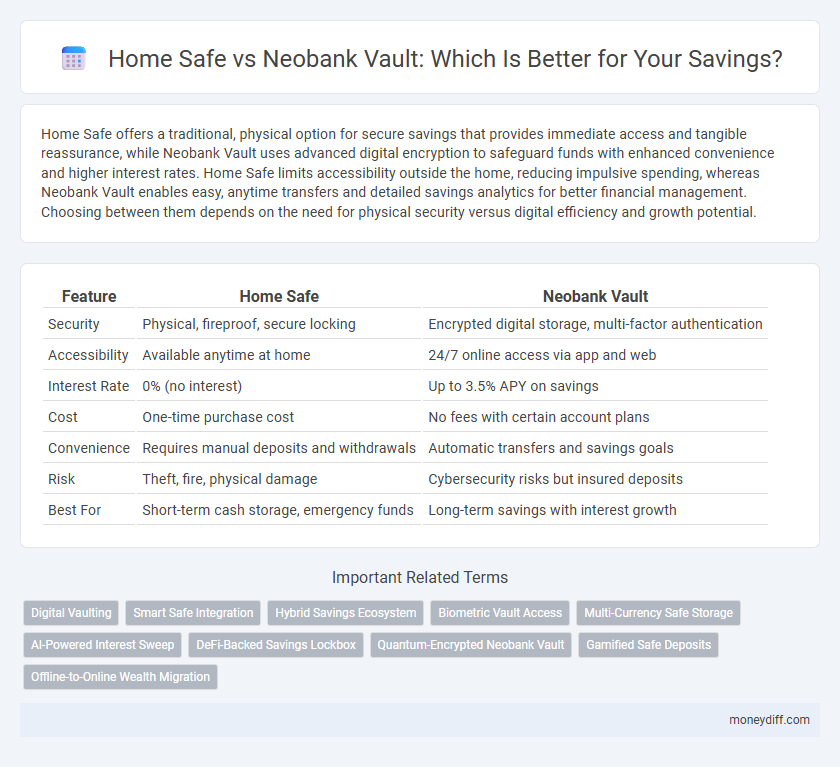

Home Safe offers a traditional, physical option for secure savings that provides immediate access and tangible reassurance, while Neobank Vault uses advanced digital encryption to safeguard funds with enhanced convenience and higher interest rates. Home Safe limits accessibility outside the home, reducing impulsive spending, whereas Neobank Vault enables easy, anytime transfers and detailed savings analytics for better financial management. Choosing between them depends on the need for physical security versus digital efficiency and growth potential.

Table of Comparison

| Feature | Home Safe | Neobank Vault |

|---|---|---|

| Security | Physical, fireproof, secure locking | Encrypted digital storage, multi-factor authentication |

| Accessibility | Available anytime at home | 24/7 online access via app and web |

| Interest Rate | 0% (no interest) | Up to 3.5% APY on savings |

| Cost | One-time purchase cost | No fees with certain account plans |

| Convenience | Requires manual deposits and withdrawals | Automatic transfers and savings goals |

| Risk | Theft, fire, physical damage | Cybersecurity risks but insured deposits |

| Best For | Short-term cash storage, emergency funds | Long-term savings with interest growth |

Understanding Home Safes for Saving Money

Home safes provide a tangible and secure method for storing cash and important documents directly within the household, offering immediate access without dependence on digital platforms. Unlike neobank vaults that rely on electronic encryption and online accounts, home safes minimize risks related to cyber threats and data breaches. However, physical safekeeping requires considerations of fire resistance, theft protection, and proper installation to maximize security and preserve savings effectively.

What Is a Neobank Vault and How Does It Work?

A Neobank Vault is a digital savings feature offered by online-only banks designed to help users set aside money separately within their checking account. It works by allowing customers to create sub-accounts or "vaults" where funds can be automatically transferred or rounded up from transactions, promoting disciplined savings without the need for a separate account. This system enhances accessibility and control over savings, often providing higher interest rates compared to traditional home safes or physical cash storage.

Security Comparison: Physical Safes vs Digital Vaults

Physical home safes provide tangible security through fire-resistant materials and robust locking mechanisms, offering protection against theft and physical damage. Neobank vaults leverage advanced encryption, multi-factor authentication, and continuous cybersecurity monitoring to safeguard digital assets from hacking and unauthorized access. While home safes excel in protecting physical valuables, neobank vaults combine convenience with cutting-edge digital security protocols for securing financial savings.

Accessibility: Retrieving Your Savings Easily

Home Safe offers immediate physical access to your money without technological barriers, making it ideal for quick cash needs or emergencies. Neobank Vaults provide seamless digital access through mobile apps, allowing instant transfers and transactions anytime, anywhere. While Home Safe ensures tangible control, Neobank Vaults enhance accessibility with secure, 24/7 online management of savings.

Cost Considerations: Upfront and Ongoing Fees

Home Safe accounts typically charge minimal upfront fees and offer lower ongoing maintenance costs, making them a cost-effective option for long-term savings. Neobank vaults may have no monthly fees but can include hidden fees such as transaction charges or withdrawal limits that impact overall savings growth. Evaluating both options requires analyzing fee structures, including ATM access costs, account inactivity fees, and interest rate conditions to optimize cost efficiency in savings.

Interest and Growth Opportunities for Your Savings

Home Safe offers competitive interest rates with minimal fees, ensuring steady growth for your savings through secure, traditional banking methods. Neobank Vaults often provide higher interest rates and innovative features like automated saving goals and investment options, accelerating growth opportunities with flexible access. Choosing between the two depends on whether you prioritize stability with guaranteed returns or higher yield potential with tech-driven financial tools.

Privacy and Control Over Your Funds

Home Safe offers full control over your funds with offline storage, ensuring maximum privacy by eliminating exposure to online threats and third-party access. Neobank Vault provides convenience with digital access but may involve data sharing and relies on institutional security measures, potentially compromising privacy. Choosing Home Safe prioritizes ultimate control and confidentiality, while Neobank Vault balances ease of use and regulated protection.

Insurance and Protection for Stored Savings

Home Safe offers physical control over cash with no inherent insurance, exposing savings to risks like theft or loss, whereas Neobank Vaults provide digital security measures backed by government insurance schemes such as FDIC or FSCS, ensuring protection against institutional failure. Neobank Vaults often include encryption and multi-factor authentication to safeguard funds, while Home Safe savings lack recovery options if compromised. Choosing a Neobank Vault ensures insured, digitally protected savings, offering greater security than uninsured, physically stored cash.

User Experience: Simplicity and Convenience

Home Safe offers a tangible approach with easy access and straightforward organization ideal for budget-conscious savers preferring physical control. Neobank Vault provides seamless digital integration, enabling automated transfers and real-time balance tracking through mobile apps, enhancing convenience and accessibility. The user experience favors Home Safe for simplicity in cash handling, while Neobank Vault excels in streamlined, hands-free savings management.

Which Is Best for Your Savings Goals?

Home Safe offers a traditional, FDIC-insured savings account with easy access and reliable interest rates, ideal for conservative savers seeking stability and quick access to funds. Neobank Vault provides a digital-first experience with higher interest rates, automated savings features, and user-friendly budgeting tools, making it suitable for tech-savvy individuals aiming to grow savings efficiently. Choosing the best option depends on your preference for either secure, straightforward saving or innovative, high-yield features tailored to modern financial habits.

Related Important Terms

Digital Vaulting

Home Safe offers a traditional, physical approach to securely storing cash, while Neobank Vault leverages digital vaulting technology to provide instant, encrypted access and automated savings features through mobile apps. Digital vaulting in Neobank Vault enhances convenience and security by enabling real-time transaction tracking and seamless fund allocation, outperforming manual methods used in Home Safe storage.

Smart Safe Integration

Home Safe offers seamless smart safe integration with biometric access and real-time monitoring, enhancing security and user convenience for physical cash savings. In contrast, Neobank Vault provides digital smart safe features with automated budgeting tools and instant transaction alerts, optimizing online savings management.

Hybrid Savings Ecosystem

Home Safe integrates traditional banking security with digital convenience, offering a hybrid savings ecosystem that allows seamless transfers between physical branches and online vaults. Neobank Vault enhances this model by providing AI-driven interest optimization and real-time analytics, maximizing savings growth while maintaining robust cybersecurity standards.

Biometric Vault Access

Home Safe offers biometric vault access through fingerprint or facial recognition, enhancing security for physical cash and valuables stored at home. Neobank Vaults utilize biometric authentication such as fingerprint or iris scans to securely manage digital savings, providing seamless access alongside mobile banking features.

Multi-Currency Safe Storage

Home Safe offers physical multi-currency storage solutions allowing users to securely hold various foreign banknotes and coins in a tangible, easily accessible format. Neobank Vault provides digital multi-currency savings with instant currency exchange, real-time balance tracking, and enhanced security through encrypted online access.

AI-Powered Interest Sweep

AI-powered interest sweep technology in neobank vaults automates transferring surplus funds into high-yield savings accounts, maximizing interest earnings without manual intervention. Unlike traditional home safes that store cash physically without generating interest, AI-driven vaults optimize savings growth by intelligently allocating funds based on real-time financial data and market rates.

DeFi-Backed Savings Lockbox

DeFi-Backed Savings Lockboxes offer higher interest rates and enhanced security compared to traditional Home Safe options by leveraging decentralized finance protocols to protect and grow assets. Neobank Vaults integrate digital convenience with regulatory oversight but may provide lower yields and less transparency than DeFi solutions for long-term savings growth.

Quantum-Encrypted Neobank Vault

Quantum-encrypted neobank vaults offer enhanced security for savings by leveraging quantum-resistant algorithms that protect against future cyber threats, unlike traditional home safes which are vulnerable to physical theft and damage. These digital vaults provide seamless access, real-time transaction monitoring, and automated savings features, making them a superior choice for securely growing and managing savings in the digital age.

Gamified Safe Deposits

Home Safe offers a physical, tangible way to store cash securely at home, while Neobank Vaults provide digital gamified safe deposits that incentivize saving through rewards and interactive challenges. Gamified features in Neobank Vaults enhance user engagement by turning savings goals into achievable milestones with points, badges, and progress tracking, making it a more motivating option for younger, tech-savvy savers.

Offline-to-Online Wealth Migration

Home Safe offers a tangible, offline savings option that ensures physical security and immediate access, contrasting with Neobank Vaults that provide digital-only environments equipped with high-yield interest rates and seamless online fund transfers. Offline-to-online wealth migration trends highlight growing consumer trust in Neobank Vaults due to their integration with financial apps, automated goal-setting features, and enhanced liquidity, driving a strategic shift from cash-held Home Safes to digitally accessible savings.

Home Safe vs Neobank Vault for savings. Infographic

moneydiff.com

moneydiff.com