential lock-in periods, reducing immediate access to cash. For savers prioritizing quick and flexible access to their money, Money Market Accounts generally outperform Digital Asset Funds in liquidity and accessibility.

Fees and Costs: A Direct Comparison

Money Market Accounts typically offer low fees and no transactional costs, making them cost-effective for short-term savings with high liquidity. Digital Asset Funds often entail higher management fees, performance fees, and potential transaction costs due to active trading and blockchain network expenses. Comparing these, Money Market Accounts provide a more predictable and lower-cost structure, whereas Digital Asset Funds may incur variable and higher fees related to fund management and digital asset operations.

Regulatory Protections: FDIC vs Crypto Safeguards

Money Market Accounts offer FDIC insurance up to $250,000, providing federally backed security and protection against bank failures. Digital Asset Funds rely on blockchain technology and third-party custodians, but lack standardized regulatory safeguards comparable to FDIC insurance. Investors must weigh the guaranteed protection of Money Market Accounts against the innovative but currently less regulated security measures in crypto asset funds.

Inflation Impact: Preserving Value with Each Option

Money Market Accounts typically offer lower but stable interest rates that may barely outpace inflation, preserving purchasing power modestly over time. Digital Asset Funds, while highly volatile, have the potential for higher returns that can outpace inflation significantly but come with increased risk. Evaluating the inflation impact requires balancing the steady value preservation of money market accounts against the growth potential and risk exposure of digital asset investments.

Suitability for Different Types of Savers

Money Market Accounts offer low-risk, liquid savings options ideal for conservative savers seeking capital preservation and predictable returns. Digital Asset Funds attract tech-savvy investors willing to accept higher volatility for potential growth through diversified cryptocurrency and blockchain-related assets. Choosing between these depends on individual risk tolerance, investment horizon, and comfort level with emerging digital finance technologies.

Making the Right Choice: Factors to Consider

Evaluate liquidity, risk tolerance, and return potential when choosing between a Money Market Account and a Digital Asset Fund for savings. Money Market Accounts offer high liquidity and lower risk with modest interest rates, while Digital Asset Funds provide higher return potential but come with increased volatility and regulatory uncertainty. Consider your investment horizon, financial goals, and comfort with market fluctuations to make an informed decision.

Related Important Terms

Hybrid Yield Stacking

Hybrid yield stacking combines the stability of a Money Market Account's low-risk interest with the high-return potential of a Digital Asset Fund, optimizing savings growth through diversification. This strategy leverages liquid, regulated assets alongside volatile digital holdings to balance risk and maximize yield in a dynamic financial landscape.

Tokenized Savings Instruments

Tokenized savings instruments within digital asset funds offer enhanced liquidity and accessibility compared to traditional money market accounts, enabling fractional ownership and faster transactions through blockchain technology. While money market accounts provide stable returns with federal insurance, digital asset funds leverage decentralized finance innovations for potentially higher yields but carry greater volatility and regulatory risk.

Stablecoin MMAs

Stablecoin Money Market Accounts (MMAs) offer high liquidity and low volatility by leveraging digital assets pegged to fiat currencies, enabling savings with steady returns and quick access to funds. In contrast, Digital Asset Funds typically provide diversified exposure with potentially higher yields but come with increased risk and less immediate liquidity.

On-Chain Interest Aggregators

On-chain interest aggregators within digital asset funds often provide higher yield potential compared to traditional money market accounts, leveraging decentralized finance protocols to maximize returns through automated liquidity provision and staking. Money market accounts offer more stable, federally insured savings with lower risk but typically yield lower interest rates than the innovative, yet volatile, on-chain interest earning mechanisms found in digital asset funds.

TradFi vs DeFi Yield Curves

Money Market Accounts in traditional finance (TradFi) offer stable, low-risk yield curves with predictable interest rates backed by government or institutional guarantees, ideal for conservative savers. In contrast, Digital Asset Funds in decentralized finance (DeFi) present higher, variable yield curves driven by liquidity mining and staking rewards but come with increased volatility and smart contract risks.

Programmable Savings Vaults

Money Market Accounts provide stable, low-risk interest returns with FDIC insurance, while Digital Asset Funds offer higher yield potential through blockchain-based investments but carry increased volatility. Programmable Savings Vaults in Digital Asset Funds enable automated, customizable savings strategies using smart contracts for optimized growth and flexible fund management.

Decentralized Managed Portfolios

Money Market Accounts offer traditional low-risk, interest-bearing savings with government-backed security but often lower returns, whereas Digital Asset Funds, specifically Decentralized Managed Portfolios, provide diversified exposure to cryptocurrencies with automated rebalancing and transparency on blockchain networks. Investors seeking higher yield potential and blockchain-based portfolio management may prefer Decentralized Managed Portfolios despite increased volatility compared to conventional Money Market Accounts.

Real-Time Net Asset Value Tracking

Money Market Accounts offer stable savings with limited fluctuations, while Digital Asset Funds provide real-time net asset value (NAV) tracking, enabling investors to monitor portfolio performance instantly. This real-time NAV transparency in Digital Asset Funds enhances decision-making and responsiveness compared to the fixed interest nature of Money Market Accounts.

Cross-Platform Liquidity Pools

Money Market Accounts offer stable interest rates and government-backed security, making them a reliable choice for traditional savings with moderate liquidity. Digital Asset Funds utilize cross-platform liquidity pools, enabling higher yield opportunities and faster access to a diverse range of digital assets, though with increased market risk and volatility.

APY Volatility Mapping

Money Market Accounts typically offer stable APYs around 0.50% to 2.00%, minimizing volatility and ensuring predictable returns for short-term savings, while Digital Asset Funds can exhibit APYs ranging from -20% to over 100%, reflecting high volatility and potential for significant gains or losses. Mapping these APY fluctuations highlights the lower risk profile of Money Market Accounts against the dynamic, high-reward yet unpredictable nature of Digital Asset Funds.

Money Market Account vs Digital Asset Fund for savings. Infographic

moneydiff.com

moneydiff.com