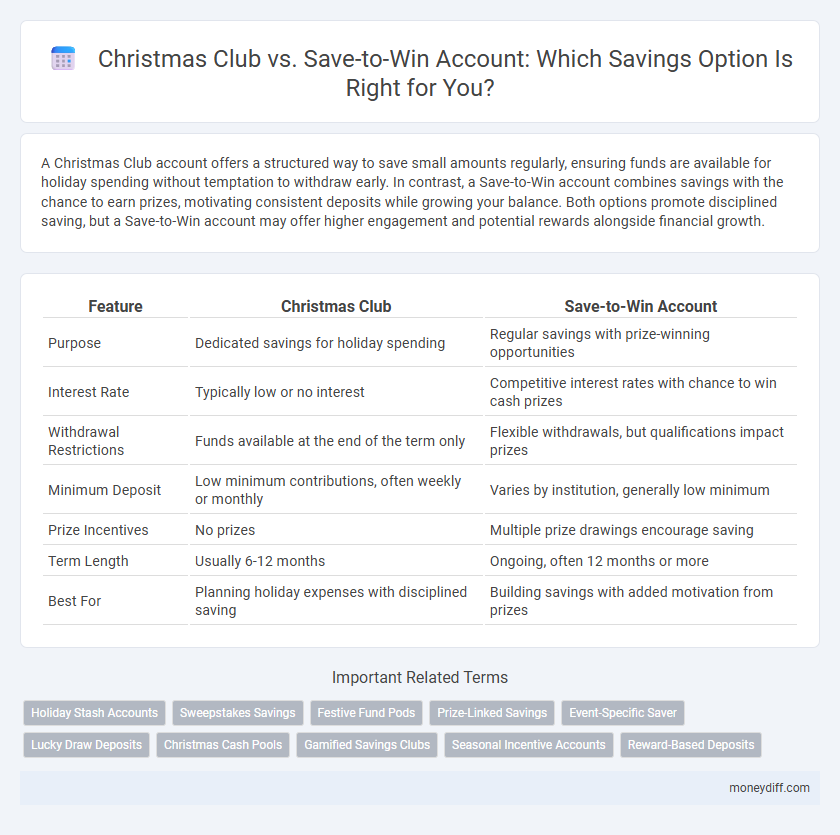

A Christmas Club account offers a structured way to save small amounts regularly, ensuring funds are available for holiday spending without temptation to withdraw early. In contrast, a Save-to-Win account combines savings with the chance to earn prizes, motivating consistent deposits while growing your balance. Both options promote disciplined saving, but a Save-to-Win account may offer higher engagement and potential rewards alongside financial growth.

Table of Comparison

| Feature | Christmas Club | Save-to-Win Account |

|---|---|---|

| Purpose | Dedicated savings for holiday spending | Regular savings with prize-winning opportunities |

| Interest Rate | Typically low or no interest | Competitive interest rates with chance to win cash prizes |

| Withdrawal Restrictions | Funds available at the end of the term only | Flexible withdrawals, but qualifications impact prizes |

| Minimum Deposit | Low minimum contributions, often weekly or monthly | Varies by institution, generally low minimum |

| Prize Incentives | No prizes | Multiple prize drawings encourage saving |

| Term Length | Usually 6-12 months | Ongoing, often 12 months or more |

| Best For | Planning holiday expenses with disciplined saving | Building savings with added motivation from prizes |

Understanding Christmas Club and Save-to-Win Accounts

Christmas Club accounts offer a structured savings plan where individuals contribute regularly throughout the year to accumulate funds for holiday expenses, promoting disciplined saving habits. Save-to-Win accounts combine savings with the opportunity to earn interest plus chances to win cash prizes through monthly drawings, incentivizing consistent deposits. Both accounts enhance savings goals but cater to different financial motivations--Christmas Club emphasizes goal-oriented, time-specific savings, while Save-to-Win integrates reward-based incentives.

Key Features of Christmas Club Accounts

Christmas Club accounts offer fixed-term savings plans that encourage regular deposits throughout the year, allowing savers to accumulate funds specifically for holiday expenses. These accounts typically provide low minimum deposit requirements, limited withdrawal options to prevent impulsive spending, and modest interest rates tailored to short-term savings goals. Unlike Save-to-Win accounts, Christmas Club accounts do not usually offer prize-linked incentives but emphasize disciplined saving for predictable seasonal spending needs.

Key Features of Save-to-Win Accounts

Save-to-Win accounts combine traditional savings with a chance to win cash prizes, motivating consistent deposits and financial discipline. These accounts typically require minimum monthly contributions, often as low as $25, and entries into prize drawings increase with higher savings balances. Unlike Christmas Clubs, which restrict access until a specific payout time, Save-to-Win accounts allow flexible withdrawals while rewarding savers through monthly or quarterly prize drawings.

Pros and Cons of Christmas Club Savings

Christmas Club savings offer a disciplined approach to set aside money for holiday expenses, often providing limited access to funds until the withdrawal period, which helps prevent impulsive spending. These accounts typically feature low or no interest rates, reducing potential earnings compared to other savings options like Save-to-Win accounts that may offer interest and prize opportunities. However, Christmas Club accounts may lack flexibility and higher returns, making them less attractive for savers seeking growth or emergency liquidity.

Pros and Cons of Save-to-Win Savings

Save-to-Win savings accounts offer the advantage of combining traditional saving with chances to win cash prizes, incentivizing consistent deposits and financial discipline. These accounts typically have low minimum deposit requirements and provide a risk-free lottery element, making them appealing for savers seeking motivation beyond interest earnings. However, the downside includes potentially lower interest rates compared to other savings options and the uncertainty of winning, which may not suit individuals focused solely on maximizing their savings growth.

Eligibility and Requirements Compared

Christmas Club accounts typically require employees or members of specific organizations to join, often with a minimum deposit to open, targeting disciplined holiday savings. Save-to-Win accounts are generally accessible to a broader audience with lower minimum balance requirements and incentivize consistent deposits via prize drawings. Eligibility for Save-to-Win focuses on residency and initial deposit criteria, while Christmas Club eligibility hinges on employer or organizational participation.

Interest Rates: Christmas Club vs Save-to-Win

Christmas Club accounts typically offer little to no interest, focusing instead on disciplined saving for holiday expenses, while Save-to-Win accounts combine savings with prize-linked incentives and tend to provide competitive interest rates. Financial institutions may vary, but Save-to-Win accounts generally yield higher annual percentage rates (APRs) compared to traditional Christmas Club plans. Choosing between the two depends on whether the priority is guaranteed savings growth through interest or the potential for winning cash prizes while saving.

Withdrawal Rules and Access to Funds

Christmas Club accounts restrict withdrawals until the designated payout period, typically just before the holiday season, ensuring funds are reserved for holiday expenses. Save-to-Win accounts permit more flexible access, allowing members to withdraw funds at any time but may limit entries into prize drawings based on withdrawal activity. Understanding these withdrawal rules is crucial for savers seeking either committed savings or more liquidity with potential rewards.

Ideal Savers: Who Should Choose Which Account?

Christmas Club accounts suit savers who prefer disciplined, periodic deposits for holiday spending without temptation to withdraw. Save-to-Win accounts attract individuals aiming to grow savings while earning chances to win cash prizes, ideal for those motivated by potential rewards. Conservative savers seeking guaranteed growth may favor Christmas Club, while goal-oriented, prize-sensitive savers benefit from Save-to-Win.

Maximizing Savings During the Holiday Season

Christmas Club and Save-to-Win accounts both help maximize holiday savings by encouraging disciplined deposits; Christmas Club accounts typically offer set amounts saved throughout the year specifically for holiday spending, while Save-to-Win accounts combine savings growth with lottery-style prize incentives to boost motivation. Christmas Club accounts provide predictable funds by a fixed date but often have lower interest rates, whereas Save-to-Win accounts usually offer federally insured savings with competitive interest and monthly prize drawings that can increase total returns. Choosing between these options depends on the individual's saving habits and desire for potential rewards, with both serving as effective tools to reduce holiday financial stress and build festive spending funds.

Related Important Terms

Holiday Stash Accounts

Holiday Stash Accounts offer a flexible alternative to traditional Christmas Club and Save-to-Win accounts by combining regular savings with prize-linked incentives that boost engagement and increase holiday funds. These accounts often feature higher interest rates and no withdrawal penalties, making them ideal for consistent, goal-oriented holiday saving.

Sweepstakes Savings

A Save-to-Win Account combines regular savings with sweepstakes entries, offering members chances to win cash prizes while building their savings, unlike traditional Christmas Club accounts that focus solely on scheduled deposits for holiday spending. Sweepstakes Savings incentivize consistent deposits by rewarding contributors with monthly and quarterly prize draws, promoting a fun and engaging approach to financial discipline.

Festive Fund Pods

Christmas Club accounts offer structured, short-term savings specifically for holiday expenses, while Save-to-Win accounts combine savings with chances to win prizes through monthly drawings, encouraging consistent deposits. Festive Fund Pods within Save-to-Win accounts create targeted savings pools for seasonal expenses, enhancing motivation and making holiday budgeting easier.

Prize-Linked Savings

Prize-linked savings accounts like Save-to-Win combine the benefits of traditional savings with lottery-style cash prizes, incentivizing regular deposits without the risk of losing principal. Christmas Club accounts offer structured savings for holiday expenses but typically lack the opportunity to win prizes, making Save-to-Win more appealing for savers seeking both growth and prize incentives.

Event-Specific Saver

Christmas Club accounts provide a structured, event-specific savings plan targeting holiday expenses with fixed, regular deposits and limited withdrawal options to encourage disciplined saving. Save-to-Win accounts combine savings with a prize-linked incentive, increasing motivation through potential rewards while maintaining accessibility and promoting consistent contributions.

Lucky Draw Deposits

Christmas Club accounts offer guaranteed savings with limited access, while Save-to-Win accounts combine regular deposits with entry into lucky draw prize pools, increasing the potential rewards for savers. Lucky draw deposits in Save-to-Win accounts incentivize consistent savings by providing chances to win cash prizes, enhancing both financial discipline and motivation.

Christmas Cash Pools

Christmas Club accounts provide a dedicated savings plan with fixed deposits accumulating towards holiday spending, while Save-to-Win accounts combine savings with opportunities to win cash prizes through monthly drawings. Christmas Cash Pools are specific to Christmas Club programs, enhancing holiday savings by pooling member contributions to increase the prize potential and incentivize consistent deposits.

Gamified Savings Clubs

Gamified Savings Clubs, such as Save-to-Win Accounts, encourage disciplined saving by combining the benefits of traditional Christmas Clubs with the excitement of prize-linked incentives, boosting user engagement and savings growth. These accounts enhance financial habits through structured deposits and the opportunity to win cash prizes, making saving both rewarding and entertaining.

Seasonal Incentive Accounts

Christmas Club accounts offer structured, short-term savings with fixed deposits aimed at holiday spending, typically featuring limited access and modest interest rates tailored for seasonal budgeting. Save-to-Win accounts combine regular savings with lottery-like drawings, providing incentives beyond interest while encouraging consistent deposits, making them a rewarding option for savers seeking both growth and seasonal prizes.

Reward-Based Deposits

Christmas Club accounts offer structured savings with predictable deposits and a guaranteed lump sum payout before the holiday season, ideal for disciplined, short-term reward-based deposits. Save-to-Win accounts combine regular savings with the chance to win cash prizes, providing incentive-driven rewards that encourage higher deposit frequency and larger balances over time.

Christmas Club vs Save-to-Win Account for savings. Infographic

moneydiff.com

moneydiff.com